Beaches, parties and nose jobs: How Bali woos tourists with thriving cosmetic surgery scene

In this fifth part of BT’s series on Asia’s medical tourism hubs, we spotlight Indonesia, where Bali’s healthcare scene is perking up despite trailing that of Malaysia and Thailand in popularity

[JAKARTA] A growing number of international tourists are flocking to Bali for cosmetic procedures ranging from rhinoplasties to breast augmentation, lured by the relatively friendly prices and the promise of pristine sandy beaches of this world-famous island getaway.

In recent years, many internationally accredited beauty clinics and hospitals have set up shop on this small island in the Indonesian archipelago, as Indonesia aims to capture a larger share of the region’s booming medical tourism market.

But even as Bali is making strides in attracting foreign patients, Indonesia as a whole faces challenges in growing this sector.

Each year, the country loses an estimated US$11.5 billion in medical treatment revenue as many of its citizens seek care abroad, underscoring the untapped potential of the nation’s medical tourism industry.

However, the surge in world-class beauty clinics and medical facilities has transformed the landscape, and the Indonesia Medical Tourism Association has forecast significant expansion and promising opportunities ahead.

Dr Putri Mayuni, director of Siloam Hospitals Bali, noted a sharp rise in foreign tourists from Australia, China and the US flocking to the Island of the Gods for beauty treatments. In 2024, plastic surgery procedures at Siloam jumped 21 per cent from the year before.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In the past two years, the hospital performed 881 procedures valued at nearly 40 billion rupiah (S$3.4 million).

“Many of our patients are interested in plastic surgery, particularly procedures like face lifts and breast augmentations,” she told The Business Times.

Australian tourists have established their own communities in Bali, where they share information and discover that the island also offers these services, she added.

Siloam Group is one of Indonesia’s largest listed healthcare providers. One of its hospitals, Siloam Hospitals Denpasar, is a modern healthcare facility located strategically on Jalan Sunset, a road serving both the local community and tourists exploring Bali’s bustling Kuta area and Denpasar city.

The hospital group also established BIMC Hospital, which focuses on cosmetic surgery for the growing influx of international patients drawn to the island.

Located in the Bali Tourism Development Corporation Complex in Nusa Dua, BIMC was among the first to offer medical tourism packages, which include luxury accommodation in five-star resorts, post-surgery support and excursions once patients are cleared to travel.

Medical tourism for plastic surgery at BIMC has had a remarkable surge in the wake of the Covid-19 pandemic.

Hermes Santosa, the hospital’s director, said the number of international patients in 2024 was projected to grow by 170 per cent from the 2022 level. Eighty per cent of the hospital’s patients are Australian tourists.

“In general, patients noted that the prices for procedures here are competitive compared to those in neighbouring countries like Thailand and Malaysia, and we offer unquestionable quality and proven results,” he said.

Indonesia’s rising appeal for aesthetic treatments is transforming the island into a prime destination for foreign investors looking to establish beauty clinics.

South Korea’s leading regenerative medicine provider, CGBio, launched Nulook Clinic two years ago in Legian, Bali, in partnership with Daewoong Group, one of the republic’s largest healthcare companies.

Specialising in premium K-beauty services, the clinic has experienced a significant rise in demand for plastic surgery since its inception. Tirta Putra, marketing manager at Nulook, said there was a “notable spike” in demand by the end of 2023.

Popular procedures such as liposuction and upper blepharoplasty – an operation to remove excess skin from the upper eyelid – have quickly become the most sought-after treatments among Nulook’s clientele.

“Korean aesthetic treatments have gained global popularity due to advanced technology and proven effective results. Both locals and tourists are drawn to this trend, and are seeking clinics that offer these procedures,” said Putra.

At Nulook, 60 per cent of the patients are international tourists, and the rest are locals.

The clinic also operates as a training centre to equip local medical professionals with expertise in Korean cosmetic surgery.

Cost-effective choice

Indonesia, South-east Asia’s largest economy, presents a compelling opportunity for medical tourism, fuelled by a combination of key factors.

A recent report by RHB said the island’s reputation as a top tourist destination – known for its rich cultural heritage, stunning landscapes and tropical climate – makes it an ideal choice for those looking to combine medical treatment with a holiday.

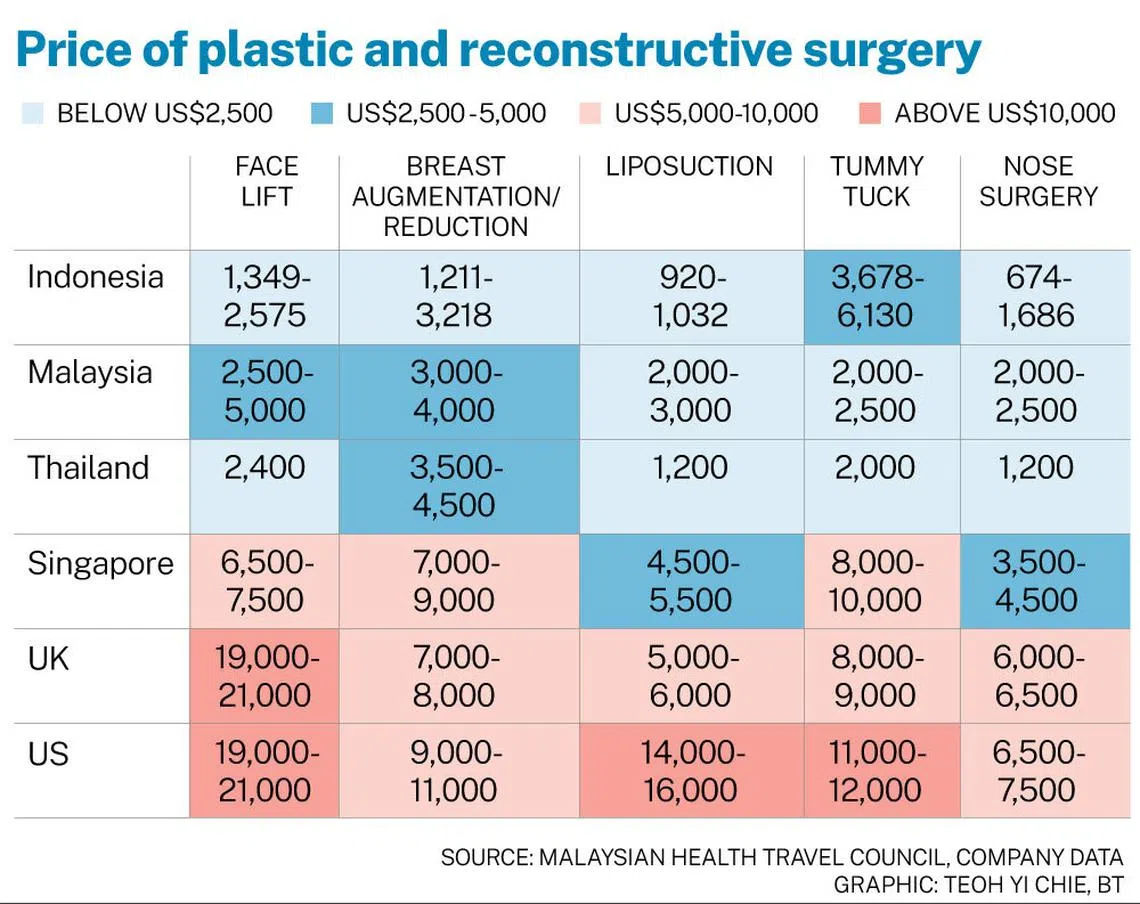

On average, the cost of plastic surgery treatments in Bali is comparable to those offered in Malaysia and Thailand, but significantly lower than the cost in Western markets such as the United States and Britain.

In Siloam Hospitals Denpasar, for example, the average cost of small breast augmentation surgery starts at 60 million rupiah – significantly lower than Australia, where such an operation would cost between US$10,000 and US$20,000.

The allure of more affordable treatment prices led 32-year-old Popy Robinson, an Indonesian with Australian permanent residency, to choose Bali as the place for her husband to undergo rhinoplasty, which is surgery to change the shape of one’s nose.

Her Australian husband, who has a history of breathing issues, found Bali to be the ideal destination, as the medical practices there are more flexible and less restrictive than those back home. For example, patients in Australia are required to get a referral from their primary-care doctor first, and also attend at least two pre-surgery consultations.

The trend of undergoing plastic surgery on the island is also being fuelled by social media influencers sharing their transformations.

A Sydney-based influencer who goes by the username “jesicafire_” on TikTok shared in a video that she spent about 120 million rupiah on her recent rhinoplasty, which covered consultation, check-ups and 21 days of hotel accommodation.

“Why did I choose Bali? Because I could also enjoy a vacation while I was there,” she said.

The island welcomed around 5.2 million visitors last year, with Australia as its top source. The growing number of Australian visitors to Bali has been boosted by the launch of direct flights between Bali and several Australian second-tier cities over the past two years.

Betting big

While Indonesia’s medical scene may still trail that of Malaysia and Thailand in popularity, the island’s healthcare industry is on an upward trajectory.

In the past two years, the government has launched several initiatives to position the island as a premier medical tourism destination, with the area now designated as one of the national government’s strategic priority programmes.

Health Minister Budi Sadikin said in October that the healthcare industry’s focus on wellness and aesthetics aligns perfectly with Bali’s identity as a global hub for leisure.

“We hope this diversification will help reduce Bali’s reliance on traditional tourism,” he said.

A 10 trillion rupiah special economic zone (SEZ), designed to attract international visitors with world-class healthcare services, is coming up in Sanur on Bali’s eastern coast.

One of the flagship facilities in the SEZ is Bali International Hospital, held by state-owned oil company Pertamina, in partnership with the Mayo Clinic from the US. The hospital is set to open in March 2025.

Gold mine of potential

Indonesia Medical Tourism Association chairman Dr Taufik Jamaan, noting Indonesia’s annual loss in medical treatment revenue from its citizens going abroad for healthcare, said it underscores the untapped potential of Indonesia’s medical tourism market.

It is a gold mine waiting to be unlocked, if the government takes decisive action to nurture and develop it, he said.

“Indonesia only realised the importance of the potential for medical tourism after the pandemic, driven by competition among hospitals in Asean countries. There needs to be greater awareness from the government to develop this industry,” he said.

Dr Jamaan noted, however, that aside from intense competition with neighbouring countries, Indonesia also faces challenges from drug prices and currency fluctuations, both of which pose risks to its fledgling medical tourism industry.

RHB identified one other challenge – that of the shortage of skilled medical professionals. “With insufficient trained personnel, the country may struggle to offer the advanced treatments that attract international patients.”

Siloam Hospitals’ Dr Mayuni said there also needs to be a shift in public mindset, especially among the Balinese themselves. They need to recognise that domestic healthcare options are just as competitive and affordable as those abroad, she said.

Read more stories in BT’s Asia Health Haven series

Coming up next: An infographic packed with country-by-country insights and fascinating facts about medical tourism in Asia

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.