MAS' S$45b transfer to GIC could give government revenues a boost

One analyst estimates the transfer of excess official foreign reserves to GIC could translate to annual contribution of over S$900 million to Singapore Budget

Singapore

THE Monetary Authority of Singapore (MAS) will be transferring S$45 billion from the official foreign reserves (OFR) in May to GIC, the city-state's sovereign wealth fund, to manage, in a move economists say is necessary to ensure adequate sustainable return on investments in the current protracted low inflation and interest rate environment.

And this has implications for public spending, as the returns from the investment of reserves have become an increasingly important component of the government budget in the face of rising social and healthcare spending.

MAS, which manages the OFR, said the foreign exchange reserves of S$404 billion as at April 2019 is in excess of what it deems necessary to maintain confidence in Singapore's exchange rate-centred monetary policy.

Based on MAS assessments, an OFR amounting to at least 65 per cent of gross domestic product (GDP) GDP should be adequate on an ongoing basis.

"This level of OFR will provide a sufficiently strong buffer against stresses in the global economy and markets, and underpin confidence in Singapore's exchange rate-centred monetary policy," MAS said.

But as at Q1 2019, the OFR amounted to 82 per cent of GDP which is more than that required by MAS. Hence, the transfer of S$45 billion to GIC.

Singapore uses the monetary policy to ensure medium-term price stability. The exchange rate plays a key role in determining core inflation. MAS manages the Singapore dollar exchange rate against a trade-weighted basket of currencies of Singapore's major trade partners and competitors. Occasionally, it intervenes to keep the nominal effective exchange rate of the Singapore Dollar (S$NEER) within a policy band, using the OFR to defend its stability during times of speculative pressures or financial crises.

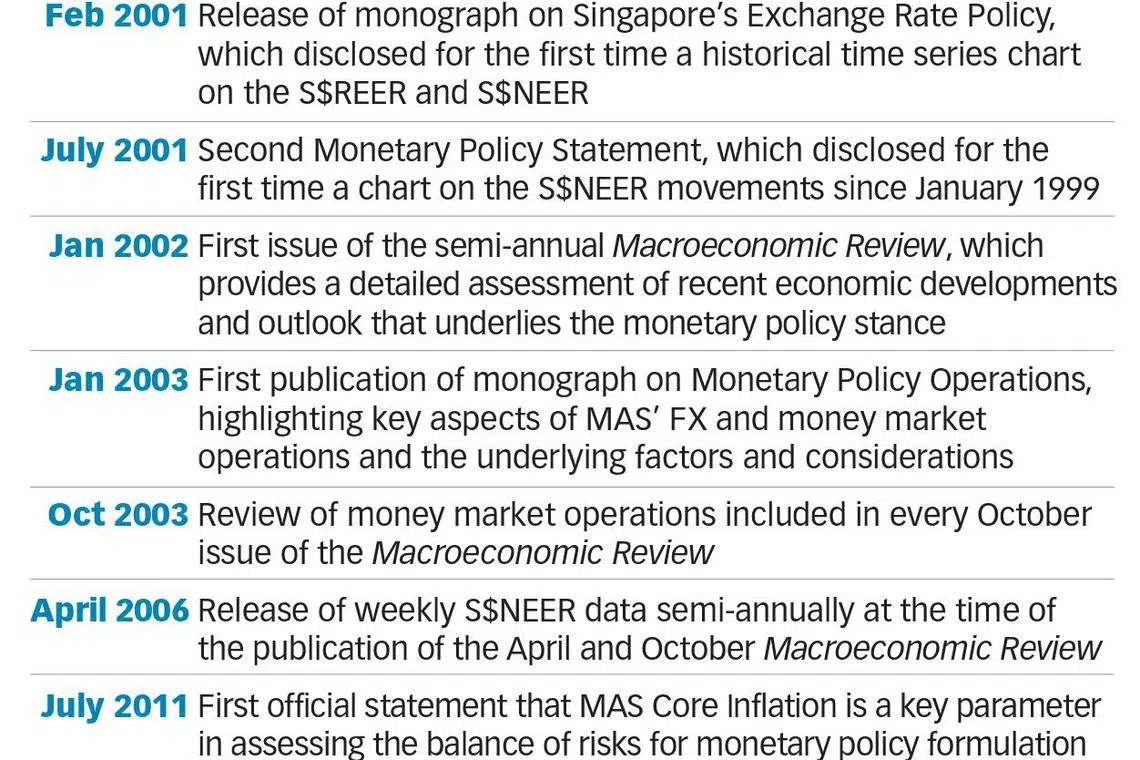

In a bid to further enhance transparency, MAS aims to release data comprising its net purchases of foreign exchange on a six-monthly basis, beginning with the data for the second half of 2019.

"This further disclosure initiative will provide market participants a better indication of the actions that MAS has undertaken to implement its monetary policy stance, while preserving MAS' operational effectiveness. MAS' foreign exchange intervention operations will remain focused on keeping the S$NEER within its policy band, so as to keep inflation low over the medium term," MAS said.

News of the extra S$45 billion in dry powder for GIC was welcomed by economists. The move, they said, reflected the government's concerns over the protracted low inflation and interest rate environment, and their impact on returns on investments. This in turn holds implications for government spending.

"Given such an environment where sustained returns are becoming more difficult to achieve, GIC is the best vehicle given its long-term focus and investments across multiple asset classes, from bonds, real estate, private equities and corporates," said CIMB Private Banking economist Song Seng Wun.

As a manager of the government's assets, GIC's mandate is to preserve and enhance the international purchasing power of the reserves over the long term, focusing on a 20-year annualised real rate of return, while riding out cycles and disruptions in global markets.

"This is all about the long-term reserve management and also how it is managed so that it continues to provide adequate sustainable returns for the government to tap on for its annual budget needs. Clearly, more will come from investments," Mr Song said.

The Net Investment Returns Contribution (NIRC) to the government budget consists of two parts: up to 50 per cent of the Net Investment Returns (NIR) on the net assets invested by GIC, MAS and Temasek Holdings, and up to 50 per cent of the Net Investment Income (NII) derived from past reserves from the remaining assets. NIRC is currently the largest single source of government revenues.

Drawing on a cake analogy on the three guardians of Singapore's reserves, Mr Song elaborated: "If you look at a cake, GIC provides the base for the cake; Temasek the cream and MAS the cherry on top."

Of the three, MAS is the most conservative, while Temasek is further out on the risk-return spectrum compared to MAS and GIC. Historically, GIC's benchmark 20-year annualised real rate of return hovered around 4 per cent real rate of return over and above global inflation.

Assuming that's the return GIC expects to get, one analyst commented that the transfer of excess OFR could translate to an annual contribution of more than S$900 million to the Singapore Budget.

At print time, news of MAS' move to greater transparency in its forex intervention operations did not have an immediate impact on the Singapore dollar.

"In the short term, the US-China trade talks take precedence in markets," said Philip Wee, a FX strategist at DBS.

However, Mr Wee added that "for the medium term, the move towards greater transparency in forex interventions operations is another brick in the solid foundation of sound fundamentals of policies that Singapore's exchange rate policy is built upon".

The announcement fuelled confidence that Singapore has the firepower and more than sufficient reserves, to address any market volatility from unforeseen global shocks and preserve the integrity of its exchange rate policy, he said.

Heng Koon How, head of markets strategy at UOB, added that the greater transparency from the publication of net forex purchases is unlikely to lead to unnecessary volatility for the SGD as the published data will be aggregated over a long period of six months and would not have any detailed monthly figures or breakdown of individual currencies.

Vishnu Varathan, head of economics and strategy at Mizuho Bank, said the move for disclosure is definitely a significant one by the MAS, which has typically been known for being discreet.

"They are formalising a process which involves the evolution of accountability and transparency in regulatory institutions," he said.

Copyright SPH Media. All rights reserved.