Chinese firms face shifting global IPO landscape

Nasdaq proposes raising minimum public float and fundraising requirements; is enforcing faster suspension and delisting procedures for companies that fail to meet ongoing standards

CHINESE companies pursuing overseas listings are at a crossroads. For years, the US – and especially Nasdaq – has been a preferred market for Chinese initial public offerings (IPOs), giving companies high valuations and access to a global investor base. But that path may be narrowing.

The tech-heavy bourse, which hosts more than 80 per cent of US-listed Chinese companies, has proposed raising the minimum public float and fundraising requirements, while enforcing faster suspension and delisting procedures for companies that fail to meet ongoing standards, casting uncertainty over the pipeline of future deals.

At the same time, China-US tensions have amplified the significance of such listings, turning them from mere fundraising deals into vehicles carrying broader political and strategic weight, said some analysts.

London and Hong Kong present alternatives, but each comes with trade-offs. The UK market holds little appeal for Chinese tech companies, given lower valuations compared with the US, while market insiders cautioned that neither market is likely to compromise on standards, with stringent compliance and disclosure rules still in place.

Listing challenges

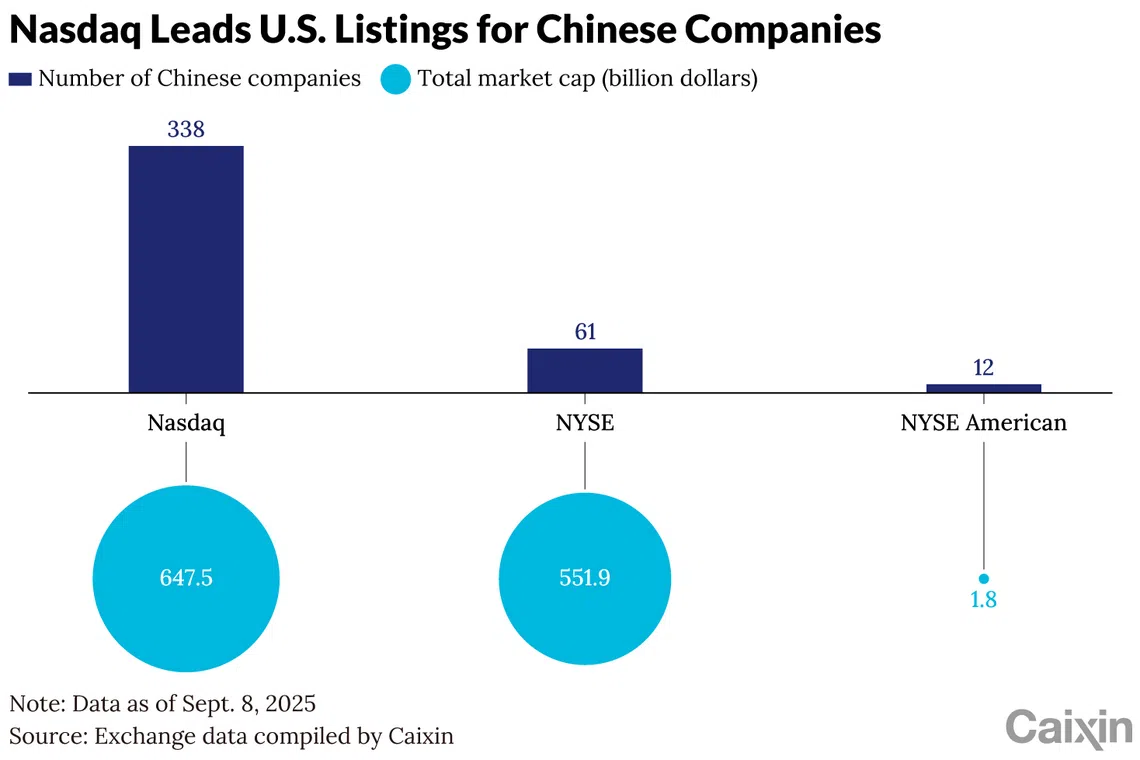

As at early September, 411 Chinese companies were listed in the US, with a combined market capitalisation of US$1.2 trillion. Nasdaq dominated the field, hosting 338 companies (82.2 per cent of the total) with a combined market cap US$647.5 billion.

The New York Stock Exchange (NYSE) and its smaller sibling, NYSE American, trail far behind with 61 and 12 listings, valued at US$551.9 billion and US$1.8 billion, respectively. Neither has signalled plans to follow Nasdaq with similar rule adjustments.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The fundraising track record of Chinese companies trading in the US suggests that Nasdaq’s proposed changes could be prohibitive for most would-be IPO candidates from China.

Among the 60 Chinese companies that floated on the Nasdaq last year, only eight raised more than US$25 million.

That means less than one in seven could meet the minimum IPO proceeds requirement that the bourse proposes for companies principally operating in China, indicated Caixin’s review of company disclosures. The trend has persisted in 2025 – in the first eight months, just four of 57 Chinese IPOs on Nasdaq exceeded the US$25 million threshold.

The proposal would also impact companies that qualify to list based on their profits. IPO hopefuls qualifying on earnings would need to achieve a minimum public float of US$15 million, up from the current US$5 million.

Companies with deficiencies and a market value that slips below US$5 million could face swifter suspension and delisting, indicated the proposal. At present, they have up to 180 days to re-comply with standards.

However, the exchange is proposing scrapping this grace period, arguing that businesses experiencing financial distress and operational downturn rarely recover during that time, exposing investors to low valuations.

Winners and losers

If the changes go ahead, dozens of Nasdaq-listed Chinese companies could be affected. As at early September, 41 Chinese firms on the Nasdaq had a market value below US$5 million – more than 12 per cent of the total – while another 45 were valued at between US$5 million and US$10 million, representing more than 13 per cent, according to Caixin’s analysis of company disclosures.

A market insider warned that the new rules could sharply reduce the number of Chinese IPOs on Nasdaq, saying that in the second half of 2025, the number of these listings could fall by 40-50 per cent compared with the same period last year.

“The rules target almost the vast majority of small and mid-cap Chinese stocks,” the insider said, adding they would both squeeze existing listings and reduce IPOs. The era in which Chinese startups could use a small IPO as a fast track to US markets may be coming to an end, the insider noted.

Some said that the shift would underscore the geopolitical significance that analysts at BOC International highlighted in a July report.

“The role of US-traded Chinese shares in US-China relations has long gone beyond mere fundraising, as they have gradually become embedded in the two countries’ strategic rivalry. As a result, capital markets have emerged as a frontline arena for institutional competition,” said the analysts, who viewed these companies as Washington’s potential bargaining chips in geopolitical negotiations.

However, a Hong Kong-based investment banker said the Nasdaq changes should not be over-politicised. Rather than shutting out Chinese companies entirely, the proposed rules are intended to help the market keep the stronger businesses and drive out the weaker ones, the banker said.

“Large, high-quality companies are essentially unaffected by Nasdaq’s new rules, as the fundraising threshold poses no challenge to them. On the contrary, with fewer competitors, their ‘scarcity’ and valuation premiums may stand out even more,” the banker said.

London’s allure

While Nasdaq looks to tighten its grip on IPOs, London has made it easier for companies from across the world to list amid a sluggish IPO market. In 2024, 18 companies debuted on the London Stock Exchange, down from 23 the previous year, while proceeds raised fell by nearly 20 per cent to about £778 million (S$1.4 billion), indicated an EY report published in January.

In the biggest overhaul of listing rules in more than three decades that took effect in July 2024, the Financial Conduct Authority (FCA), a UK financial regulator, removed the mandatory three-year revenue-earning track record previously required for companies listing on the premium segment.

That was part of a broader restructuring that replaced the “premium” and “standard” with a single, simplified category.

Other reforms included being more permissive toward dual-class share structures (DCSS), which enable founders and major shareholders to retain control through shares with greater voting rights. Notably, the FCA does not ban the use of variable interest entities (VIE) — a corporate structure that has been commonly used by Chinese companies such as Alibaba and JD.com for overseas listings.

These reforms would be particularly attractive to Chinese companies, market insiders said. In the past, many Chinese Internet companies faced restrictions in London due to VIE and DCSS issues, they said.

London is expected to draw in more Chinese companies to raise funds, said Tom Attenborough, head of international primary markets at the London bourse.

“Chinese companies have multiple viable routes into London, just as companies from other international markets do,” he said, adding that as long as they are able to articulate their story clearly and deliver strong performance, they can find a long-term home in the London market.

However, London’s appeal has limits, some market insiders said. Compared with Nasdaq, London lacks a strong retail investor culture and the investment appetite to give premium valuations to high-growth companies, an employee at the London office of a US investment bank told Caixin.

The London market tends to value new economy businesses conservatively, so for Chinese tech companies seeking higher valuations, New York remains the first choice, he said. London has traditionally favoured sectors such as energy, finance and consumer goods, and technology companies are typically valued 20-30 per cent lower in London than in New York, he said.

He also cautioned that the market’s openness remains a question mark, pointing to Chinese fast-fashion label Shein reportedly shifting its planned London IPO to Hong Kong, indicating potential hurdles.

Moreover, just because London relaxed its listing rules does not mean Chinese companies get an easy ride, said a lawyer who has long tracked their overseas listings.

“The vast majority of firms unable to meet Nasdaq’s new requirements will also find it difficult to satisfy London’s listing conditions,” the lawyer noted. “While the UK has relaxed certain rules, the FCA still conducts very stringent substantive reviews of companies’ governance structures, disclosure and compliance operations.”

Hong Kong hustle

In stark contrast to London’s IPO slowdown, Hong Kong is gaining momentum, with funds raised in the first eight months of 2025 soaring nearly sevenfold year-on-year to nearly HK$135 billion (S$22.5 billion).

Nasdaq’s proposed tighter IPO rules are expected to accelerate the pace of Chinese companies listing in Hong Kong, some analysts said. This aligns with the city’s goal. In an April blog post, Financial Secretary Paul Chan said the city will be “fully prepared for the potential return of Chinese Concept Stocks listed abroad”.

But not all Hong Kong market observers are convinced. Some warned that letting US-delisted Chinese companies go public in the city could undermine overall market quality and damage its global IPO reputation, as many of them have shaky business models and depressed share prices.

Others are more optimistic, arguing that as a mature international market, Hong Kong has the experience and tools to balance attracting companies with safeguarding quality. CAIXIN GLOBAL

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.