Issue 170: Potential CapitaLand, Mapletree merger’s ESG challenge; COP30 confronts US pullback

This week in ESG: Temasek-linked real estate companies explore union; report finds US gains at expense of others in climate withdrawal

Sustainable investing

Merging ESG strategies for CapitaLand, Mapletree

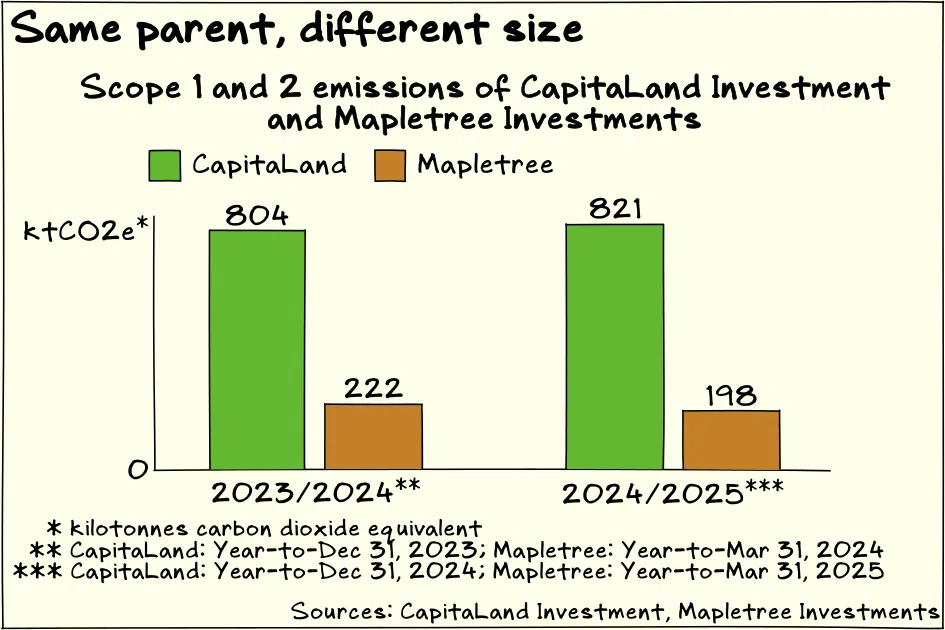

A possible merger between two Temasek-linked real estate groups might require harmonising of environmental, social and governance (ESG) goals and governance if a deal were to materialise.

CapitaLand Investment (CLI), in which Temasek holds a majority stake, and Mapletree Investments (MIPL), a wholly owned Temasek subsidiary, are considering a possible merger, Dow Jones reported this week. Plans are preliminary, the news agency reported.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.