Sony Music deepens Vietnam push with 49% voting stake in YeaH1 subsidiary

The deal builds on YeaH1’s hit local TV shows that have helped usher in a new era for Vietnamese pop culture

[HO CHI MINH CITY] Sony Music Entertainment is set to deepen its presence in Vietnam’s buzzing entertainment scene by contributing capital to a key subsidiary of Vietnam’s largest listed media company YeaH1 Group.

The transaction, for an undisclosed sum, will be undertaken by Sony Music Entertainment Hong Kong into 1Label JSC – a YeaH1 unit focused on music production, publishing and marketing.

The deal will give the multinational record label giant 49 per cent of voting shares at 1Label, as well as opportunities for cooperation between YeaH1 and Sony Music for future digital music distribution projects, said the Vietnamese media company in a statement issued on Tuesday (Dec 16).

YeaH1 had completed the acquisition of the remaining shares in 1Label from the latter’s founding shareholders in May this year, turning it into a wholly owned subsidiary before bringing in Sony as a strategic investor.

Another YeaH1 unit, 1Talents, which specialises in artiste management, training and brand building, was also transferred under 1Label.

Upon completion of the new transaction, 1Label and 1Talents will cease to be subsidiaries and will instead become associates of YeaH1.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The deal gives Sony a significant foothold in Vietnam’s music industry while allowing YeaH1 to retain control of its broader media ecosystem.

Founded in 2006, YeaH1 rose alongside Vietnam’s early Internet boom and became one of the country’s largest integrated digital media groups. As at end-2024, it boats a network of more than 240 owned channels across Facebook, YouTube, TikTok and DailyMotion, with a combined audience of over 300 million subscribers.

Meanwhile, Sony Music Entertainment, part of Sony Music Group – the world’s second-largest music company after Universal Music Group – operates in more than 100 countries. The industry giant has been expanding its presence across South-east Asia, opening its regional headquarters in Singapore in 2022 to tap the city-state as a regional hub for innovation in the entertainment industry.

Beyond bringing international capital into Vietnam’s entertainment sector, the partnership will give YeaH1’s music arm access to Sony Music’s globally standardised distribution network and artiste management technologies, the company said.

“This partnership aims to... realise the goal of exporting Vietnamese culture to international markets, and establish a new position for Vietnamese music through a comprehensive support ecosystem,” said YeaH1.

The transaction extends an existing relationship between the two firms. In September, YeaH1 partnered Sony Music Entertainment on its televised talent show, Tan Binh Toan Nang – Show it all. Sony has supported the global release, distribution and promotion of music produced by emerging Vietnamese artistes featured on the programme.

Turnaround story

YeaH1 made its stock market debut in 2018 as Vietnam’s first entertainment company on the Ho Chi Minh City Stock Exchange, commanding a market capitalisation of about 8.2 trillion dong (S$401 million) on its first trading day.

At its peak, the media firm was YouTube’s third-largest multi-channel network (MCN) partner globally, managing about 3,000 channels on the video platform with more than 600 million subscribers and close to seven billion views per month.

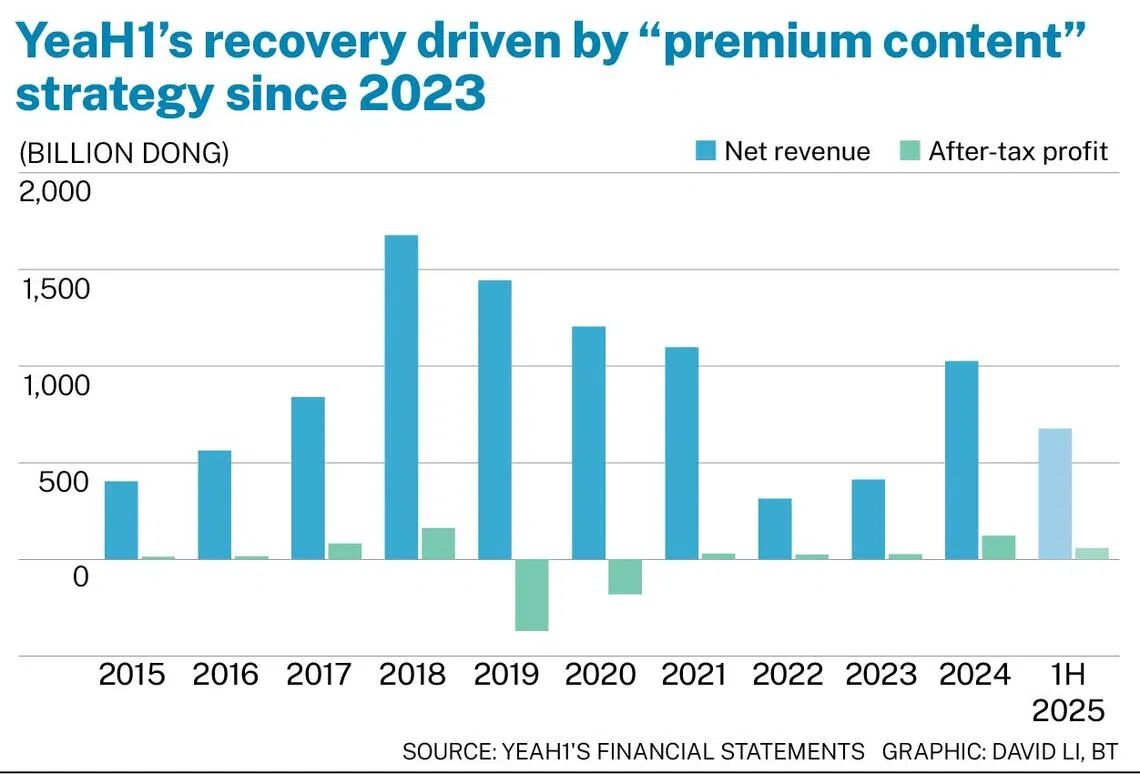

That dominance collapsed in 2019 after YouTube terminated its partnership with YeaH1, citing policy violations linked to a Thai MCN backed by the group. Loss-making e-commerce ventures during the Covid-19 pandemic and the structural decline of television advertising further weakened the business.

After a management overhaul in 2023, YeaH1 shifted its strategy toward premium, locally produced entertainment content through a comprehensive strategic partnership with MangoTV – China’s Netflix-like over-the-top video streaming platform. YeaH1’s flagship adapted reality shows such as Sisters Who Make Waves and Call Me by Fire became major hits in the domestic market, marking the dawn of Vietnamese pop culture. These programmes also helped restore brand image and opened up new revenue streams for YeaH1, including music publishing, concerts, merchandising and intellectual-property (IP) licensing.

The group’s gross revenue jumped nearly 2.5 times to over one trillion dong in 2024, while net profit rose nearly five times to 122.6 billion dong from the year before. In the first nine months of FY2025, revenue grew 70 per cent to 1.1 trillion dong from the year-ago period.

Petri Deryng, portfolio manager at Finland-based PYN Elite Fund, which has gradually raised its stake in the media firm to about 10 per cent, is sanguine about YeaH1’s long-term prospects in a market of 100 million people. “(It has) a whole new management team with a different style, replacing the old one that was too start-up oriented and overly focused on risk-taking,” he stated.

New growth pillars

Music and talent development are emerging as central pillars of YeaH1’s next growth phase.

Through its global partnerships, including the one with Sony Music Entertainment, the Vietnamese company aims to tap into the so-called “idol economy” by developing a professional talent ecosystem. This approach would involve internationally-aligned training and marketing programmes across Asian markets beyond Vietnam such as Thailand, South Korea, and China, said YeaH1 chief executive Ngo Thi Van Hanh.

“Reaching out to the world doesn’t mean copying it and losing our own identity,” Hanh told The Business Times in a recent interview. “These rookies we are investing in will become true assets for YeaH1 with long-term commercial value to be unlocked over time.”

Hanh now calls this the “second startup chapter” of the media group, looking to reignite the dream of being a unicorn with US$1 billion valuation – far from its current market capitalisation of under US$100 million.

Other growth pillars include its over-the-top streaming platform, Mango+, launched in Vietnam in October to better monetise content through paid subscriptions.

YeaH1 has also entered the fast-growing ultra-short film segment, producing annually dozens of vertically formatted micro drama series – typically just over one or two minutes per episode.

However, rising production costs for high-quality television programmes and content remain a challenge. YeaH1’s net profit fell sharply by nearly 80 per cent in the third quarter ended September from a year ago, owing to rising expenses and a record-high base last year.

YeaH1’s stock rose 2.5 per cent on Tuesday but has dropped about 35 per cent in the year to date, closing with a market capitalisation of roughly 2.3 trillion dong.

Vo Phan Hong Kiet, an analyst at Vietcap Securities, said the decline reflects the entertainment industry’s cyclical nature, with revenue from heavy investment in new IP and show production expected to be recognised in the coming quarters.

The return of flagship programmes next year, including Call Me by Fire Season 2, could drive a re-rating of YeaH1, he noted.

“We do not expect the decline in net profit to be prolonged,” said Kiet, who sees this period as a transitional phase for the company as it builds its content catalogue for a new growth cycle.

Meanwhile, revenue diversification into areas such as talent and IP management, as well as platform investments, would help offset the industry’s cyclicality, he added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.