Rental rates remain key factor in influencing industrial space location choices: NUS

This cost consideration far outweighs other issues such as quality and condition of space

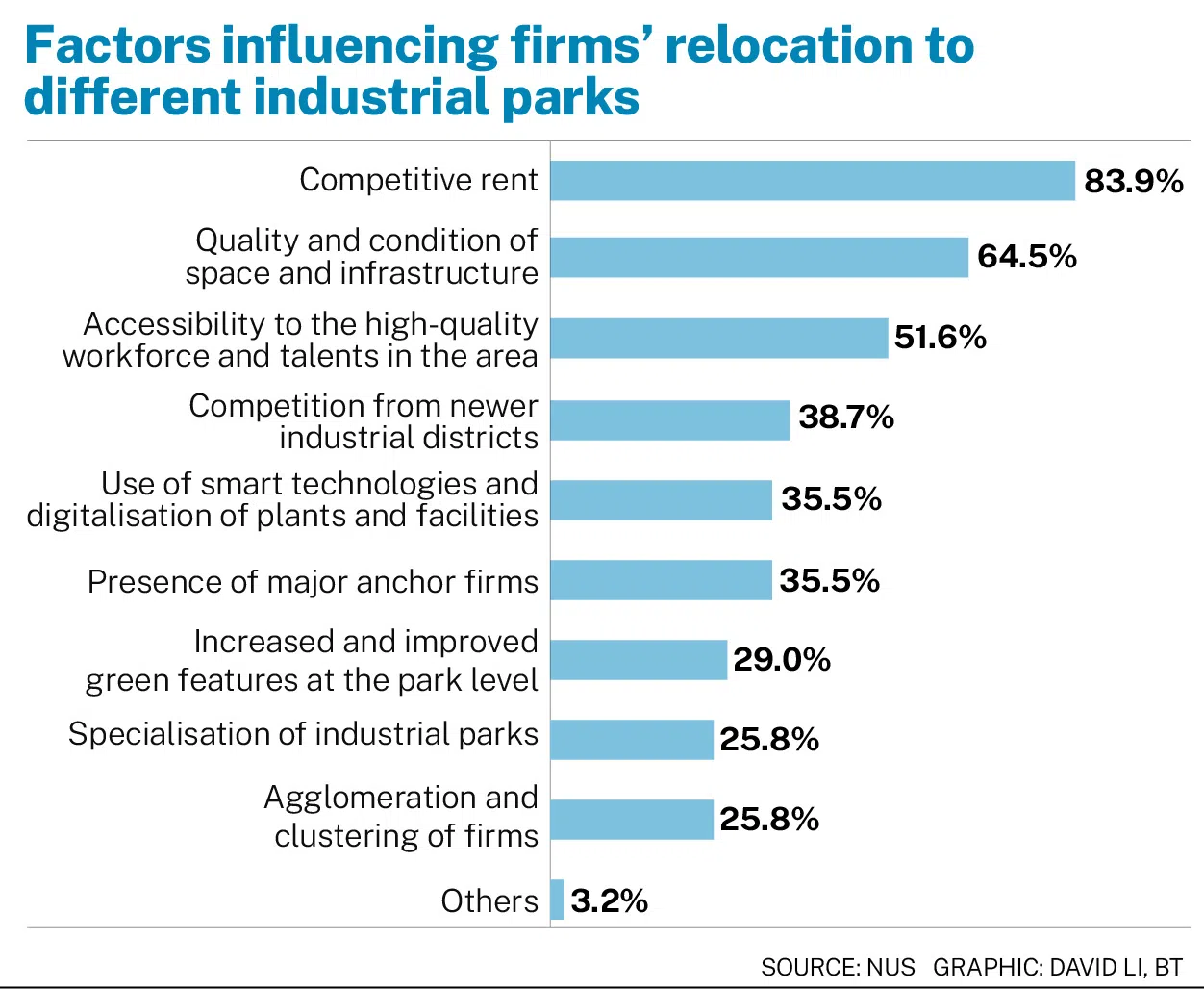

COMPETITIVE rental is the most important factor that determines how industrial space users decide where to move, a Singapore survey found.

An overwhelming majority – 84 per cent – of respondents said that a competitive rental rate is the key determinant in relocation decisions, based on a poll by the National University of Singapore (NUS) Business School released on Wednesday (Nov 27).

Such cost considerations far outweighed other issues such as quality and condition of space – 62.5 per cent felt this was key; and access to workforce and talent (51.6 per cent).

And 78 per cent of respondents indicated that industrial park landlords would need to offer competitive rents to attract firms.

Despite facing a manufacturing sector contraction in the first six months of 2024, the industrial real estate market has remained “fairly resilient”, said NUS.

The survey report added that even though sentiment has been dampened by global uncertainties, the outlook remains cautiously optimistic. The manufacturing sector has rebounded, expanding 7.5 per cent year on year in Q3.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

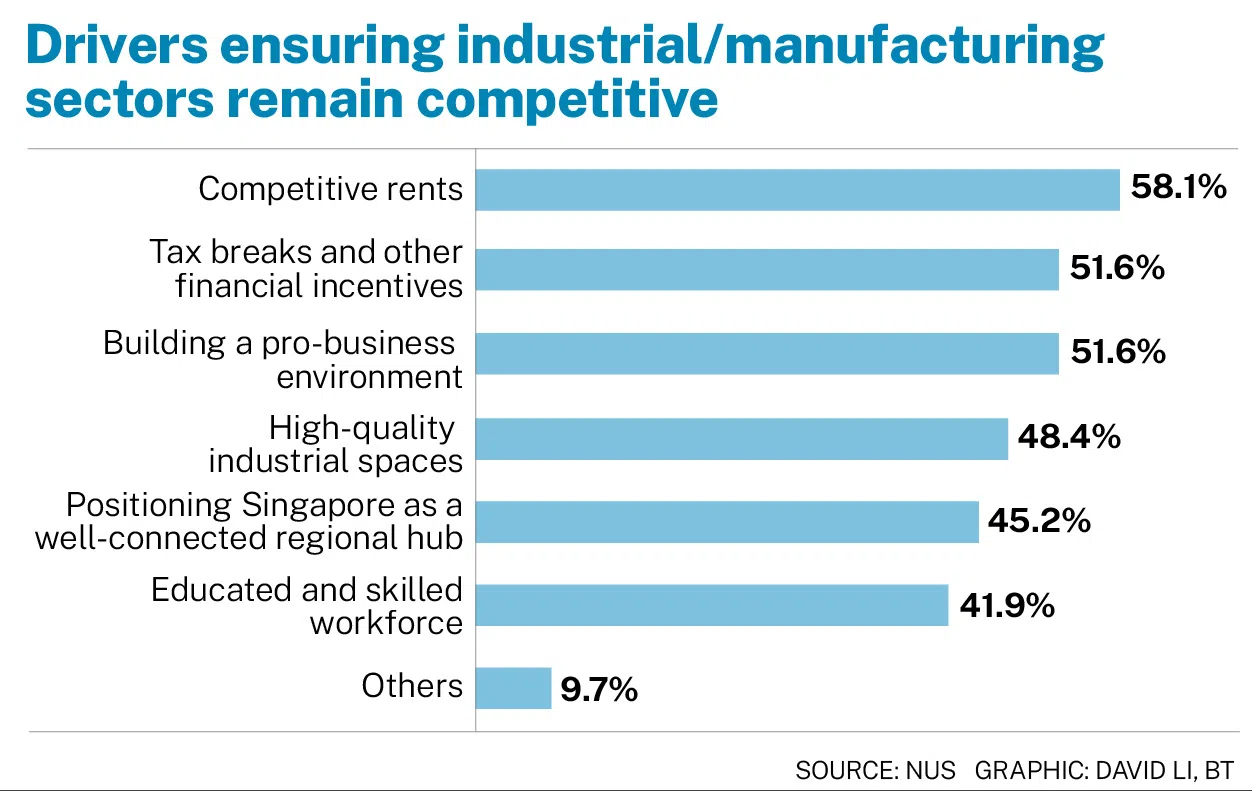

Sing Tien Foo, provost’s chair professor of real estate at NUS Business School, said: “The government will need to stay ahead of the curve by attracting more investments from global firms to set up manufacturing plants and facilities to strengthen Singapore’s position in the global value chains.”

In terms of what drivers would ensure that the Singapore industrial sector remains competitive, 58 per cent cited competitive rents as key, while 52 per cent pointed to tax breaks and financial incentives.

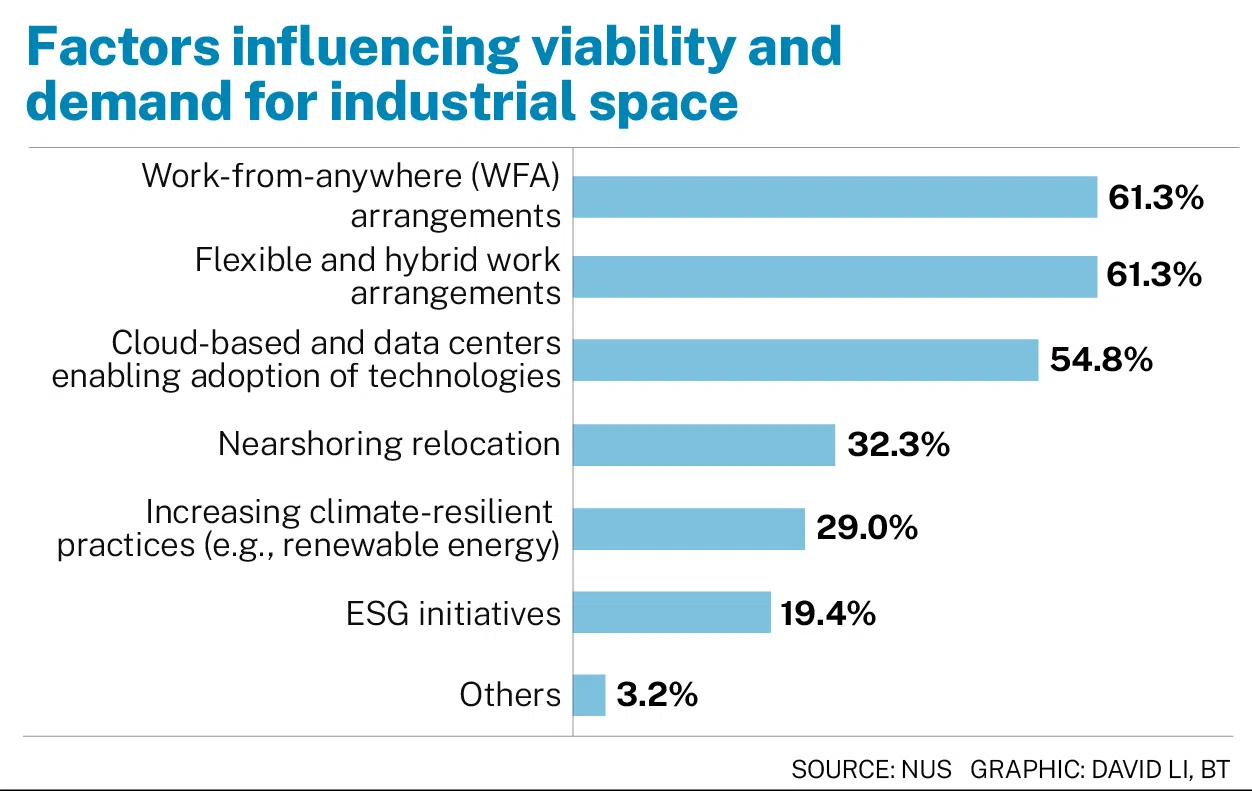

Most respondents felt that work-from-anywhere arrangements that would allow companies to relocate operations to cheaper overseas locations, as well as hybrid work arrangements, will affect viability and demand for industrial space.

The adoption of new technologies, such as cloud-based technologies and data centres, was also cited as another factor the respondents felt would affect industrial space demand.

Having easy access to public transport was the top factor in attracting firms to industrial parks, with most respondents (81 per cent) citing this as key, over other draws such as the availability of lifestyle and dining facilities (58.1 per cent) and clustering of relevant firms (55 per cent).

Innovative and flexible land use, coupled with increased connectivity, are other non-price factors that would attract firms to relocate and meet their evolving needs for space, the survey report said.

Prof Sing added: “Other than having a highly skilled manufacturing workforce, providing world-class industrial facilities with clustering of like-minded people and firms is important to attract world-class manufacturing firms to Singapore.”

Land use zoning for industrial spaces are classified into Business 1, for clean and light manufacturing activities, while the Business 2 category will see more heavy manufacturing and production activities, with stricter requirements on noise and pollution.

In the latest JTC quarterly figures, overall industrial rental rose a marginal 0.3 per cent in Q3, compared with the previous quarter. Multiple-user factory and warehouse rental growth moderated to 0.6 and 0.1 per cent, respectively, while single-user factories had a 0.3 per cent decline in the quarter.

JTC’s overall price index of all industrial space also slowed 0.5 per cent compared to Q2 and 2.1 per cent versus the year-ago period.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.