Marina Gardens, Jurong Lake sites among 7 new housing plots to go up for sale in H1 2023

Ry-Anne Lim

SEVEN new sites will be on offer under the Government Land Sales (GLS) for private residential housing in the first half of 2023 - four on the confirmed list and three on the reserve list.

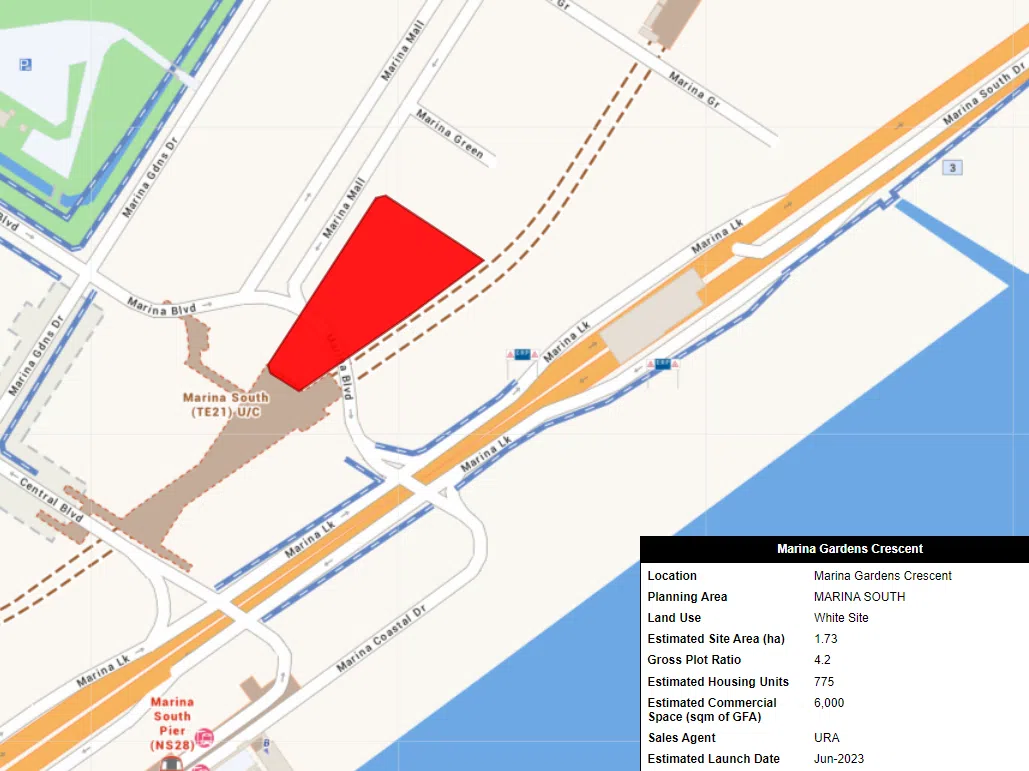

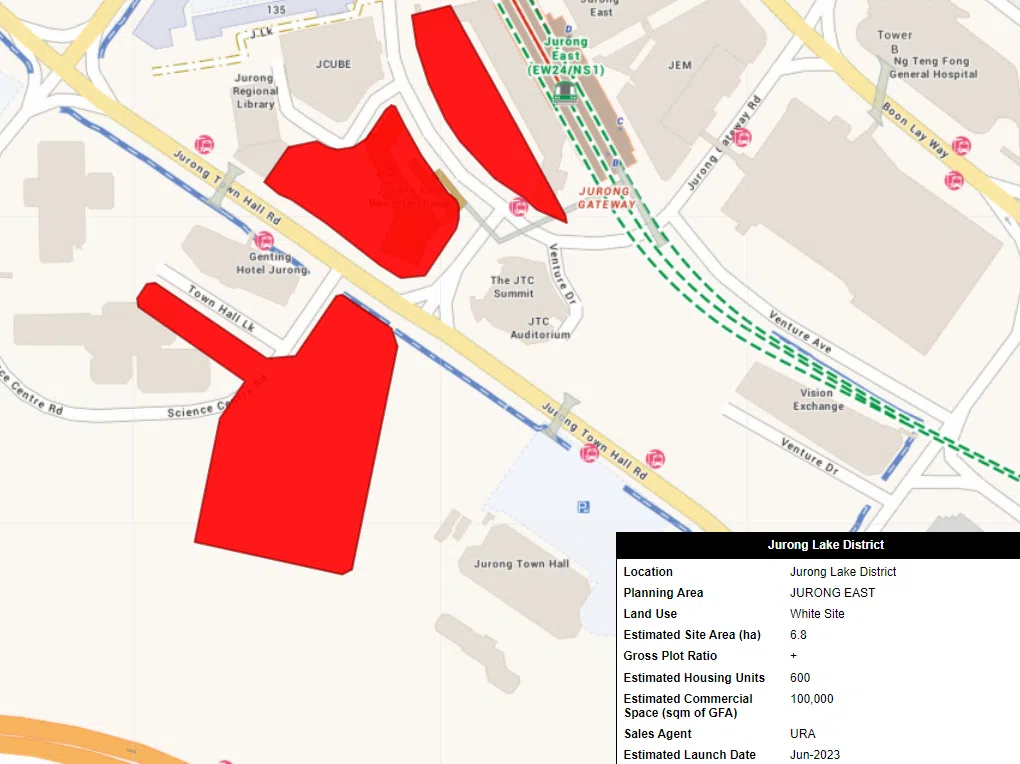

The confirmed list includes two large white – or mixed use – sites at Marina Gardens Crescent and Jurong Lake District that caught analysts’ attention.

The Marina Gardens Crescent parcel can yield about 775 private homes and 6,000 square metres (sq m) gross floor area (GFA) of commercial space. It is zoned under the city fringe, or Rest of Central Region.

The Marina South area plot, which spans 1.73 hectares and is expected to launch in June 2023, is much larger than the adjacent Marina Gardens Lane, which was recently released for tender on the confirmed list in the H2 2022 GLS Programme, noted chief executive officer of OrangeTee & Tie Steven Tan.

The site, however, has a lower plot ratio than Marina Gardens Lane, said CBRE South-east Asia head of research Tricia Song, and is likely to have a lower height than that at Marina Gardens Lane. She expects bidders to take the cue from the response to the first site, whose tender will close on Jun 27, 2023.

Chia Siew Chuin, head of residential research and consultancy at JLL Singapore, expects the land cost to be high, which could limit tender participation notwithstanding the draw of the Marina South locale, particularly when it is expected to be launched in June 2023. Potential bidders are likely to form joint ventures, she said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Huttons senior director of research Lee Sze Teck added that the site at Marina Gardens Crescent was probably introduced in the latest GLS Programme to “check against any exuberant bid for the Marina Gardens Lane site”.

“It should see good interest from not more than five developers and may potentially attract a top bid between S$1,250 and S$1,350 per square feet per plot ratio (psf),” he said.

The other white site at Jurong Lake District spans a massive 6.8 hectares, and will yield around 600 private homes and 100,000 sq m of commercial space. It has a GFA of 375,00 sq m and is expected to launch in June 2023. It will also be the first private residential launch in the area since 2013, when J Gateway was launched and nearly sold out in a month, noted Wong Xian Yang, head of research at Cushman & Wakefield (C&W).

The estimated bid could be a “very huge quantum”, anywhere between S$3 billion and S$4 billion, but the returns are also “higher as the master developer gets to control the supply and pricing for the area”, Huttons’ Lee said.

According to director and head of research at Colliers Singapore Catherine He, this is also the first time white sites are unveiled on the confirmed list since H2 2018, which saw the release of a white site at Pasir Ris Central.

Edmund Tie head of research and consultancy Lam Chern Woon noted that the release of these two white sites indicate “the government’s intention to build up the core central business district and the largest regional business district as vibrant mixed-use precincts, allowing developers to have a greater hand in adapting and meeting market demand needs”.

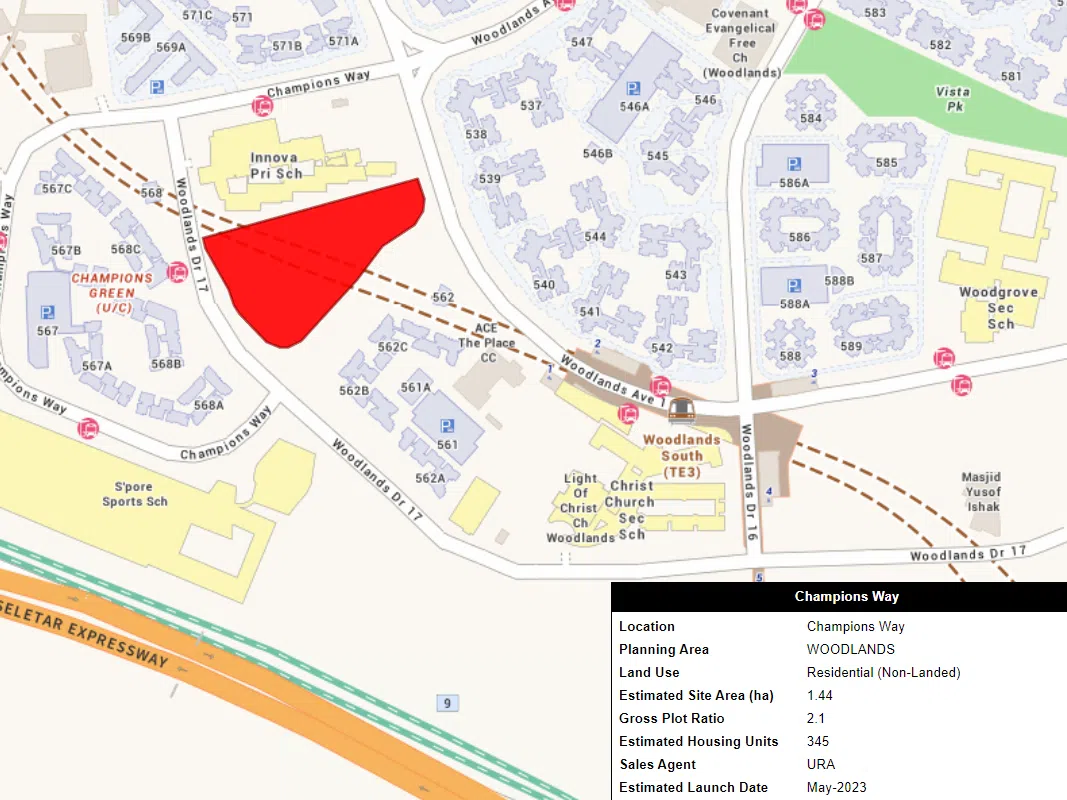

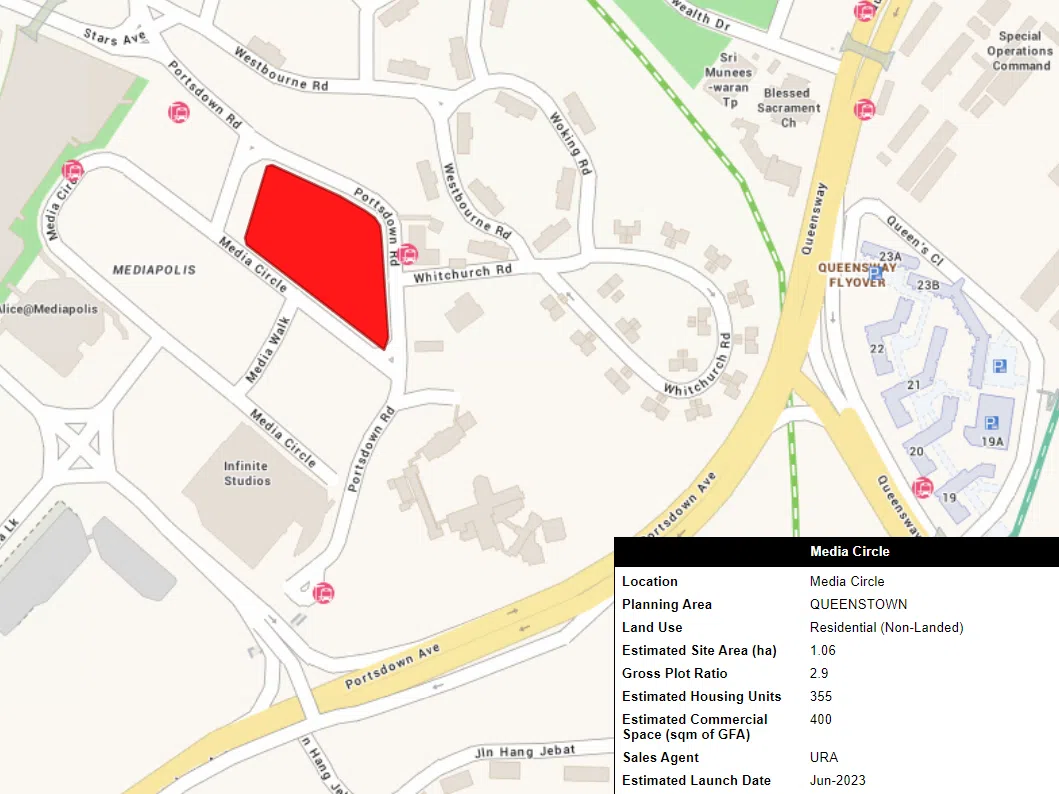

The confirmed list supply includes two other new residential sites at Champions Way and Media Circle, both of which are seen to be of palatable size.

The parcel at Champions Way in Woodlands can generate 345 units, with a 500 sq m minimum for childcare space, and is expected to launch in May 2023. JLL’s Chia expects the land parcel to attract top bids of around S$235 million or S$722 psf ppr.

Analysts also anticipate strong interest for the Media Circle site, which would yield 355 units and includes about 400 sq m of retail space, due to its vicinity to office clusters near Buona Vista, including Mediapolis, Biopolis and Fusionopolis.

Nicholas Mak, head of research and consultancy at ERA Realty, said the future development might attract a pool of investors due to its “high rentability potential from white-collared workers in the precinct”.

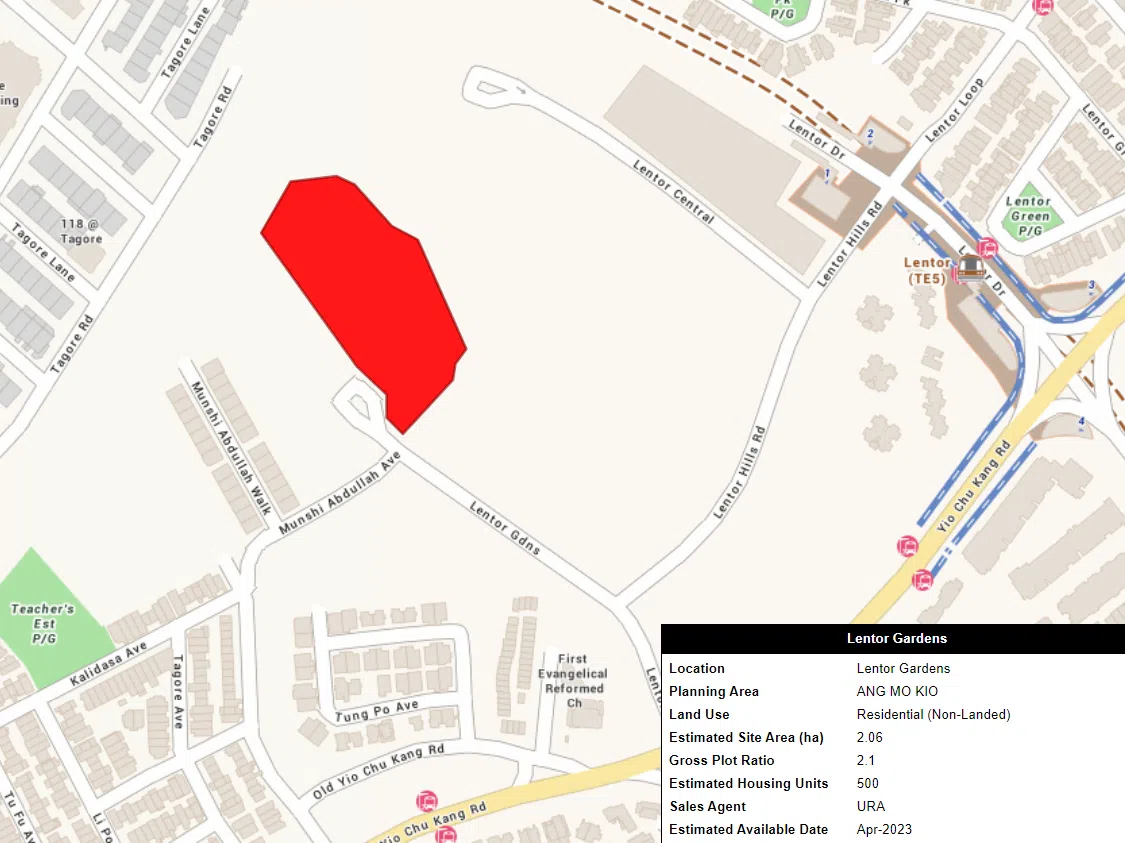

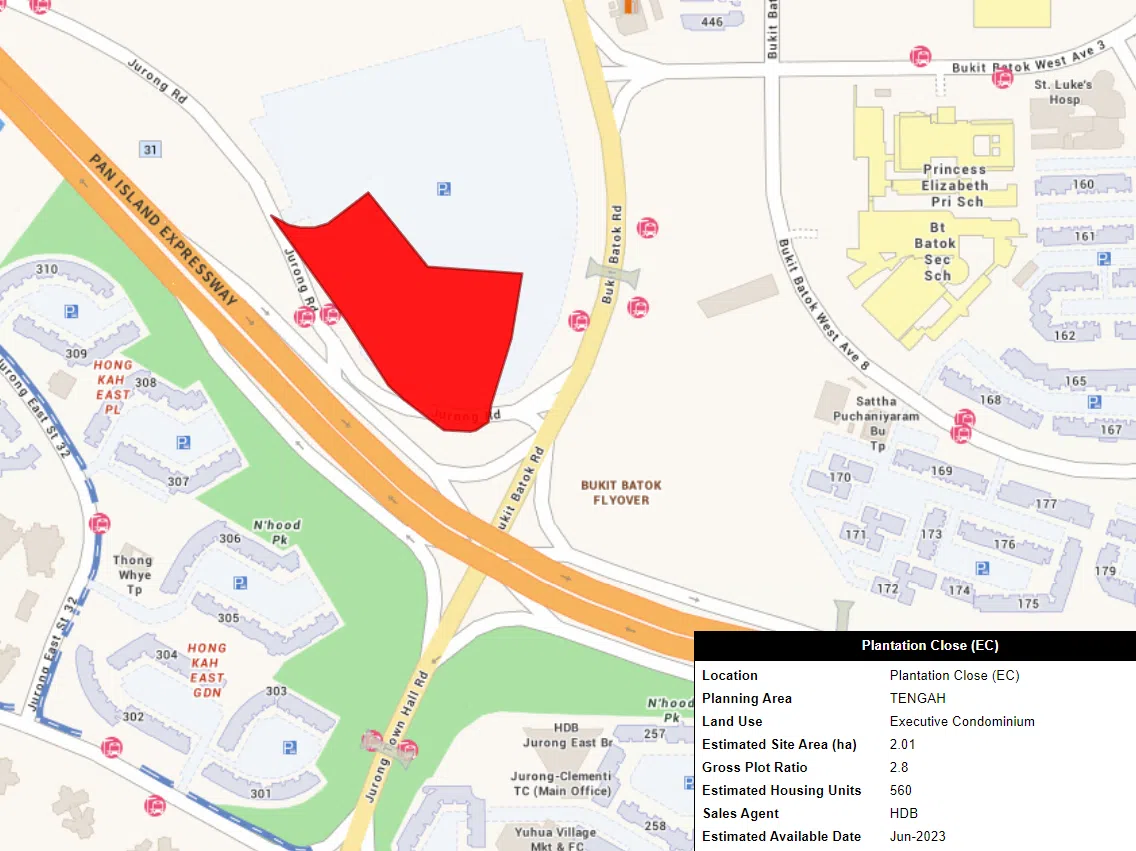

The three new land parcels on the reserve list of the H1 2023 GLS Programme are an executive condo (EC) project in the Plantation Close area for 560 homes, and two plots at Toa Payoh and Lentor Gardens. Sites on the reserve list are put up for sale only if a developer’s indicated minimum price in their application is acceptable to the government.

Analysts say the 765-unit parcel at Lorong 1 Toa Payoh is more likely to be triggered for tender. CBRE’s Song noted that there has been no private residential land tender in the mature estate since June 2015, which then saw 14 bids for the site that now holds GEM Residences.

ERA’s Mak pointed also to “pent-up demand from HDB upgraders or their adult children in the area”. A similar example is AMO Residence at Ang Mo Kio, said Mak, which sold nearly all its 372 units on the first day of its launch in July 2022.

Altogether, the sites offered in the H1 2023 GLS Programme will ramp up supply of private homes as demand for housing continues to surge.

Leonard Tay, head of research at Knight Frank Singapore, said this showed the government “recognises the weight of demand for housing that has built up in the past nine months to a year”.

The Urban Redevelopment Authority’s private residential rental index has climbed 20.8 per cent in the first nine months of 2022, while the price index made gains of 8.2 per cent, even with December 2021’s round of cooling measures, said Tay.

This latest round of the GLS Programme sees the projected number of private housing units, including ECs, hike 16.7 per cent to 4,090 units from the 3,505 units in H2 2022. Of the 4,090 units, 2,015 units were carried forward from the H2 2022 GLS Programme and 2,075 are from new sites.

“Therefore, the government is steadily increasing supply to meet the demand for housing – both for purchase and rental – that has blossomed in post-pandemic Singapore,” he said.

He from Colliers Singapore added that with the wider options of sites available, “more developers might look to (these) GLS sites instead of the collective sales market to replenish their land banks”. But those looking to develop more luxury properties on freehold or 999-year leasehold sites in prime districts might still need to turn to the private market, she said.

Mak from ERA however highlighted that the ramp up in supply might only come onstream in the longer term and is likely to have “little effect” on housing prices next year. Any residential projects built on these newly released land parcels might only be launched for sale to homebuyers after H1 2024, he said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.