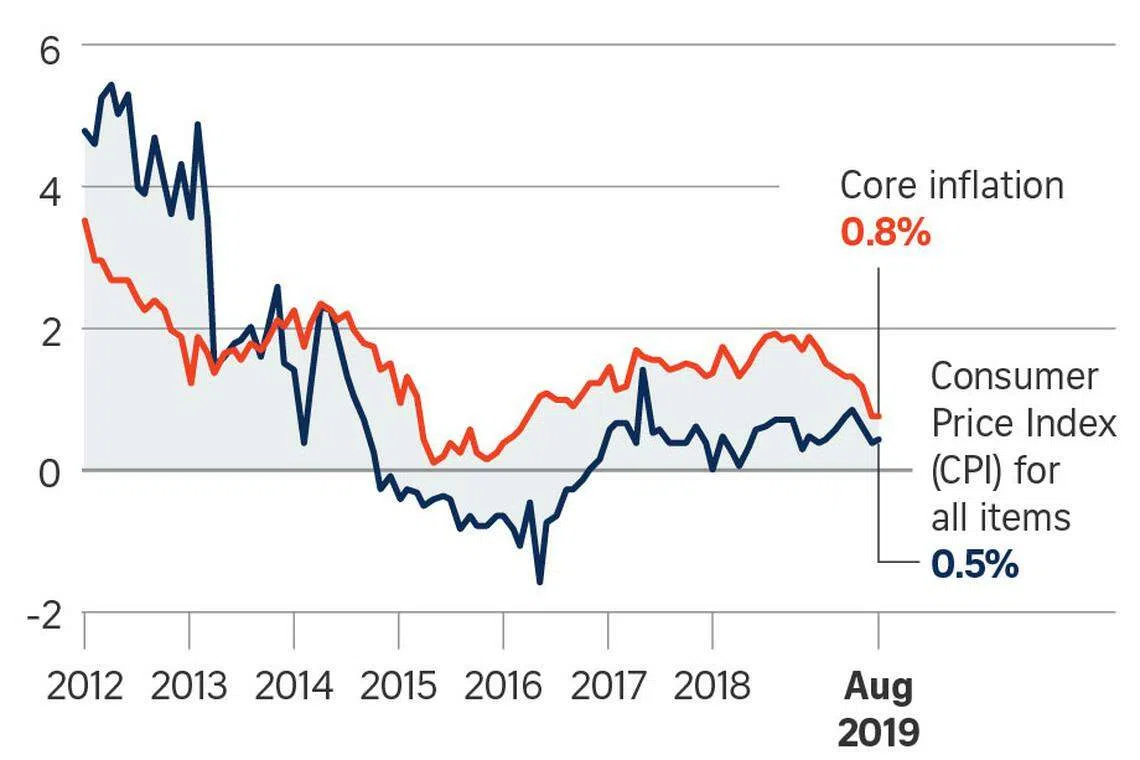

Singapore headline inflation edges up to 0.5% in August; core inflation stays flat

SINGAPORE's headline inflation edged up slightly in August reversing from a dip July, while core inflation remained flat, according to statistics released by the authorities Monday.

Headline inflation rose to 0.5 per cent, up from 0.4 per cent in July and largely in line with economists' expectations. This reflects higher private road transport inflation and a smaller decline in accommodation costs, the Monetary Authority of Singapore (MAS) and the Ministry of Trade & Industry (MTI) said in a joint statement.

Food inflation picked up slightly to 1.6 per cent year on year in August, from 1.4 per cent in the previous month. MAS and MTI said this was on account of a larger increase in the cost of non-cooked food items, as well as higher food services inflation.

The cost of retail goods registered a year-on-year decline of 1.5 per cent, larger than the 1 per cent fall in July. The steeper drop primarily reflected a sharper decline in the cost of medical products, household durables, household supplies, and clothing and footwear items, as well as a slower pace of increase in the cost of personal care products, the authorities said.

Meanwhile, core inflation, which strips out accommodation and private road transport costs, remained at 0.8 per cent and is unchanged from July. MAS and MTI said a steeper fall in the costs of retail goods, and electricity and gas was offset by higher food and services inflation.

The cost of electricity and gas fell at faster pace of 7.8 per cent year on year in August, compared to the 7.0 per cent decline last month The authorities have attributed this to the dampening effect of the nationwide launch of the Open Electricity Market (OEM) on electricity prices.

Services inflation saw a year-on-year uptick of 1.7 per cent in August, up from 1.6 per cent in July. This was on account of higher telecommunication services fees and a larger pickup in air fares, which more than offset a slower pace of increase in holiday expenses and fees for recreational and cultural services, MAS and MTI said.

The authorities have maintained their inflation outlook for the rest of the year, with headline inflation expected to average 0.5 to 1.5 per cent, and core inflation, 1 to 2 per cent.

Global oil prices for the full year are still expected to average lower than in the previous year, despite recent volatility, MAS and MTI said.

Selina Ling, head of treasury research and strategy at OCBC Bank, said: "Notwithstanding the recent bump higher in crude oil prices due to the drone attacks in the Saudi Arabia oil facilities, our view remains that any supply shocks due to geopolitical hotspots are unlikely to precipitate a lasting impact on Brent beyond US$65 per barrel."

On the whole, economists say the numbers set the stage for the central bank's policy meeting next month, during which they are expecting the authority to ease its monetary policy.

"We expect the MAS to ease and reduce the slope of the SGD NEER (Singapore Dollar Nominal Effective Exchange Rate) at the October meeting, given sluggish GDP growth and subdued core inflation. But MAS may reduce the slope slightly rather than to zero, as Singapore likely escaped a technical recession in 3Q19," Chua Hak Bin, senior economist at Maybank Kim Eng, said in a report.

Economists from Barclays Investment Bank, Citi and HSBC Singapore say they are expecting the MAS to reduce the slope of its SGD NEER policy band by 50 basis points.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Global wave of consultancy layoffs has not hit Singapore

Daily Debrief: What Happened Today (Apr 19)

An economy transformed: Lee Hsien Loong’s 20 years as Singapore’s Prime Minister

Daily Debrief: What Happened Today (Apr 18)

Singapore’s first RoboCluster launched for facilities management, to turn R&D into market solutions

Daily Debrief: What Happened Today (Apr 17)