The Centrepoint’s rear block up for collective sale at S$418 million

Frasers Property, its developer, is likely to be a top contender for the site for possible redevelopment

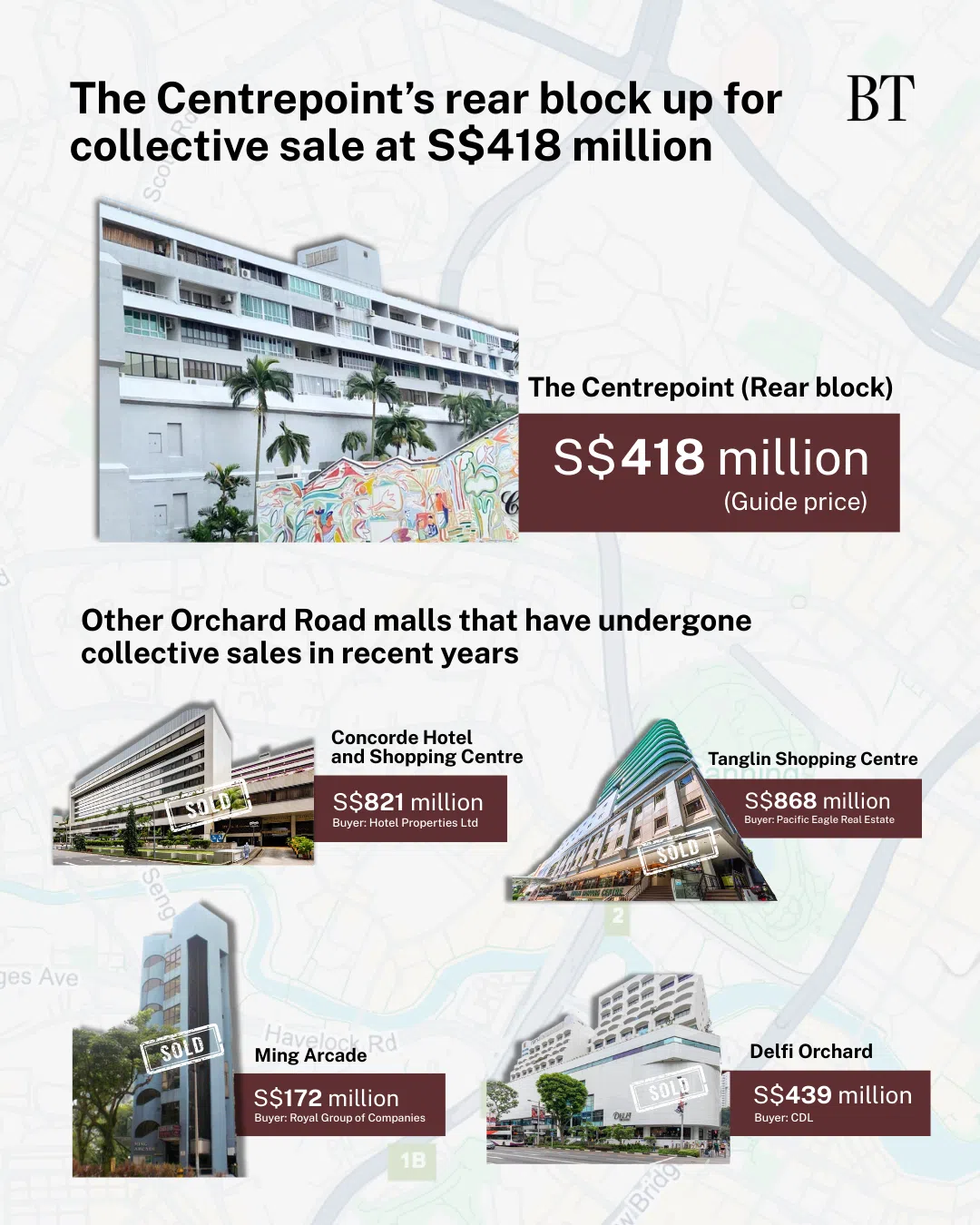

[SINGAPORE] The residential component of The Centrepoint, along with about a third of the Orchard Road development’s retail units, have been put up for sale at a guide price of S$418 million.

The 66 apartments and 66 retail units to be sold en bloc sit on an L-shaped plot which has around 52 years left on its 99-year lease. The remaining 151 retail units at The Centrepoint are located on a freehold plot mostly owned by Frasers Property, in front of the leasehold portion now being put up for sale.

The guide price of S$418 million values the site at a land rate of S$2,709 per square foot per plot ratio (psf ppr), after factoring in a land betterment charge of S$260 million, said marketing agent Savills Singapore.

A land betterment charge will be payable for topping up the plot’s lease to a fresh 99 years, and building the site up to its maximum gross plot ratio of 5.6. Currently, the plot has a development baseline of 171,482 sq ft, equivalent to a plot ratio of 3.83.

Jeremy Lake, managing director for investment sales and capital markets at Savills Singapore, said: “Developers have been bidding aggressively for GLS (Government Land Sales) sites, and some of them will be keen to buy a part of The Centrepoint. For this reason, we are confident we can exceed the guide price of S$418 million.

“With its direct link to Somerset MRT station, excellent accessibility and location in the heart of Orchard Road, the property offers developers a chance to develop a landmark property with an internationally recognised address.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Top contender

Frasers Property, the developer of The Centrepoint, is likely to be a top contender for the site. The mall opened in 1983, when Frasers Property was the property division of Cold Storage. In 2002, Frasers Property became part of Fraser and Neave, which was then bought over by Thai billionaire Charoen Sirivadhanabhakdi’s TCC Assets in 2013.

Frasers Property continues to manage both the residential and retail units at The Centrepoint. The Business Times understands it owns 52 per cent of the units in the rear block, and 95 per cent of the units in the front block by strata area.

Asked about plans for The Centrepoint at the group’s year-end earnings briefing in November 2025, chief executive officer Soon Su Lin said it was business as usual at the mall.

“We continue to look at new concepts, to upgrade the mall’s tenant mix, but at the same time we are aware of the Urban Redevelopment Authority’s (plans) for the area with the Strategic Development Incentive Scheme (SDI). We continue to look at how we can combine our sites to create an even better development in future,” Soon said on Nov 14.

The URA’s SDI scheme is aimed at encouraging renewal and redevelopment of ageing buildings in core areas. It offers incentives in terms of bonus gross floor area, more intensive land use and/or building height to asset owners combining at least two adjacent sites in a way that can have a strong transformational impact on the area.

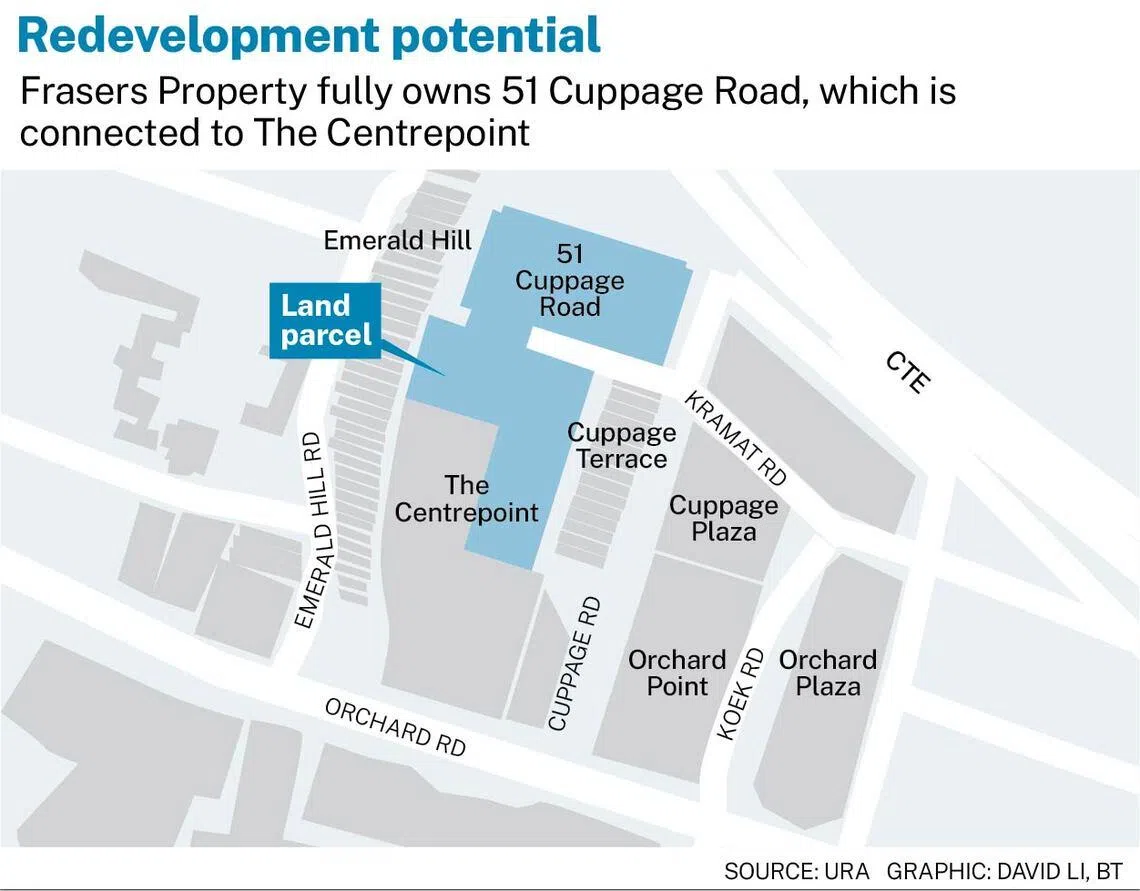

Observers note that Frasers Property could be looking at amalgamating The Centrepoint site with 51 Cuppage Road, a neighbouring 10-storey office building owned by Frasers Property. The 99-year-leasehold property, completed in 1998, is directly connected to The Centrepoint via a link-bridge.

Most recent transaction

The block at The Centrepoint up for collective sale has a site area of about 44,700 square feet (sq ft). Under the 2025 Master Plan, the site is zoned Commercial, with a height control of up to 10 storeys.

The 66 residential units include one to three-bedroom units, sized between 732 sq ft and 3,003 sq ft.

Based on URA Realis, the most recent transaction in the rear block of The Centrepoint was the sale of a 743 sq ft apartment on the seventh floor, which was sold for S$2.16 million in November 2024.

When asked how much owners stand to receive, Lake said owners are expected to receive about 30 per cent more than the current open market value for their properties.

In recent years, several Orchard Road malls have been sold via collective sales. Concorde Hotel and Shopping Mall was sold for S$821 million, or about S$1,804 psf ppr, to an HPL subsidiary in November 2024, and CDL bought out Delfi Orchard for S$439 million, or S$3,346 psf ppr, in April 2024.

Before that, Ming Arcade was sold for S$172 million, or S$3,125 psf ppr in December 2022.

In the same year, the freehold Tanglin Shopping Centre was sold to Pacific Eagle Real Estate held by the Tanoto family for S$868 million or S$2,769 psf. All were brokered by Savills.

The tender for the rear block of The Centrepoint closes on Feb 26.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.