Short-term pain could make way for long-term gain in prime condos

While cooling measures dampen near-term prospects, the CCR offers an interesting value proposition and potential margin of safety

THE prime condominium market has seen better days. The latest cooling measures, implemented in April 2023, have further tempered demand for prime condos with the increase in Additional Buyer’s Stamp Duty (ABSD) rates for most types of buyers. For foreigners, ABSD rates jumped to 60 per cent of the property purchase price.

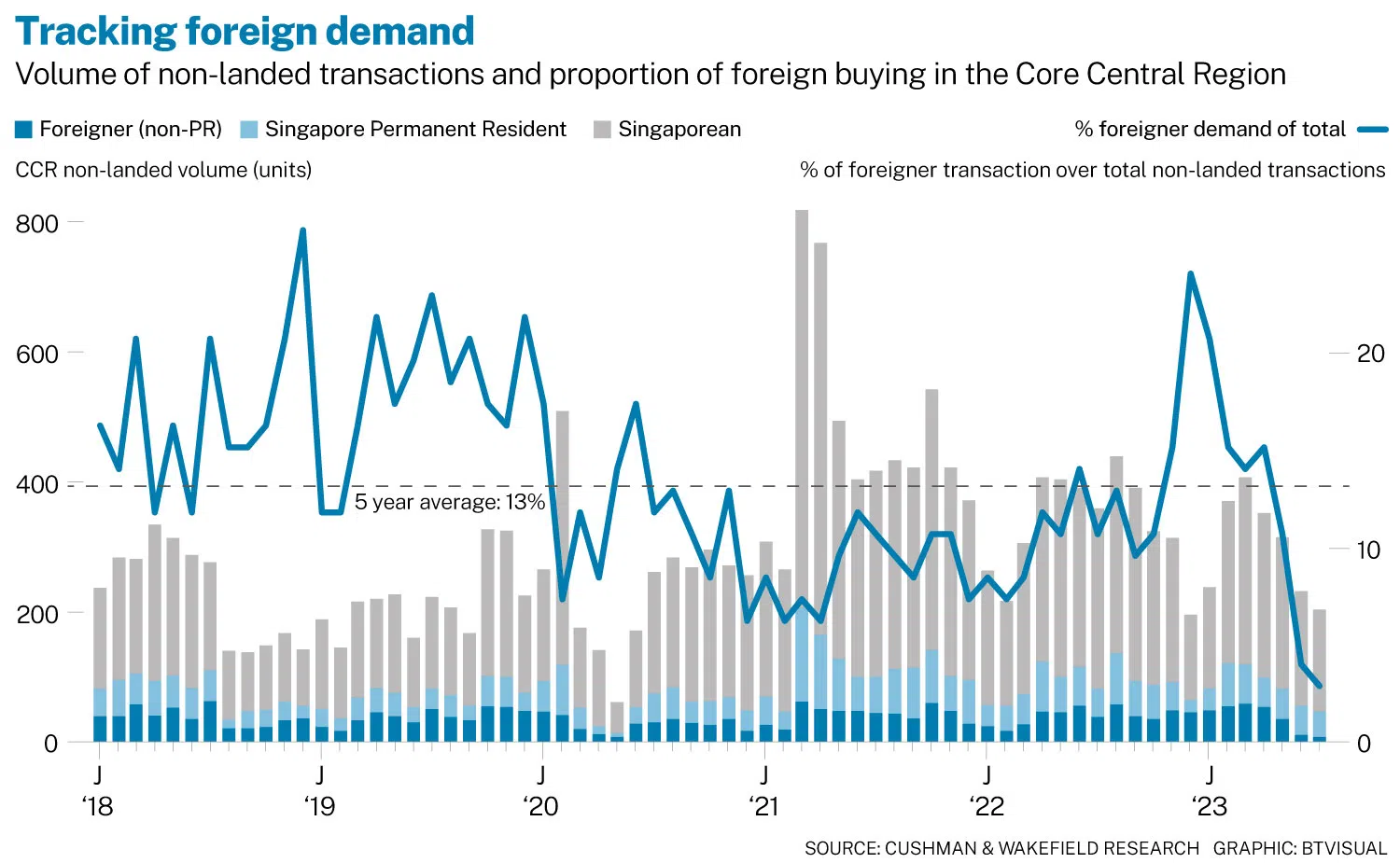

Unsurprisingly, foreign demand for prime condos has frozen. After the latest measures, foreigner buying activities in the prime condo market – defined by non-landed units in the Core Central Region (CCR) – have plunged.

The proportion of foreign demand fell to 4 per cent of total prime condo transactions in July 2023, a new monthly low since December 2008.

That said, prime condo prices have not collapsed as the market is primarily supported by local resident demand.

Based on data over the past five years, the average monthly proportion of foreign demand for prime condos is about 13 per cent of total purchases.

The largest fall in foreign demand was from Chinese buyers, whose purchases plunged to zero in July 2023.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Even buyers from the United States, who are relatively unaffected by the latest cooling measures due to existing Free Trade Agreements, have held back, with volumes falling by 57 per cent year on year in July 2023. The mix of foreign buyer demand is likely to show more prominent US demand in the future, though it is unlikely to offset the decline from other source markets.

No doubt, market sentiment has cooled, and many buyers are adopting a watch-and-wait stance. Overall prime condo prices showed a 0.1 per cent dip while volumes declined 8.8 per cent in Q2 2023 compared to Q1.

Prime condo prices may still end 2023 in positive territory as sellers have holding power. As at Q2 2023, prime condo prices are still up 0.8 per cent year to date. Based on our analysis of caveats (matched caveats with a prior transaction history since 2012, excluding transaction costs), most prime condo transactions remain profitable: 78 per cent of transactions in Q2 2023 were profitable and only 22 per cent were loss-making.

SEE ALSO

Sellers’ asking prices have stayed relatively firm. Barring an unexpected deterioration in economic conditions, the long-term fundamentals for the prime condo market remain unchanged. Property replacement and transaction costs remain high.

The lower you climb, the milder the fall?

While the latest round of cooling measures has dampened near-term prospects, the prime market offers an interesting value proposition and potentially provides a margin of safety amid current heightened pricing levels.

We analysed annual price growth across the prime, mid-tier (Rest of Central Region, RCR) and mass market (Outside Central Region, OCR) segments of the condo market.

In our analysis, the prime condo market outperformed the mid-tier and mass market segments between 2005 and 2007, in the run-up to the Global Financial Crisis (GFC).

However, post GFC, prime condo demand was slow to recover. Furthermore, consecutive rounds of cooling measures tightening liquidity and tempering investment demand have further flattened demand.

As such, the prime condo market has been a multi-year laggard relative to other segments. Over a 10-year historical period, prime condo prices only grew by 4 per cent cumulatively as at Q2 2023, compared to mid-tier and mass market condo price growth of about 34-35 per cent.

This has led to a shrinking price gap between the prime, mid-tier and mass market condos. In 2013, prime condos resale prices were about 1.3x and 1.8x that of mid-tier and mass market counterparts, based on analysis of caveats for non-landed resales of apartments of 900-1,100 square feet.

For YTD 2023 (January-August), the resale price gap between prime versus mid-tier and mass market has shrunk to 1.1x and 1.4x respectively.

Notably, the prime condo market saw greater price resilience from 2014 to 2016, when the Singapore housing market went through a soft landing following the implementation of the Total Debt Servicing Ratio (TDSR) in 2013.

The prime market fell by only 7.7 per cent between 2014 and 2016, compared to mid-tier and mass market which fell by 11.9 per cent and 9 per cent respectively over the same period.

While we don’t anticipate a property market downturn, potential downside risks are arguably increasing. Sluggish economic growth, heightened interest rate levels, cooling measures coupled with a recent run-up in prices have dampened buyer demand and sentiment.

Should a downturn occur, the prime market could prove to be relatively more resilient as prices have not run up as much.

Short-term pains but long-term repricing potential

Over the short term, foreign demand would remain depressed as current ABSD rates are prohibitive. Given that foreigner demand has plunged to near-record lows and represents a small proportion of total buying demand, we speculate that current cooling measures would eventually be tweaked, and could provide a potential catalyst for prime condo demand.

Prime condo rental yields are also more attractive with the recent run-up in rents.

Unlike prices, prime condo rents have largely kept pace with their mid-tier and mass market counterparts.

Over the last one year (H2 2022 to H1 2023), prime condo rents have increased by 24.5 per cent, compared to mid-tier and mass market rental growth of 27.4 per cent and 28.5 per cent.

Given Singapore’s position as a regional business hub and sustained financial sector growth, coupled with a strong return to office, rental demand for prime condos could grow.

Given a mismatch in price and rental growth, prime condo gross rental yields have risen to about 3.9 per cent in H1 2023, based on analysis of caveats for non-landed resales of apartments of 900-1,100 square feet between January and June 2023.

This compares with mid-tier and mass market condo yields of about 3.9 per cent and 4.3 per cent respectively.

Another potential catalyst is the introduction of new housing supply in the Central Business District (CBD).

A slew of new launches in the CBD are expected to be launched over the next few years. These new launches would set new pricing benchmarks and could catalyse resale price growth.

With sentiment for the prime condo market dimming, opportunities could emerge. The prime condo market presents an interesting value proposition, with steady rental demand and long-term re-pricing potential.

However, prime demand remains selective, and investors need to do their due diligence. Not all prime condo investments are profitable.

Given current market uncertainties, prospective buyers should adopt a long investment horizon and buy within their means to reap the long-term repricing benefits.

Wong Xian Yang is head of research, Singapore and South-east Asia, at Cushman & Wakefield

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.