Higher interest rates, falling incomes key risks to household balance sheets: MAS

HOUSEHOLDS will need to adjust to higher-for-longer interest rates, and some may be vulnerable to income and rate shocks, the Monetary Authority of Singapore (MAS) said in its annual Financial Stability Review on Monday (Nov 27).

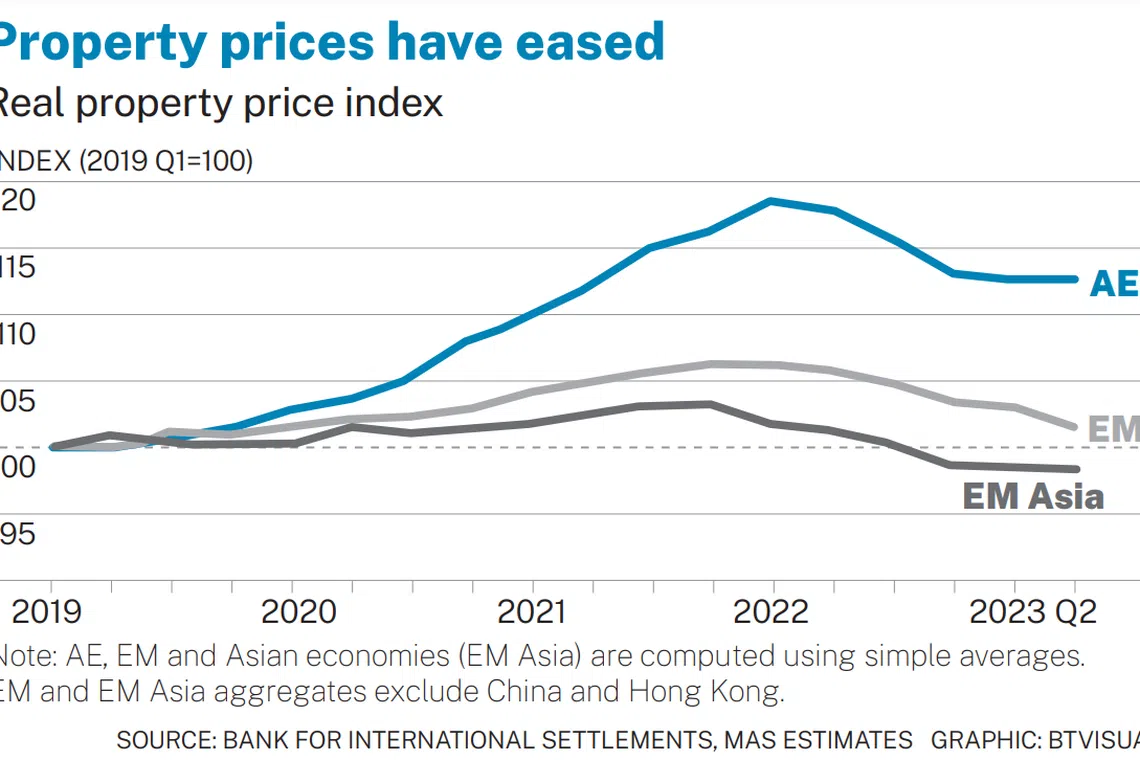

In some global markets facing falling property prices, declining valuations would have a negative impact on household wealth and banks’ asset quality.

While Singapore households’ overall financial vulnerabilities remained fairly low over the past year, with most having “adequate” buffers to manage shocks to incomes and financing costs, MAS noted that a small proportion are highly leveraged and may face challenges in servicing their debt.

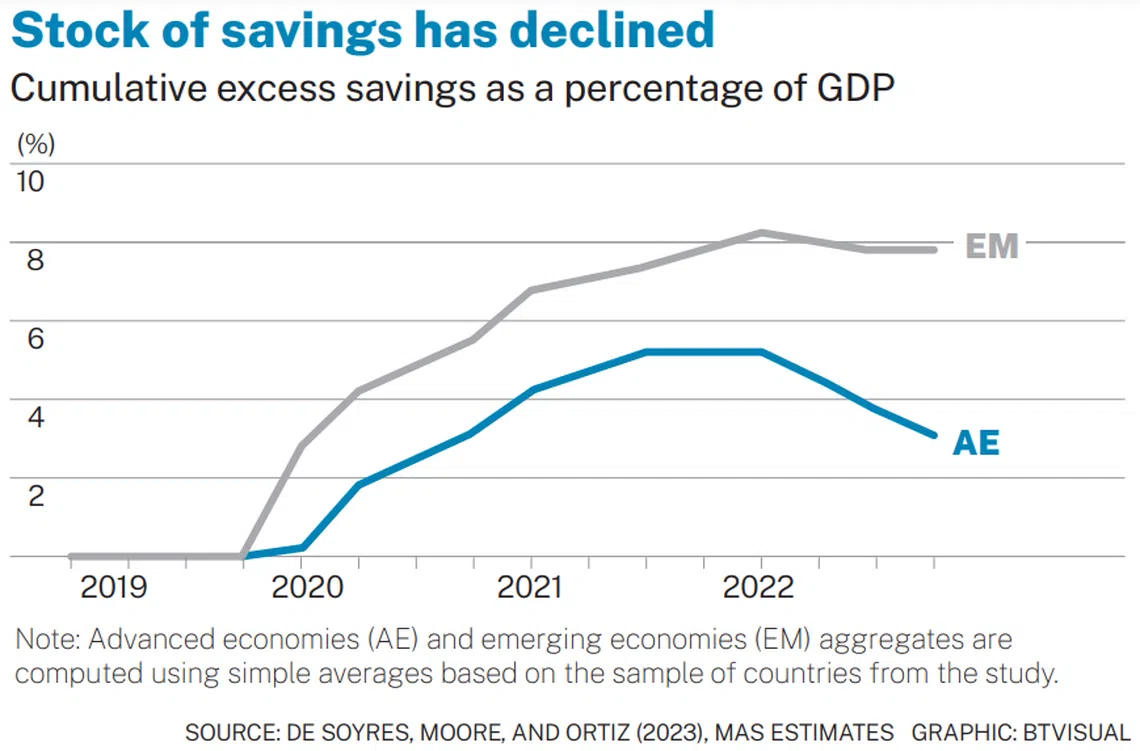

Households have been largely insulated from the full impact of monetary tightening, thanks to pandemic-induced savings, relatively stable leverage and strong income gains. But MAS cautioned that these buffers are eroding, as interest rates continue to surge and labour market conditions soften.

Households therefore need to remain vigilant to downside risks, it said.

Still, MAS noted that the household sector remains resilient with leverage risk falling, with households showing “healthy” income gains, and the credit quality of housing loans remained “strong”.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Stress tests done on borrowers showed that most would be able to weather higher mortgage rates, even at higher rate scenarios of 4.5 per cent and 5.5 per cent, with an income loss of 10 per cent. This is due in part to measures such as the loan-to-value limit and total debt servicing ratio, which ensure financial prudence among borrowers in their property purchases, said MAS.

Most of those with existing mortgages have paid down a significant portion of their loans over time, MAS pointed out. If there are increments to their monthly instalments, these would be less pronounced than for new borrowers.

Loans signed or last refinanced in the low-rate environment in 2021, when prevailing rates were about 1.2 per cent, saw the largest step-up in monthly mortgage payments. Households on fixed-rate loan packages that were refinanced at a higher average rate of 3.7 per cent between January and August 2023 saw their monthly payments go up by S$680 on average, or about 6.7 per cent of their monthly income in 2021.

SEE ALSO

Strong income growth mitigated the impact of higher mortgage rates, with the monthly income of households having risen by around 15 per cent on average since 2021.

Mortgages grew at a “subdued pace” of around 1 per cent year on year in Q3, as existing borrowers paid down their mortgages and new housing loans moderated amid a cooler property market. Housing loans make up about three-quarters of aggregate household debt as of Q3.

Property price growth moderated from 11.4 per cent year on year in Q1 to 4.4 per cent year on year in Q3. A Monday report by Savills also showed that new private residential sales volume dropped 8.5 per cent in the third quarter to 1,946 units, following two consecutive quarters of increase. This comes despite a rise in the number of launched units in Q3 and is likely due to buyers’ selectivity amid today’s high interest rate climate, it said.

The net wealth of the household sector grew 7.6 per cent year on year to S$2.7 trillion in the third quarter, largely driven by sustained growth in liquid assets and in the value of residential property assets. The housing non-performing loan ratio was just 0.2 per cent as at Q3; the number of foreclosed residential units remained “low” at 27 units thus far.

The “still relatively high” personal savings rate, on the other hand, dipped slightly to 34.6 per cent on the back of higher travel and domestic retail spending.

In the coming year, MAS believes that floating mortgage rates could be repriced higher, while expiring fixed-rate packages could see a “sharp increase” in monthly debt instalments when refinancing.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.