South-east Asia’s nascent electric vehicle ecosystem presents investment opportunities and challenges

The region is helping EV players to diversify production base and supply chain with each nation playing to its own strengths.

SOON, the electric vehicle (EV) you buy could be a largely made-in-South-east Asia product – if the ambitions of the region to build an empire in green transportation come to fruition.

Electric vehicle manufacturing is largely at mainland Chinese, European and American production sites. But South-east Asian nations are capitalising on the global race to decarbonise, and setting up electric vehicle supply chains of their own.

Tasmaratul Qolbi, senior associate of professional services firm Dezan Shira & Associates, said supply chains are vital in supporting the production of EVs.

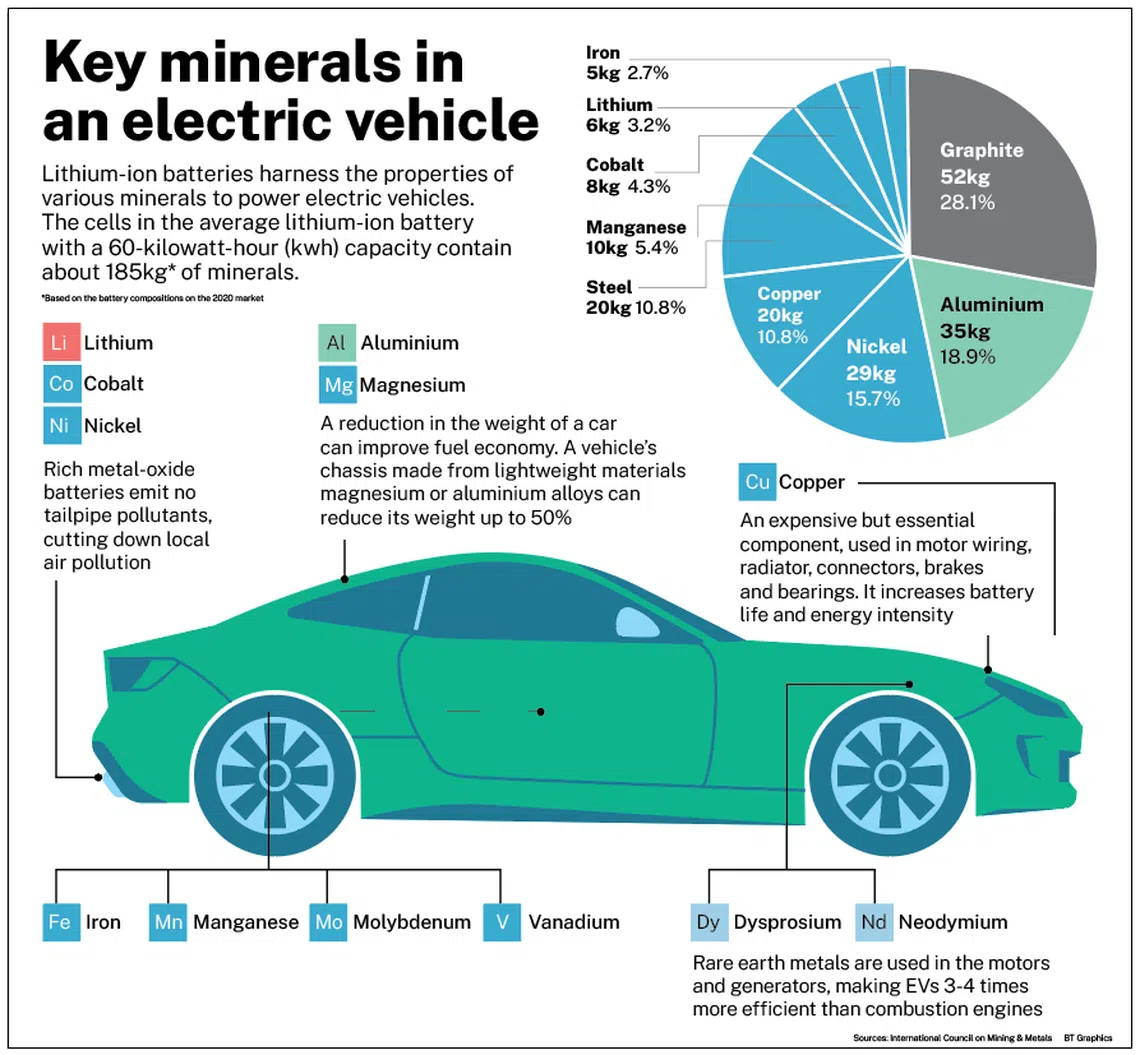

The main component of an electric vehicle is the battery, Qolbi said, and lithium-ion batteries are the most popular because they are light, small and store a lot of energy. Producing the battery requires several raw materials, among them lithium, nickel, and cobalt.

The main mineral producers are Australia, Chile, mainland China, and Argentina. Mining activities are mostly in South Africa, China and Indonesia, said Qolbi, who is based in Indonesia.

Battery supply chains are concentrated in China, which produces three-quarters of all lithium-ion batteries. Also, over half of the world’s lithium, cobalt and graphite processing and refining capacity is located in the North Asian country.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Europe, meanwhile, produces over a quarter of the world’s electric vehicles. It has a very small role in the supply chain, however. The United States has an even smaller role, as it only accounts for 10 per cent of EV output and 7 per cent of battery production capacity.

This concentration of resources presents an opportunity for South-east Asian nations and companies operating in the region.

Demand for EVs has increased in recent times. But there has not been a parallel increase in production due to supply chain disruptions.

South-east Asia has established a case for helping EV players diversify their production bases and supply chains – presenting both investment opportunities and challenges. Each nation is playing to its own strengths – whether that is an availability of mineral reserves or a pool of tech talent – and employing its own strategy, including dangling attractive government incentives.

Indonesia and Thailand, in particular, are racing to capture the coveted title of EV manufacturing hub in the region. Both have found success attracting companies to set up production facilities, including non-traditional players entering the sector across the value chain.

Indonesia, rich in minerals

Leveraging its abundance of mineral deposits, Indonesia hopes to make 400,000 electric cars in 2025.

The archipelago, with the world’s largest nickel reserves – estimated by its Ministry of Investment to be 30 per cent or 21 million tonnes – presents vast opportunities to players that want to produce closer to their raw material sources as well as diversify away from China, which has been in geopolitical crosshairs.

Andrew Digges, a partner at Norton Rose Fulbright in Singapore, said Indonesia is likely to be the source of almost all the global growth in the supply of refined nickel for EV batteries over the next decade, due to the country’s substantial investment in the nickel refining industry in the past decade, its cost advantages and an abundance of resource.

The lawyer, who specialises in project development and project finance across the energy, power, renewables, transportation and social infrastructure sectors, pointed out that Indonesia recently surpassed annual production of over 1 million tonnes of refined nickel. He said this could more than double over the next decade, depending on demand.

Nickel refining investment in Indonesia was in part triggered by a regulatory requirement to process the mineral in the archipelago before it can be exported.

South-east Asia’s largest economy has incorporated what it touted as the first EV battery manufacturer in the region. The factory is a US$1.1 billion investment by a South Korean consortium made up of the world’s third-largest EV battery maker, LG Energy Solution, as well as Hyundai Motor Manufacturing Indonesia and the Indonesian government.

This facility is expected to start producing batteries in 2024. Hyundai expects the batteries to be used for its Indonesian-made EVs, enhancing the price competitiveness of its products.

Hyundai invested US$1.55 billion to develop its first electric vehicle manufacturing hub in Asean. The Indonesian plant had begun production in the second half of 2021 with an annual capacity of 250,000 units. The company will create models that are strategically suited to the needs of the local and regional markets. The initiatives demonstrate Hyundai’s dedication to expand within the South-east Asian market, the South Korean manufacturer said.

An LG Energy Solution-led group could also be investing in a US$9 billion mega-project to establish an EV value chain in Indonesia, after signing a non-binding framework agreement earlier this year.

The world’s largest EV battery maker Contemporary Amperex Technology of China is also investing in an almost US$6 billion battery project in the archipelago.

And, Indonesia has been open about its invitation to Tesla to set up a plant in the archipelago; though there appears to be no action from the American EV maker.

Thailand, a global auto leader

Thailand has the strongest footprint in automobile manufacturing in South-east Asia, earning itself the reputation of Detroit of the region (after the city in Michigan, in the US, often called the automotive capital of the world).

The country is ranked 11th globally on output, and rolled out 1.7 million vehicle units in 2021. It expects 30 per cent of its output to be electric-powered by 2030, and 50 per cent by 2035.

With an ecosystem already in place, the kingdom has a head start in the race to be an EV manufacturing hub in South-east Asia.

Investment incentives are helping to fast-track its move: corporate tax breaks and low-interest loans for almost every piece of the EV puzzle, ranging from vehicles to parts to charging stations.

Among the investors that have responded is Taiwan’s Foxconn, which will make EVs in Thailand beginning 2024, with an initial annual output of 50,000 and the goal to hit 150,000 by 2030, under a US$1 billion joint investment with Thai state-owned oil and gas player PTT.

Singapore, a tech hub

With a skilled workforce, albeit one that isn’t cheap, Singapore is taking on its neighbours by concentrating on the higher end of the value chain.

Hyundai Motor Group is establishing in Singapore a research and development (R&D) centre and small-scale production facility with an output of up to 30,000 vehicles per year at an investment of S$400 million.

Hyundai Motor Group Innovation Center in Singapore is the group’s first “smart factory”, tasked to develop, build and demonstrate the smart future mobility value chain and new businesses to realise the group’s future mobility vision. The South Korean industrial behemoth said Singapore was picked because of its dynamic business-friendly policies and environment.

“Additionally, Singapore has a strong presence of international startups and competitive institutions to collaborate and conduct research on the new future mobility solutions, as well as an exceptional talent pool to fulfil the needs of sophisticated intelligence technologies,” said Hyundai.

Chinese EV maker Nio is also opening an R&D centre for artificial intelligence and autonomous driving. Vietnamese electric vehicle maker VinFast, meanwhile, has moved its headquarters to Singapore ahead of an initial public offering in the US, as it said the Republic is a jurisdiction that will give investors more confidence

Chuang Tze Mon, group president of Singapore-based Memtech International, said his company is closely following these developments: “This will provide us with further motivation to expand our operations in the region, tapping into the potential opportunities to participate in EV projects that are designed or built in South-east Asia.

“With our experience working with more than a few major global EV names, we hope we can witness and play a meaningful role in the potential establishment of an EV supply chain in our region.”

Memtech started manufacturing in Vietnam 3.5 years ago on the invitation of major US non-automotive customers to have a China + 1 approach – a strategy to deal with trade tariffs imposed against China by the US.

It supplies components for EVs too, from that site, including parts of the display module for Porsche and Mercedes-Benz.

Vietnam’s educated and skilled labour is a boon to manufacturing, said Chuang.

Gregory Seow, who is Maybank’s global head of financial institutions group, said: “Setting up a base in South-east Asia allows companies to access raw materials available in this region as well as opens up potential JV (joint venture) opportunities. The availability of financing to support EV manufacturers’ trading and logistics operations in the region will ensure a win-win for all stakeholders.”

Demand drivers

Apart from the conducive manufacturing environment, South-east Asia’s 660 million population is an added incentive for makers to base their facilities here. Governments are helping to drive demand by dangling rebates or lower taxes to encourage EV adoption.

Dezan Shira’s Qolbi noted that ride-hailing service providers Grab and GoTo, for example, aim to have fully-electric fleets by 2030. Indonesia is converting 130,000 state vehicles to electric-powered ones by 2030. There will also be growing demand for tailored logistics solutions in the region. Qolbi said materials used to make the batteries, such as lithium, nickel and cobalt. are considered hazardous materials and require special logistic solutions or skills.

The shortage of charging stations has been named as an impediment to the wide adoption of EVs in many countries, but S&P Global Mobility research analyst Siri Kanjanasiri pointed out that this means opportunities for charging stations to be built. Thailand-based Kanjanasiri said there are only about 900 charging stations across the kingdom, whereas its EV roadmap is for 12,000 stations by 2030.

Seow, also head of global banking (Singapore) at Maybank, noted that a key challenge for EV players will be navigating different national regulations and tax regimes within Asean’s 10 member states. There should therefore be a more uniform approach within the region to maximise attractiveness and forge an EV ecosystem, including collaboration with various institutes of higher learning for both R&D and human resources development.

Digges of Norton Rose Fulbright said shareholders, interest groups and other stakeholders are demanding that attention be given to EV supply chain emissions as well as biodiversity, governance and pollution issues.

Among the issues he flagged: nickel production in Indonesia, which comes with a “problematic” carbon footprint, and other ESG concerns. “The lowest carbon nickel production globally is in North America, followed by Australia. Indonesian suppliers have carbon emissions at market average or higher, in large part because most use coal-fired power to provide electricity to smelters. The mining and refining of nickel in Indonesia is a carbon-intensive business,” said Digges.

Indonesia needs to develop alternative, lower-carbon energy sources. “This is not easy as the battery mineral resources themselves are often located remotely, on islands such as Sulawesi and Halmahera, distant from substantial renewable energy sources,” Digges said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.