Singapore’s office market: A temporary pause or a prelude to a structural decline?

Expansions and new openings by tech companies have dried up; ample supply likely to keep rents under pressure

THE Singapore office market performed well after the Covid-19 pandemic. According to CBRE Research, Core CBD (Grade A) office rents rose by 14.9 per cent over 12 consecutive quarters since Q1 2021.

This has come about as Asia-Pacific markets, including Singapore, saw a faster return to office compared to Europe and US, amid tight supply and new project delays.

However, the positive rent growth has paused since Q2 2024, with prime rents remaining flat for two consecutive quarters.

The latest URA data has also shown that the office rental index (Central Region) registered a 0.5 per cent quarter-on-quarter decline, and median rents of Category 1, a proxy for the best office spaces in the city centre (based on contracts signed), declined by 0.8 per cent quarter on quarter in Q3 2024.

Lack of large demand drivers

The slowdown can be attributed to the vacancy spike to 7.8 per cent, following the completion of IOI Central Boulevard Towers, which added 1.2 million square feet of office space in the last few months.

The high vacancy has shone a spotlight on the noticeable lack of large demand drivers since late 2022. The expansions and new set-ups from tech firms, which previously occupied large chunks of space in excess of 30,000 square feet, have dried up.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

While there have been incremental space requirements from private wealth, family offices, asset managers, as well as professional services firms in 2023 and 2024, these typically involve smaller spaces and have not compensated for the reduction in demand from the tech sector.

Ample immediate supply

In addition, the rise of flexible working arrangements, coupled with escalating interest rates and real estate costs amid economic uncertainty, have prompted many occupiers to downsize or seek more affordable alternatives.

While shadow space (excess space on an existing lease obligation that a tenant would like to give up) in the market has stabilised, there are some 0.6 million sq ft of secondary spaces or lease expiries that will not be renewed, which are coming up in 2025. News of fresh layoffs, including the most recent round at Dyson, has also raised concerns of more consolidations in the market.

As a result, on a rolling basis, the five-year average annual net demand declined to 0.31 million sq ft over 2019-2023, a stark contrast to the historical 10-year average of 0.72 million sq ft. Is this the prelude to a structural decline of the Singapore office sector?

Longer term supply not excessive

After nearly six months of evaluating two bids from a single bidder group, the 6.5-hectare Jurong Lake District (JLD) site was ultimately not awarded, as the shortlisted concept price was assessed to be too low.

While the withdrawal of supply may offer medium-term relief for office landlords, the poor bidding outcome for the JLD site highlights perceived high risks of insufficient demand to meet the proposed supply.

“The poor bidding outcome for the Jurong Lake District site highlights perceived high risks of insufficient demand to meet the proposed supply. ”

The pessimism could be attributed to the rise of hybrid work trends, which have diluted demand. Consequently, developers are adopting a more cautious approach and may lack the confidence to enter the market at present.

Despite the current hesitation, there remains optimism for the future. Market conditions are expected to stabilise, potentially driven by a stronger economic recovery and when upcoming supply falls below historical average levels in the next few years.

Although there has been a spike in vacancy due to the completion of IOI Central Boulevard Towers in Q3 2024, ongoing negotiations are expected to boost leasing momentum in the development, supported by continued flight to quality.

Furthermore, the supply of new offices from 2025-2027 will be below the historical average, with only Keppel South Central in 2025 and the Shaw Tower redevelopment in 2026 as key projects.

New supply in 2028 could exceed 2 million sq ft from redevelopments such as The Skywaters and the New Comcentre, though some completions could spill over to 2029 due to potential delays.

Future redevelopments to tighten supply, support demand

Looking ahead, more buildings may undergo rejuvenation as obsolete buildings may need to be rebuilt to better serve their occupants and meet sustainability standards.

In fact, the rate of redevelopment has accelerated over the past five years, with an annual average of 0.69 million sq ft of office space being removed from stock between 2019 and 2023, which is about 2.5 times more than during the 2014-2018 period.

Some of these redevelopments have been encouraged by the CBD Incentive Scheme and Strategic Development Scheme (SDI) which grant additional gross floor areas subject to various conditions and approval.

With more buildings embarking on redevelopment plans, displaced tenants may seek temporary leases elsewhere by moving to other available properties, but this could be a challenging task given tight market supply conditions beyond 2025.

Return to work could see occupiers reassessing office requirements

As hybrid work arrangements continue to evolve post-pandemic, it is evident that the future of work, both globally and in Singapore, will be predominantly hybrid.

The upcoming Tripartite Guidelines on Flexible Work Arrangement Requests, effective in December 2024, will require employers to consider formal requests from employees for flexible work arrangements, including four-day work weeks and remote work options.

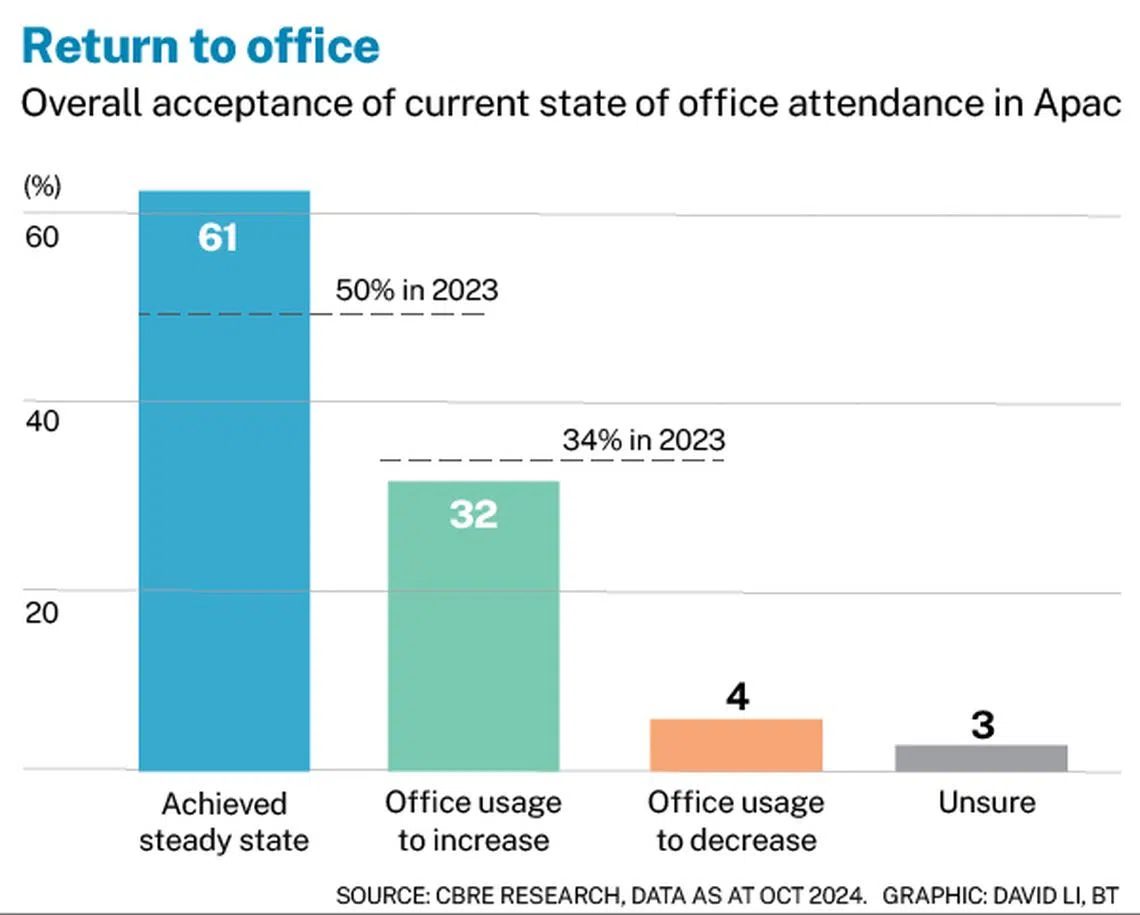

While most companies have largely achieved a steady state of office attendance by now, businesses are constantly reassessing their office needs.

Anecdotally, there is a trend of increasing office attendance. Most recently, Grab issued a five-day return-to-office mandate starting in December 2024, while Amazon recently announced a five-day work week starting next year.

Similarly, according to CBRE Research’s 2024 Apac Office Occupier Survey, about 32 per cent of companies expect an increase in office usage over time, with this trend being particularly pronounced in the technology, media and telecom (TMT) sector, where half of the respondents expect increased usage.

The potential rise in space requirements could drive office demand, but this shift could take time as leases are typically signed for three to five years and existing space allocations are fixed.

Instead, in the near term, companies can explore recalibrating their workplaces by prioritising space efficiency and reducing excess space. This could involve converting underutilised areas into phone booths or additional workstations.

Balancing challenges and opportunities

With interest rates coming off, fit-out costs stabilising, and economic growth expected to accelerate, more companies may gain the confidence to expand their headcount and office space.

“With ample supply in the near term, rents are likely to remain under pressure. CBRE anticipates that rents will resume their growth trajectory in the second half of 2025.”

Nonetheless, with ample supply in the near term, rents are likely to remain under pressure. CBRE anticipates that rents will resume their growth trajectory in the second half of 2025.

In the long term, Singapore’s strong talent pool, excellent infrastructure and pro-business environment continue to make it an attractive destination for global businesses.

Looking ahead, there is optimism for future growth driven by emerging fields such as the expanding AI ecosystem. New drivers of demand are expected to pick up the slack, with companies such as OpenAI planning to open an office in Singapore by the end of 2024.

Singapore’s strategic advantages ensure that its office market remains poised for balanced and sustainable growth.

David McKellar is head of office services, Singapore; Goh Jia Ling is associate director of research, South-east Asia; and Tricia Song is head of research, South-east Asia at CBRE

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.