Real estate owners need to get ahead in the net-zero race. Here’s how

Improving energy efficiency can bring significant long-term savings, enhance asset resilience, and improve occupancy and rents

GLOBALLY, and especially in Singapore, the race to net zero is well under way. The Republic has raised its national climate target to achieve net-zero emissions by 2050, as part of its long-term low-emissions development strategy. To reach the target, steps must be laid out for both commercial real estate owners and occupiers.

Net zero in real estate is when the carbon emissions emitted by a building’s operational activities and tenant energy usage are reduced to zero, or are negative. This can be achieved with a net-zero energy-efficient building, where the building generates on-site renewable energy that is equal to, or more than, what it utilises in a year.

Carrots and sticks

Globally, 37 per cent of energy-related emissions come from building and construction. Singapore policies and regulations promoting sustainability in the built environment include the Singapore Green Building Masterplan, the Building and Construction Authority’s (BCA) Green Mark scheme, and the Building Control Act for new buildings.

In 2018, BCA introduced the Super Low Energy (SLE) programme to drive development of SLE buildings. Meanwhile, under the GreenGov.SG initiative, the government aims to make SLE buildings mainstream.

In February 2017, Singapore announced an initial carbon tax set at S$5 per tonne of carbon dioxide equivalent (tCO2e) for 2019 to 2023. This carbon tax will be raised to S$50 to S$80 per tCO2e by 2030.

The tax hike could lead to a substantial increase in operating costs for properties with high energy usage (such as data centres) as well as buildings that are major emitters of greenhouse gases. This gives greater impetus to investors and asset owners to pursue redevelopment or asset enhancement initiatives to increase energy efficiency and reduce operating costs, to preserve future asset value.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The energy-efficiency movement picked up the pace in September 2024, when the Mandatory Energy Improvement regime kicked in. Existing buildings deemed energy-intensive must implement measures to improve their energy use, or face a fine of up to S$150,000. The penalty will be meted out by the third quarter of 2025.

From 2025, Singapore will also implement mandatory climate-related reporting requirements for listed and large non-listed companies. Asset owners can benefit from compliance – providing such disclosures could help real estate companies access new markets, customers, and a growing pool of sustainable capital at lower costs.

Although transitioning to net zero may involve upfront capital expenditure, it often leads to significant long-term savings through reduced energy costs. This is especially valuable with the volatility of global fossil fuel prices.

Net-zero buildings often feature the use of renewable energy sources, which enhance a building’s resilience to energy supply disruptions and reduce dependence on fossil fuel-based sources.

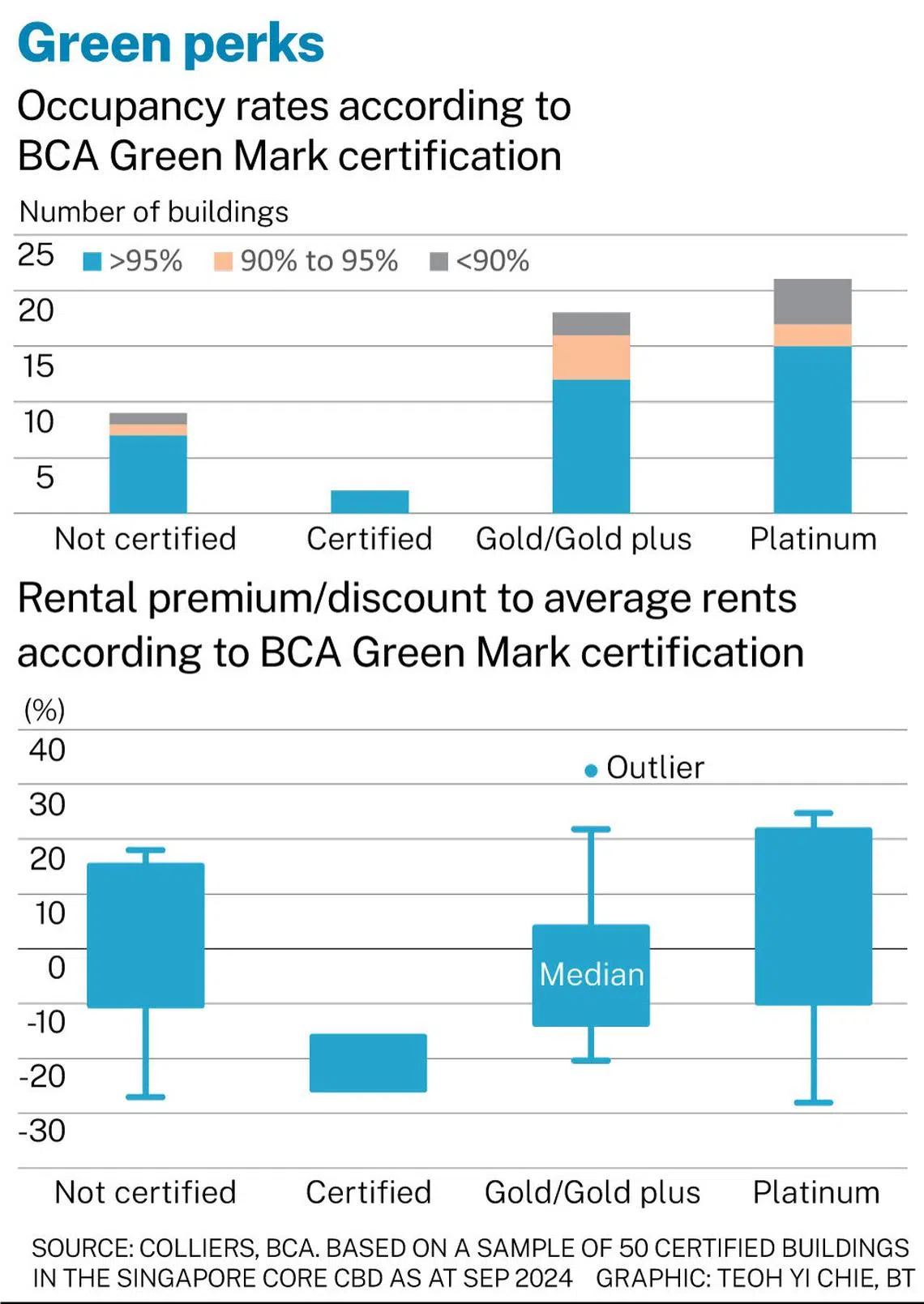

Such buildings also typically offer better indoor air quality and thermal comfort. And with increasing investor and tenant awareness about sustainability, these buildings typically command higher occupancy and rents.

Are we there yet?

Implementing a road map to net zero should involve a collaborative effort from various stakeholders, such as those in management, design, development and operations. It is essential to incorporate sustainability strategies into key performance indicators to make sure that teams in the field are equipped with the resources and capacity to execute these strategies.

Success in execution will depend on technology, data, workflow tools, and leadership support. The adopted strategy will also require ongoing adjustments to meet evolving investor and regulatory requirements.

To effectively gauge and depict an asset’s or portfolio’s performance in terms of carbon emissions, various net-zero carbon frameworks, goals and initiatives have been developed. The Science-Based Targets initiative is among the most commonly adopted approaches.

Comprehensive monitoring and reporting in these areas will involve disclosing information on emissions and progress, which can help build trust with stakeholders such as investors, tenants and regulators. It is crucial to not only collect data that is accurate and reliable, but also analyse this data effectively and meaningfully.

The Greenhouse Gas Protocol supplies the world’s most widely used greenhouse gas accounting standards and guidance, while data quality tools such as the Partnership for Carbon Accounting Financials can help evaluate the reliability and accuracy of emissions data.

Finally, adopting widely accepted reporting standards and initiatives – such as the Global Reporting Initiative, Principles for Responsible Investment, Task Force on Climate-Related Financial Disclosures, the International Sustainability Standards Board, the Sustainability Accounting Standards Board, and RE100 – could help shape reporting and decision-making.

Optimisation before commitment

Optimising for a net-zero carbon strategy comprises two parts. The first involves direct actions that the asset owners or managers can control, such as selecting sustainable building materials and procurement methods to reduce carbon emissions.

The second involves influencing occupier behaviours that they cannot control, such as fit-out decisions and operational hours. Here, green lease agreements with tenants or collaboration with external partners such as contractors, utilities and district heating providers could prove instrumental to reaching the net-zero carbon goal.

This is also where technology can be vital. Simulation software, for instance, can help identify points for optimisation.

Once optimisation has been done, there may be instances where building design or equipment will still need to be upgraded or replaced. Significant cost savings could arise from optimisation, and these funds can then be invested in upgrades such as heat pumps, cooling systems, LED and lighting sensor upgrades, and smart meters for utilities.

Once energy consumption has been reduced and optimised, offsetting carbon emissions can then be achieved by using onsite renewables, offsite renewables, and climate change mitigation projects funded by carbon credits.

Onsite renewables are feasible if the asset offers the required space, such as industrial properties or retail malls; these assets typically have extensive surface areas that can accommodate the installation of a significant number of solar panels.

It is also possible to procure offsite renewables from energy providers through power purchase agreements or renewable energy credits. Some providers allow customers to purchase zero-emissions electricity (generated from renewables) for a slight premium in price.

Offsets can also be achieved by demonstrating reductions on removals through climate change projects that are not directly under the company’s operations but have been funded using carbon credits.

However, carbon credits do not lower emissions directly at their source and outcomes are unpredictable. Verifying the authenticity of offset projects and choosing projects that match the organisation’s environmental objectives and values could also pose considerable challenges.

Achieving net zero for commercial buildings in Singapore requires a concerted effort. By developing and implementing comprehensive strategies, monitoring progress, optimising energy use and investing in sustainable technologies, the real estate sector can reap long-term financial benefits, while also contributing significantly to global climate goals.

Catherine He is head of research and Henry Hsu is head of ESG at Colliers Singapore

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.