Multi-faceted industrial market in Apac has diverse growth opportunities

AN uncertain trajectory of inflation and rising interest rates have fuelled a gap in buyer-seller expectations and slowed industrial investment in the Asia-Pacific (Apac), but the region’s growth story remains underpinned by strong demographic growth and rising inter-regional trade.

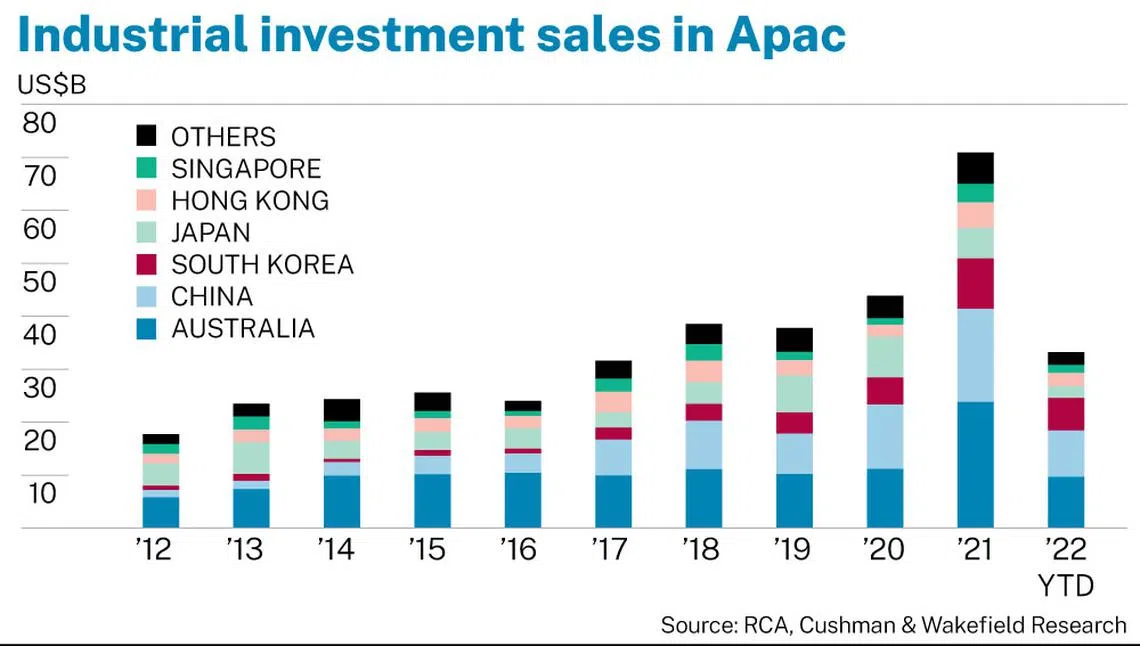

Apac industrial investment has reached about US$33 billion year to date (as at Sep 13), with full-year volumes unlikely to surpass 2021 levels of US$70 billion, a historical high.

Nonetheless, industrial investment volumes are on track to beat 2020 volumes, a previous record high, reflecting sustained investor interest. For now, there is limited evidence of market repricing while valuations remain stable.

Logistics investments are a significant proportion of Apac industrial investment sales, accounting for about a third of total industrial investment volume over the last five years. Most of these investments are concentrated in developed markets where the investible universe is deeper.

Long term supply-demand dynamics remain compelling

The middle-class population in Apac is on a strong upward trajectory, and will outpace growth in North America and Europe. Between 2020 and 2030, the middle-class population in Apac is forecast to swell from two billion to 3.5 billion people – an increase of 73 per cent and accounting for 89 per cent of the global growth, noted Brookings Institute.

An increasingly fragmented world order and supply chain diversification will shift globalised trade towards trade regionalisation. The nearshoring and reshoring of supply chains within Apac will propel intra-regional trade in Apac and increase opportunities in the region.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Additionally, the Regional Comprehensive Economic Partnership (RCEP) agreement – which took effect in 2022 – would simplify and lower the cost of intra-Apac trade.

The “China plus One” strategy continues to gain traction, as firms look to diversify or expand production outside of China.

Vietnam, Malaysia, Thailand and India are key beneficiaries given their geographical proximity to China, lower costs and growing manufacturing base. For example, Apple is diversifying iPhone 14 production to India because of supply chain disruptions in China.

Nonetheless, diversification from China – the world’s manufacturing hub – will happen gradually due to the depth and scale of infrastructure in the Chinese manufacturing ecosystem. China remains an attractive manufacturing hub and continues to attract foreign investment.

The growth of e-commerce is a secular trend, and the pandemic has accelerated this. Emerging concepts such as livestream shopping, social commerce and the metaverse will drive more retail spending online. Currently, Apac e-commerce retail spending has reached US$1.7 trillion in 2020, and is poised to reach US$2.8 trillion in 2025, market researcher Forrester has noted in its forecasts.

In the United States, every additional US$1 billion spent online generates demand for approximately 1.25 million square feet (sq ft) of logistics space. Assuming a similar ratio for Apac, at least 1.25 billion sq ft of logistics space would be needed to service future online retail demand.

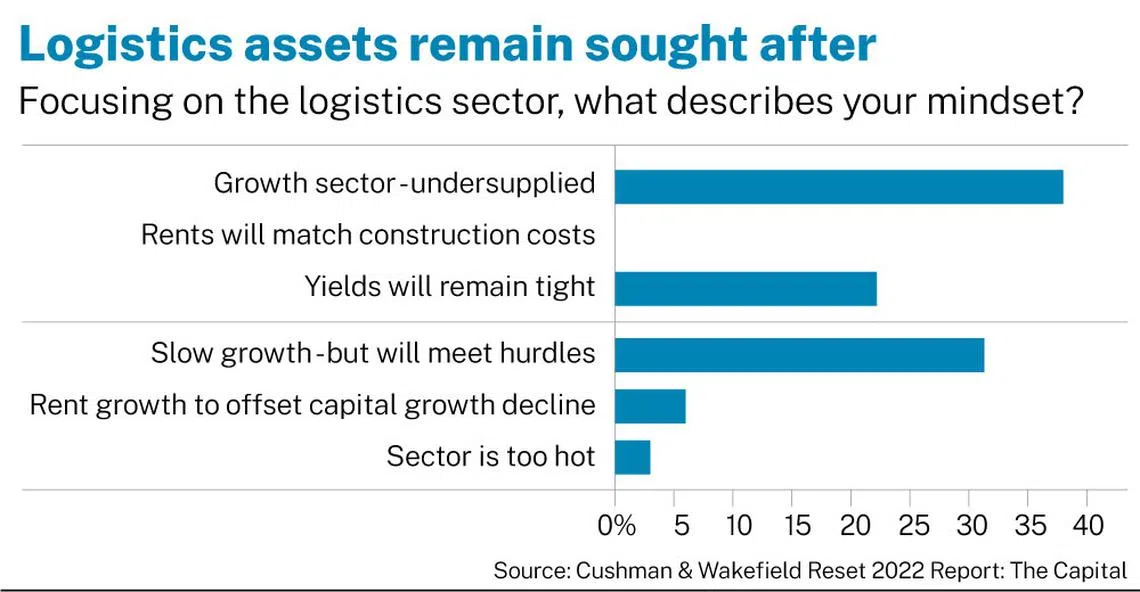

The supply-demand dynamics for prime logistics remain compelling. Prime logistics stock across Apac is for the most part undersupplied, rents are growing, and opportunities from digitalisation will fuel demand.

Also, construction and storage technologies including multi-storey ramp-access structures can increase the productivity of the land. The aforementioned factors should mitigate the impact of rising interest rates. Cushman & Wakefield’s Reset 2022: The Capital report noted that most investors remain upbeat on the logistics sector despite a rise in valuations in recent years.

Thus, capital will continue to enter the Apac logistics market, albeit at a slower pace from 2021. In most developed markets, logistics offer higher yield spreads over the risk-free rate compared to offices and would attract investors.

China’s monetary policies remain accommodative, and its economy is expected to recover in 2023. The confluence of these factors should bode well for logistics demand. In mainland China, industrial/logistics is currently the second-largest sector by investment volume, accounting for approximately 25 per cent of the total investments in the first half of this year – up from around 10 per cent in 2020 and 2021, Cushman & Wakefield data showed. In Hong Kong, the industrial/logistics sector attracted the highest investment volumes in H1 2022.

Australia’s logistics market remains undersupplied and is an investor favourite. With that, Australian logistics yields are extremely tight, which is leading some investors to now focus more on income growth strategies as strong rental growth is seen in industrial sub-markets.

The Japan market could see stronger cross-border inflows as Japanese logistics become more attractive due to the depreciation of the yen, and financing costs remain low as ultra-easy monetary policies continue.

In Singapore, prime logistics assets remain highly sought after by investors, with vacancy rates of less than 5 per cent. However, available inventory for sale remains low, and the shorter site tenures and Jurong Town Corporation (JTC) regulations limit investment volumes. Investors can move up the risk curve and look at value-add or development opportunities for more mileage and options.

Looking past e-commerce and logistics

The industrial market encompasses a wide range of assets, and investors should look “laterally” to find investment targets. Cushman & Wakefield’s investor survey noted that value-add opportunities in tier one markets and emerging market opportunities are the top two investor choices for best risk-return ratio in the current climate.

With mainstream capital concentrating in developed logistics markets, other alternative opportunities can be considered, where capital has not yet accumulated, and pricing remains reasonable.

This could include investment in other industrial sub-types such as cold-chain logistics, life science and data centres. Such assets tend to command higher yields compared to logistics due to lower investor familiarity in these markets.

Emerging markets in South-east Asia offer attractive growth opportunities for investors with a higher risk appetite.

Vietnam currently leads investor interest, due to growth opportunities and as a key beneficiary from a “China plus one” strategy. Thailand, the largest automotive manufacturer in South-east Asia, is ramping up to be an electric vehicle (EV) manufacturing hub and is a promising diversification option for the automotive industry. Malaysia and Indonesia data centre (DC) markets have seen higher interest as alternatives, given tight DC supply in Singapore.

The India market presents growing opportunities with rising demand for logistics especially in tier one and tier two cities, and increasing participation by institutional players such as Blackstone and GIC via platform deals.

In short, there is a wide variety of opportunities in the Apac industrial market with different risk-return profiles. Investors need to strike a balance between an uncertain macro-outlook and long-term growth potential. Locking up all capital or going all-in is unlikely to provide a good risk-reward ratio. Investors should employ an “averaging-in” mentality and deploy capital in phases.

Investors who wait too long may find themselves priced out of the market when mainstream capital turns “risk-on” during the eventual recovery.

Dennis Yeo is head of investor services and logistics & industrial (Asia-Pacific) at Cushman & Wakefield while Wong Xian Yang is head of research (Singapore).

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.