No signs of cooling for the rental market in 2022

IF THERE is one word to describe the 2022 rental market in Singapore, it is hot.

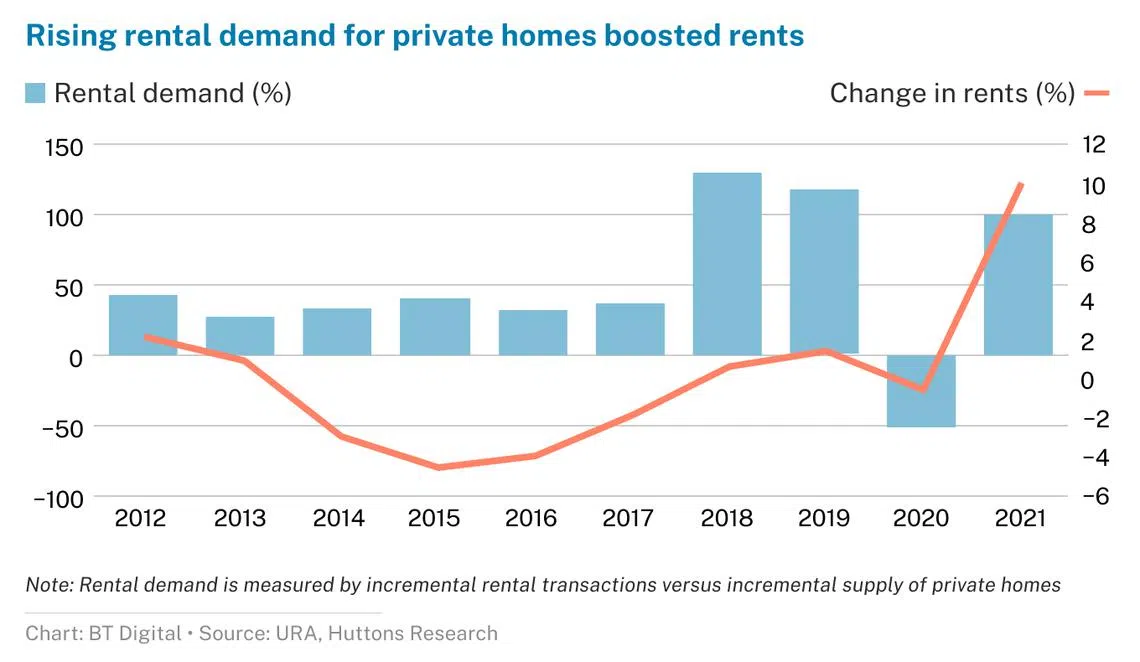

The Urban Redevelopment Authority (URA) Rental Index of Private Residential Properties jumped by 9.9 per cent in 2021. Six months into 2022, the rental index spiked by another 11.2 per cent to reach an all-time high of 127. Such double-digit increases in the rental index were last seen in 2010, more than 10 years ago.

From a tenant’s market in the period between 2014 and 2020, the balance has now tilted the other way with landlords calling the shots. What has caused this imbalance and when will rents stabilise?

Rents for private homes are largely a function of supply and demand. In periods where the new supply of private homes is larger than demand, rents will soften. Vice versa.

In the last 10 years from 2012 to 2021, the total new supply of private homes was 113,427, or 11,343 per annum. The supply of new private homes started to increase from 2012 and reached its peak in 2016. Thereafter, the new supply declined and hit rock bottom in 2020 because of the pandemic. As pandemic restrictions eased, more homes were completed in 2021.

Another 3,334 private homes were completed in H1 2022. Examples of projects completed in this period include 8 Hullet, Juniper Hill, MeyerHouse, Nyon, Parc Botannia, Petit Jervois, Seraya Residences, Stirling Residences, The Hyde and Whistler Grand.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Not all the new supply of homes are available for rent. In the last 10 years, if the annual rental demand exceeds 40 per cent of the new supply of homes, it sets the stage for a strong run-up in rents. If it falls below 40 per cent, rents are poised for a correction.

Rental demand was below 40 per cent from 2013 to 2017. Landlords were eager to secure or retain their tenants, often agreeing to demands for lower rents for fear of losing them. This led to a softening in rents by 12.1 per cent over the five-year period.

The rental market returned to growth in 2018, partly supported by tenants who were displaced by the en-bloc cycle. As the market had excess supply from 2013 to 2017 to consume, the recovery in rents in 2018 and 2019 was gradual. In 2020 however, the Covid-19 virus hit. The economy shrank by 4.1 per cent and many industries, particularly the aviation, hospitality and tourism sectors, either cut or furloughed their workforce. Rental demand contracted by more than 50 per cent. Support from the government and landlords prevented rents from falling off a cliff.

Despite the borders remaining largely closed to foreigners in 2021, demand for private homes staged a dramatic recovery. Rents spiked by almost 10 per cent in 2021 on the back of strong demand.

The demand for private homes in 2021 was driven mainly by:

A change in work arrangements

As the fight against the pandemic extended beyond 2020, many companies decided to make hybrid work a permanent feature. Workers who had to compete for space and privacy with their family members decided to rent a private apartment for a more conducive work environment.

Newly married couples and Housing Board (HDB) upgraders renting while waiting for their new homes

Newly married couples whose home ownership plans were disrupted by construction delays also decided to rent a place to stay while waiting for their matrimonial homes to be completed. The new homes market saw its highest sales volume since 2013, fuelled by more than 4,000 HDB upgraders. Many of these upgraders will sell their HDB flat and rent for the time being instead of paying the additional buyer’s stamp duty (ABSD).

Return of foreign students

According to the Ministry of Education and the Immigration & Checkpoints Authority, the number of foreign students in Singapore (as of April 2022) increased by roughly 10 per cent to about 65,400 from a year ago. These students together with their chaperones will rent near the international schools.

Sharp jump in number of single family offices (SFOs)

The Monetary Authority of Singapore estimates that the number of SFOs increased by 75 per cent to 700 as of end-2021. The additional hires, which may include foreigners, have spurred rental demand.

As Singapore fully opened its borders to all visitors in two stages on Apr 1 and Aug 29, more foreigners were able to enter Singapore for work. According to the Ministry of Manpower, employment in H1 2022 rose by 108,500, 2.6 times the annual employment growth in 2021. Some companies and residents from Hong Kong relocated to Singapore, where life has returned to almost normal, further boosting rental demand.

It is not uncommon to hear of rents increasing by more than 50 per cent upon renewal. Of the top 10 completed developments with the largest percentage increase in median rents in H1 2022, five are in the Outside Central Region (OCR) and four are in the Core Central Region (CCR). Recently a three-bedroom unit at J Gateway was renewed at a monthly rental of more than S$6,000, over 80 per cent higher than its previous rent.

In the luxury segment, there has been an increase in demand for larger homes, which unfortunately are in short supply. That has led to a bigger increase in rents for larger homes in 2022. Based on Huttons’ luxury homes basket, rents for five-bedroom luxury homes went up by more than 17 per cent in H1 2022, higher than the increases seen for three and four-bedroom luxury homes.

Over at the Good Class Bungalow Areas (GCBA), a bungalow in Ewart Park was understood to be leased for S$43,000 per month in August this year, more than double its previous rent. Another two bungalows in Queen Astrid and Gallop Road/Woollerton Park were each rented out in recent months at an eye-popping S$200,000 per month.

Rents to continue ascent

The relentless pace of rent increase is likely to continue for the rest of 2022. Since the start of the year, more than 2,000 owners and tenants are estimated to be displaced due to the successful en-bloc of their properties. Demand from HDB upgraders is expected to stay robust in H2 2022, with many buyers of new homes opting to sell their flat and rent instead of paying the ABSD.

As Singapore moves ahead with economic transformation and developing new growth sectors, there may be a need to bring in expertise from overseas to plug the talent gap in the initial stages. Singapore is moving fast in the talent hunt with the launch of the new Overseas Networks and Expertise (One) Pass for top foreign talent.

The cooling measures on Sep 30 may have caught out some ex-private property owners (PPOs) who had sold their homes and are unable to submit their HDB resale application in time. There may be some PPOs who will go ahead with their plans to downgrade and look for a rental unit. This is likely to boost demand in 2023.

On the supply front, new supply of homes in 2022 is estimated to be below the 10-year average of 11,343 units. While more than 17,000 private homes will be completed in 2023, it may not bring relief to the market as demand is given a boost by ex-PPOs who are forced to rent while waiting to buy an HDB resale flat.

The landlord’s market is likely to continue in 2022 and rents are estimated to increase up to 10 per cent in H2 2022. The strong run-up in rents is likely to be given another lift in 2023 in the wake of the cooling measures.

Lee Sze Teck is senior director of research, and Mark Yip is chief executive officer at Huttons Asia.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.