Market for new ECs a bright spot after cooling measures

Some HDB upgraders may find new ECs a good alternative to buying a private condo and this hybrid housing form remains in short supply.

SINGAPORE'S property market has been buoyant despite the pandemic. Billions of dollars in government stimulus, record-low interest rates and a recovering economy pushed prices of properties higher across the island. Many local and foreign investors parked their funds in our real estate market as Singapore is deemed a safe haven.

A surge in buying activity was observed across many segments of the housing market last year. Overall prices of private residential properties rose to a record high, according to data from the Urban Redevelopment Authority (URA).

Prices of non-landed homes in the suburbs or Outside Central Region (OCR) and the city-fringe areas or the Rest of Central Region (RCR) as well as landed homes islandwide all reached new highs in 2021.

Limited impact from new cooling measures

The government introduced new cooling measures to address the upward momentum in prices and rein in the housing market. From Dec 16, 2021, the additional buyer's stamp duty (ABSD) rates were increased, and the total debt servicing ratio (TDSR) was tightened to temper demand.

Foreigners, as well as permanent resident and Singaporean investors holding multiple properties, bear the brunt of the ABSD hikes.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

As executive condominiums (ECs) are mainly bought by Singaporeans who are not allowed to hold other properties, this market segment could be least affected by the new cooling measures. Buyers do not incur ABSD when they purchase a new EC.

ECs are a hybrid of public and private housing sold at lower prices than private condos despite being built by private developers. Buyers of new ECs are subjected to restrictions such as eligibility requirements, income ceiling, minimum occupation periods and a mortgage servicing ratio (MSR) in addition to the TDSR.

An EC project is privatised 10 years after its completion; thereafter units in the development can be sold to foreigners, thus increasing the potential demand pool.

The ABSD rate increases may impede some buyers from investing in private properties as more cash is required. With a higher ABSD rate, Singaporeans purchasing a S$1 million condo unit will incur a 17 per cent ABSD for their second property, up from 12 per cent before the new cooling measures took effect on Dec 16, 2021. This translates to S$170,000 in ABSD, compared with S$120,000 previously.

HDB flat owners who wish to upgrade to a private property have to pay ABSD as the flat is considered their first property.

However, some HDB upgraders may not have the financial means to pay the ABSD upfront. They may have to sell their HDB flat first before buying a private home. Some may rent in the interim, thus incurring additional costs and the hassle of house moving.

Therefore, some HDB upgraders may find new ECs a good alternative. Buyers of new ECs do not need to pay ABSD even if they continue to own (and live in) their HDB flat while they wait for the completion of their new EC home. However, they will need to dispose of their existing flat within 6 months of taking possession of the EC unit.

Price disparity may keep new ECs attractive over condos

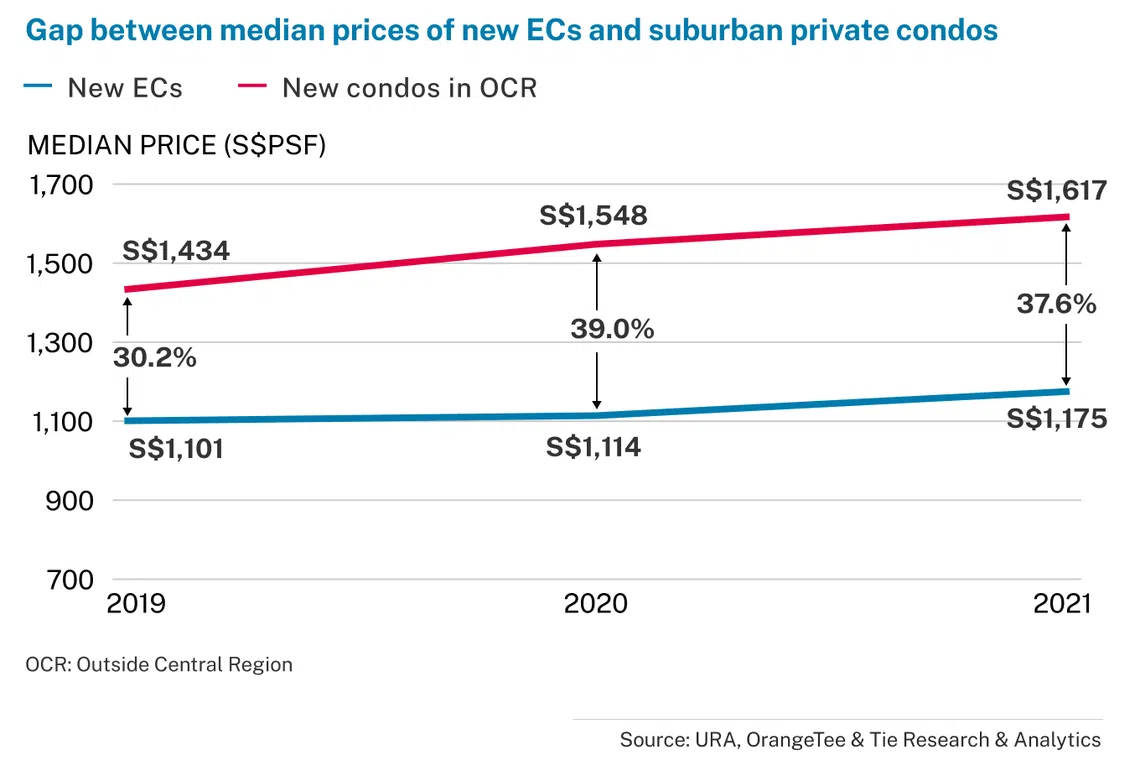

The recent run-up in private condo prices may keep ECs attractive to many buyers. Prices of new condos in the suburban areas are rising at a much faster rate than new ECs.

For instance, the median price of new ECs rose 6.7 per cent from S$1,101 per square foot (psf) in 2019 to S$1,175 psf in 2021. New condos in the OCR, on the other hand, grew at a faster pace of 12.8 per cent from S$1,434 psf to S$1,617 psf over the same period.

Some young couples and HDB upgraders may consider ECs more affordable and enticing. As a result of the higher price growth of new condos in OCR, the price gap between such condos and ECs widened from 30.2 per cent in 2019 to 37.6 per cent in 2021.

Despite slower price growth compared with suburban condos, 36 of the 40 EC projects launched over the past 10 years yielded positive price appreciation from their respective launch years to 2021. Of these 36 projects, 34 posted double-digit price growth. (The other 2 projects posted increases of 4.4 per cent and 1.8 per cent.)

The remaining 4 projects saw either negative or zero price growth due to the short time span since their launch in either 2020 or 2021.

Treasure Crest recorded the highest price appreciation of 43.9 per cent from S$748 psf during its launch year in 2016 to S$1,076 psf in 2021. Another project, Twin Waterfalls, similarly saw its median price rise 39.5 per cent from S$726 psf during its launch year in 2012 to S$1,012 psf in 2021.

The price trend indicates that most EC projects gain value over time, mainly due to the low acquisition prices compared with private condos. Families can enjoy condo facilities at affordable prices and their homes can yield attractive capital appreciation over time.

Demand may continue to outstrip supply

ECs have been one of the most popular residential property segments in recent years, going by the strong demand observed across many new EC launches.

Based on URA's February 2022 developers' sales data, most EC launches have been substantially sold, including Piermont Grand (100 per cent), Parc Canberra (100 per cent), Parc Central Residences (100 per cent), OLA (98.9 per cent), Provence Residence (94.9 per cent) and Parc Greenwich (94.2 per cent).

Strong demand pared down developers' launched but unsold stock to only 56 EC units.

This year, 3 EC projects are slated for launch.

They include the 616-unit North Gaia in Yishun Avenue 9 being developed by Sing Holdings, the 639-unit project along Tengah Garden Walk by City Developments and MCL Land, and the 618-unit development in Tampines Street 62 by Qingjian Realty and Santarli Realty.

The launch of the Tengah Garden Walk project will be keenly watched as this is the first EC project to be built in the precinct. Couples attracted to the location, which is envisioned to be a smart and sustainable town with eco-friendly features, may be interested in this project.

The market has been facing an undersupply of ECs. Over the past 10 years, demand for new ECs (24,943 units) outpaced the number of units launched (22,933 units). Although more than 1,800 units could be sold to end-users this year, the numbers may not satisfy the high demand for ECs.

Developers launched on average around 2,293 EC units annually between 2012 and 2021. As many as 4,936 units were released in 2012 and 3,750 units in 2015.

Three more land parcels are in the pipeline.

The tender for the site along Bukit Batok West Avenue 8 under the H2 2021 Government Land Sales (GLS) Programme confirmed list was closed recently, with the highest bid coming from a joint venture between Qingjian Realty and Santarli Group, while the tender for 1 more site in Bukit Batok West Avenue 5 under the H1 2022 GLS confirmed list is slated to be launched in June this year.

The third site, along Tampines Street 62 (Parcel B), is on the H1 2022 GLS reserve list. If developers buy all 3 sites, the projects can be launched only from 2023.

Therefore, supply is likely to remain limited, and prices of ECs may continue to rise this year.

Christine Sun is Senior Vice President of Research & Analytics at OrangeTee & Tie. Timothy Eng is Senior Research Analyst of Research & Analytics at OrangeTee & Tie

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.