Singapore exports clock surprise rise of 2.4% in December

SINGAPORE exports turned the corner in December 2019, expanding for the first time in nine months, as shown by trade figures released on Friday.

Non-oil domestic exports (NODX) grew by 2.4 per cent year on year, beating the decline of 1 per cent that had been predicted by private-sector economists in a Bloomberg poll.

The numbers were lifted by stronger exports of non-monetary gold, as well as pharmaceuticals and specialised machinery, according to data from trade agency Enterprise Singapore (ESG).

"On a month-on-month seasonally adjusted basis, NODX increased by 1.1 per cent in December 2019, extending the previous month's 5.8 per cent growth," ESG added, noting that seasonally adjusted export values hit S$14.3 billion. Unadjusted, exports were worth S$14.1 billion.

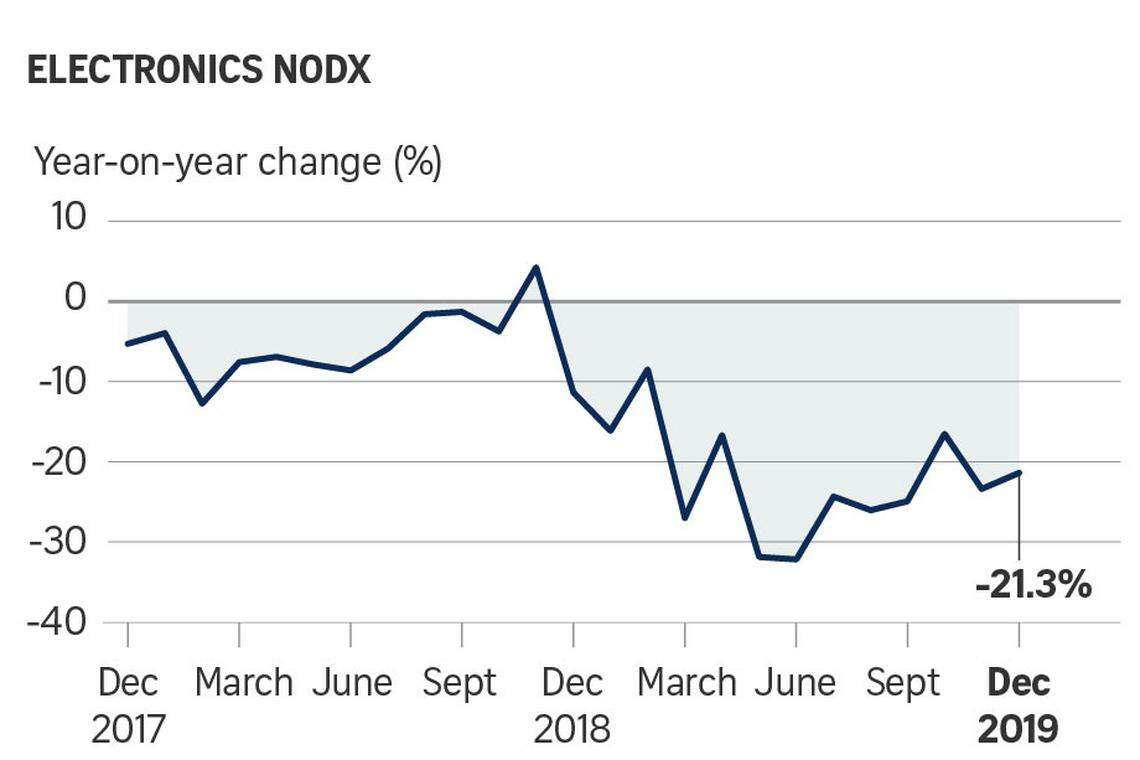

But the linchpin electronics sector remained soft, with shipments shrinking by 21.3 per cent, dragged down by weakness in integrated circuits, personal computers and computer parts.

The pace of contraction, while easing slightly from the 23.3 per cent slide posted in November, fell short of private-sector watchers' estimate of a 13.9 per cent decline.

Barclays Bank economist Brian Tan noted that December's turnaround "was mainly due to pharmaceuticals exports - which tend to be volatile - skyrocketing by 34.7 per cent".

"This pushed headline NODX back into positive territory despite still-weak electronics exports," he wrote in a flash note.

Otherwise, NODX to almost all of Singapore's top 10 markets improved year on year in December, with the upswing led by demand from mainland China, where exports rose by 9.8 per cent; Taiwan, up by 16.2 per cent; and the United States, up by 8.5 per cent.

On the other hand, exports to the top markets of Indonesia and Hong Kong shrank, as did shipments to emerging markets such as the Caribbean, South Asia and the Middle East.

Still, exports to top markets have bounced back from "the trend seen for most of 2019, during which the US was usually the only market posting growth", Maybank Kim Eng researchers Chua Hak Bin and Lee Ju Ye wrote in a report.

They also highlighted Singapore's electronics exports to the US, which "are surging strongly on the back of (integrated circuits)... despite the plunge in most other markets".

Overall, total trade grew by 0.7 per cent in December, turning around from the decrease of 5.9 per cent in the month before, as a rise in total exports offset the slip in imports.

Singapore's official forecasters last projected full-year NODX to decline by between 9.5 per cent and 10 per cent for 2019, before recovering to between zero and 2 per cent growth in 2020.

China's semiconductor imports jumped in December, which "bodes well for outlook" for Asian chipmakers, according to a report by Citi analysts Kim Jin-Wook and Johanna Chua on Jan 15.

"A surge in China's semiconductor imports growth to double digits in December 2019 may raise the odds for resumption of inventory restocking in 2020," they wrote, adding that semiconductor exports and sales in Asia are expected to continue their upward momentum in early 2020.

Meanwhile, United Overseas Bank economist Barnabas Gan said on Friday: "The ongoing stabilisation seen in the global economy is an encouraging sign for export-oriented economies like Singapore."

In the wake of a Phase One trade deal between the US and China this week, he added: "With the cautiously optimistic view for an improving trade environment in 2020, Singapore's exports should benefit into the year to come."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Global wave of consultancy layoffs has not hit Singapore

Daily Debrief: What Happened Today (Apr 19)

An economy transformed: Lee Hsien Loong’s 20 years as Singapore’s Prime Minister

Daily Debrief: What Happened Today (Apr 18)

Singapore’s first RoboCluster launched for facilities management, to turn R&D into market solutions

Daily Debrief: What Happened Today (Apr 17)