Singapore non-oil domestic exports miss expectations with 1.1% growth in June

SIMMERING trade war tensions and slowing electronics momentum have led to a sharp moderation in non-oil domestic exports (NODX) in June, putting Singapore's growth in the second half of the year at risk.

Singapore's June NODX fell short of economists' expectations with a muted 1.1 per cent growth that was well shy of the 15.5 per cent surge in May.

Economists had projected NODX to increase by 7.8 per cent year-on-year in June.

Non-electronic exports led the growth in June, while electronic shipments continued to slide.

Non-electronic NODX grew by 4.6 per cent in June, slowing sharply from the blistering 26.2 per cent expansion in the previous month. Food preparations, pharmaceuticals and petrochemicals contributed the most to the growth.

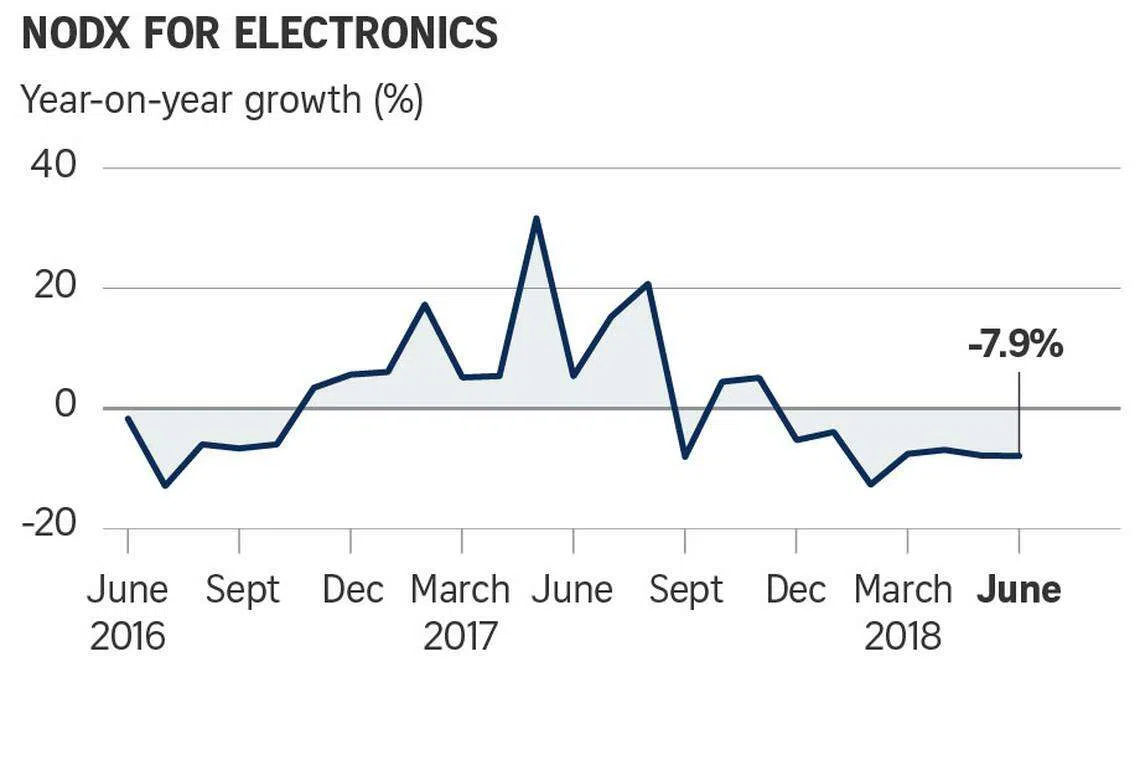

Electronic NODX declined by 7.9 per cent, keeping pace with the 7.8 per cent decrease in May. The slump was led by integrated circuits, parts of PCs (personal computers) and consumer electronics.

Shipments to the majority of Singapore's top 10 markets declined in June, except for exports to the United States, Indonesia, Hong Kong and the European Union.

Non-oil re-exports (NORX) - seen as a proxy for the wholesale trade sector - rose by 5.1 per cent in June after the 4 per cent increase in May. This is due to the growth in non-electronic NORX, which outweighed the decline in electronics.

Total trade increased by 10.3 per cent in June, extending the 9.8 per cent growth in the preceding month. This was supported by both export and import growth.

OCBC economist Selena Ling believes that NODX momentum is likely to decelerate further in the third quarter due to the trade conflict.

"There is some downside risk to full-year 2018 NODX growth forecast, assuming potential further disruptions to regional supply chains if the next leg of US$200 billion of US tariffs on Chinese imports materialise in September," she noted.

DBS economist Irvin Seah also expects an even slower GDP growth in the third quarter: "Coupled that with the effects of trade protectionism and tighter liquidity conditions, economic outlook in the longer horizon is turning increasingly cloudy."

Aside from the trade conflict, the latest property cooling measures will also weigh on growth.

Maybank Kim Eng economists Chua Hak Bin and Lee Ju Ye said: "Recent property measures appear ill-timed and overly harsh, coming on the back of a visible growth slowdown and an escalating US-China trade war."

Copyright SPH Media. All rights reserved.