Unilever’s empire falters in Indonesia amid fierce competition, boycotts

With the ongoing shifting consumer behaviour, the consumer goods giant faces significant hurdles in reclaiming its position as a dominant force in the sector

[JAKARTA] Unilever, the London-based consumer goods giant, is battling turbulent waters in Indonesia, with shifting consumer habits, fierce competition and boycott campaigns – reportedly linked to the Israel-Palestine conflict – shaking its once-dominant position in South-east Asia’s largest economy.

The company’s market share in Indonesia slipped to 34 per cent in the third quarter of 2024, down from 38 per cent a year earlier, reflecting a notable slide in its standing in a critical market of 280 million consumers.

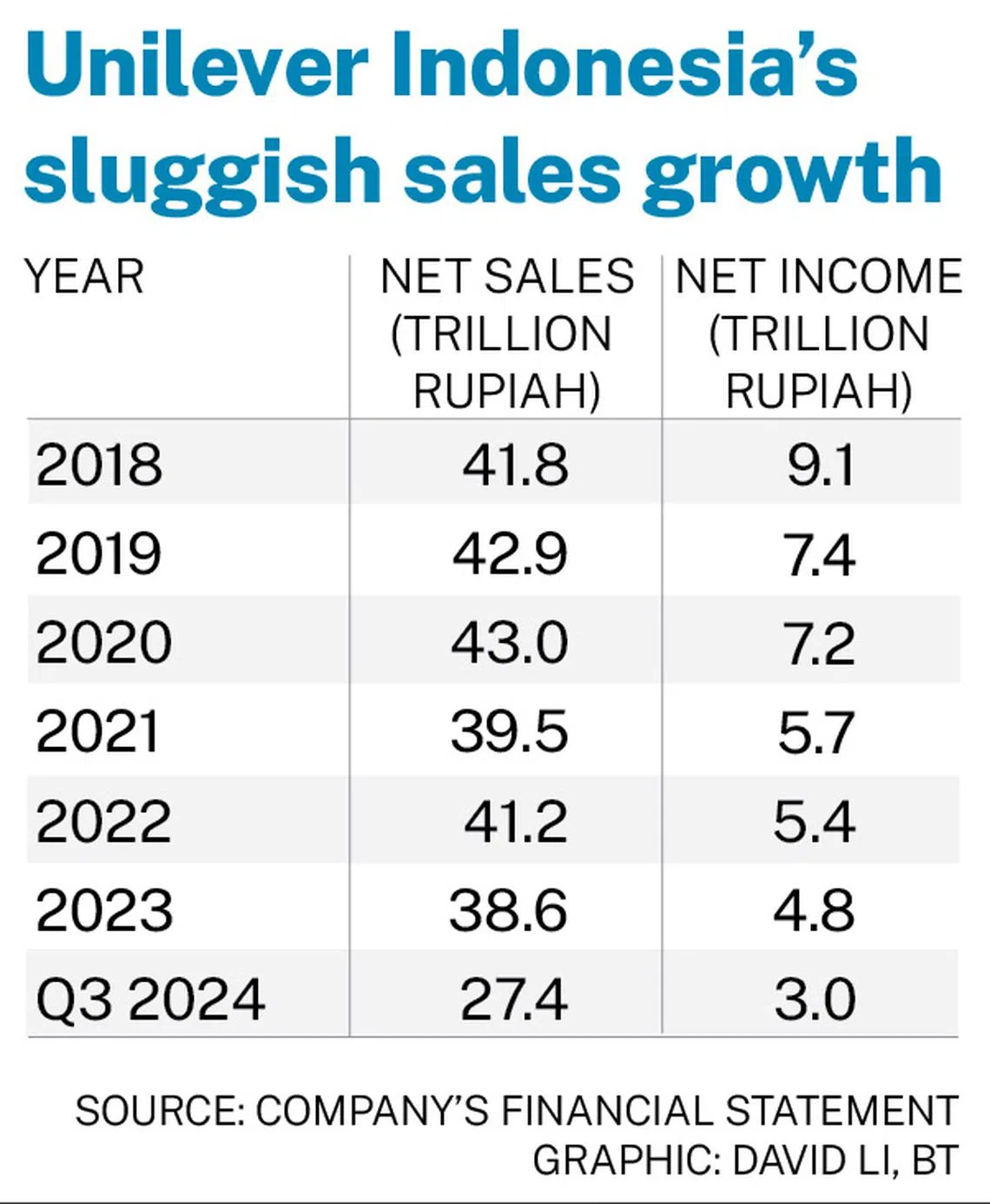

This decline marks a dramatic shift for Unilever Indonesia, once the undisputed king of consumer goods, as it battles falling sales and shrinking profits. In 2023, the company’s net profit dropped to 4.8 trillion rupiah (S$398.4 million), down from 5.4 trillion rupiah the previous year.

The company’s stock performance has been weighed by market concerns over its woes. By Jan 20, 2025, the company’s share price had plummeted to 1,750 rupiah – a sharp 84 per cent drop from its February 2018 peak of 11,080 rupiah – underscoring a dramatic erosion of market value over seven years.

In an effort to streamline operations and refocus on its core business, Unilever Indonesia recently sold its ice cream business for seven trillion rupiah to Magnum Indonesia. The sale, finalised late last year, marked a major pivot for the company, which is now doubling down on its beauty and wellness segments.

Unilever Indonesia’s president director, Benjie Yap, recently stated that the company aims to streamline operations, boost efficiency, and drive innovation by refocusing on its core business areas. “This strategic approach enables better resource allocation, strengthens our market position, and ultimately enhances our financial performance,” he said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

But the road ahead will not be a walk in the park, as the company faces steep hurdles in reclaiming its throne as a dominant force in the country’s fast-moving consumer goods (FMCG) sector.

The food and refreshment category, including the ice cream business, has been a big breadwinner for Unilever, contributing 9.8 trillion rupiah and making up 35 per cent of the company’s total revenue.

With the sale of its ice cream business, Oktavianus Audi, vice-president at Kiwoom Sekuritas, said that Unilever Indonesia’s revenue from the food and refreshment segment could drop to 28 per cent, assuming the ice cream business previously contributed at least 20 per cent of the company’s total income.

“We believe it will be quite challenging to regain balance and maintain market share after the spin-off of this business. Moreover, there is no commitment from Unilever’s parent company to expand revenue opportunities in Indonesia,” he told The Business Times.

Historical dominance at stake

Unilever has long been a heavyweight in the country’s FMCG sector, commanding a substantial share across various product categories.

With over 90 years of market presence, it has firmly established itself as a household name, with beloved brands such as Lifebuoy, Pepsodent, Sunsilk, and seasoning powder Royco woven into the fabric of daily Indonesian life.

Indonesia contributed a robust US$2.4 billion in revenue in 2023, accounting for nearly 4 per cent of Unilever’s total sales – a significant share in the company’s global performance.

Even the mightiest giants face their battles.

Unilever Indonesia now faces mounting competition from locals, alongside the shifting winds of consumer preferences and the stormy waters of socio-political issues, challenges that could threaten its reign in the long run.

Boycott campaign hits hard

Indonesia, home to the world’s largest Muslim population, has had a surge in the “no-buy” movement targeting brands allegedly linked to Israel in the wake of its actions in Gaza – a campaign that has also taken a toll on Unilever.

In October last year, the company reported an 18 per cent decline in sales to 8.4 trillion rupiah for Q3 compared to the same period in 2023. On its part, Unilever has admitted that the boycotts had hurt sales but has refrained from providing details.

Nafan Aji Gusta, senior investment analyst at Mirae Asset Sekuritas, said that Unilever Indonesia’s financial performance has been lacklustre in recent years and warned that if the boycott continues, it will certainly disrupt the company’s financial standing.

“Positive sentiment will arise if there is clarity...and good communication from Unilever to consumers, showing that they care about humanitarian issues,” Gusta added.

Rivals seize opportunities

The boycott has created an opportunity for local brands to step in and position themselves as alternatives to Unilever’s products. E-commerce market insight dashboard, Compas.id, revealed that local products from Indonesia’s homegrown FMCG giants, such as Wings Group and Mayora – Unilever’s competitors – have become popular alternatives amid the ongoing boycott of global brands with alleged ties to Israel.

Compas.id’s findings reveal that sales of beauty and personal care products from Wings Group on e-commerce platforms like Shopee and Tokopedia skyrocketed by 22 per cent between May and June last year, coinciding with the escalation of the Israel-Palestine conflict in Rafah, which triggered a global wave of boycott calls.

In the food and beverage race, Mayora came out on top, with a 9 per cent uptick in product sales.

Shifting preferences

Unilever’s struggle to boost its sales comes at a time when Indonesia’s middle class, the backbone of its consumer economy, is shifting its priorities.

Recent data from the statistics agency reveals a contraction in the country’s middle class between 2019 and 2024, driven by widespread layoffs and dwindling job opportunities in the wake of Covid-19 pandemic.

This has led to a rising demand for more affordable groceries, said Nailul Huda, director of digital economy at the think tank Center for Economic and Law Studies.

“The change in consumption patterns has led to a broader range of products being consumed. Consumers now have access to more affordable FMCG products from abroad, local brands, and branded goods, all through e-commerce,” he said. “As a result, Unilever’s premium sector has been impacted by the increased competition in the market.”

Like many consumer goods companies, Unilever experienced a sharp decline in sales during the pandemic, with revenue dropping to 39.5 trillion rupiah – an 8 per cent fall from the previous year.

In response to the rise of e-commerce, Unilever Indonesia attempted to ride the digital wave by launching GoToko, a joint venture with Gojek in 2020, designed to capitalise on the booming online market. However, the initiative turned out to be short-lived, shutting down in early 2023, less than three years after its ambitious debut.

“Unilever seems unprepared for these shifts in consumption patterns and only began addressing them seriously when the Covid-19 pandemic was already underway,” said Huda.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.