Wild ride ahead: Asean currencies tick up as Trump holds off on dropping the T-bomb

South-east Asia is not off the hook, say pundits, warning of currency volatility to come

THE US dollar had a soft day on Tuesday (Jan 21), as fears over the much-dreaded Chinese tariffs take a backseat for now, with US President Donald Trump wrapping up his first day in office with no explicit orders to levy previously threatened import duties.

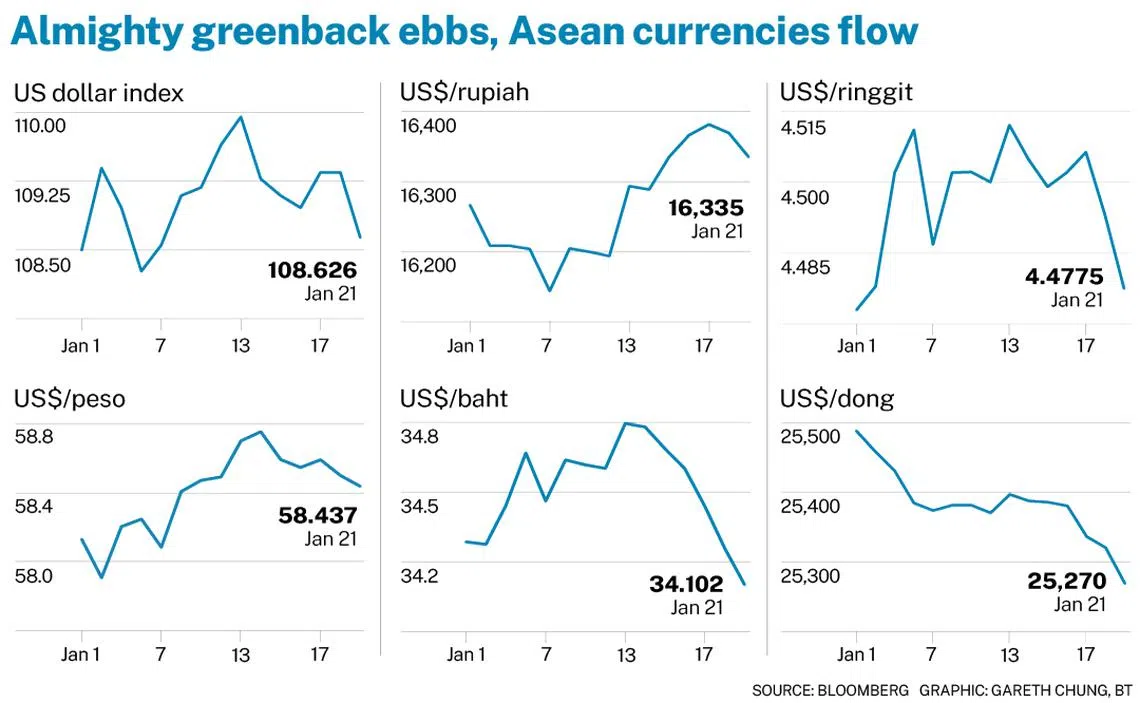

The US dollar index measures the greenback’s value against a basket of six major currencies: the euro, yen, pound, Canadian dollar, krona and franc. It has been on a decline in the days leading up to Trump’s inauguration, dropping to about 108.3 on Tuesday noon before strengthening to 108.7 as at 7 pm.

In turn, major South-east Asian currencies ticked higher.

The rupiah strengthened as much as 1.1 per cent to about 16,219 per US dollar before midnight Singapore time on Monday, from 16,400 the same evening. It settled at 16,336 to the dollar as at 7 pm on Tuesday.

The Philippine peso gained some 0.9 per cent to a high of under 58 per US dollar before Monday midnight, from around 58.5 in the day. As at 7 pm on Tuesday, it weakened back to 58.5 to the dollar.

The ringgit grew some 0.8 per cent to a high of about 4.45 per US dollar on Tuesday morning from 4.49 before Monday midnight. As at 7 pm on Tuesday, it had retreated to 4.48 to the dollar.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The baht gained some 0.8 per cent to 34 per US dollar on Tuesday noon from about 34.3 to the dollar on Monday evening. By 7 pm on Tuesday, it fell to 34.1 to the dollar.

Short-lived pardon

Foreign exchange (FX) strategists The Business Times spoke with explained that markets had already priced in expectations of aggressive trade policies leading up to Trump’s inauguration.

Abrdn head of Asian sovereign debt Kenneth Akintewe said: “The USD had already moved significantly into the event (so we are) likely seeing some position covering; it doesn’t necessarily have any bearing on the medium term.”

SEE ALSO

Jonathan Koh, economist and FX analyst for Asia at Standard Chartered Bank, said: “In FX, reaction is also a function of positioning, and the market was relatively long USD going into Trump’s inauguration as there was likely some expectation that Trump may be rolling out tariffs on day one.”

Therefore, the market may be seeing it as a temporary reprieve, said Koh.

MUFG Bank senior currency analyst Lloyd Chan concurred that the greenback’s latest decline is expected to be contained as some form of tariff hikes are likely still in the pipeline.

Global trade uncertainties will remain a drag on Asean currencies, he said.

Brace for impact

Across the board, pundits warned of currency volatility to come.

“It’s difficult to say how long the greenback will stay in reprieve, particularly given that there can be a gap between what Trump says and what is ultimately implemented,” said Katrina Ell, director and head of Asia-Pacific economics at Moody’s Analytics.

Expect ongoing currency volatility as markets digest further clues on how Trump’s presidency will unfold, she cautioned, noting that his ultimate agenda and priorities remain highly speculated.

In particular, currencies that are sensitive to the US dollar’s movements are likely to underperform, said StanChart’s Koh.

“Assuming the Trump trade as the pre-dominant theme… we are cautious on Asean currencies that are more trade-reliant and economically linked with China,” he noted.

Coupled with potential volatility arising from uncertainty on the timing of policies that may be US dollar-supportive, he believes the baht and won may underperform, followed by the Singapore dollar and ringgit.

Therefore, Parisha Saimbi – foreign exchange and local markets strategist for Asia at BNP Paribas – pointed out that long US dollar-won and US dollar-baht would be the house’s preferred picks in Asia.

“Their higher sensitivity to tariff risks, high-beta nature and, hence, sensitivity to risk-sentiment, weaker domestic fundamentals and low-yielder status (make) them attractive funding currencies,” she said.

Rate movements

Broadly across South-east Asia, central banks are expected to continue their easing cycles – although pundits said there is a high degree of uncertainty surrounding the timing of the rate cuts.

Several regional central banks began easing monetary policy towards the end of 2024, moving in lockstep with the US Federal Reserve – which cut rates for the first time, and by a significant half-percentage point, in more than four years last September.

Recall that Thailand made its first cut in more than four years in October, while the Philippines dished out three consecutive reductions in August, October and December.

Indonesia doled out one quarter-point cut each in September and, most recently, January.

Moody’s Ell raised Bank Indonesia (BI) as an interesting case.

“Typically, during bouts of currency weakness, BI is clear on prioritising rupiah stability with monetary policy and other interventions,” she said.

“However, in January, BI felt sufficiently comfortable prioritising the domestic economy by delivering a surprise rate cut.”

Ell concluded that further easing in the first half of the year is expected from Indonesia.

Specific to Singapore, MUFG Bank’s Chan believes its central bank will ease its S$NEER policy as early as this month, given the deceleration in core inflation to below the 2 per cent level.

The S$NEER refers to the Singapore dollar’s nominal effective exchange rate, which is used by the Monetary Authority of Singapore (MAS) as its main monetary policy tool instead of interest rates.

But given that there has been no specific mention of US tariffs on China thus far, MAS could adopt a wait-and-see stance, delaying a potential policy easing move till later this year, he said.

StanChart’s Koh concluded: “For the region in general, we expect policy rates to remain higher than pre-Covid levels amid a shallower Fed rate cut cycle.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.