Singapore business optimism wanes for Q1 2019

BUSINESS confidence among local companies moderated significantly for the first quarter (Q1) of next year, weakening for the second straight quarter.

This is according to the latest quarterly Singapore Commercial Credit Bureau's (SCCB) Business Optimism Index released on Tuesday.

The overall index eased from +9.19 percentage points in Q4 2018, to +7.19 percentage points for Q1 2019. However, compared to a year ago, this was up from +4.29 percentage points in Q1 2018.

The figures, derived from a survey of 200 business owners and senior executives, represent the net percentage of respondents expecting improvements in the coming quarter compared to the same period last year.

An expansionary Q1 outlook was seen for three out of six indicators: selling price, new orders and inventory levels. Meanwhile, the other three indicators - sales volume, net profits, and employment levels - slipped on a year-on-year basis. The net profits indicator was the hardest hit, as it slid into contraction territory at -2.63 percentage points, compared to +2.63 percentage points in Q1 2018.

Compared to Q4 2018, two of the indicators - sales volume and net profits - were lower for Q1 2019. The other four indicators rose on a quarter-on-quarter basis. Notably, the selling price indicator rebounded into the expansionary zone from -0.98 percentage points in Q4 2018, to +6.84 percentage points in Q1 2019.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Overall, services, transportation and wholesale emerged as the most optimistic sectors, with five indicators showing positive outlook.

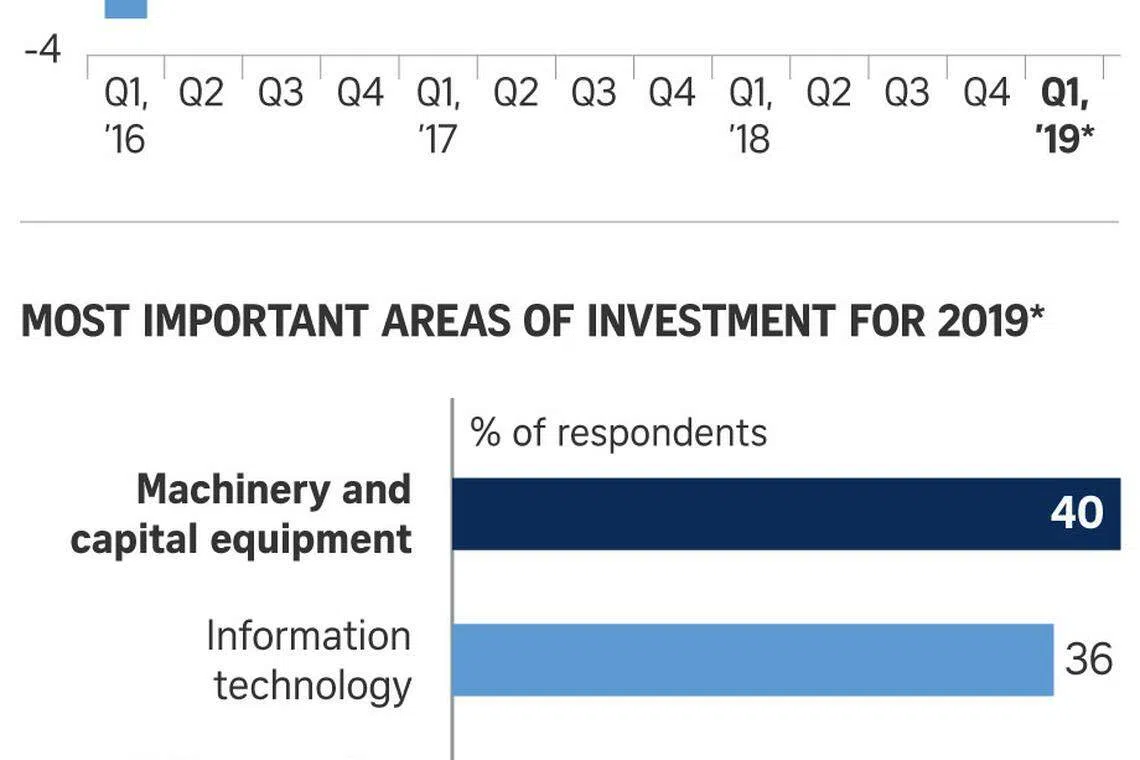

Firms are also more optimistic about investments in business expansion for the year ahead.

"This is particularly in the area of technological investments in software, infrastructure and upskilling of employees for ICT (Information and Communications Technology) training programmes," said SCCB's CEO Audrey Chia.

The proportion of companies expecting an increase in investments rose from 9 per cent in 2018, to 14 per cent in 2019. However, the proportion of firms expecting investments to decrease also climbed - from 4 per cent in 2018, to 7 per cent for 2019. The majority of local firms anticipated investments to remain unchanged at 79 per cent.

Looking ahead, global economic uncertainties was highlighted by 32 per cent of respondents as the main challenge for 2019. Other key challenges include higher business costs (26 per cent) and increased competition (22 per cent).

"Moving into Q1 2019, we expect visible signs of moderation in the outlook for local firms, particularly within the manufacturing sector in light of muted global demand and softer growth within the region," said Ms Chia.

"The services and financial sectors will continue to remain the key sectors for growth in the new year. While the construction sector is one of the least optimistic, we are seeing signs of green shoots with the surprising rebound in optimism levels."

Copyright SPH Media. All rights reserved.