Making the leap from HDB to private condo

With growth of resale HDB flat prices outpacing private home prices and the gap between the edges of the two segments narrowing, the dynamics of the property ladder are changing

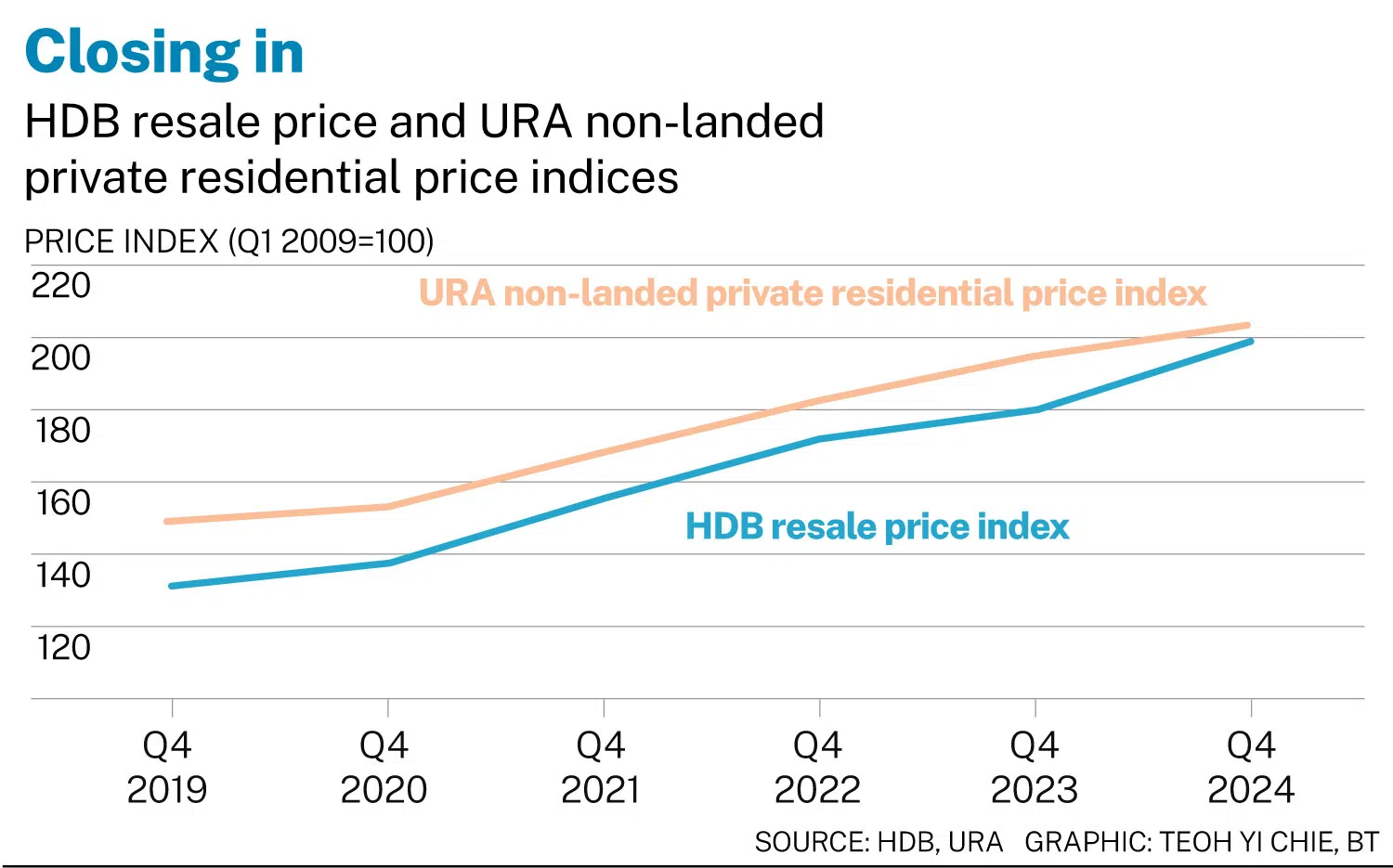

[SINGAPORE] From 2021 to 2024, resale prices of public housing flats on the whole rose faster than prices of non-landed private residential prices, suggesting that bridging the gap and making the leap from public to private housing should become increasingly within reach.

Between the fourth quarter of 2019 and Q4 of 2023, the Housing and Development Board (HDB) Resale Price Index grew 37.2 per cent, at a compounded annual growth rate (CAGR) of 6.5 per cent.

In the same period, private home prices tracked by the Urban Redevelopment Authority (URA) non-landed private residential price index rose by 29.8 per cent, with a corresponding CAGR of 5.4 per cent per annum.

Both HDB resale and non-landed private home prices continued to climb in 2024, despite the global economy being uncertain throughout much of the year and with interest rates only beginning to ease from the second half onwards. The HDB resale index recorded an uptick of 9.7 per cent, while the URA non-landed index rose 4.7 per cent.

Given this trend, HDB homeowners – especially those looking to upgrade to private housing – should, in theory, be able to sell their flats at a gain that financially facilitates an upgrade, incentivising more to get on the bandwagon.

Getting on the upgrading ladder

In 2024, there were 28,986 HDB resale transactions made across all 26 HDB towns, with prices ranging from S$230,000 to S$1.6 million in all locations, of all ages and flat sizes.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This translated to an islandwide median price of S$590,000, and the 75th percentile transaction price of S$715,000.

For obvious reasons, the higher rungs of HDB resale transactions (75th percentile) will have the better mathematical potential to reach the lower end of the non-landed private home market (25th percentile).

In the non-landed private resale market, 13,567 transactions were recorded in the same period, with prices ranging between S$492,633 and S$19.8 million.

Within this price range, the 25th percentile, median and the 75th percentile transaction prices stood at S$1.2 million, S$1.6 million and S$2.2 million respectively.

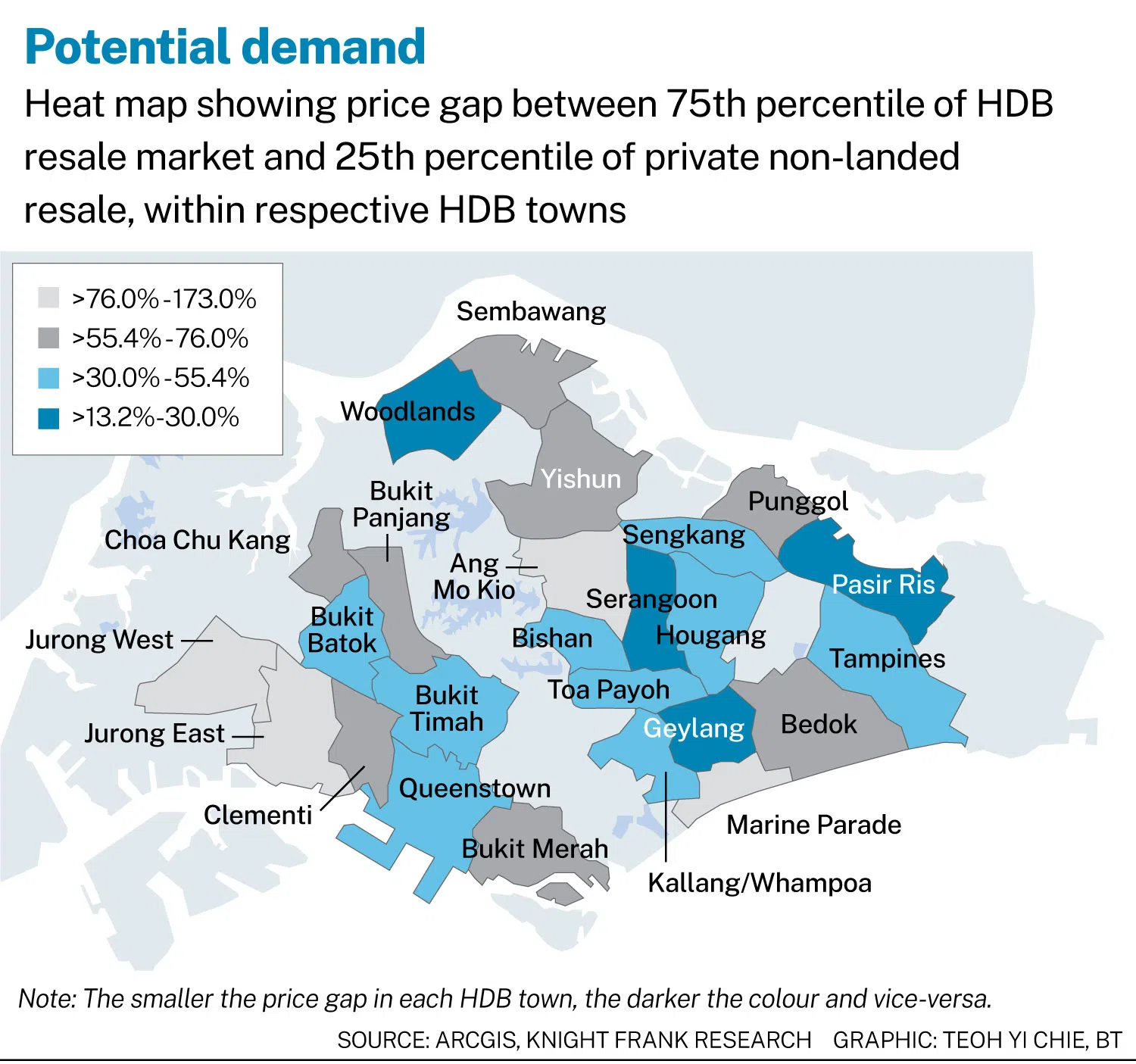

So how much of a price gap exists between HDB and private resale homes, and in what areas can the gaps be possibly favourable for a transition to private homes?

The nine HDB towns of Hougang, Kallang/Whampoa, Pasir Ris, Punggol, Queenstown, Sengkang, Serangoon, Tampines and Toa Payoh recorded median resale prices that were at or above the islandwide median but below the 75th percentile; while Bishan, Bukit Merah and Bukit Timah had median transaction prices at the higher end of the HDB resale market – exceeding the islandwide 75th percentile.

In the non-landed private residential resale market, 19 planning areas had median resale prices that were less than the islandwide median. These areas were Bedok, Bukit Batok, Choa Chu Kang, Clementi, Geylang, Hougang, Jurong East, Jurong West, Mandai, Pasir Ris, Punggol, Queenstown, Rochor, Sembawang, Sengkang, Serangoon, Tampines, Woodlands and Yishun.

Most of these were in suburban areas with a smattering of some that were at the city fringe, as well as the Rochor Planning Area close to the Central Business District.

When comparing median resale transaction prices between HDB and non-landed private homes in HDB towns, the price gap ranged from 81.6 per cent to 372.7 per cent, as HDB homeowners looking to upgrade can face significant financial hurdles.

However, comparing the upper ranges of HDB resale prices and the bottom quarter of private housing – 75th percentile HDB resale prices against the 25th percentile of non-landed private home resale prices – the price gap narrows to between 13.2 per cent and 173 per cent.

The table above provides a ballpark guide based on 2024 prices in both the HDB resale and non-landed private resale markets, where cross comparisons can be made to shortlist potential upgrading paths based on the different HDB town locations and varying price levels.

And perhaps, lines of possible upgrades can be drawn between HDB resale flat price levels in various HDB towns with the 25th percentile and median price ranges in the non-landed private home secondary market. After which, if a prospective upgrader factors in cash and CPF savings together with other individual household variables and concerns, a shortlist of viable upgrading locations can be made.

Movement could take place in the opposite direction also. Non-landed private homeowners, especially retirees or those seeking to downsize, could get a rough sense of probable profits from selling off their private homes and purchasing a HDB resale flat in an area where the price levels are within their target range. Naturally, other factors such as outstanding loans should also be considered.

Data from the Department of Statistics showed that between 2015 and 2024, Singaporean household liquid assets (such as cash, deposits, shares, etc, not inclusive of insurance, CPF and properties) had increased by a CAGR of 6.2 per cent per annum, much faster than the increase in total household liabilities which grew by a CAGR of 1.8 per cent per annum in the same period.

With total household net worth doubling in the same period from S$1.5 trillion to S$3.1 trillion, more households are getting more affluent, with greater spending power.

In addition, two generations of Singaporean homeowners have enjoyed exponential appreciation in their housing assets since independence as the nation developed from Third World to First. The gains made by more than a few Baby Boomers and Generation X are currently being passed down to the next generation, enabling more to make the transition into private homes, alongside the gains from HDB resale prices.

Both the public and private housing market have evolved in tandem with the nation’s growth where steady economic progress has created wealth across the board, providing residential options for a wide swathe of society.

Depending on the stage of life, the build-up in overall wealth has afforded households the wherewithal to actualise aspirations up the housing ladder, and at the same time bolstered asset values for others to simplify their lifestyles and downgrade in the opposite direction with savings when retirement beckons.

It is not just a matter of moving on up from public housing to private. Whether moving up or down or staying put in whatever position in the property ladder, the Singapore residential market is wide and deep enough to provide possibilities and options for many households in various phases of life.

Leonard Tay is head, research and Koh Kai Jie is senior analyst, research at Knight Frank, Singapore

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.