Three ways to beat inflation with commercial real estate

However, not all commercial real estate will hedge well against inflation.

AMID Covid-19 and the challenges it brought, most people may not have imagined that inflation would emerge as an immediate concern. However, the fact is that Singapore's Consumer Price Index (CPI) rose 2.3 per cent in 2021 - the biggest increase since its 2.4 per cent increase in 2013.

This elevation in price pressure was driven by the strong recovery in global demand, government stimuli, as well as shifts in spending patterns. Concurrently, supply-chain disruptions, higher wage growth and geopolitical tensions have also added to this rising price pressure.

It is often heard that real estate assets are effective hedges against inflation. But the truth is, not all are - even in the commercial real estate space. Although commercial real estate has been one of the better inflation hedges historically, due to the positive correlation with rents and capital values, not all types of these assets may be able to beat inflation going forward.

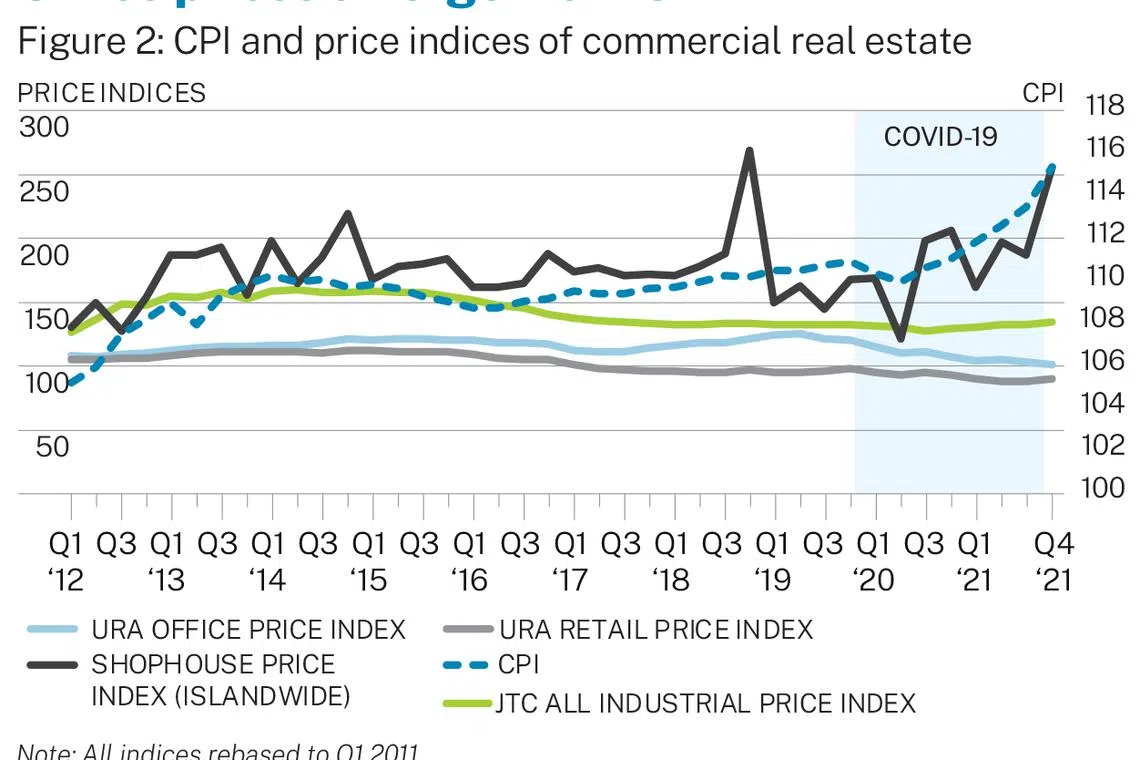

Looking at historical trends, when the CPI increased by 7.0 per cent in the period from 2012 to 2013, prices of all commercial real estate rose in tandem; this is most evident for industrial properties and shophouses.

Comparing the past performance of the commercial real estate price indices, it shows that the office, industrial and shophouse sectors would be able to provide positive returns over a longer-term horizon (see Figure 1).

That said, even as offices may have traditionally offered protection against inflation, this direct relationship appears to have weakened since the onset of Covid-19 (see Figure 2).

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

With the change in occupier preferences for a hybrid work model and more modern amenities, it is likely that only high-quality office buildings will be in strong demand going forward, offering investors a more effective hedge against inflation.

Industrial assets have clearly been the outperformer during Covid-19, given the rise of e-commerce, third-party logistics players, and the biomedical sector. And with their finite supply and flexible use, shophouses continued to retain their lustre, with prices appreciating strongly over time.

Inflation brings about rate hikes but office and shophouse prices stayed firm.

To keep inflation in check, the US Federal Reserve in mid-March raised its benchmark interest rate by 0.25 per cent for the first time in 4 years, and also laid out an aggressive plan of rate hikes in the months ahead. The actions of the US Fed have repercussions in global markets, and especially on an open economy like Singapore, where interest rates are largely determined by foreign interest rates and expectations of future movements in the Singapore dollar.

In the previous rate hike cycle between Q4 2015 and Q4 2018, the Fed's confidence in a strengthening economy and its bid to curb inflation had led to a series of 9 consecutive fed funds rate hikes. In tandem, the 3-month Singapore Interbank Offered Rate (Sibor) and Swap Offer Rate (SOR), on which borrowing costs were based, climbed to 1.89 per cent and 1.92 per cent respectively.

These rates remained elevated till the start of 2020, as the Fed started cutting rates in response to the unfolding Covid-19 pandemic. During this previous rate hike cycle, office and shophouse prices were the most resilient, whereas retail and industrial prices were negatively impacted (see Figure 3).

Strategise your investment approach

Against the current backdrop of impending rate hikes and rising inflation, real estate investors could consider the following strategies to strengthen their property investment portfolios:

1. Invest in centrally located offices and shophouses

Offices and shophouse assets in central locations are likely to continue outperforming in the longer term, as they become scarcer and more sought after by both investors and tenants.

The authorities have recently restricted the strata subdivision of commercial properties in the central area, effectively stemming any new supply of strata commercial units.

Further, the residential property market cooling measures announced in December 2021 may lead to more spillover demand into commercial real estate assets, especially shophouses and strata offices, which come at palatable prices to family offices and high-net-worth individuals.

On the supply side of the equation, there is no upcoming state tender for commercial sites in the central business district in the near term, and it is unlikely that there will be any new shophouses. Demand-wise, out of the total number of shophouse and office transactions in 2021, 48.9 per cent and 51.8 per cent were in the Central Area respectively, as these assets have been, and will continue to be, prime targets for local and international capital.

Given the strong demand and limited supply, centrally located offices and shophouses have been outperforming since the last CPI trough in Q2 2020 to Q4 2021, as shown in Figure 4, and are likely to continue to do so. Given that these asset types have shown resilience against inflation, real estate investors should consider adding them to their portfolios.

2. Review rental terms

This is perhaps one of the rare times when a shorter weighted average lease expiry is welcomed, as shorter lease expiries coupled with rental escalation would allow asset owners to take advantage of rising rents in an inflationary environment.

If there is no immediate plan to sell the asset, shorter leases would also provide a window to renegotiate lease agreements and position an asset within a higher rental return bracket.

Meanwhile, adding rent clauses and regularly reviewing rental terms can also help to capture any rent upside. However, such a strategy might come with additional costs to the asset owners, from managing and minimising tenant turnaround.

3. Repurpose, upgrade and make your assets more sustainable and flexible

Real estate asset owners can also unlock higher returns from assets that have the potential for value enhancement. This can be achieved by repositioning them or carrying out asset enhancement initiatives, especially if yields are substantially compressed.

Well-designed, environment-friendly office buildings will have a greater potential to command a premium and bring in higher rents, as they would provide a healthier, more productive and conducive work environment.

Financially, sustainable office buildings would also help tenants save on their utilities bills, resulting in lower operating expenses, quicker payback periods, as well as higher capital values - which would offset the higher borrowing costs.

This implies that attaining a sustainability certification or using technology and big data to achieve the building's efficiency goals for your existing assets more quickly will be imperative.

Compared with ageing office assets, smart buildings with these features will be able to better attract and retain tenants, as well as provide income security for investors. Asset owners can also inject more vibrancy and flexibility into "tired" office buildings by incorporating more shared amenities, retail and hospitality options, and even residential components.

On the industrial front, older warehouses can be repurposed as higher-value assets, such as cold storage and prime logistics. These assets generally fetch higher capital values, rents, and occupancy rates than normal warehouses.

Shophouse assets that are granted commercial use are more flexible in their property usage. This means that the owners can redesign and repurpose the usage of their shophouses strategically, depending on the property cycle and market demand.

That way, these assets will provide local investors, private funds, ultra-high-net-worth individuals, as well as family offices a means of wealth preservation, stable recurring income, and the prospect of capital appreciation over time.

In summary, it would be wise to position your portfolios against rising prices. While active monetary policies from the central banks aim to keep rising prices in check, protracted geopolitical tensions may weigh down on the global recovery, further strain supply chains, and still lead to higher inflation.

This might also result in stagflation - slowing growth amid persistently high inflation - as volatility increases and business confidence is affected. Certain types of commercial real estate, as long-term investments, could provide a safe harbour for capital in such a scenario.

The commercial real estate market is undeniably complex, driven by a wide range of factors beyond just inflation and rate hikes. Nevertheless, with inflationary pressure likely to remain longer than anticipated, investors should actively position their real estate portfolios to effectively hedge against rising prices.

Catherine He is Head of Research, Colliers. Dickson Koh is Associate Director, Colliers.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.