Singapore factory output plunges by 8% in August, dashing hopes of recovery

SINGAPORE factory output plunged by 8 per cent year on year in August, extending the Republic's manufacturing decline into its fourth month and proving July's reprieve short-lived.

Industrial production was dragged down by the struggling electronics sector, according to statistics released by the Economic Development Board on Thursday.

Excluding support from the volatile biomedical manufacturing sector - where both pharmaceuticals and medical technology were in positive territory - factory production fell by 12.4 per cent.

The drop output was much sharper than the revised 0.1 per cent dip posted in July, and also far steeper than the forecast of 0.6 per cent from private economists polled by Bloomberg.

It could worsen analysts' fears that a manufacturing downturn may push the Republic into technical recession, or two straight quarters of quarter-on-quarter contraction. The Singapore economy already contracted by 3.3 per cent in the June quarter, compared to the first quarter.

On a seasonally adjusted, monthly basis manufacturing output slid by 7.5 per cent in August - or by 12.1 per cent with biomedical manufacturing left out - reversing the uptick of 3.6 per cent seen in July.

After the second-quarter slowdown, Barclays analysts suggested on Wednesday that third-quarter growth could still rebound, on improved factory data in July.

But the latest numbers could stymie economists' hopes of a recovery in manufacturing, which had been fanned by July's better-than-expected showing, where the preliminary print - a 0.4 per cent contraction - has now been revised upwards.

The risks of a technical recession have increased, United Overseas Bank economist Barnabas Gan told The Business Times.

"Singapore being a price-taker and highly reliant on trade, the tensions between the United States and China could be a main driver that is really damping hopes of a recovery in the contraction in trade numbers and industrial production," he said.

Noting that "Singapore produces to sell", Mr Gan added that the outlook for semiconductor sales in Asia remains in negative territory.

Non-oil domestic exports most recently fell by 8.9 per cent year on year in August, and the weakness is expected to persist, with official forecasters predicting a full-year export contraction of between 8 per cent and 9 per cent.

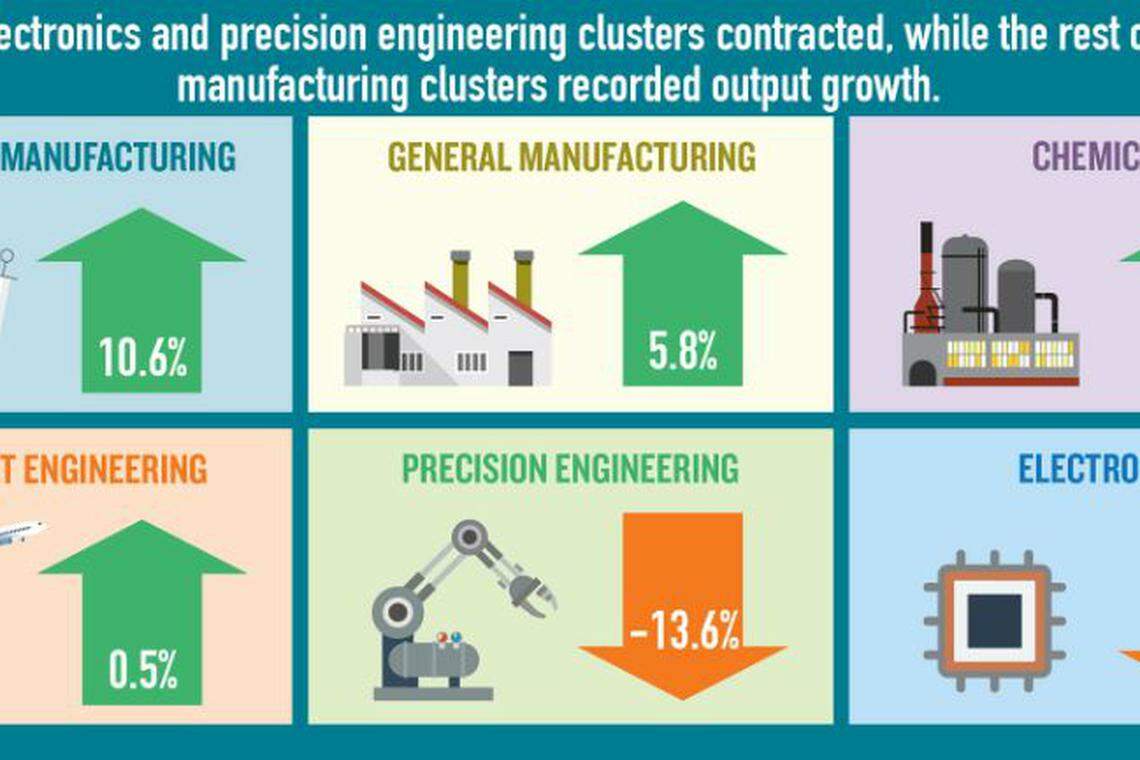

On the factory front, August's 10.6 per cent expansion in biomedical manufacturing could not offset the tough outlook in the ailing electronics industry, the latest data showed.

The electronics cluster contracted by 24.4 per cent year on year - despite growth in the data storage and infocomms and consumer electronics segments - as the linchpin semiconductor segment returned to double-digit decline to the tune of 29.6 per cent.

Similarly, the adjacent precision engineering sector shrank by 13.6 per cent. Output in the machinery and systems segment was down on lower production of refrigeration systems and semiconductor equipment, while precision modules and components output fell as fewer optical products and metal precision components were made.

Chemicals output rose by 2.7 per cent, propped up by higher fragrance production in the "other chemicals" segment, but petrochemicals, specialty chemicals and petroleum were all in the red, with maintenance shutdowns affecting the petroleum through-put.

Meanwhile, transport engineering output inched up by 0.5 per cent as growth in the land and aerospace segments made up for the hit to marine and offshore engineering, amid declines in offshore activity and shipbuilding and repair.

General manufacturing increased by 5.8 per cent, spurred on by milk powder and drinks production, as well as growth in metal containers and clothing output.

As for the recession risk, "it all depends on how the numbers for September come in. We do note that September is a low base", Mr Gan said.

Jonathan Koh, an economist at Standard Chartered, also believes that there is a favourable low base effect from 2018 for the third and fourth quarters of the year.

"Services, if it performs better, could outweigh the manufacturing slowdown, but we do not have a good leading indicator for services, unfortunately," he told BT.

Manufacturing typically contributes to about one-fifth of the Singapore economy, which is otherwise dominated by the services industries.

Still, Mr Koh added that - despite the higher likelihood now of a technical recession - "in our view, this is just a technical definition".

That's because the central bank is expected to ease the slope of the Singdollar's appreciation at its October policy meeting in any case, amid a wider slowdown, he said.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

NTUC aims to do more to support PMEs, who now account for nearly half its membership

Daily Debrief: What Happened Today (Apr 25)

Singapore’s inflation eases more than expected in March, with headline inflation at 2.5-year low

8 in 10 firms in S-E Asia, Greater China positive about business environment: UOB survey

Flexi-work request guidelines not meant to prescribe blanket outcomes for employers or influence hiring of workforce: SNEF

Daily Debrief: What Happened Today (Apr 23)