Opportunities beckon in Malaysia residential properties

RESIDENTIAL property investors on both sides of the Causeway did not enjoy the best of times in 2016. That was largely due to weak economic conditions and Malaysian government policies on residential property investments, which prevented prices from escalating. Hence, both domestic investors and Singapore capital seeking residential properties in Malaysia were affected.

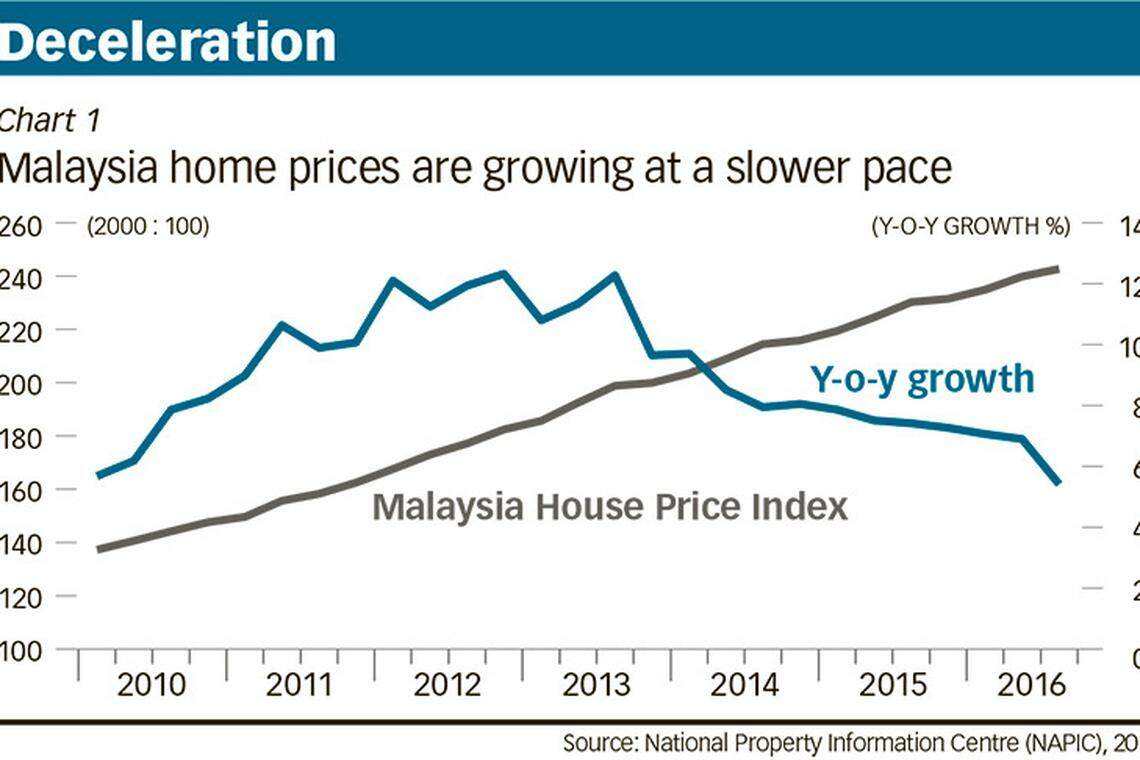

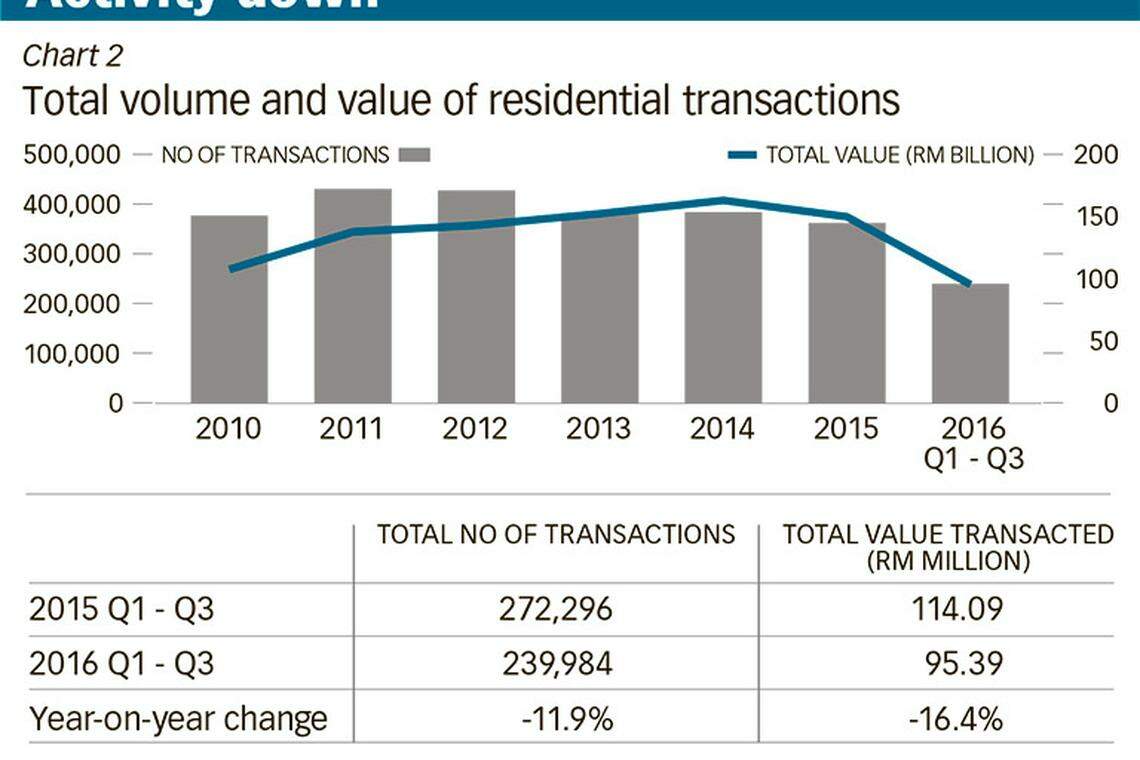

Today, there are signs that the residential market of Malaysia is slowing (Chart 1). Although investors currently in the market might be disadvantaged, the various measures were generally welcomed, if long-term sustainability is to be maintained. The number of transactions and total value of transactions have dropped by 11.9 per cent and 16.4 per cent respectively year-on-year for the period Q1 - Q3 2016 (Chart 2).

In Greater Kuala Lumpur, the market was booming prior to the government's implementation of the cooling measures in late 2013, as competitive pricing supported by successful marketing campaigns and a low interest rate environment boosted sales. The market showed signs of stabilising after the implementation of the measures. Even though there is evidence of an oversupply, especially in the high-end residential segment, developers remained cautiously optimistic and are keen to kick-start new launches after adopting a wait-and-see approach for over a year since the implementation of the goods and services tax in Q1 2015.

Given current economic fundamentals and government intervention, residential prices are expected to fall. However, there is little indication of that happening at the moment. Despite the weaker secondary market, there is hardly any sign of distress sales, with a key barometer - the non-performing loans ratio - remaining low at 1.7 per cent. This is much lower as compared to the Asian financial crisis in 1998, when it rose to a double-digit high. The various state governments have also tightened the minimum residential price point for foreign ownership of Malaysia property. In general, this is around RM1 million (S$316,000), with slight variations among individual states, although it does not apply to certain areas, such as Medini in Iskandar Malaysia for example.

While it is generally not a buyers' market now, homeseekers can take advantage of the fact that completed but unsold units (which have been building up over the years especially with recent completions) have spurred developers to offer substantial discounts to reduce inventory.

Within the established central city locations, such as Kuala Lumpur City Centre, properties in the RM1-2 million range are generally a good choice and are considered resilient over the longer term. The smaller one to twobedroom units tend to be popular among expatriates looking to rent. Expected yield in the short term is nevertheless rather low at around 3 to 4 per cent. Major redevelopments within the central locations present new opportunities, such as Bukit Bintang City Centre (BBCC) and Tun Razak Exchange (TRX). These are comprehensive integrated developments with MRT linkages and will be internationally appealing.

The submarkets in Iskandar Malaysia and Penang reflect the general trend in Kuala Lumpur, although there is concern over Iskandar, with the presence of Chinese developers and their large-scale projects.

Iskandar Malaysia, the star destination for investors in recent years, had seen major price escalations until talk of emerging "ghost towns" put a brake on investors' sentiment from mid- 2016. In addition to the opportunity for price arbitrage, Iskandar Malaysia has always been an attractive destination for Singaporean buyers on both grounds of familiarity and proximity. Chinese buyers are the new addition to the equation. Pricing has started to show weakness and price discounts are starting to become prevalent, although the secondary market has not seen much activity.

Unfortunately, the success of the residential sector in Iskandar has outpaced its commercial and industrial counterparts, which were supposed to be the catalyst for job creation and population growth. So, owners of recently completed units may need to exercise patience for their investment to yield a decent rental return.

In Penang, home prices have traditionally been supported by land constraints on the island and its popularity as a second home for retirement or vacation. However, the recent downturn and consolidation within the electrical and electronics sector have dampened local demand. Even so, the situation is cyclical in nature and will not persist indefinitely. This year, the state government halved the approval fee of 3 per cent to 1.5 per cent for stratified residential properties on the island that cost between RM1 million and RM1.5 million, and this is likely to spur foreign demand. Prices in Penang are comparable to Kuala Lumpur, with high-end condominiums priced between RM1,000 and RM1,400 per sq ft.

The re-emergence of Penang as a regional holiday destination will to a certain degree support demand, especially with the attraction of resort apartments with sea views along its famous beach front stretching from Tanjung Bungah to Teluk Bahang. The rejuvenation of Gurney Drive along with the implementation of Gurney Wharf, a 60-acre public park, will also be a boost to the area. Nonetheless, the state government of Penang has recently raised the minimum price for foreign purchases of landed properties on Penang island from RM2 million to RM3 million, which will put a lid on any recovery in the landed market.

Moving forward, the decline of the ringgit has been generally in foreign buyers' favour, but with the volatility of the currency showing no sign of abating anytime soon, potential investors need to keep a keen eye on the situation as they could enter the market prematurely. For existing investors, any return on the asset will be drastically affected by potential currency exchange losses upon realisation of a sale. Ideally, the ringgit would recover to its fundamentals in the mid to longer term. If your existing assets show a positive cash flow and provide a reasonable return on investment, it is advisable to ride out any short-term losses and wait for the next upturn - which will invariably return. This will also be a good time to perform asset enhancement work to improve the property's rentability.

Talk about the pending election this year is not helpful to the market, as investors, both domestic and foreign, will require a clear sense of direction with regard to the country's future. To be successful, investors will need lots of patience, an eye for emerging bargains, and an appetite for risks on emerging locations.

The writer is executive director, investment, research & consulting, Nawawi Tie Leung Property Consultants Sdn Bhd

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

New Articles

Digital Core Reit Q1 distributable income slips 2.4% to US$10.6 million

BT subscribers can now share 5 premium articles a month with unlimited number of non-subscribers

First Reit reports 3.2% lower Q1 DPU of S$0.006 amid interest rate, forex headwinds

Vietnam holds first gold auction in 11 years to stabilise market

How Hudson Yards went from ghost town to office success story

Hot stock: Nanofilm jumps 13.1% amid heavy trading on improved Q1 results