Asean green investments fall 7% despite rise in commitments: Bain-Temasek report

Wong Pei Ting

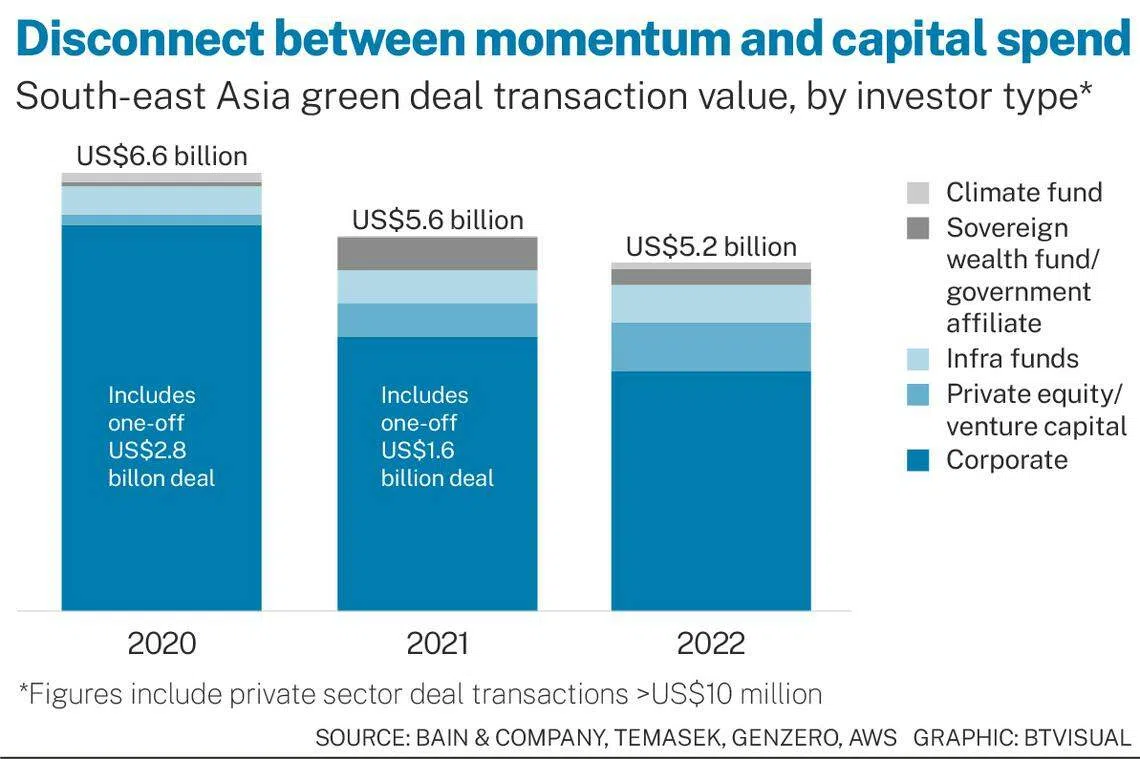

GREEN capital spend in South-east Asia dwindled for two years straight, despite a notable rise in government and corporate commitments to channel new capital towards the region’s decarbonisation needs in 2022.

Bain & Company, Temasek, GenZero and Amazon Web Services’ latest stocktake found that the region’s green deal transaction value fell again in 2022, this time by 7 per cent to US$5.2 billion, from US$5.6 billion in 2021. The spend in 2020 was US$6.6 billion.

The drop is due, in part, to the shifting nature of foreign investment. In 2022, monies from outside of South-east Asia fell by over 50 per cent compared with 2020 and 2021, while intra-regional investments doubled.

The slowdown is of concern as an estimated US$1.5 trillion in cumulative investment is needed for South-east Asian countries’ energy and nature sectors to fulfil their nationally-determined contribution targets by 2030. If this goes on, the top emitting countries – Indonesia, Vietnam and Thailand – are at risk of missing their targets.

Fleshing these out in a report on Tuesday (Jun 6) as Temasek’s annual flagship sustainability event Ecosperity Week kicked off, the collaborators now stress that proven solutions need to start scaling.

These known, high-potential levers include increasing renewable deployment, grid enhancement and accelerating nature-based solutions development, as well as building and scaling the carbon market. Nature-based solutions include protecting intact lands, sustainable agriculture, and restoration of deforested lands.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Combined, they could deliver up to 85 per cent of the needed action to close the emissions gap of 2.4 gigatonnes towards the region’s unconditional 2030 targets, the report stated.

This means “no scientific breakthroughs are required” for countries to realise their decarbonisation potential today, the report’s authors said, as they counter-propose that what is needed is intentional coordination in these areas:

- Create domestic and bilateral grid connections (governments and investors),

- Scale blended financing to fund grid and renewable infrastructure (corporates and investors),

- Early retirement of coal power plants (governments, investors and corporates),

- Enforcement of existing conservation policies (governments),

- Incentivise forestland restoration and protection (governments and investors), and

- Adopt carbon pricing (governments).

Such collective action could pump up to US$2 trillion of new investments into South-east Asia, the report noted.

SEE ALSO

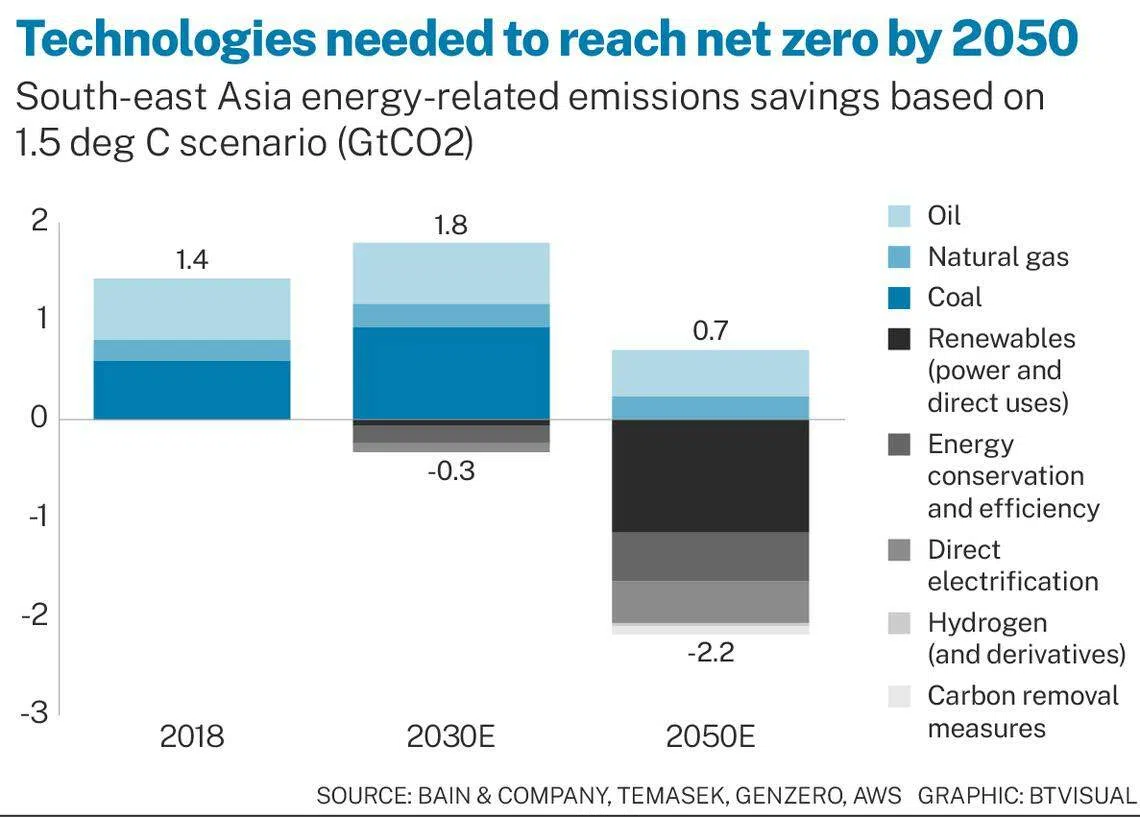

The energy transition piece

The authors, meanwhile, spelt out their take on how the region should approach its energy transition, considering that energy is a key growth driver in South-east Asia, with energy consumption expected to rise by 40 per cent by 2030. They called renewable energy a “critical near-term decarbonisation lever”, even as new technologies, such as hydrogen-based fuels and carbon capture, utilisation and storage, are needed in the longer term to meet net-zero goals. The report noted that the share of renewables investments has remained stable at 70 per cent to 75 per cent.

Renewable resources are, in any case, what South-east Asia has in abundance, they pointed out, citing a technical potential that is more than 20 times greater than the capacity required for its demand in 2050.

Addressable potential would inevitably be lower due to political considerations, interconnectedness risk, and insufficient infrastructure, but the authors foresee that there will still be enough potential to cover the region’s demand.

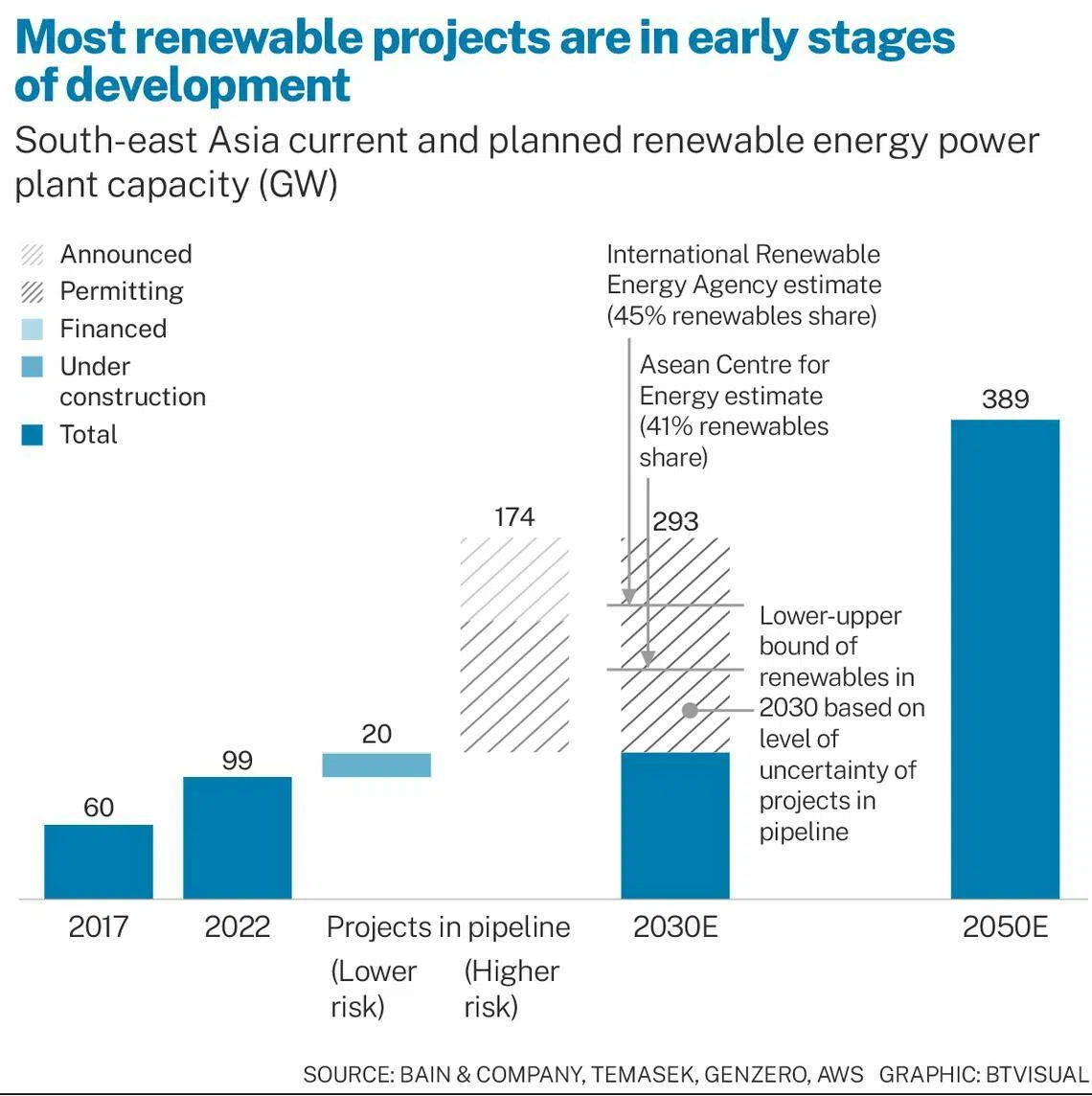

Despite this, and rapid progress in renewable deployment – installed capacity grew 10 per cent per year from 2017 to 2022, largely driven by rapid installations in Vietnam – the region still has a long way to go to achieve its renewable target in 2030. The report noted that about 90 per cent of 2030’s planned renewables capacity is still in an early stage of development, given that up to eight years is needed to clear the necessary permits for such deployment.

The choke points are diagnosed as:

- Lack of clarity over plans and who pays for generation and transition facilities: two countries are struggling with contested grids;

- Insufficient financial attractiveness due to the lack of incentives, high country risk in terms of currency and offtake, and shallow debt capital pools;

- Regulatory uncertainties and inconsistent implementation of policy;

- Fossil fuel dependency: the region’s coal-fired power plants are 12 years old on average, lower than the average age of such plants in China (14 years), Europe (41 years) and the United States (44 years); and

- Mismatch of demand and supply due to geographical dispersion of renewable resources both across and within the South-east Asian countries. In Indonesia, Kalimantan, Sulawesi and West Papua lack large demand centres, despite their significant potential for deployment.

To free up capital, it is critical to raise the participation of multilateral development banks (MDBs) in the region, the authors added. Currently, South-east Asia receives just US$1.6 billion in bilateral and multilateral funding – half the US$3.3 billion MDB support that South Asia gets – and 70 per cent of the total funding goes to Indonesia.

With coal generating one-fourth of energy in the region, managed coal phase-out is another important lever, but the authors acknowledged that capital sources risk reputation if the project is perceived by the public as greenwashing.

The capital sources also risk not meeting emission targets as their involvement in the plants would lead to a short-term spike in financed emissions, as well as the integrity of internal policies since existing frameworks on allowed transactions will have to be amended, they added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.