Respite for residential renters around the corner

Rental growth has pulled back from the surges of the past two years, but suburban and HDB markets are holding strong

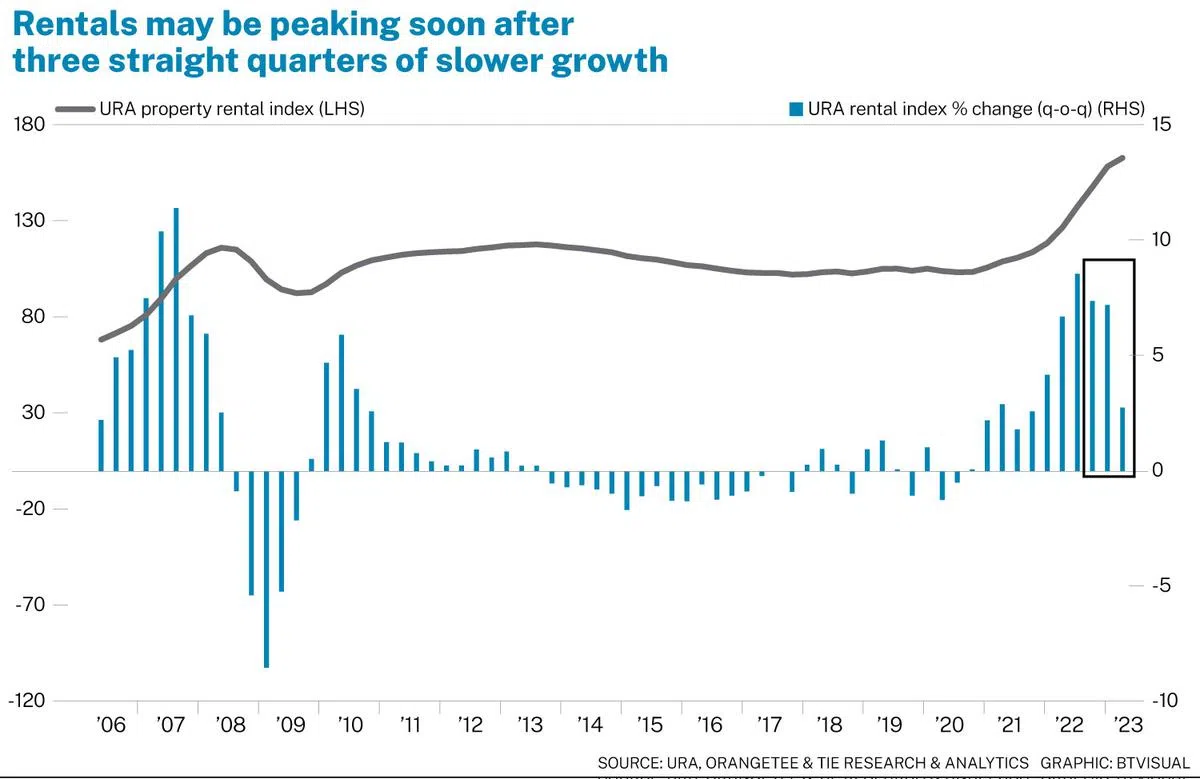

THE private residential rental market may have turned a corner after relentlessly rising for almost three years. Rents could be peaking soon, as rental growth slowed for a third consecutive quarter in the second quarter of 2023.

The slower leasing market spells good news for tenants, for whom recent renewals at jacked up rents have been a cause of much anxiety.

According to the Urban Redevelopment Authority’s quarterly real estate data, the rental index for private residential properties climbed at a significantly slower pace of 2.8 per cent in Q2 2023, compared to quarterly gains of 7.2 per cent in Q1 2023 and 7.4 per cent in Q4 2022.

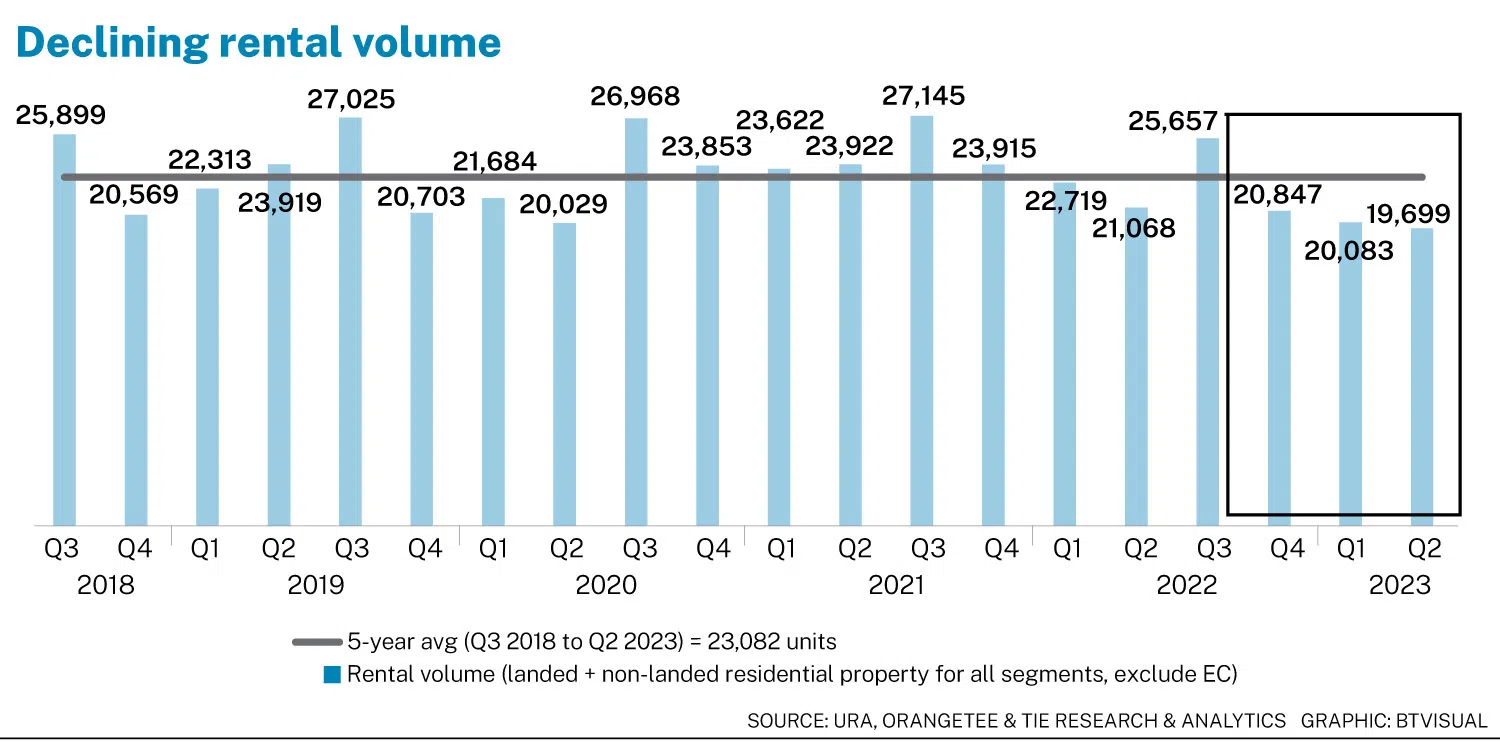

Demand has contracted. Rental volume for non-landed and landed properties (excluding executive condominiums or ECs) fell for three straight quarters from 25,657 units in Q3 2022 to 19,699 units in Q2 2023.

Last quarter marked the lowest rental volume since 19,281 units were leased in Q4 2017, well below the 23,082 quarterly average for the previous five years. Some of the loss of volume could be attributed to locals who had been renting temporarily while their HDB flats and condominiums were still under construction.

Fewer deals were also closed as many landlords held on to their asking rents. Meanwhile, last year’s surge in rentals impacted affordability for many expatriate residents, some of whom moved to cheaper properties or leased smaller units.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Rental slowdown observed across the entire market

Signs of cooling seem to be broad-based as rents rose more slowly across all market segments. The luxury market was hardest hit. Rental growth for non-landed homes in the prime segment or Core Central Region (CCR) rose 2 per cent in Q2 2023, which was 4.4 percentage points less than the 6.4 per cent increase in the preceding quarter.

In city fringe locations or the Rest of Central Region (RCR), rents grew by 2 per cent, down 4.2 percentage points from the 6.2 per cent gain in Q1.

Landlords of suburban or Outside Central Region (OCR) properties fared best – rental growth dipped only 3.2 percentage points from 6.1 per cent to 2.9 per cent in Q2.

SEE ALSO

Rents grew slower for smaller homes in the prime segment

Within the prime segment, smaller units saw the most impact. Price growth for one-bedroom units in the CCR fell back by seven percentage points from 9.4 per cent in Q2 2022 to 2.3 per cent in Q2 2023, according to URA data.

For two-bedroom units, growth slipped by 5.2 percentage points to 1.8 per cent in Q2 from a robust 7 per cent in Q1.

But bigger homes held on to gains. Rental growth for four-bedroom units registered 4.2 per cent gains in Q2, just 1.3 percentage points slower than the 5.4 per cent in Q2 2022.

Similarly, rents rose by 2.6 per cent quarter on quarter (qoq) for three-bedroom units in Q2 2023, about 2.4 percentage points lower than the 5 per cent gains in 2022.

Demand for suburban condos and HDB flats remains resilient

As escalating costs squeezed tenants’ budgets, more locals and expats leased mid to large-size units in the suburbs to get the most bang for their buck. This may explain why demand and rents in the OCR were most resilient among the three market segments this year.

Further, demand for HDB flats remains robust. Unlike the private market, there was a pick-up in rental volume even as HDB rents climbed to new records. Total HDB rental transactions rose by 1.9 per cent from 9,657 units in Q1 2023 to 9,842 units in Q2 2023, based on data from the Housing and Development Board. Over the same period, rents inched up by 3.2 per cent, going by SRX’s HDB rental index.

Many young expats and Employment Pass holders, especially single executives, shifted to HDB neighbourhoods in the city fringe areas, or near their workplaces and MRT stations, as they prioritise affordability and accessibility over having condo facilities.

To avoid digging deeper into their pockets, many local renters have similarly downgraded to HDB flats.

Rents may peak in H2 this year

The rental market is now facing a triple whammy – increased housing supply, declining local demand and a slowing economy.

Supply was ramped up as 4,401 private residential units (including ECs) were completed in Q2 2023, about 16 per cent more than the 3,785 units completed in the preceding quarter.

Year on year, completions were significantly higher. Q2 completions tallied at 83 per cent more than the quarterly average of around 2,400 units in 2022.

With more private home completions, competition for tenants has intensified.

Last quarter’s vacancy rate rose to a seven-quarter high of 6.3 per cent.

We can expect some tenants not to renew their leases in the coming months with more new units coming onstream in the suburbs and city fringes.

Dimming macroeconomic prospects have also cast a shadow on the rental market.

Total employment is expanding slower, retrenchments are rising, and job vacancies dropping.

When major economies like China slow down, the impact on global businesses will trickle down in job cuts or smaller expat budgets.

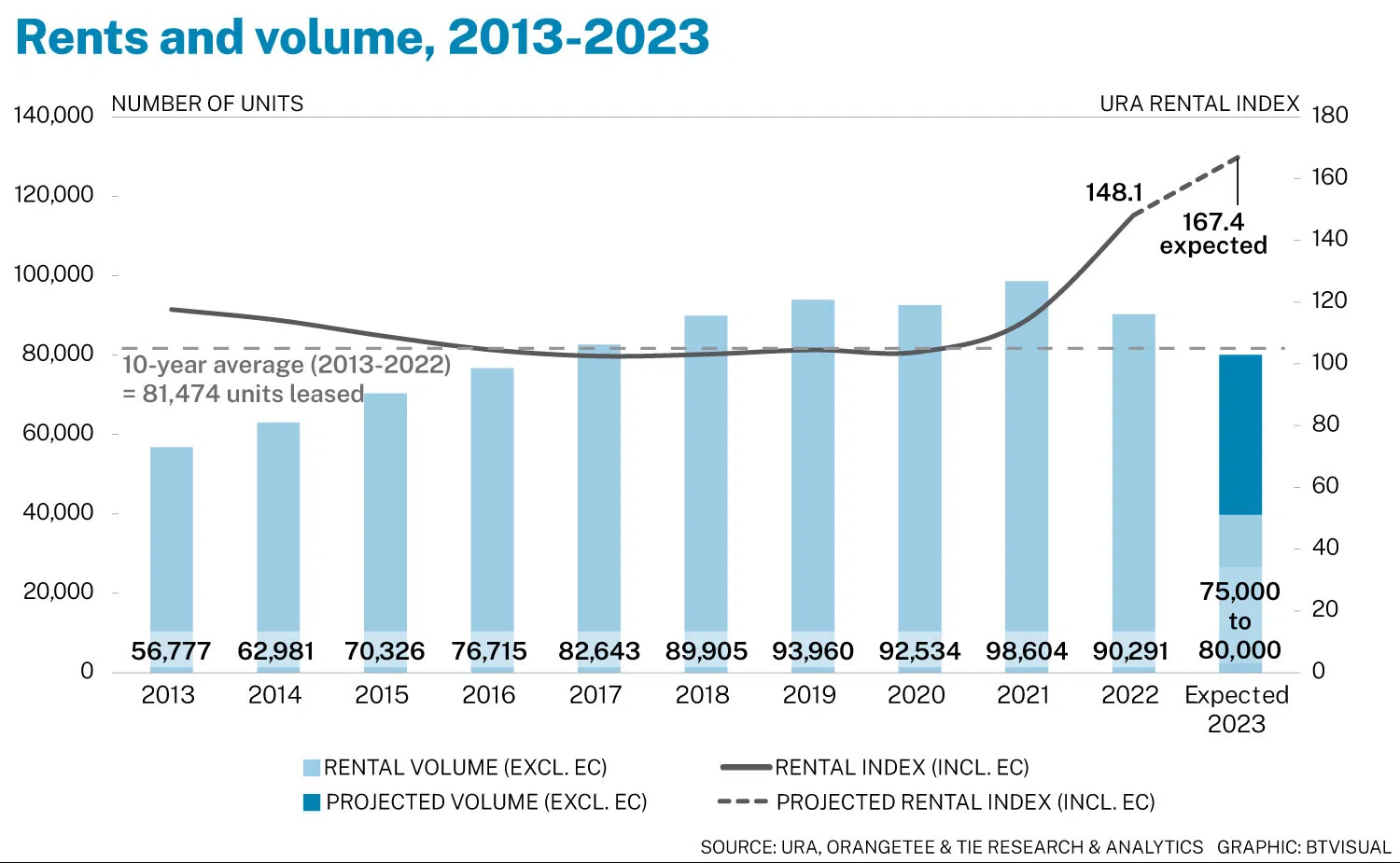

With more housing supply coming onstream, we estimate rents may grow by a slower rate of 12 per cent to 14 per cent this year, down from 29.7 per cent in 2022.

Total rental transactions excluding ECs may fall from 90,291 units in 2022, to 75,000-80,000 units this year.

Christine Sun is senior vice-president and Timothy Eng is assistant manager of research & analytics at OrangeTee & Tie

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.