Temasek tops best practices leaderboard for state-owned investors

GIC placed 32nd among sovereign wealth funds worldwide

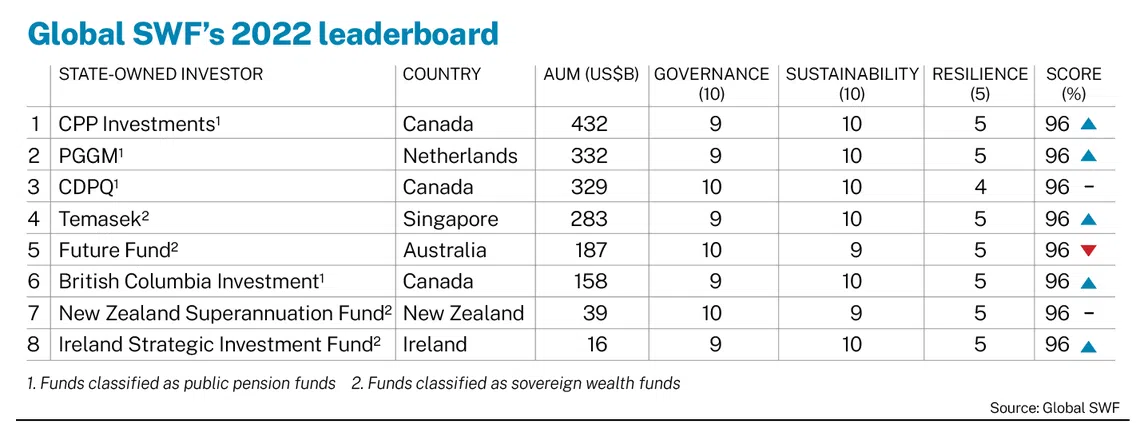

SINGAPORE’S state investor Temasek has overtaken Australia’s Future Fund as the world’s largest state-owned investment fund with best practices in governance, sustainability and resilience.

This is according to the latest scorecard released by Global SWF on Friday (Jul 1). The data platform has been ranking state-owned investors on aspects such as transparency and accountability, responsible investing and legitimacy and long-term survival since 2020.

For 2 years running, Global SWF had given perfect scores to Future Fund. But this year, it perceived Temasek to have fulfilled its criteria for a publicly available indication of how it is funded and how it is possibly withdrawn, and gave Temasek a better score.

That was enough to move Temasek to the top of its chart of the 100 best sovereign wealth funds, as Future Fund lost 4 percentage points for failing to align with the United Nations’ Sustainable Development Goals and came to be tied with Temasek, scoring 96 out of 100.

Temasek, which owns and commercially manages investments and assets previously held by the Singapore government, was placed higher by virtue of the size of its assets under management (AUM) – US$283 billion, versus Future Fund’s US$187 billion.

With the improvement, the only area that Temasek lacks in is sufficient disclosure around how the fund is structured as an investment organisation.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

Addressing the need for state-owned investors to disclose this, Global SWF said: “We believe (an organisational chart) says a lot about how any kind of organisation is run and it is key information to be shared with the stakeholders.”

It noted that 53 per cent of the 200 state-owned investors assessed fulfilled this criteria.

When public pension funds are added to the mix, Temasek is 4th on the leaderboard behind Canada’s CPP Investments and CDPQ and the Netherlands’ PGGM – all of which also scored 96 points. The AUM of these pension funds are greater, at US$432 billion, US$329 billion and US$332 billion respectively.

Meanwhile, GIC, which manages Singapore’s government reserves, including surpluses accumulated and built up since its independence, was placed 32nd among sovereign wealth funds, and 95th overall.

Its score of 60 had stayed unchanged over all 3 years of Global SWF’s assessment, although average scores across state-owned investors were observed to have moved up by 6 percentage points.

Global SWF’s scoring is based on 25 categories, and GIC was marked down on the same 10 categories over 3 years, over its failure to provide clarity on how much capital it manages and what assets it holds, among others.

GIC has long contended that it is in Singapore’s national interest to not disclose the size of its AUM.

On its website, GIC states that the government has explained that revealing this information, taken together with the published assets of the Monetary Authority of Singapore and Temasek, will amount to publishing the full size of Singapore’s financial reserves.

“It is not in the national interest to publish the full size of the reserves for it will make it easier for markets to mount speculative attacks on the Singapore Dollar during periods of vulnerability,” GIC said.

Global SWF, however, highlighted in its latest report that only 28 of the top 200 state-owned investors still consider the size of their balance sheet a state secret, adding that the National Development Fund of Iran is the latest to confirm that its AUM was US$139 billion.

Using its internal model, Global SWF estimates GIC’s AUM to be US$799 billion, which would make it the world’s fifth-largest sovereign wealth fund.

The Central Provident Fund (CPF), which was not rated in previous years, was placed 126th overall with a score of 52. It fulfilled none of Global SWF’s 10 categories under sustainability, but fared better than GIC when it comes to clarity around the actual size of its balance sheet and investment portfolio.

Temasek, on the other hand, scored full marks for sustainability, which evaluates funds for their ethical standards and policy, environmental, social and governance (ESG) risk management and role in the domestic economy, among others.

Currently, only 50 per cent of the funds include ESG in their risk management policies, only 43 per cent employ ESG professionals, and only 30 per cent report ESG activities regularly, Global SWF pointed out.

High scores do not necessarily translate to high returns, however. Despite Temasek’s high scores, the fund generated low returns, while GIC saw high returns despite its low scores, Global SWF noted.

The New Zealand Superannuation Fund, Canada’s CPP Investments and Sweden’s AP-Fonden are listed as examples of state-owned investors with high scores and high returns.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Singapore’s inflation eases more than expected in March, with headline inflation at 2.5-year low

8 in 10 firms in S-E Asia, Greater China positive about business environment: UOB survey

Flexi-work request guidelines not meant to prescribe blanket outcomes for employers or influence hiring of workforce: SNEF

Daily Debrief: What Happened Today (Apr 23)

Daily Debrief: What Happened Today (Apr 24)

Daily Debrief: What Happened Today (Apr 22)