March exports power ahead to score fifth straight monthly gain

Figure jumps 16.5%, and shipments to all top 10 markets rise - mostly by double-digits to boot

Singapore

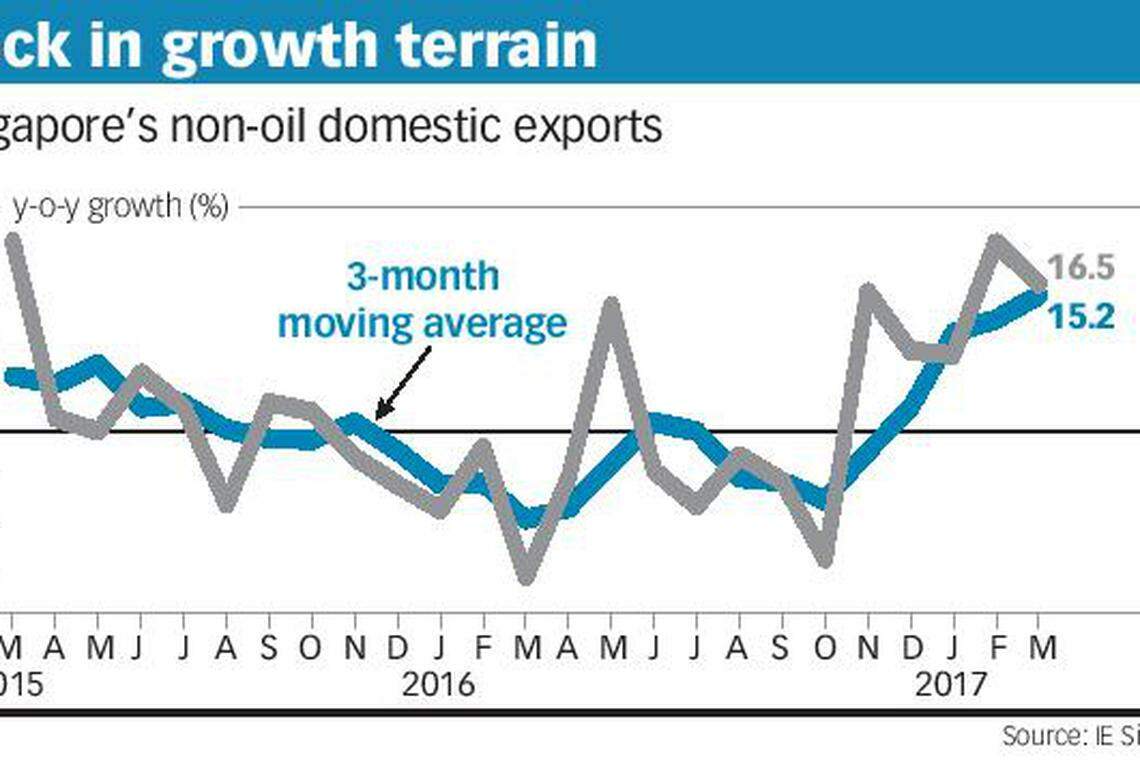

SINGAPORE'S exports appear to be firmly back on the growth path, with non-oil domestic shipments powering to a fifth straight monthly rise in March.

Non-oil domestic exports (NODX) registered a 16.5 per cent rise last month, easily beating market expectations of 7.3 per cent, going by figures released on Monday by trade promotion agency International Enterprise (IE) Singapore.

While March's NODX expansion eased from a downward revised 21.1 per cent in February, it was still a double-digit growth, and surpassed the estimated average 15.4 per cent growth for the first quarter of the year.

Irvin Seah, a senior economist at DBS Bank, wrote in a brief note: "While one can attribute this (March's NODX) partly to the low base in the same period last year, one can't deny that we've got some of the best showings in export sales in a long while.

"In terms of absolute dollar value of exports, this is the highest in two years. Compared to historical record, NODX growth has averaged a solid 14.3 per cent over the past five months. This is the strongest growth streak since the period from October 2010 to February 2011."

Mr Seah said last month's NODX underscored the pick-up in external demand; both he and Chua Hak Bin of Maybank Kim Eng expect it to lead to an upward revision in the preliminary first-quarter gross domestic product (GDP) growth figure, estimated to be 2.5 per cent.

Reflecting the recovery in global demand, NODX shipments to all top 10 major markets, especially to the Greater China markets of China, Taiwan and Hong Kong, rose last month by double-digits; shipments to the US and Japan were the exceptions.

The release of Singapore's latest trade data come barely a week after the World Trade Organisation announced that global trade, after a weak 1.3 per cent rise in 2016, is likely to grow 2.4 per cent this year if the world economy recovers as expected and governments pursue the right policy mix.

The only negative sign in last month's Singapore trade data is the dip in NODX when held up against figures for February. Month on month, the NODX fell a seasonally-adjusted 1.1 per cent in March, a reversal of the 1.1 per cent increase in the previous month.

Private-sector economists seem unfazed by it.

The market's overall mood was upbeat, though with some caution about the rise of trade protectionism. UOB Bank's Francis Tan expects NODX to expand strongly at least until June, but he believes there is a likelihood that the trade pick-up in the past few months could produce stronger NODX growth for the full year.

Selena Ling of OCBC Bank added: "First-quarter NODX growth was already a stellar 15.4 per cent; given the low base in 2016, there are some upside risks to our full-year growth (projection) of 0-2 per cent."

IE Singapore's 2017 growth forecast for Singapore's NODX is 0-2 per cent and its total trade, 4-6 per cent.

UOB's Mr Tan said the NODX expansion in the past five months was strongly supported by electronics shipments. "The five-month on-year gains in electronics exports was a result of past months of higher manufacturing activities and inventory accumulation in the semiconductor segment."

While the electronic NODX continued to rise in March, the growth eased from 17.2 per cent in February to 5.2 per cent. Gains in shipments of integrated circuits, parts of PCs and consumer electronics contributed to the expansion. But Maybank Kim Eng's Mr Chua noted that the only electronic product group still registering an acceleration in export growth was parts of PCs.

Non-electronic NODX growth also moderated last month, though by a smaller quantum - 20.8 per cent against 22.7 per cent in February. Petrochemicals (+42.8 per cent), specialised machinery (+70.1 per cent) and structural parts made of iron, steel and aluminium (+4,697.5 per cent) accounted for the bulk of the expansion.

In terms of markets, China (+45.5 per cent), Taiwan (+32.5 per cent) and Hong Kong (+17.4 per cent) were the biggest drivers of last month's NODX jump. The increase in shipments to China, extending February's growth of 65.1 per cent, was led by non-monetary gold, petrochemicals and disk media products.

The trade data released on Monday also showed that oil domestic exports jumped 68.5 per cent in March, after a 82.5 per cent rise in February. It was the seventh consecutive month of increase after a 24-month decline previously.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Britain’s retail sales disappoint in sign of lacklustre recovery

Explosions in Iran, US media reports Israeli strikes

US veto sinks Palestinian UN membership bid in Security Council

Pro-China local leader ousted in Solomon Islands election

Japan‘s March inflation slows to 2.6%, eyes on BOJ move

S&P downgrades Israel rating on heightened geopolitical risk