Don’t blink: ‘Asean tigers’ to claw back above 6% economic growth in 2025

Vietnam charges full steam ahead, the Philippines roars on, Indonesia pushes through headwinds and Malaysia appears set to be among best-performing

SOUTH-EAST Asia’s fastest climbers are about to get faster – economic growth this year is anticipated to accelerate across major Asean markets as Asia latches onto its crown as the fastest-growing region.

With Vietnam “firing on all cylinders” and the Philippines powering on, the region’s brightest growth stars are expected to see annual economic expansion of 6.25 per cent this year, said the latest outlook report by London-based think tank Asia House.

Indonesia pulled itself back up to a forecast annual gross domestic product growth of 5.5 per cent. This came after two consecutive years of dips threatened to take growth below the 5 per cent threshold, revealed the report released on Jan 16.

Across Asia, the economic outlook is positive – driven by digital innovation, increased consumer demand and green finance.

These factors are believed to mitigate possible shocks from policy shifts in the US and their macroeconomic impact, as president-elect Donald Trump prepares to take office on Monday (Jan 20).

The T in Trump

With Trump in power, US-China trade tensions are likely to be reignited, said the report.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

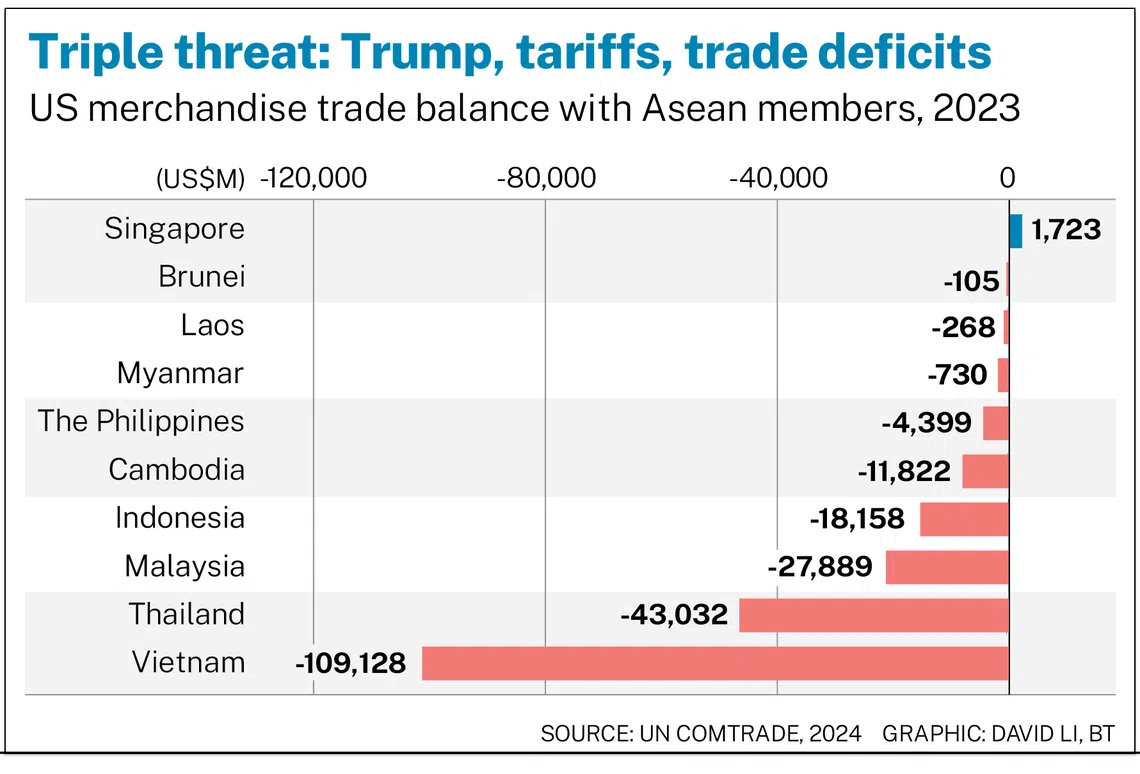

Asian countries that maintain substantial trade surpluses with the US or which are used by Chinese companies to circumvent tariffs are likely to find themselves under increased scrutiny.

Vietnam is the country to watch.

The US’ trade deficit with the export-reliant nation has soared beyond US$110 billion in the first 11 months of 2024.

SEE ALSO

Said the report: “Over the next four years, US policies towards these countries pose a risk as Trump will likely want to tackle what he deems to be unfair trade.”

Within Asean, Singapore remains the only country in 2023 with which the US had a merchandise trade surplus.

To appease Trump, Asian countries may ramp up demand for American imports while scrutinising Chinese investments.

Citing Vietnam as an example, the report said the republic will likely take further action against Chinese firms illegally using “Made in Vietnam” labels, and establish stricter criteria for product labelling.

“Countries with large trade surpluses may increase spending on US military equipment, civilian aircraft or liquefied natural gas, although barriers remain to their ability to meaningfully ramp up imports,” continued the report.

Despite this, Asia is well-placed to defy the host of looming challenges.

Vietnam: Firing on all cylinders

With a projected GDP growth of 6.25 per cent this year – up from 5.8 per cent in 2024 and 5.1 per cent in 2023, Vietnam is likely to be “a source of strength” for its regional partners.

Strong domestic demand and accelerating export growth will be key drivers.

The dominance of Vietnam’s digital economy continues to grow, and it is expected to reach double digits on the back of an unprecedented boom in the nation’s digital consumer base and continued expansion of its cities.

The Philippines: Powering on

The Philippines is expected to sustain robust growth driven by private consumption, developments in its service sector economy, and an impending general election in May.

Growth is also likely to be supported by a moderation in inflationary pressures, which in the Philippines are among Asia’s highest due to the country’s dependence on imports.

Therefore, the slowdown in the global economy will likely have a limited impact given the strength in the domestic economy, said the report.

Indonesia: Pushing through headwinds

Although accelerated growth is still expected for South-east Asia’s largest economy, Indonesia’s outlook hinges on several factors.

These include continued acceleration in exports; the ongoing diversification of its economy beyond its resource sectors, which is vulnerable to swings in global coal and palm oil prices; and growth in Indonesia’s largest trading partner, China.

Regardless, the archipelagic nation will continue to be an economic leader in the region, owing in part to its resource-rich trading relationships.

Malaysia: Soon-to-be star performer?

With a forecast GDP growth of 5 per cent this year, Malaysia is set to be one of the best-performing economies in the region and on track to becoming a high-income economy by 2028, noted the report.

The federation boasts a firm service sector, robust digital economy, durable external trade relationships and a strong, positive trade balance – all of which put it on track to weather the risks arising from global economic uncertainty.

As the first country in the world to establish a digital free trade zone, Malaysia serves as an e-commerce hub, and is expected to continue to use its platform for small and medium-sized enterprises to attract investments.

Thailand: Brighter days ahead

Often criticised as a laggard compared with its regional counterparts, Thailand pushed ahead with a forecast GDP growth of 3 per cent this year – up from 2.7 per cent last year and 1.9 per cent in 2023.

The report highlights that the kingdom’s ongoing transition into services and manufacturing gives its economy resilience to weather a global economic slowdown.

Pivotal to the success of its broader economy will be further digital economy growth – its expansion will be driven by regulatory measures that promote, scale and finance the adoption of digital technologies, including artificial intelligence regulation and cross-border data flows.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.