Asean+3 growth prospects a tad drearier with China, South-east Asia bracing themselves for Trump tariffs

Headline inflation in the region to remain low with price pressures ‘well-contained’ as energy, transport costs ease: Amro

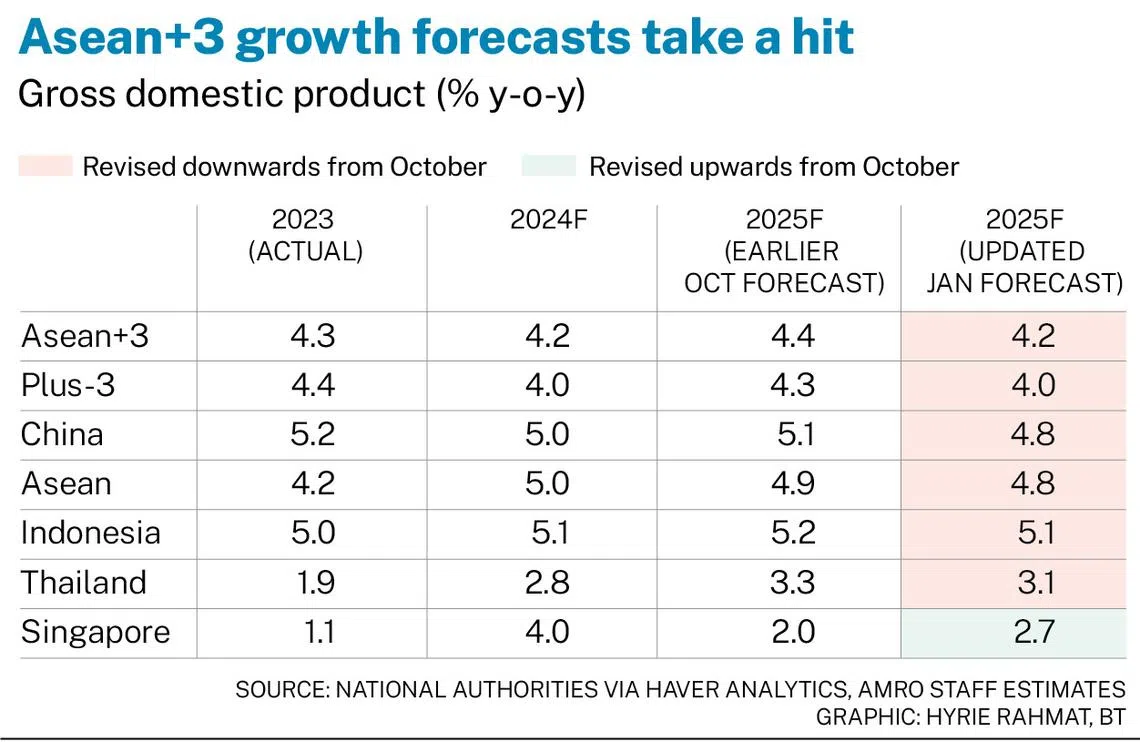

THE Asean+3 Macroeconomic Research Office (Amro) has trimmed its 2025 growth projections for most of the 10 Asean member states, as well as China, Hong Kong, Japan and South Korea – a region that altogether contributes to more than 40 per cent of global growth.

The downward revisions reflect Amro’s baseline assumption that, in the second half of the year, the US will increase tariffs on imports from China by 25 per cent. This would bump up American prices and constrain private sector spending.

This would lead to a decline in demand from the US – a major export market for most Asean+3 economies – and weigh on regional exports, dragging growth down with it, said Amro in a quarterly report released on Tuesday (Jan 21).

Higher tariffs are expected to hit the plus-three economies harder, noted the macroeconomics surveillance organisation, referring to the markets of China, Hong Kong, Japan and South Korea.

It slashed its 2025 overall gross domestic product forecast for the plus-three economies by 0.3 percentage point to 4 per cent, from an earlier prediction of 4.3 per cent in October.

Asean’s GDP forecast was cut by a smaller 0.1 percentage point to 4.8 per cent, from 4.9 per cent previously.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Overall, the Asean+3 region is now forecast to grow 4.2 per cent this year, down from Amro’s earlier estimate of 4.4 per cent.

Growth in the region will continue to be driven by domestic demand, with firm external demand providing continued support, Amro noted in its report.

Said Amro’s chief economist Khor Hoe Ee: “The global tech upcycle bolstered Asean+3’s export performance in 2024, helping to offset weaknesses in domestic consumption in some parts of the region.”

SEE ALSO

But he added that rising trade tensions pose a threat to external demand for the region and other parts of the world in the coming year.

Price pressures moderate

Inflation numbers are a shade rosier.

Compared with 2.8 per cent in 2023, inflation for the Asean+3 region decelerated to 1.7 per cent in 2024 – falling in tandem with lower commodity prices and moderation in underlying inflationary pressures.

Inflation is expected to be slightly higher at 2.1 per cent this year – though not a bad thing.

Higher inflation in China, Hong Kong, Thailand, Malaysia, Cambodia and Brunei reflects improving domestic demand and supply-side adjustments, such as a reduction in energy subsidies, said Amro.

This is excluding Laos and Myanmar, where inflation is largely driven by persistent currency depreciation.

More importantly, inflationary pressures remain “well-contained” in the region, with headline inflation returning to pre-pandemic rates for most economies, said Amro group head and principal economist Allen Ng in a press conference on Tuesday.

Cuts, cuts and more cuts

Amid declining inflationary pressures, many regional central banks began easing monetary policy, said Dr Khor.

Amro pointed out that China further reduced its one-year and five-year loan prime rates by 25 basis points in October, following a similar adjustment in July, to support domestic demand.

However, a weakening yuan has limited China’s monetary policy easing efforts; it left its benchmark lending rates unchanged for a third consecutive month on Monday.

Hong Kong implemented two consecutive quarter-point cuts in the last two months of 2024, in lockstep with the US Federal Reserve.

Last year, South Korea eased its policy stance for the first time since May 2020, doling out a quarter-point cut in October and November each before holding steady at the central bank’s most recent meeting on Jan 16.

Similarly, Thailand’s October meeting saw the kingdom’s first cut in more than four years as it stood pat against repeated high-profile calls to ease monetary policy.

Indonesia and the Philippines continued their easing cycles as well – the former with a Jan 15 quarter-point cut, and the latter with three consecutive reductions in August, October and December.

“However, the upward revision in US interest rate expectations could widen the divergence between US and regional interest rate paths, complicating the conduct of monetary policy for Asean+3 economies,” Dr Khor said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.