Singapore's wealth per adult among the highest in the world

Singapore

EVEN as growth slows, Singapore's wealth per adult remains among the highest in the world, led by high savings, asset price increases, and a favourable rising exchange rate from 2005 to 2012.

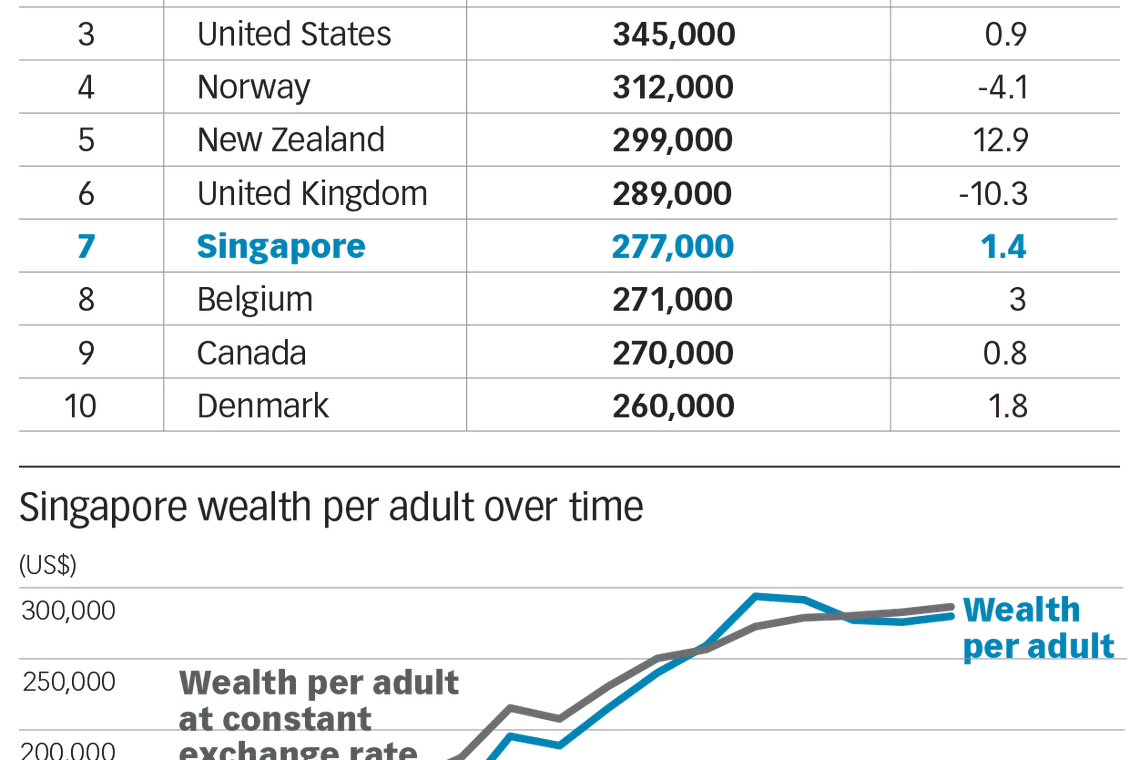

Personal wealth per adult here was up 1.4 per cent to US$277,000 in 2016, taking the seventh position globally among major economies. Switzerland (US$562,000) led the top 10, followed by Australia (US$376,000) and the United States (US$345,000).

In the next five years, wealth per adult here is projected to rise 2.2 per cent per annum to hit US$309,000 in 2021, said the Credit Suisse Research Institute on Tuesday in its seventh annual global wealth report.

The report gives a flavour of global wealth development and provides estimates of global household wealth levels in all regions and population segments.

It found that Singapore's household wealth grew 2.9 per cent in 2016 to reach US$1.1 trillion. This is projected to go up 3.5 per cent per year in the next five years to reach US$1.4 trillion in 2021.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Financial assets make up 54 per cent of gross household wealth in Singapore, a ratio similar to that of Switzerland and the United Kingdom. The average debt of US$54,800 is moderate for a high-wealth country, equalling just 17 per cent of total assets, said the report.

It added that Singapore publishes household sector balance sheet data, which means that wealth information is more reliable compared to that of most of its neighbours in South-east Asia.

In terms of wealth distribution, Singapore is only moderately unequal with 18 per cent of its people having wealth below US$10,000, compared to 73 per cent globally.

Also noteworthy is that the number with wealth above US$100,000 is six times the world average.

About 5 per cent of adults here, or 222,000 individuals, are in the top one per cent of global wealth-holders - a very high number given that the country has just 0.1 per cent of the world's adult population.

In 2016, there were 150,000 millionaires here, up 2 per cent, with a total wealth of US$541 billion.

Meanwhile, the number of ultra-high-net-worth individuals grew even faster at 14.2 per cent to 885.

By 2021, the report said, the number of millionaires here is estimated to grow 4.2 per cent per annum to 185,000.

Overall, total global wealth in 2016 edged up 1.4 per cent to US$256 trillion, in line with the growth in the world's adult population. Correspondingly, average wealth per adult of US$52,800 remained unchanged.

The report highlighted the impact of adverse currency movements, which caused wealth to fall in every region except in the Asia-Pacific. Downward movement in equity prices and market capitalisation also led to a relatively small increase in household financial wealth.

Among individual countries, Japan recorded the highest growth in total wealth, followed by the US. The UK, on the other hand, suffered a sharp drop in wealth, hit by the Brexit vote which triggered a sharp decline in exchange rates and stock market.

John Woods, Credit Suisse's chief investment officer, Asia Pacific, said: "The consequences of the 2008-2009 recession will continue to have a material impact on growth, which is pointing more and more towards a long-term stagnation. The emergence of a multi-polar world, confirmed by the impact of the Brexit vote in the UK and by the US Presidential election, is likely to exacerbate such a trend, which could possibly lead to a new normal lower rate of wealth growth."

The Asia-Pacific region, he noted, is now the second largest wealth region globally and it continues to see steady growth in total wealth albeit at a slower pace.

Copyright SPH Media. All rights reserved.