Singapore firms' payment performance worsens in Q2: SCCB

LOCAL firms' payment performance has worsened following a previous quarter rebound, the Singapore Commercial Credit Bureau (SCCB) said on Tuesday.

For the second quarter, prompt payments accounted for less than half of total payment transactions, while slow payments accounted for more than a third of total payment transactions.

Prompt payment refers to when 90 per cent or more of total bills are paid within agreed payment terms, while slow payment is defined as when less than 50 per cent of total bills are paid within the agreed terms.

In the second quarter of this year, prompt payments fell 2.26 percentage points to 49.44 per cent, from 51.7 per cent the previous quarter. Compared to the second quarter of 2018, prompt payments fell 0.11 percentage point from 49.55 per cent.

Slow payments, meanwhile, edged up by 0.51 percentage point to 37.1 per cent, from 36.59 per cent the previous quarter. Year on year (y-o-y), slow payments fell by 0.08 percentage point from 37.18 per cent.

Partial payments also rose by 1.74 percentage points to 13.45 per cent in the second quarter, from 11.71 per cent the previous quarter. Y-o-y partial payments were up 0.18 percentage point from 13.27 per cent.

Partial payment occurs when between 50 and 90 per cent of total bills are paid within the agreed payment terms.

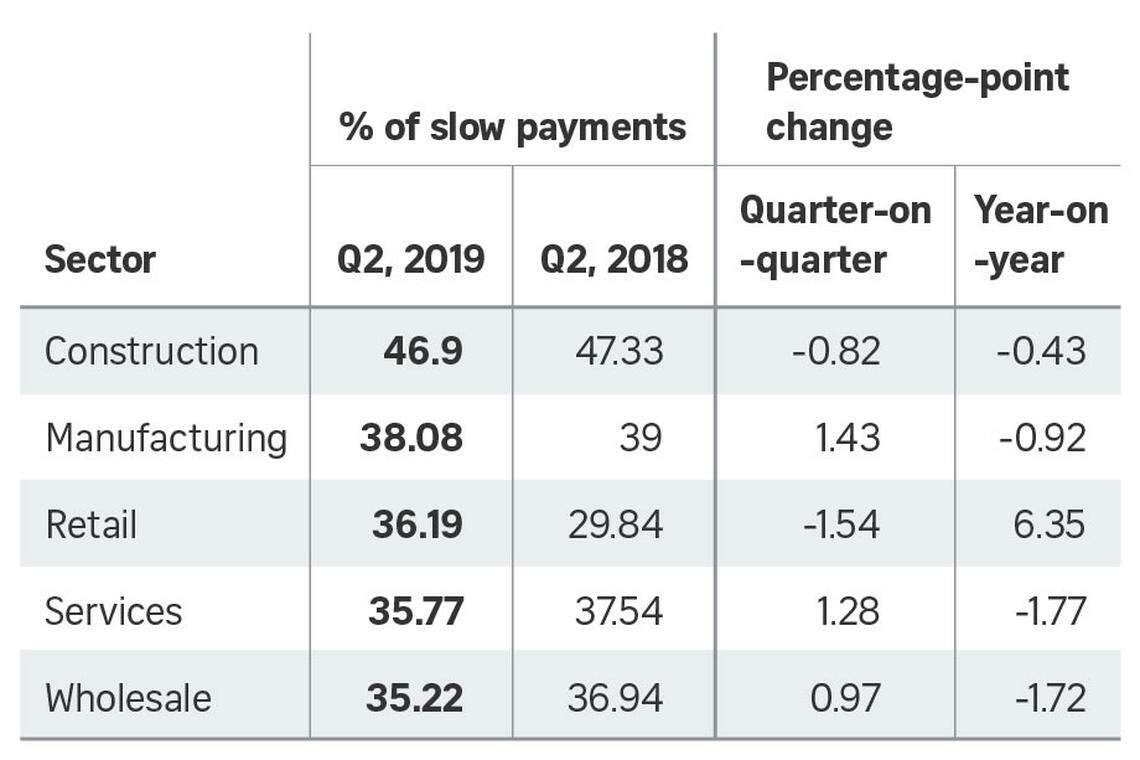

Among the five sectors, the manufacturing sector saw the largest increase in slow payments quarter-on-quarter (q-o-q), inching up 1.43 percentage points to 38.08 per cent, from 36.65 per cent in Q1. Y-o-y, slow payments dipped by 0.92 percentage points from 39 per cent.

The sector also saw an increase in slow payments from payment delays by manufacturers of printing and publishing, leather products and tobacco products.

The retail sector saw slow payments fall the most among sectors on a q-o-q basis, down 1.54 percentage points to 36.19 per cent, from 37.73 per cent. Slow payments fell for the third consecutive quarter from a decrease in slow payments from retailers of general merchandise, food and beverage, building materials and garden supplies.

On a y-o-y basis, the sector saw the largest percentage increase in slow payments, up 6.35 percentage points from 29.84 per cent.

The wholesale industry saw slow payments fall the most among sectors on a y-o-y basis, down 1.72 percentage points to 35.22 per cent, from 36.94 per cent. Q-o-q, delays edged up 0.97 percentage point to 35.22 per cent, from 34.25 per cent. A rise in slow payments from wholesalers of durable goods was observed.

The construction sector saw slow payments improve slightly in the second quarter due to a decrease in payment delays primarily in building construction. Slow payments dipped 0.82 percentage point to 46.90 per cent, from 47.72 per cent the previous quarter. Y-o-y, slow payments fell 0.43 per cent from 47.33 per cent a year ago. Special trade contractors accounted for the largest increase in slow payments.

In the services sector, slow payments rose for the first time after four straight quarters of decline, largely from an increase in payment delays within the hotels and accommodation, education and social services sub-sectors. Q-o-q slow payments inched up 1.28 percentage points to 35.77 per cent, from 34.49 in the first quarter. Y-o-y, slow payments were down 1.77 percentage points from 37.54 per cent.

D&B Singapore chief executive Audrey Chia said the rise in slow payments for the second quarter was largely due to weaker performance within the manufacturing sector and the overall deterioration in credit conditions.

She added: "On the external front, challenges remain as the wholesale trade sector continues to face headwinds. However, compared to the same quarter in the previous year, the increase in slow payments is relatively marginal. It remains to be seen whether the payment performance will continue to worsen in the coming months."

D&B compiles the figures by monitoring over 1.6 million payment transactions of firms operating through its unit SCCB, which manages a database of local enterprises and their credit history.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Fed survey cites inflation, US election as key financial stability risks

Oil prices steady after Iran plays down reported Israeli attack

G7 pledges swift aid for Ukraine, seeks to calm Middle East

H5N1 strain of bird flu found in milk: WHO

China moves to boost foreign investment in domestic tech companies

Xi orders China’s biggest military reorganisation since 2015