Navigating the digital revolution

Whether in the workplace or the home, digital technology has permeated almost all aspects of our lives. Yet, experts say the revolution has only just started as more powerful tools emerge to disrupt jobs and businesses. Several key digital megatrends that have been in the making for several years are now starting to make its presence felt across a wide swathe of industries. These include the merger of business analytics with artificial Intelligence (AI); ultra-fast fifth-generation (5G) mobile networks, and the mainstream adoption of Internet of Things (IoT) solutions.

Knowledge-intensive sectors such as accounting and financial services are strong candidates for disruption by these key technologies. In the finance and accounting function, for instance, technology will replace much of the tedious and labour-intensive work of mining and analysing data. These low-end services can be replaced by self-service platforms or will become commoditised functions, especially when technology enables accountants to tap directly into client data flow for accounting and audit purposes, among others. The use of data analytics tools will also allow accountants to add value by providing richer insights to their clients, while helping them to keep costs down at the same time.

"With the rapid advances in technology, we are already seeing how technology and artificial intelligence can substitute and complement certain processes in the professional services. Highly complex tasks and processes can be simplified through technology and there will be significant impact on research and analysis processes. The use of knowledge platforms, crowdsourcing models and knowledge sharing models will also become a common practice," says Philip Yuen, Chief Executive Officer, Deloitte Southeast Asia and Singapore.

He cited blockchain technology as another megatrend that has the potential to shift the nature of the accounting profession, as it has the ability to automate accounting processes in compliance with regulatory requirements. Auditors could leverage blockchain to automatically verify a large portion of the most important data behind a company's financial statements.

"As a result, the cost and time necessary to conduct an audit would decline considerably, and auditors could spend freed up time on areas they can add more value, including very complex transactions or internal control mechanisms," explains Mr Yuen.

Not if, but when

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The groundwork for today's digital megatrends was laid as far back as the 1980s. Back then, "Expert Systems" - a pillar of the AI domain - was touted as a potential replacement of experts such as auditors and actuarists. But progress in that AI solution was hampered due to the lack of extensive data and ultra-fast computing. Rapid advancements in technology over the past decade, however, means that the promise of AI technology to replace human experts is now finally being realised.

"That scenario has changed and we can expect that this time the likelihood of replacement of knowledge-based roles, especially those where business rules can be codified, will happen - not if but when. My prediction is within five years with disruptions in financial services, accounting and audit," says Patrick Thng, Senior Lecturer of Information Systems and Co-Director, Institute of Innovation & Entrepreneurship, Singapore Management University.

An example is the use of IOT, AI and analytics technology to generate dynamic, on-demand national economic forecasts. Says Mr Thng: "It is no longer the time-delay-after-the-event reporting that we have been used to."

Impact on consumers

Digital technology is also having a significant impact on how companies analyse and understand consumer preferences, especially those of the digitally-immersed Millennial generation. Joerg Niessing, Affiliate Professor of Marketing, INSEAD, said that digital tools are key enablers in helping brands engage their target consumers.

"Organisations need to find out what customers really want and not what they just need. The re-alignment of investments into technologies should help businesses to create more value by engaging target customers more effectively at important touchpoints in the entire customer experience lifecycle," he says.

However, while customer-centricity is becoming more important, many organisations have missed this point in their rush to go digital. According to a study by the IBM Institute for Business Value last year, there is a disconnect between the aspects of the digital experience that executives think are important to customers and what customers actually care most about.

In a survey of 600 executives and 6,000 consumers, two-thirds of consumers felt the experience of exploring products using virtual reality, interactive digital displays or voice commands was disappointing. As a result, they decided not to adopt these products for future use.

"The future will belong to firms that identify customer pain points and provide digital solutions where they matter most. This requires rethinking the customer journey, drawing out customer journey maps and working with multiple parts of the business to provide the most relevant solution to those pain points," says Mr Niessing.

Much of the digital efforts by businesses will be focused on Millennials who have grown up in a predominantly digital world. Branded as Generation C (for "connected"), the use of computers, the internet, mobile devices, and social networking is ingrained in their nature.

"Generation C are prolific digital consumers. They will drive intense competition as they pressure the industry and governments to deliver anytime and anywhere information about themselves and unmet social needs with a high dose of security protection," says Mr Thng.

Economic benefits

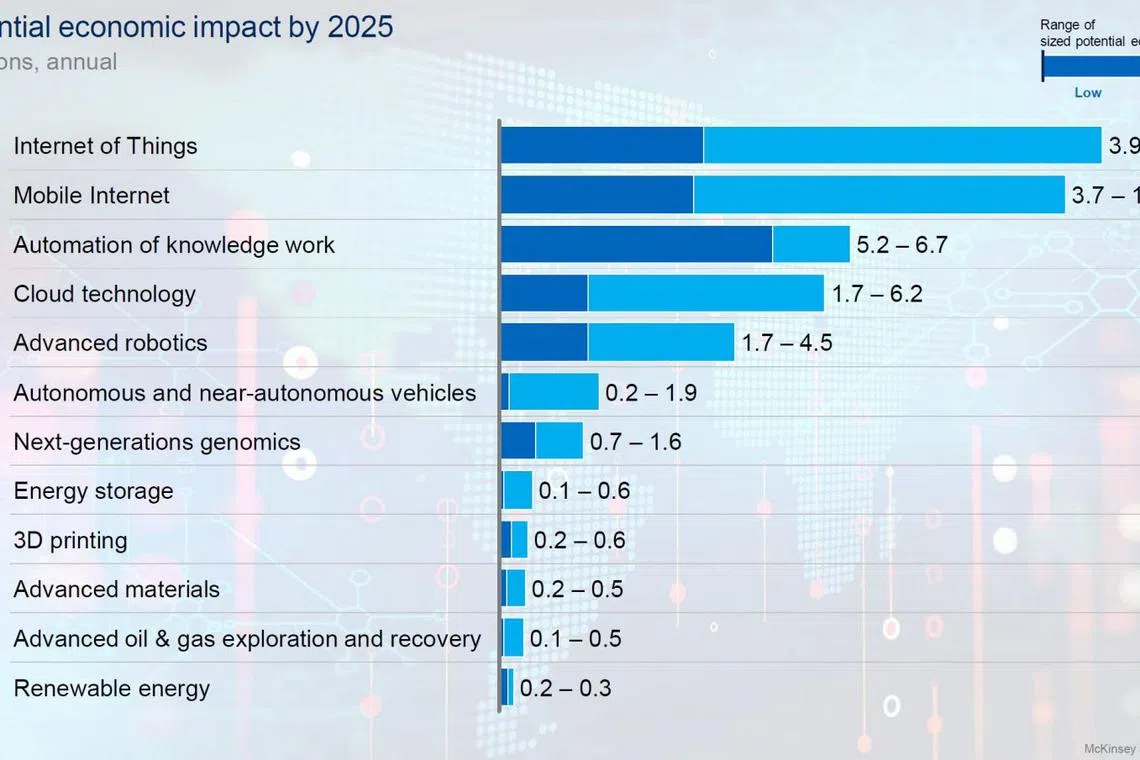

Taking a broader view, experts believe that the significant increase in digital usage brought about by new technologies has helped to drive economic growth, and could lead to job and earnings growth over the long run. This has come about as digitalisation enables new ways of communicating and socialising, creates new business models and industries, and provides more efficient ways for companies and workers to operate.

For instance, the adoption of cloud solutions enables remote working, while the ability to access products through websites saves time for people and opens up international markets for companies. This in turn increases productivity and opportunities for businesses, making them more competitive at home and abroad. Having access to global markets also increases the incentives for companies to innovate and introduce new services. "With increased market activity, the number of jobs and earnings is expected to increase," says Mr Yuen.

However, Mr Thng argues that those hoping to succeed in the digital economy must be prepared to adopt of radically different mindset. "The winners in the new economy will be those that have been positioning themselves to adapt, future-sense and dare-to-experiment mindsets - very few and far in between."

This article is part of a series brought to you by CPA Australia to share knowledge on topical issues relevant to business, finance and accounting.

Share with us your feedback on BT's products and services