Singapore exports post shock 3.1% drop in October as gold shipments recede

Annabeth Leow

SINGAPORE exports posted a shock fall in October, snapping a four-month winning streak, according to trade agency Enterprise Singapore (ESG) on Tuesday.

Non-oil domestic exports (NODX) lost 3.1 per cent year on year, reversing the 5.8 per cent increase in September.

The drop - which also disappointed private-sector projections of 5.1 per cent growth in a Bloomberg poll - came as a trade boost from non-monetary gold has evaporated.

Non-electronic shipments declined by 3.9 per cent in October, against an increase of 1.7 per cent in September. Most of the decline came from a 61 per cent drop in exports of non-monetary gold, while petrochemical exports shed 15.3 per cent. Pharmaceuticals were up modestly by 2.7 per cent.

That's as non-monetary gold had posted steep growth in the first nine months of 2020 - which ESG said was driven by investment demand in the United States, European Union (EU) and Britain, even while Asian demand was weaker.

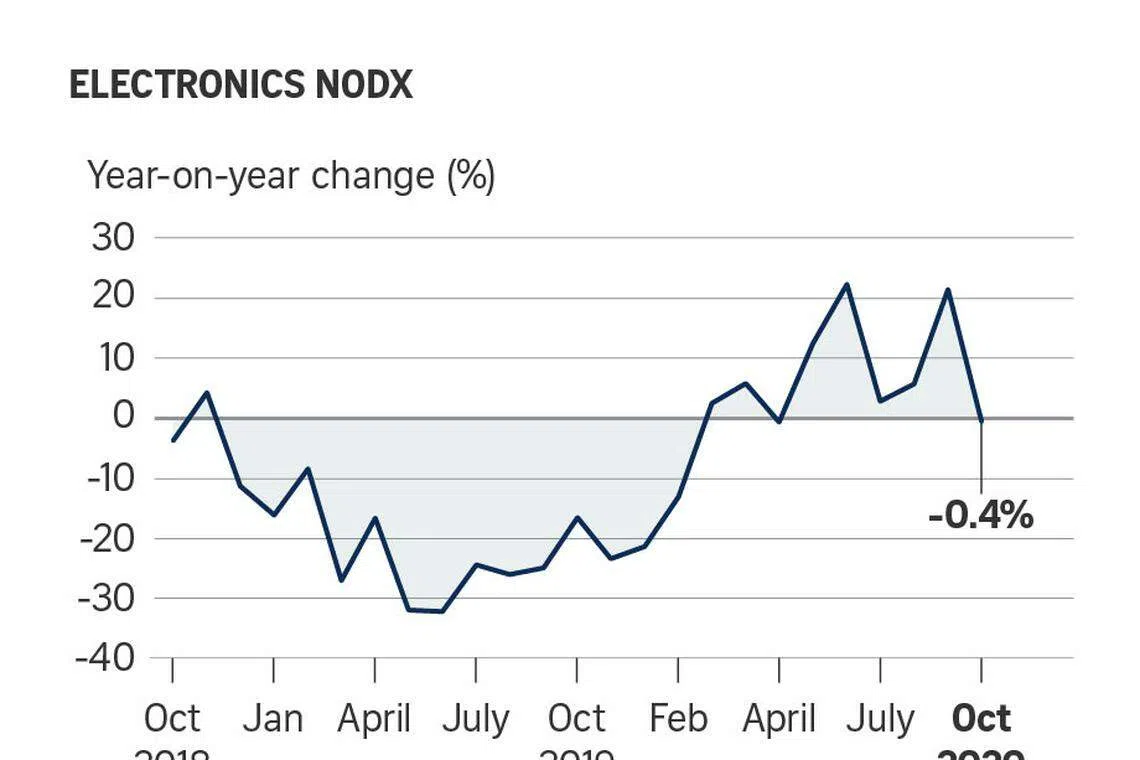

In the linchpin electronics segment, NODX slipped by 0.4 per cent, compared with a rise of 21.4 per cent in the previous month, with the contraction of 12.8 per cent in integrated circuits posing the main drag for the industry.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Barclays economist Brian Tan - whose forecast of an overall 2 per cent decrease had been closest to the mark - said in a note that the plunge in non-monetary gold exports was expected as prices had cooled.

"Excluding gold, we estimate headline NODX growth would have slowed more modestly to 0.5 per cent year on year in October from 1.6 per cent in September," he added, citing a decline in electronics shipments as a low base effect wore off.

"Base effects are set to turn more favourable again from December, which should imply stronger year-on-year comparisons."

On a seasonally adjusted, month-on-month basis, NODX was down by 5.3 per cent to S$13.1 billion in October, extending the drop of 11.4 per cent in the month before.

Singapore saw year-on-year NODX growth with just four of its top 10 markets - the US, China, Japan and the EU.

Selena Ling, head of treasury research and strategy at OCBC, noted that exports to Japan and the US outperformed their peers, while shipment growth in China affirmed a sustained recovery in that market from the initial outbreak of Covid-19.

Otherwise, Hong Kong, Malaysia and Thailand were the largest contributors to the overall decline in shipments to top export destinations, ESG noted.

NODX to emerging markets also shrank, to the tune of 12 per cent, after an earlier decline of 14.4 per cent in September.

An overall decline in both exports and imports in October pushed total trade down by 9 per cent year on year, or 3.1 per cent on a seasonally adjusted, monthly basis. ESG attributed this to a continued decrease in oil trade, on the back of lower oil prices.

Ms Ling suggested that "the disappointing October NODX print" could push quarterly export growth into negative territory for the last three months of 2020, which would moderate full-year expansion to between 4 per cent and 5 per cent.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.