China overtakes West in Gulf trade for the first time in ‘watershed’ moment: report

Structural and fundamental factors suggest the trend will only pick up pace in coming years, says think tank

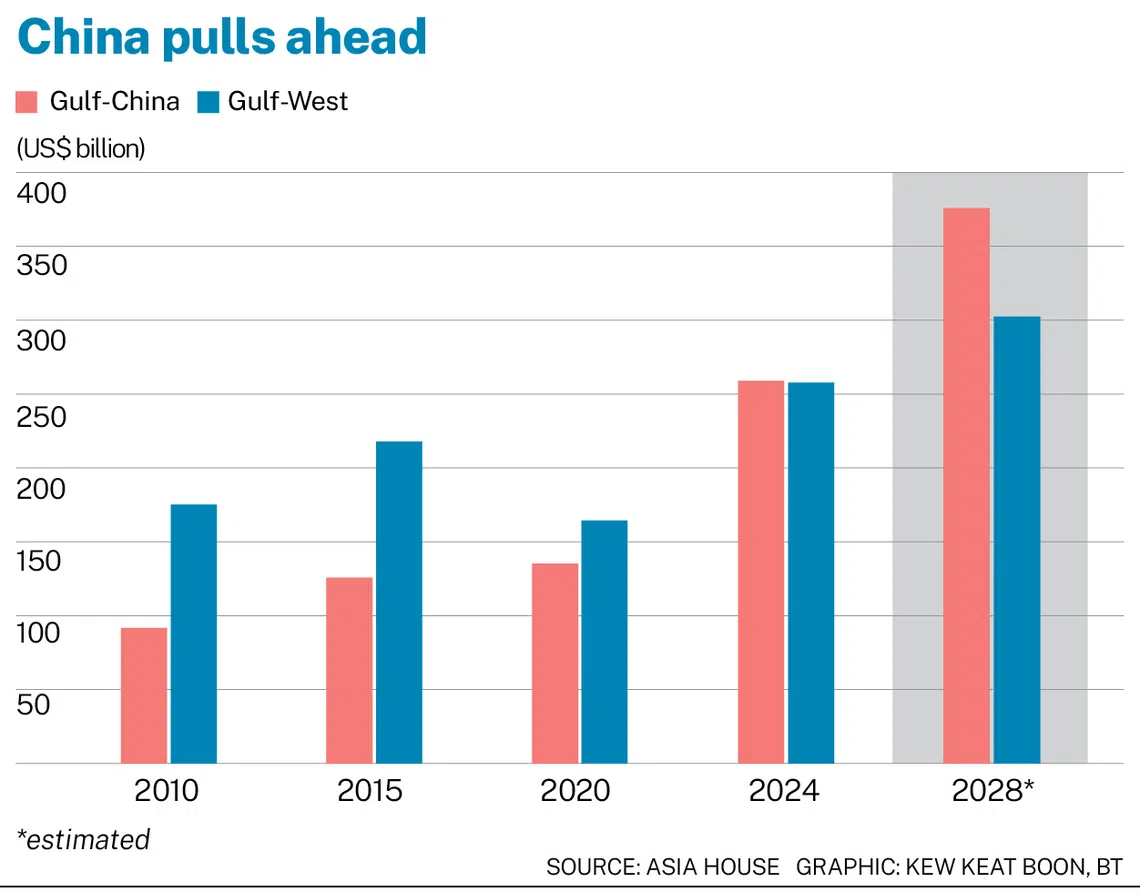

[SINGAPORE] For the first time, China’s trade with the Gulf surpassed the combined total that Western powers – the US, UK and the eurozone – ship to the Arab states. This watershed moment last year came ahead of expectations, underscoring the eastward drift of global economic activity, said Asia House.

The lead stands at a mere US$1 billion for now, after China’s trade volumes with the Arab countries soared 14.2 per cent to US$257 billion in 2024, as the Gulf-West trade slipped some 4 per cent to US$256 billion. The think tank expects the narrow margin to increase to US$75 billion by 2028, and estimates that the Gulf-China trade will be worth US$375 billion by then.

“Structural and fundamental factors overwhelmingly suggest the Gulf-China trade will widen its lead over the West in the coming decade,” said Freddie Neve, who authored the Asia House flagship report titled The Middle East Pivot to Asia that was released on Thursday (Nov 13).

Chinese energy imports remain a vital anchor of the relationship, powered by long-term deals and Gulf investment in downstream refining and petrochemicals on China’s mainland, noted the report. Gulf-China cooperation also grew across non-oil sectors, including renewables, construction and technology.

Conversely, Western economies have reduced their dependence on hydrocarbons from these Arab countries, and are expected to continue doing so amid their energy-transition ambitions.

The implications are significant, pointed out Neve.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“Over time, the Gulf will begin to accord Beijing’s perspectives equal weight to those of Washington, Brussels and London in its strategic decision-making,” he wrote.

Neve contended that, while the Arab states are unlikely to deprioritise their diplomatic relations with the West, they “will increasingly see China as a key node of their middle-power strategy, and cooperation may deepen in non-commercial sectors, including security and diplomacy”.

This may also translate into greater Gulf engagement with Chinese-led multilateral forums such as Brics, the Shanghai Cooperation Organisation or the Asian Infrastructure Investment Bank, he said.

China’s rise comes amid a significant year for Gulf-Asia trade.

It rose 14.4 per cent last year to a record US$516 billion, with flows projected to reach US$802 billion by 2030. The report added that emerging Asia is expected to surpass advanced economies as the Gulf’s largest trading partner in 2028.

Energy remains a core component of the relationship, with Asia accounting for 85 per cent of the Middle East’s oil exports.

But the report noted that the partnership is also broadening into the likes of renewables, hydrogen, critical minerals, technology, logistics and construction – in line with the Gulf’s pursuit of economic diversification.

Where Asean comes in

The Gulf’s trade corridor with Asean is fast becoming another key node of its middle-power strategy, added the paper.

The relationship between the two blocs has been gathering pace since they held their inaugural summit in Riyadh in 2023, decades after formal relations between Asean and the Gulf states were established. A second joint summit was held in Kuala Lumpur this year, alongside the inaugural Asean-GCC-China Summit.

“Deeper Asean ties diversify the Gulf’s trade exposure across Asia’s major growth centres and offer a hedge against overreliance on China,” wrote Neve.

Other driving factors include the fact that the South-east Asian alliance is expected to become one of the largest drivers of growth in global oil demand past 2030. There are non-oil dynamics at play too, such as the region’s economic reforms and growing middle-class, digitally literate population.

Gulf-Asean trade rebounded 14.8 per cent to a near-record high of roughly US$128 billion last year. The United Arab Emirates accounted for more than half of this total, noted the report.

Neve concluded that the continued eastward shift of the Gulf’s trade will aid the region’s evolution into a global middle power – a role that offers it both geopolitical and economic leverage.

“Asia’s importance to Gulf trade will continue to grow, leading states to give added weight to Asian perspectives and setting the stage for deeper economic integration and greater geopolitical alignment in the years ahead.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.