CBD offices coming back to life

With WFH no longer the default and amid a talent crunch, tenants are likely to be more selective and willing to pay for the right office space.

AFTER 2 years of an uncertain future for the central business district (CBD) office market, the Singapore government's directive that work-from-home would no longer be the default since Jan 1, 2022 is bringing the CBD back to life.

In Q1 this year, the Google mobility index has shown a promising improvement of workplace footfall in Singapore to about 10-15 per cent below pre-Covid levels.

While hybrid working - a mixture of office-based and remote working - is likely here to stay, given the widespread recognition on the merits of flexibility in the future of work, there is also the wider acknowledgement that the physical workplace will remain central to a firm's corporate identity, talent attraction and productivity.

We envisage the following market trends to shape the Singapore office in 2022 and beyond:

Clear guidelines around hybrid working

We expect companies to focus on implementing hybrid working by adopting clearer guidelines and greater coordination. While occupiers are keen to secure cost savings through the use of less space, they are concerned about the potential impact on productivity, engagement and corporate culture.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The challenge for occupiers will be redefining the role of the office, while accurately gauging space utilisation and creating an agile office network for a far more dispersed workforce.

Talent crunch

Although the "Great Resignation" has been more pronounced in the US, the pandemic has prompted many white-collar employees in Asia Pacific to seek a more equitable work-life balance.

Lower unemployment has sparked a talent crunch, with many companies utilising workplace design as a means to attract and retain staff. As remote working will enable staff to be far more mobile than ever before, workplaces will need to be designed in such a way to attract people to work there.

Tighter ESG requirements

With more countries pledging to reach carbon neutrality between 2030 and 2060, occupiers are under pressure to comply with Environmental, Social and Governance (ESG) standards on sustainability disclosure. The year 2022 will see companies exercise more scrutiny in selecting offices based on sustainability and wellness features as well as the landlord's ESG performance. Green leases, energy audits and resilience will feature more prominently in leasing portfolios.

A broad-based economic recovery on the cards

Looking back, 2021 has been a year of reckoning with the global vaccine roll-out and some governments, including Singapore's, endorsing the endemic state of living but with varying and often-interrupted pace of border reopenings and return-to-office.

Despite the Omicron variant introducing some uncertainty, Singapore appears set to remain on the path of reopening the economy and to function with Covid-19 as an endemic.

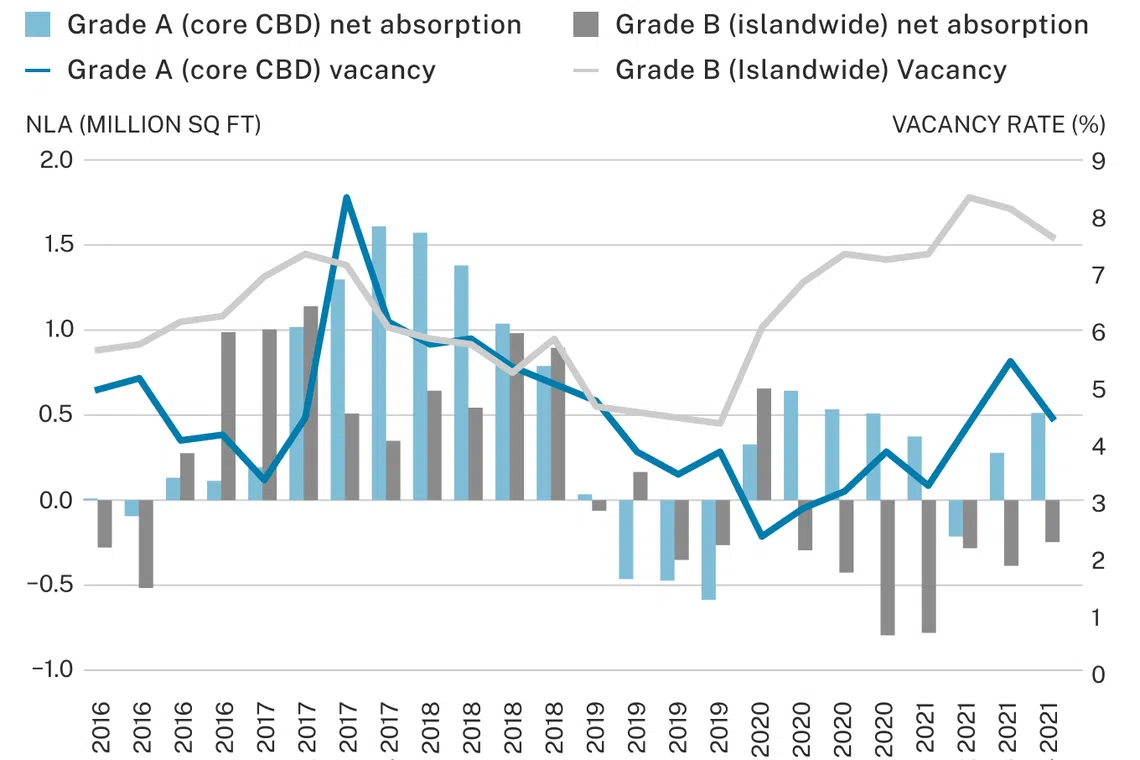

These serve to give occupiers confidence. The year 2021 concluded with an islandwide net absorption of 0.32 million square feet of office space, reversing the net absorption of -0.56 million sq ft in 2020.

While there was some downsizing activity on the back of occupiers adopting hybrid working arrangements, the technology and non-banking financial sectors, such as private wealth and asset managers, drove the absorption of large-scale availabilities in the core CBD. These 2 sectors were the top office demand drivers in 2021, accounting for 52 per cent of leasing volume.

Singapore continues to be a thriving hub for technology and financial services, supported by a strong talent pool and world-class digital infrastructure. Singapore is also seen as a key gateway city to South-east Asia, which is expecting an economic recovery and reigniting investor interest in the next few years.

With new and expansionary demand from technology occupiers and a broad-based economic recovery, the office market is poised to benefit from employment gains.

Flight to quality

The office market is a 2-tier market, with a widening demand gap between prime and subprime assets. In 2021, the Grade B market registered negative absorption of 0.25 million sq ft as some cost-conscious occupiers downsized, while others leveraged the downturn to take "flight to quality".

Conversely, the Grade A (Core CBD) market registered 0.51 million sq ft of positive net absorption in 2021. This was largely supported by the strong take-up in CapitaSpring, a mixed-use re-development in prime Raffles Place completed in Q3 2021.

Flight-to-quality relocations will remain a major driver of demand in 2022. A heightened emphasis on sustainability and wellness will also trigger upgrading to green buildings. Amid competition for talent and with more certainty of economic growth, occupiers are likely to be more selective and willing to pay for the right space.

New supply remains tight

On the supply front, the office market will likely have further support due to the pretty lean development pipeline. Over the next 3 years (2022 -2024), an average new supply of 1.25 million sq ft per annum is estimated to come onstream, some 13 per cent lower than the historical 10-year annual average of 1.45 million sq. ft.

That said, the bulk of the new supply remains in the CBD, in the form of Grade A buildings, equipped with intelligent building systems, biophilic features and large floor plates. Hence, we expect these should continue to draw occupiers into the CBD.

This year, around 710,000 sq ft net lettable area (NLA) of office space is slated for completion at the Guoco Midtown integrated project along Beach Road.

In October 2023, occupiers can look forward to some 1.26 million sq ft of premium office space in IOI Central Boulevard Towers, in the heart of Marina Bay, which incidentally has not seen a new office building in 6 years. Marina One was completed in 2017.

At the same time, office building owners are redeveloping older assets in the CBD. Prior to the pandemic, in 2019, the Urban Redevelopment Authority had rolled out 2 schemes - the CBD Incentive Scheme and Strategic Development Incentive (SDI) Scheme.

The CBD Incentive Scheme offers incentives to encourage the conversion of existing, older, office developments into mixed-use developments that will help to rejuvenate the CBD, while the SDI Scheme is intended to encourage the redevelopment of older buildings in strategic areas into new, bold and innovative developments that will positively transform the surrounding urban environment.

Since then, several redevelopment projects that are leveraging on these schemes and that have either been or are being taken off the market are AXA Tower and Fuji Xerox Towers under the CBD Incentive Scheme, and Central Mall and Central Square, and Faber House under the SDI Incentive Scheme.

With the removal of some existing stock due to redevelopment activity, as well as potential demand from displaced tenants from the office assets which are undergoing redevelopment, the demand and supply dynamics are turning favourably towards landlords and investors.

Core CBD Grade A office rents grew 3.8 per cent to S$10.80 per square foot (psf) per month in 2021, after declining 10 per cent in 2020. While hybrid working could keep the overall office demand footprint below pre-pandemic levels, CBRE Research expects further rental growth in the mid-term, supported by the rapid expansion in demand from the technology sector and limited new supply.

This will be led by the Grade A market in Core CBD, with office rents growing 6.9 per cent to S$11.55 psf per month by end-2022, in a reversion to pre-Covid levels. We expect Grade B offices to also benefit from the rising tide, though the rental gap should remain wide.

Singapore remains well-placed as a key business hub and an attraction for talent and investments, which bodes well for its world-class office market. After the storm, Singapore's office market is set for brighter skies and possibly a rainbow.

David McKellar is Co-head of Office Services, Singapore, CBRE. Tricia Song is Head of Research, Southeast Asia, CBRE.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.