Vietnam switches on first LNG-fired power plants, plans 20 more by 2035

Early liquefied natural gas imports have come from Indonesia, Malaysia, Qatar and Russia, with growing interest in US supplies

[HO CHI MINH CITY] Vietnam has inaugurated its first cluster of power plants fuelled by imported liquefied natural gas (LNG), marking a milestone in the country’s push to secure electricity supplies from a cleaner fossil fuel in one of Asia’s fastest-growing economies.

The Nhon Trach 3 and 4 LNG-fired plants were inaugurated on Sunday (Dec 14) in Dong Nai province, an industrial hub north-east of Ho Chi Minh City.

The US$1.4 billion project has a total capacity of 1.6 gigawatts (GW), with investment from PetroVietnam Power Corporation (PV Power), a subsidiary of the state-owned PetroVietnam, with a Lilama-Samsung C&T consortium serving as the contractor.

With its ground-breaking in 2022, it is Vietnam’s first LNG-fired power plant project to secure nearly US$1 billion in financing without government guarantees – a milestone closely watched by both local and international investors.

Earlier this year, PV Power also signed a 25-year agreement with its sister company, PetroVietnam Gas (PV Gas) to supply LNG to the two plants, marking the country’s first long-term LNG supply contract with a committed volume of 530 million cubic metres (cu m) per year for the first five years.

Both PV Power and PV Gas are listed on the Ho Chi Minh City Stock Exchange, with market capitalisations of 27 trillion dong (S$1.3 billion) and 148 trillion dong, respectively, at market close on Friday.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Kick-starting the sector

Vietnam sees LNG as a critical “bridging fuel” between coal and renewables with significantly less carbon and air pollutants. More importantly, for Vietnam’s grid, gas-fired plants can serve as a reliable base load and help stabilise the power system as wind and solar – inherently intermittent sources – expand rapidly.

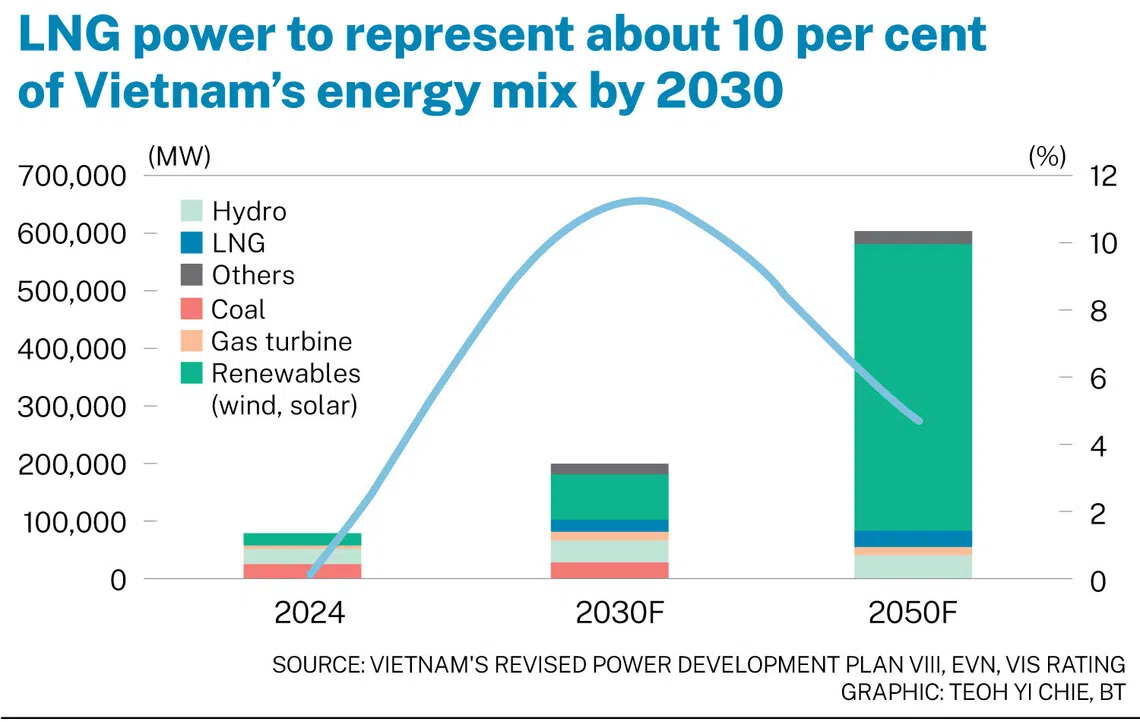

Under Vietnam’s revised Power Development Plan VIII (PDP8) approved in April, LNG-to-power capacity is targeted to reach 22.5 GW by 2030, from less than 1 GW today, accounting for roughly 10 per cent of the country’s power mix.

To kick-start the LNG sector, the government has rolled out a series of incentives. These include cutting preferential LNG import tariffs to 2 per cent from 5 per cent, and introducing an annual ceiling price for LNG power generation to provide a benchmark for power purchase agreement negotiations with state utility Vietnam Electricity (EVN).

Current regulations also guarantee that EVN will buy at least 65 per cent of annual output from LNG plants for up to 10 years, with fuel costs allowed to pass through to electricity prices.

Still, investors say the framework remains fragile. Many argue that a 65 per cent offtake guarantee is below the break-even point for LNG projects, given high fuel costs and complex financing structures. They also seek even stronger terms, such as extending guarantees to between 20 and 25 years, to improve cash flow certainty and project profitability.

In a joint petition sent to the government in October, a consortium of eight LNG power investors, including Vietnam’s T&T Group and South Korea’s Hanwha Energy, suggested that lawmakers lift the guaranteed offtake level to 90 per cent for the entire contract term.

Without deeper reforms, they warned, projects will continue to stall. So far, Nhon Trach 3 and 4 are among the few LNG plants progressing on schedule. Many others remain stuck in negotiations over power purchase agreements, gas supply contracts and financing.

Hanoi-based rating firm Vietnam Investors Service (VIS Rating) estimated in a recent note that nearly a quarter of PDP8’s planned 21 LNG power plant projects in the coming decade lack investors, and more than half face construction delays.

Only three projects are currently under construction, including the 1.6 GW Hai Phong plant, backed by a joint venture between Vingroup and its subsidiary VinEnergo.

A recent government document submitted to the National Assembly, reviewed by The Business Times, proposed raising the minimum long-term contracted output to 75 per cent and extending the contract duration to up to 15 years.

It is unclear at this time whether the new rule has been included in the special mechanisms and policies for national energy development approved by parliament on Thursday, as the full resolution has not yet been released for public review.

“Further enhancements of offtake guarantee (to 75 per cent) will boost investor confidence and unlock greater LNG investment,” VIS Rating analysts wrote in October.

They viewed the proposal attractive and pivotal for accelerating new LNG-related investments in Vietnam, as no other Asean market offers comparable incentives.

“We expect project development to accelerate from 2026 onward,” they added, citing typical construction timelines of four to five years for LNG power plants and policy incentives that require projects to begin commercial operations before 2031.

LNG imports to surge

Vietnam began importing LNG in 2023, with initial cargoes delivered to the Thi Vai and Cai Mep terminals at Ba Ria-Vung Tau, now part of Ho Chi Minh City.

PV Gas, currently the sole long-term LNG supplier, is also expanding import and storage capacity nationwide to offset declining domestic gas production.

The energy giant imported about 400 million cu m of LNG in 2024 and 245 million cu m in the first half of 2025, with a full-year aim of 500 million cu m.

Under national plans, Vietnam expects LNG imports to reach between 15.7 billion and 18.2 billion cu m annually by 2030. The amount will be lowered to between 10.6 billion and 12.2 billion cu m by 2050, reflecting an intention to convert some LNG power plants to other cleaner forms of fuel, such as hydrogen, or retire them.

Early supplies have come from Indonesia, Malaysia, Qatar and Russia, with growing interest in US cargoes.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.