Good Class Bungalow market poised to remain buoyant

Despite recent cooling measures, sellers are unlikely to adjust their prices downwards; buyers generally have to be Singaporeans, who typically ensure that their GCB purchase will be counted as their only residential property and hence not be subject to ABSD.

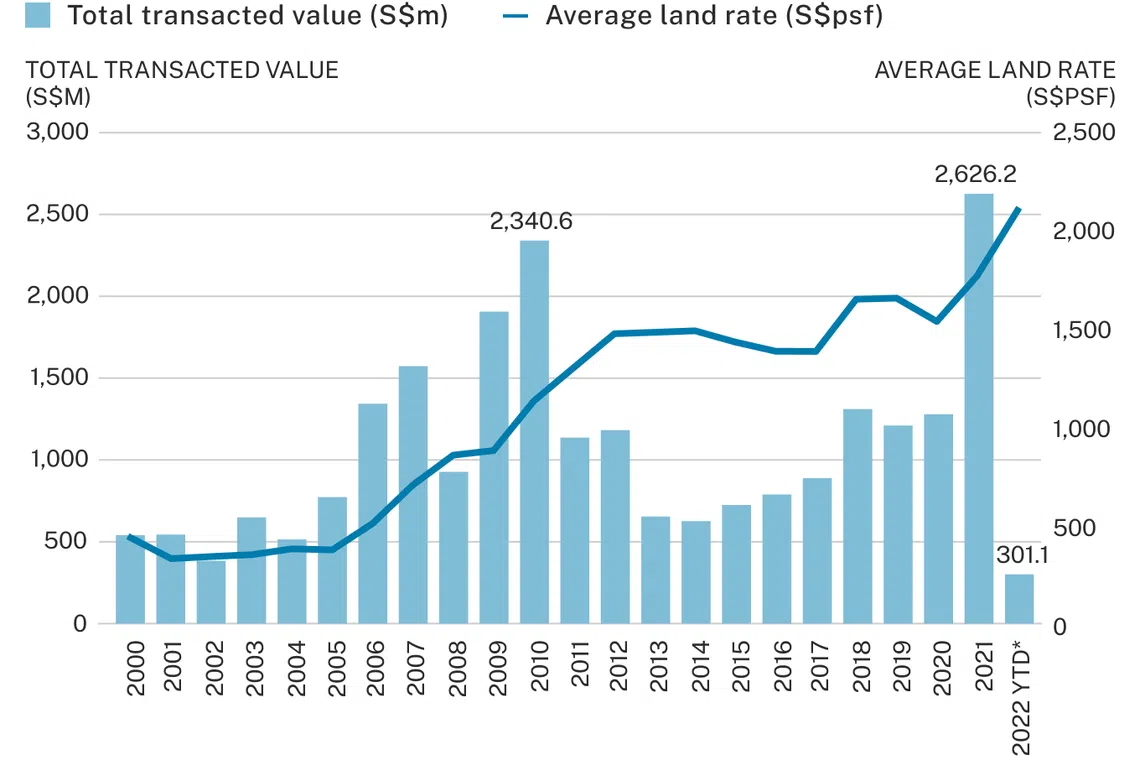

THE Good Class Bungalow (GCB) market reached uncharted heights in 2021, with more than S$2.6 billion in total transacted value. On an individual transaction basis, a number of record-breaking deals were also concluded, as GCBs reinforced their position as a top-choice asset among wealthy Singaporeans.

Sitting at the apex of the Singapore housing pyramid, GCBs are well established as a symbol of high social status and viewed by many as a trophy asset. This rare asset class is exclusive and highly sought-after for its long-term investment value with only 39 gazetted GCB Areas and a total of less than 3,000 units.

Stellar market performance in 2021

The S$2.63 billion in total transacted value in GCB Areas last year was a record figure and double the S$1.28 billion in the previous year.

2021's tally of 92 deals in GCB Areas was almost double the 48 transactions in the previous year.

Robust demand from buyers drove GCB sales and price increases last year. The total transacted value in 2021 surpassed the previous record of S$2.34 billion in 2010. Interestingly, however, the number of deals in 2021 was still lower than 2010, when 126 GCBs changed hands.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

From where we stand, this is due to rising GCB values, supported by the fact that the average price in terms of per square foot (psf) of land area for GCB deals rose 55 per cent between 2010 and 2021.

There were several notable record-breaking deals in 2021, especially during the first half of the year.

The sale of an old bungalow in Nassim Road for S$128.8 million (S$4,005 psf on land area) to the wife of Nanofilm Technologies International's founder in March 2021 was the highest unit land rate recorded for a GCB transaction. In quick succession, a bungalow being developed in Cluny Hill fetched S$63.7 million, reflecting a record land rate of S$4,291 psf.

Buyers include second- and third-generation adult children from wealthy families, ultra-high-net-worth individuals (UHNWIs), well-heeled newly-minted Singapore citizens and wealthy parents purchasing GCBs under trust for their minor children.

Demand for GCBs also comes from non-GCB homeowners looking to upgrade their homes and enter the GCB market, and young CEOs or owners of successful start-ups.

Market outlook in 2022

So far this year (based on caveats data downloaded on Mar 11), there have been 10 transactions involving GCBs amounting to S$301.11 million, pointing to sustained interest in the market.

Buyers are expected to pay a premium for GCBs with positive attributes, such as elevated terrain, wide frontage and those in preferred locations, such as near the Singapore Botanic Gardens UNESCO World Heritage Site. Moving forward, we do not expect the main buyer profiles of GCBs to differ from that of 2021.

One generally has to be a Singapore citizen to be allowed to buy a landed property in a GCB Area.

As buyers will typically ensure that their GCB purchase will be counted as their only residential property, they are not subject to the additional buyer's stamp duty (ABSD).

Hence, we do not expect the property cooling measures introduced in December 2021, which include raised ABSD rates, reduced Total Debt Servicing Ratio (TDSR) and lowered loan-to-value limit for public housing, to have a significant impact on GCB prices and sales activity in 2022. The latest punitive ABSD is a significant deterrent in the purchase of GCBs only for those buying them as second, third or subsequent residential properties.

Despite the recent market cooling measures, sellers are unlikely to adjust their prices downwards. Activity in the past year has demonstrated that GCBs are an asset class of their own, distinct from other property types in Singapore, and these sellers will only divest their GCBs if the prices meet their expectations. On the other hand, as sellers continue to raise their price expectations, buyers may not readily give in, and deals may take longer to negotiate due to the mismatch in price expectations.

During the Budget 2022 speech, it was announced that property tax rates for owner-occupied and non-owner-occupied residential properties will be raised in 2 phases over the next couple of years. The revised property tax rates reflect a steeper increase for higher value homes; thus, owners of luxury and high-end homes may be hit harder by the new rates.

That being said, we do not expect potential buyers of GCBs to be largely deterred by the tax increase, as they are likely to be from higher income households. Moreover, the benefits that come with owning a GCB (that is, having a stable investment with long-term appreciation) may outweigh the additional taxes incurred.

In conclusion, GCBs remain a choice asset for wealthy buyers and will likely continue to be in demand despite the recent market cooling measures and planned property tax hikes. Their long-term investment value and exclusivity in the housing market continue to draw citizens with aspirations to own a GCB within their lifetime.

GCBs in good/move-in condition may attract a larger pool of buyers as they stand to save on high construction and renovation costs amid the current labour and material shortage in the construction industry caused by the pandemic. In 2022, we expect sales volume to stabilise and price growth to moderate, rising at a slower pace than in 2021.

Carin Puah is Senior Director, Capital Markets, JLL Singapore. Sara Ong is Research Analyst, Research & Consultancy, JLL Singapore.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.