Malaysia targets Tier 2 cities in Indonesia and China for next wave of medical tourists

In Part 2 of our series on Asia’s booming medical tourism, we explore how Malaysia leverages hubs like Penang and Selangor to rival the medical hubs of Thailand and Singapore

[KUALA LUMPUR] Malaysia is riding on the boom in its medical tourism sector by wooing patients from second-tier cities such as Batam and Palembang in Indonesia, as well as Xiamen in China, as it leverages its cost advantage of up to 80 per cent over higher-cost countries.

With Indonesians already accounting for more than 60 per cent of its medical tourists and arrivals from China surging 26 per cent in the first half of 2024, Malaysia is tapping into the growing demand from the region’s middle-income earners seeking medical treatment overseas.

Penang and the Klang Valley, including Kuala Lumpur and Selangor, remain key hubs for medical tourism, drawing patients with their state-of-the-art facilities and affordable treatment options.

Dr Mohamed Ali Abu Bakar, chief executive officer of Malaysia Healthcare Travel Council (MHTC), told The Business Times that he expects demand for medical and healthcare tourism to grow steadily, particularly among middle-income earners from second-tier cities.

He said the rising demand is being primarily driven by patients from Indonesia, India and the Middle East.

He did not go into the figures for the first six months of this year, but indicated that this year’s number of medical tourists would be consistent with last year’s levels. The revenue from them for this year, however, is projected to go up by 20 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

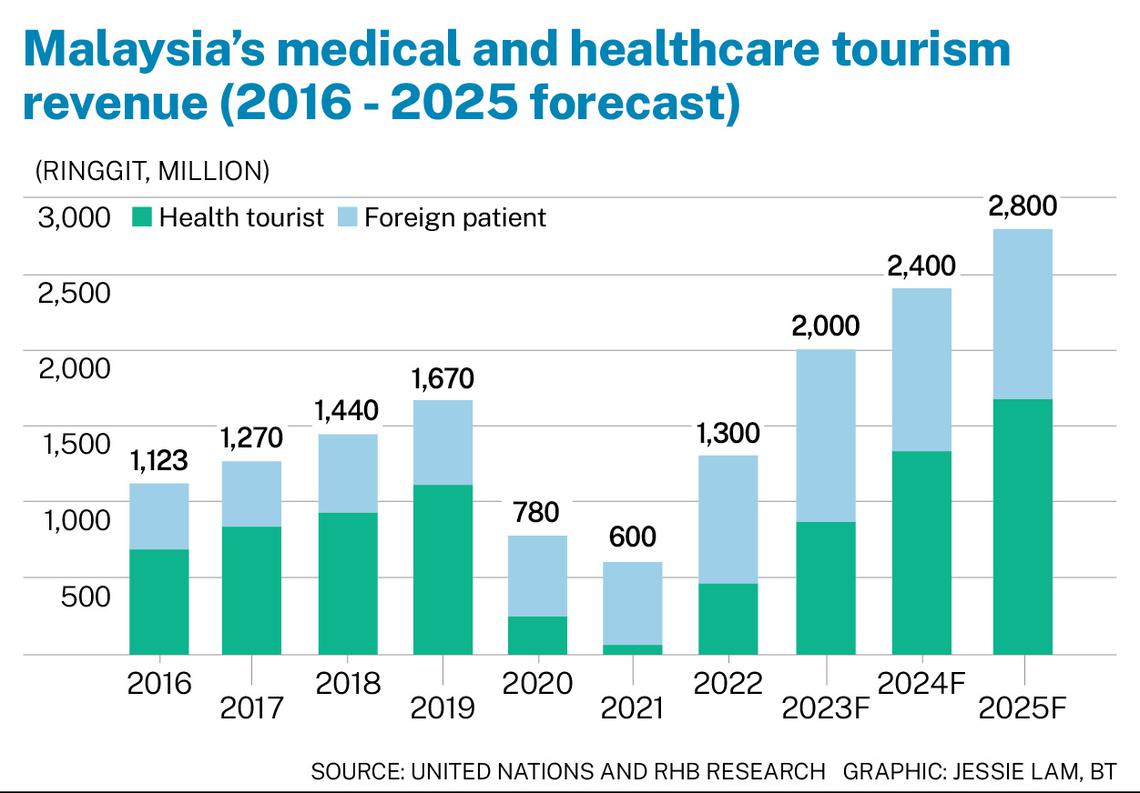

In 2023, Malaysia’s medical tourism sector rebounded strongly from the slump caused by the pandemic, attracting 1.4 million visitors and generating RM2.25 billion (S$680 million) in revenue – surpassing its pre-pandemic peak of nearly RM1.7 billion.

The first half of this year built on the momentum and the promise of this resilient sector, with revenue rising 12 per cent year on year (yoy) to more than RM1.1 billion.

Dr Mohamed Ali said: “We expect the second half to be a significant booster, as this period coincides with the peak travel season, when many individuals take their year-end leave for holidays and medical treatments.”

Key treatments they seek include health screenings, in-vitro fertilisation (IVF), robotic microsurgery and care for heart problems and cancer.

Indonesia remains the largest source of medical tourists, followed by China, India, Singapore, Japan and Bangladesh. MHTC is planning to reach out to potential patients from regional cities such as Palembang, Pekan and Batam in Indonesia, and Xiamen, Guangzhou and Sichuan in China.

Malaysia’s draw

Malaysia’s appeal as a medical tourism destination lies in its competitive pricing, offering significant cost savings relative to what treatments elsewhere in the region can cost, all while maintaining high standards of care.

“We’re not the cheapest in the region, but we’re affordably priced for the quality of care we provide,” Dr Mohamed Ali said. He noted that an appendicitis surgery in Malaysia costs between RM11,000 and RM18,000, significantly less than in neighbouring Indonesia, where prices are 40 to 70 per cent higher.

An RHB Research report highlights Malaysia’s cost advantage, with patients from high-cost countries such as the US saving 60 to 80 per cent on treatments. Treatment in Malaysia is highly affordable, even when compared to that in Singapore and Thailand.

Affordability aside, Malaysia offers a range of treatments, from routine check-ups to complex surgeries, in a patient-friendly environment.

“English is widely spoken, and translators for languages and dialects such as Mandarin and Bahasa Indonesia are readily available, ensuring seamless communication,” said Dr Mohamed Ali.

To boost medical tourism, Malaysia has introduced a 30-day visa-free policy for key markets until the end of 2025. A medical tourism visa is also available: This single-entry visa, valid for three months, lets patients stay longer for treatment and recovery, with the option of having two adult companions along for the journey.

Regional powerhouse

Ranked among South-east Asia’s top three medical tourism destinations, Malaysia competes closely with Thailand and Singapore.

In 2023, its medical tourism revenue reached US$444 million, second only to Thailand’s US$850 million, bolstered by its affordability and robust healthcare infrastructure with more than 280 private hospitals.

Within Malaysia, Penang leads the market, contributing 45 per cent of the country’s medical tourism revenue; Selangor is emerging as another key hub, clocking a 62.5 per cent rise in medical tourists (to 168,000 visitors) in 2023.

Tourism Selangor industrial development manager Chua Yee Ling, noting the state’s more than 50 medical centres and its connectivity through its three airports, said: “Many remain unaware of Selangor’s medical tourism capabilities as they perceive the state as an economic hub.”

The growth in medical tourism is also driving related sectors. Indonesian airline TransNusa, for instance, has partnered Malaysian medical centres to offer discounted health screening packages and free airport transfers.

Emerging opportunities: fertility and chronic diseases

Malaysia has also established itself as a prominent destination for fertility treatments, with its IVF sector steadily growing to around 10,000 cycles performed annually, reflecting the country’s expanding expertise in this field.

Dr Melvin Heng, group chief executive of Thomson Medical Group, said: “About 90 per cent of these cycles are conducted in the private sector, and healthcare tourists account for 20 to 25 per cent of the total.”

IVF cycles in Malaysia grew 20 per cent yoy in the first half of 2024, driven by increasing confidence in its fertility-care services.

Patients from Indonesia and China dominate this segment, comprising over two-thirds of medical tourists seeking fertility treatments, said Dr Mohamed Ali.

Thomson Medical Group, through its Bursa Malaysia-listed TMC Life Sciences, is tapping into this demand with Thomson Hospital in Selangor and five TMC Fertility Centre clinics across Malaysia. The group is also developing Vantage Bay Healthcare City in Johor Bahru to expand its offerings further.

Beyond fertility treatments, Dr Heng noted a growing demand for chronic disease management in Malaysia, driven by its ageing population. This is a significant growth opportunity for Malaysia, particularly as it seeks to attract patients from Indonesia, China and other regional markets.

Major players such as HMI Medical and IHH Healthcare are expanding their footprint or capacity to capture this demand. IHH’s acquisition of Island Hospital in Penang, which added more beds and specialised services to its portfolio, shows Malaysia’s potential in medical tourism.

Dr Prem Kumar Nair, group chief executive of IHH Healthcare, said the revenue contribution from medical tourism is on an uptrend for its operations in Malaysia. Between 2019 and 2023 – even with the impact of Covid – the average contribution stood at 3 per cent for IHH Malaysia.

As at the third quarter of 2024, medical tourism contributed 7 per cent of revenue to IHH Malaysia. “We are optimistic about the continued opportunities in this area,” said Dr Prem.

He added that IHH Malaysia is actively upgrading its hospitals and adding 1,500 beds by 2028. “This represents a nearly 50 per cent growth, reflecting our commitment to meeting the strong and growing demand for quality healthcare.”

HMI Medical, which runs Mahkota Medical Centre in Melaka and Regency Specialist Hospital in Johor, has noted a steady post-pandemic rise in medical tourism.

“After an initial surge driven by pent-up demand, trends have stabilised at pre-pandemic growth levels,” said Chin Wei Jia, group chief executive of HMI Medical.

Mahkota serves more than 300,000 patients annually, with medical tourists making up 20 to 30 per cent of its patient load. Regency, experiencing similar growth, plans to expand its capacity from 218 to 500 beds by 2025.

Treatments are being sought in areas such as cancer care, cardiology, neurology, orthopaedics and obstetrics. There is also rising interest in health screenings and wellness packages, signalling a shift towards preventive care.

Challenges ahead

Despite the sector’s rosy outlook, analysts from RHB Research pointed out that Malaysia is facing several risks in its medical tourism sector, including rising operation costs, slower industry expansion as well as the volatility of the ringgit.

“Rising utility costs and increasing staff wages, particularly for nurses, may squeeze profit margins. And slower hospital expansions could also hinder the ability to meet growing patient demand,” said RHB Research.

The research firm also identified regulatory risks as a potential challenge for the sector. It noted that Bank Negara Malaysia’s proposed co-payment requirements – aimed at sharing payment responsibilities between insurers and policyholders – could increase the financial burden on patients.

Recent clarifications from the central bank eased concerns. Full-reimbursement medical insurance products will still be available; insurance plans with lower premiums will have a co-payment element, and require upfront payments for claims to be made.

Dr Mohamed Ali noted that the weakening Malaysian currency against the US dollar could add pressure, especially on generic drug manufacturers facing production costs denominated in US dollars.

Read more stories in BT’s Asia Health Haven series

Coming up next week: Thailand

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.