US sanctions three Singaporeans in global fraud takedown tied to Cambodian scam empire

Seventeen entities registered here have also been sanctioned

[SINGAPORE] In one of the largest financial fraud takedowns in history, three Singaporeans and 17 Singapore-registered entities have been sanctioned by the US over their alleged links to Cambodian national Chen Zhi, his affiliates and Prince Holding Group.

In a statement on Tuesday (Oct 14), the US Treasury Department’s Office of Foreign Assets Control (OFAC) said these individuals and entities have been added to its Specially Designated Nationals and Blocked Persons list.

This effectively bars US persons from conducting any transactions with them, and requires the blocking of any property in their possession or under their control.

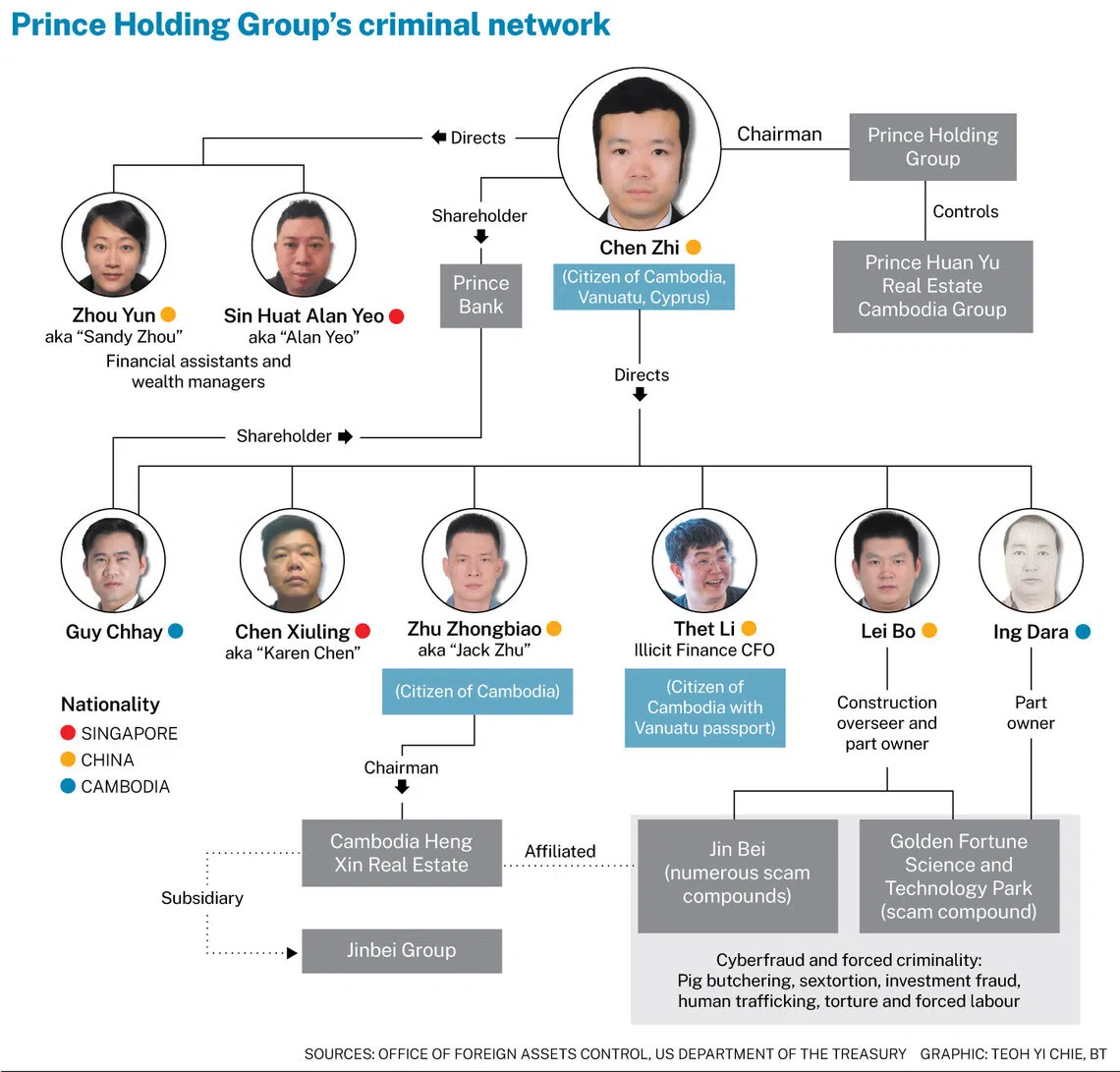

US authorities alleged that Chen Zhi and his top executives grew Prince Holding Group – a multinational conglomerate – into “one of Asia’s largest transnational criminal organisations.”

One name stands out among the Singaporeans: Chen Xiuling, also known as Karen Chen. US authorities alleged that she is owned, controlled by, or acted on behalf of, Prince Holding Group.

The authorities further claimed that the 43-year-old Singaporean oversees the group’s companies in Mauritius, Taiwan and Singapore. They added that she is listed in corporate filings as the ultimate owner of several entities controlled by the group, which share the same Singapore address.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

According to local regulatory filings in Singapore, Karen Chen is a director, company secretary, or both, in all 17 Singapore-registered companies targeted by the sanctions.

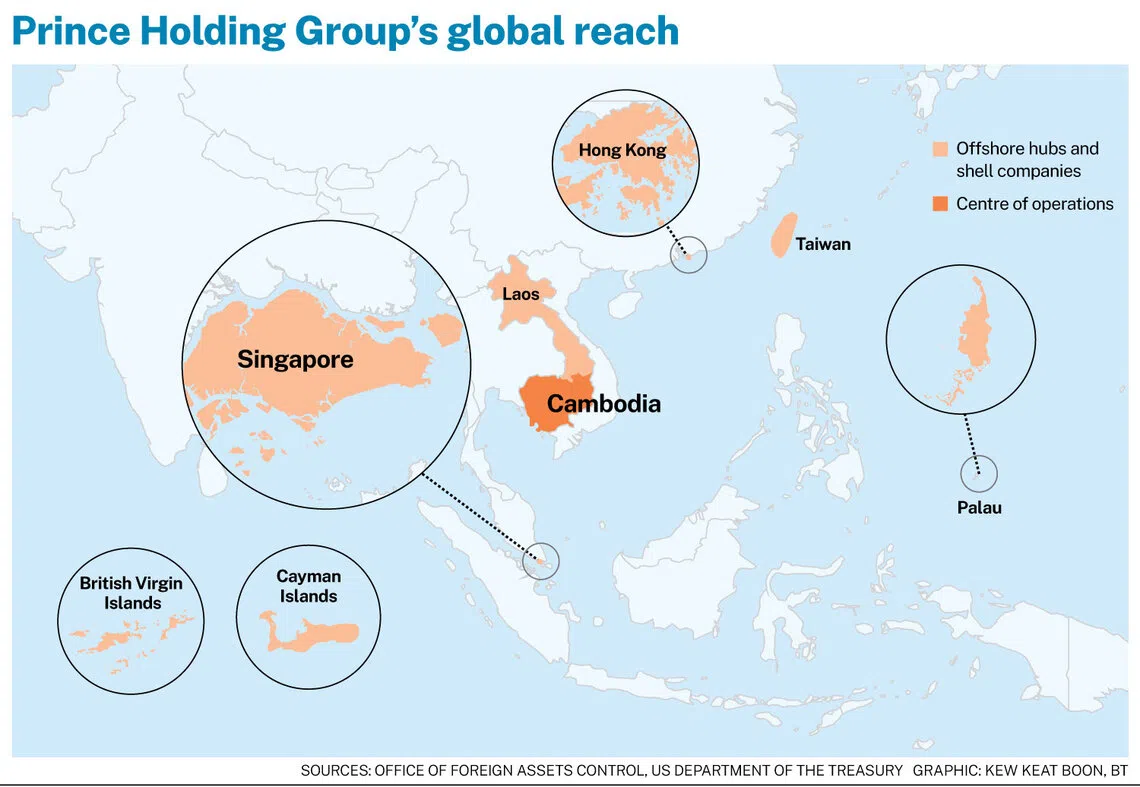

The broader network of entities is far more widespread. A total of 128 entities have been newly added to the sanctions list due to their links to Chen Zhi, his associates or Prince Holding Group.

These companies are not just registered in Singapore, but also in Cambodia, Taiwan, Hong Kong, Palau, Laos, as well as the British Virgin and Cayman Islands.

SEE ALSO

The Cambodian connection

On Tuesday, Chen Zhi – founder and chairman of Prince Holding Group – was charged in New York with wire fraud and money laundering conspiracies for directing the multinational business conglomerate’s operation of forced-labour scam compounds across Cambodia.

Fujian-born Chen Zhi, 38, is at large, according to US authorities.

Individuals held inside the compounds were forced to operate online investment schemes – known as “pig-butchering” scams – that defrauded victims worldwide of billions of dollars, said the US Department of Justice (DOJ) in a press release.

The US government also seized about 127,271 Bitcoin – currently worth some US$15 billion – marking the largest forfeiture action in the DOJ’s history.

The funds, described as proceeds and tools of Chen Zhi’s fraud and money laundering schemes, were previously stored in unhosted cryptocurrency wallets controlled through private keys held by Chen Zhi.

The UK’s Foreign, Commonwealth and Development Office has concurrently also imposed sanctions on the group, Chen Zhi and his key associates.

Of luxury yachts, wine, cigars and Singapore

A search by The Business Times of Singapore corporate filings revealed that Karen Chen is a director in 11 companies.

In eight of these, she also holds the role of “company secretary”, said data from Acra-authorised information service provider Handshakes. She is listed as the company secretary for another 20 entities.

According to her LinkedIn profile, she is currently head of internal audit at Neil Professional Services – another Singapore-registered entity targeted in the latest US sanctions – and has held this role since September 2019.

Her past roles include lead internal auditor at Neil Innovation (Singapore) from September 2018 to August 2019, audit manager at PwC from May 2010 to April 2017, and senior associate at Moore Stephens LLP from February 2006 to May 2010.

According to US authorities, one of the entities she owned was the holding company that managed Chen Zhi’s luxury yacht, though the specific entity was not named.

Checks by BT showed that Karen Chen’s portfolio of Singapore-registered companies includes leisure craft management firms Warpcapital Yacht Management and Cloud Xero Management – both among the entities targeted by the sanctions.

Handshakes data revealed the two firms share the same Jalan Kilang Barat address as at least 20 other companies linked to Karen Chen, including Capital Zone Warehousing.

Notably, Warpcapital Yacht Management, Cloud Xero Management and Capital Zone Warehousing also list Nigel Tang Wan Bao Nabil – the second Singaporean sanctioned for his ties to Chen Zhi – as a director.

Tang is the head of operations at Capital Zone Warehousing, a storage solutions provider of luxury collectibles such as wines, whiskies, fine teas and cigars. It is also a distributor of premium handmade cigars in Singapore.

Regulatory filings showed the 32-year-old is the sole director of another luxury yacht brokering and management company, Quantum Yacht Asia, of which he is also a shareholder.

Tang is also listed as a partner of food business Lauuk House.

The third Singaporean added to the list for his ties to Chen Zhi is Alan Yeo Sin Huat.

The DOJ said Yeo is Chen Zhi’s financial assistant and wealth manager, coordinating large wire transfers, corresponding with banks, managing accounts and working to obfuscate the group’s corrupt and criminal activities.

Yeo, 53, is listed as holding passports from Singapore and China. Singapore does not allow its adult citizens to hold dual citizenship.

According to Handshakes data from regulatory filings, he was previously listed as the owner of several Singapore-registered companies, including management consultancy Redog Global Services, computer hardware retailer Nagami Asia and general wholesaler Summer Stream Impex.

His LinkedIn profile, which has since been removed, showed that he is the chief executive of DW Capital. The company is also a target of the sanctions and counts Karen Chen as its chief finance officer, according to its website.

His profile also listed him as the current director of Prince Horticulture Development since January 2022 and of Skyline Investment Management since April 2021. Both companies are targets of the sanctions.

Long time coming

In recent years, Prince Holding Group has issued public statements to deny and rebut allegations from consultancy groups and media organisations linking it to criminal activity.

It hit back at Radio Free Asia (RFA) in the early months of 2024, after the news publication launched a three-part investigative series detailing allegations of mistreatment at a cyberscam compound in Cambodia linked to the group, and drew light to the conglomerate’s deep ties to political elites in the kingdom and its offshore dealings.

Prince Holding Group also publicly rebutted a subsequent interview by The Diplomat with the RFA journalist in February 2024, as well as Central News Agency Taiwan’s accusations of its involvement in illicit activities in Palau in March 2025.

The conglomerate has vehemently dismissed the claims as falsehoods, denied links to alleged subsidiaries and affiliates – some of which were targeted in the latest sanctions – and questioned the credibility of the publications, accusing its authors of having a vendetta.

As recently as May this year, Prince Holding Group rebutted a report by UK-registered social enterprise Humanity Research Consultancy, labelling as defamatory its claim that the conglomerate is a “notorious transnational online gambling criminal group”.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.