A niche investment window in strata-titled office space

After a long lull with low supply and thin volume, the market for subdivided office units is undeniably picking up

WITH the recent increase in Additional Buyer’s Stamp Duty (ABSD) rates for residential properties, real estate investors may be turning their attention towards commercial property. Within this market lies a niche segment – strata office spaces – where demand and prices have recently run up.

In a strata-titled office building, usable space is subdivided into individual office units, and sold by the developer to users or investors, much like condominiums in Singapore.

Strata offices allow small and medium-sized businesses to own office space without the need to purchase an entire building, and can offer various advantages that include cost savings, flexibility, and the opportunity for ownership and investment potential.

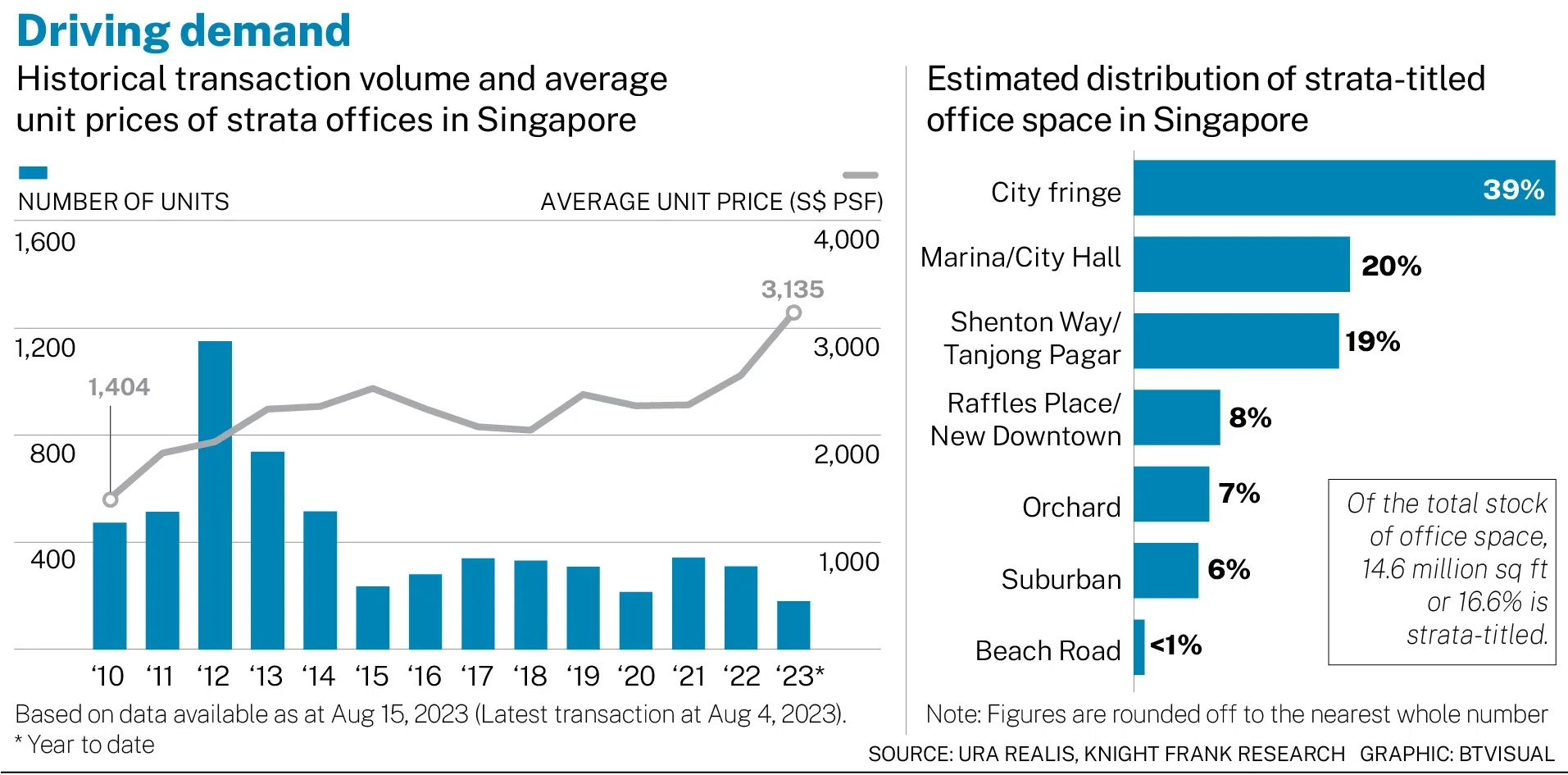

In Singapore, an estimated 14.6 million square feet or 16.6 per cent of the total available office stock is strata-titled. The bulk of that – more than 55 per cent – is in the Central Business District (CBD), the Downtown Core and Orchard Planning Areas. These strata-titled offices come in a variety of central locations, age and quality.

However, due to the fragmented ownership structure, such buildings can face challenges in maintenance and upkeep, at times resulting in varying degrees of physical deterioration and a poor and disharmonious tenant mix.

As Singapore matured into a business hub over time, established developers and investment institutions shifted their strategy towards holding entire office buildings for recurring rental income, preferring that over subdividing for strata-titled sales. Since Centrium Square and Woods Square were launched for sale in 2016, there were no other new strata-titled office projects until late 2022.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Furthermore, the Urban Redevelopment Authority announced in March 2022 strata subdivision of commercial developments into individual units would no longer be allowed in specific areas in the Orchard Road and CBD corridors, and near national landmarks around the Padang.

With this move by the government to ensure the upkeep and quality of commercial buildings, there will be even less new strata-titled office inventory in the future.

Substantial activity

There is evidence of demand for such properties. The launch and sale of units at Solitaire on Cecil from end-2022 spurred a substantial amount of transaction activity. All units were sold, recording an average unit price of S$4,186 per square foot (psf).

SEE ALSO

This reflected pent-up demand and a total transaction value of about S$478.3 million (based on caveats that were lodged) for new bite-sized freehold office assets of investment quality in a CBD location – a niche office product that had been absent from the market for several years.

From 2015 to 2023 (year to date), the annual number of strata-titled office units transacted was typically under 400 units. This was likely because no new strata-titled office units were introduced into the larger market.

This already-thin volume was made worse by the Covid-19 outbreak, which hit all aspects of the economy in 2020. The period from 2012 to 2022 was the lowest point for the strata office market, when little over 200 transactions were recorded at an average unit price of S$2,268 psf.

The strata-titled office market picked up from 2021. Average unit prices increased steadily from S$2,277 psf in 2021 to S$2,553 psf in 2022. From Jan 1 to Aug 4, 2023, average unit prices rose further to S$3,135 psf, defying gravity in a time of economic uncertainty.

Apart from the strong take-up at Solitaire on Cecil, transactions in existing quality strata-titled office buildings in the CBD also contributed to the upward movement in prices.

For example, the average unit price for Suntec City in 2023 year to date was S$3,088 psf, an increase of 18.4 per cent from the S$2,608 psf for the whole of 2021. In 2021 and 2022, the average unit price at Samsung Hub rose above the S$4,000 psf level, from under S$4,000 psf before and during the pandemic.

Actual demand for strata-titled office space may also be understated, as not all transactions that took place were caveated or reported.

Solitaire on Cecil was reported to be sold out, even though not all transactions were captured, due to some buyers and/or investors keeping a low profile and information on their purchases private.

What are some reasons that might drive a decision by firms and businesses to acquire strata-titled office space instead of leasing?

One is that buying their own space would give them a hedge against rising office rents, which in turn makes for a more predictable cash flow and greater control over the operational flexibility of the unit.

With the current economic headwinds, ownership of a strata-titled office unit can be beneficial to certain small and medium-sized firms and businesses, as they can rent out unutilised space for supplementary income. They can also pivot quickly, based on business needs.

Buyers and investors such as family businesses are also likely to be attracted to freehold strata-titled office units for potential capital preservation and appreciation that serve longer-term financial goals.

There is evidently demand due to the increasing rarity of strata-titled space in the market, especially for freehold or longer tenure commercial sites in the Downtown Core Planning Area. If developers are able to snag such plots to add to their land bank, they can expect niche, but firm, demand for new builds.

Despite the demand for this niche investment commercial property, the challenges inherent in a strata-titled commercial building remain, and buyers should be mindful of possible drawbacks.

Ownership of multiple units within the same office building will challenge the standards of upkeep by the management corporations, especially as the building ages.

But a poorly-managed building is in no way a forgone conclusion. Many residential condominium projects have been able to maintain quality over time.

There are also examples of strata-titled office buildings that have maintained quality.

In turn, they have been able to keep – if not enhance – their respective values over an investment horizon.

Strata-titled office buildings might just provide the unique office solution that meets the considerations of occupier space requirements, investment potential and the need to rightsize in a tech-enabled, post-pandemic world.

Mary Sai is executive director of capital markets, and Sim Li Wei is an analyst at Knight Frank, Singapore

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.