Issue 180: Sembcorp shareholders vote on Alinta deal; new directorship institute launches

This week in ESG: Sembcorp acquisition’s coal exposure raises questions; GDInstitute offers alternative to Singapore Institute of Directors

Sustainable investing

Sembcorp needs to better address Alinta’s coal business

Shareholders of renewable energy group Sembcorp Industries meet on Friday (Jan 30) to decide on a planned A$6.5 billion (S$5.6 billion) takeover of Australian utility Alinta Energy.

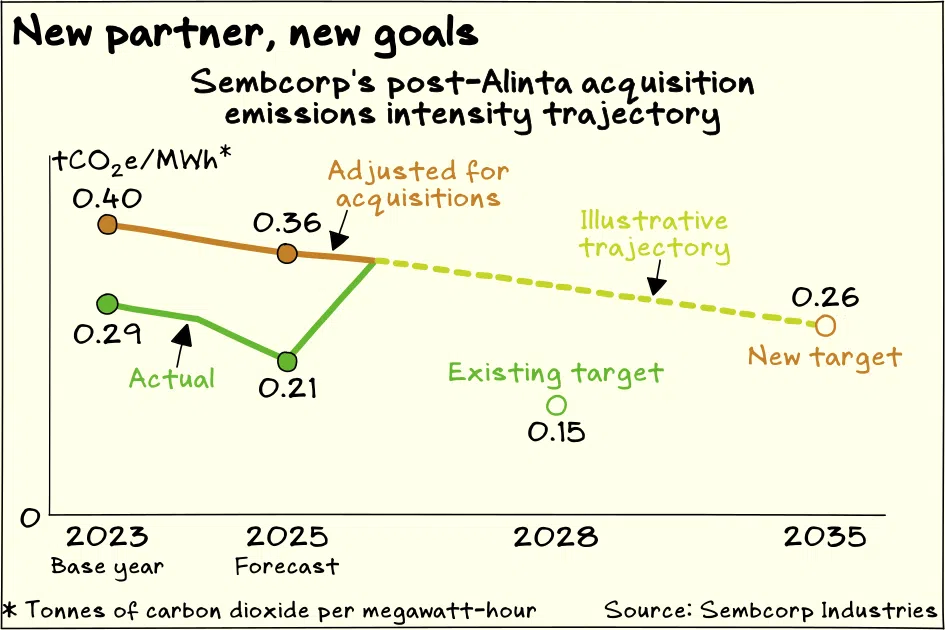

Beyond financials, Sembcorp’s management and board will also have to address concerns about the deal’s impact on the company’s hard-won green credentials. While Alinta has a large renewable-energy pipeline, its existing business includes a substantial coal-fired power segment that will set Sembcorp back on its climate targets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.