Some 12,000 new homes to come up on sites rezoned for housing across 11 areas

The move will boost supply in popular residential areas

[SINGAPORE] A slew of land parcels in 11 areas across the island are set to be rezoned for housing, in a move that will give a major boost to supply in popular residential areas.

These include plots of land in established regional centres such as Toa Payoh and Tampines, where previous government land sales saw strong interest from developers and where new projects were recently launched at fresh benchmark prices.

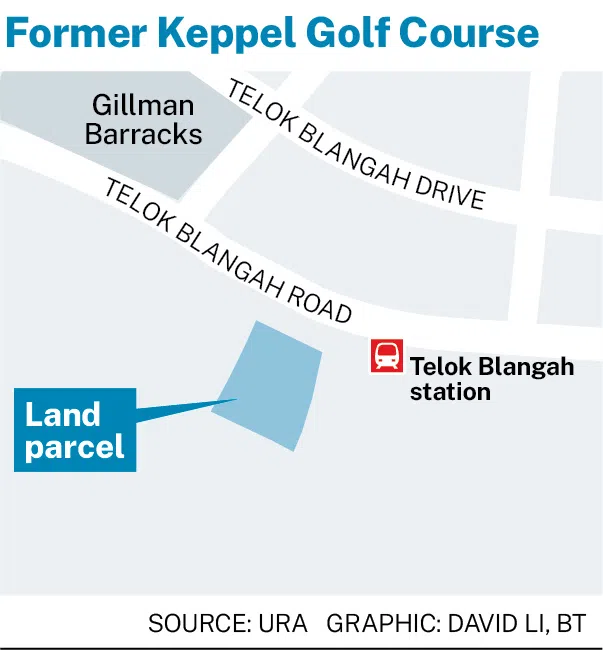

Sites are also being lined up for rezoning or higher-density development in other in-demand housing areas such as Bedok and Pasir Ris, upcoming neighbourhoods such as Tengah, and fresh supply on the former Keppel Golf Course land.

The planning changes, proposed in amendments to the Master Plan 2019 gazetted by the Urban Redevelopment Authority on Wednesday (May 7), could produce some 12,000 new housing units in both private and public projects in the near term.

A parcel carved out of the former Keppel Golf Course site, along Telok Blangah Road, has been earmarked with a high-intensity gross plot ratio of 4.3, which analysts estimate could yield up to 1,000 public housing flats. These would add to the first 740 new homes from the Keppel site, to be built on a plot being sold in this year’s Government Land Sales (GLS) programme.

Lee Sze Teck, senior director of data analytics at Huttons Asia, reckons the Housing and Development Board (HDB) project will be a Prime category Build-to-Order (BTO) one.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“The response to this Prime BTO is likely to be overwhelming,” he said. The last BTO project in the area, Telok Blangah Beacon, attracted more than 30 first-timers for each four-room flat in 2021, he noted. BTO prices of the four-room flats ranged from S$602,000 to S$710,000, while three-room flats were priced from S$419,000 to S$504,000. The project is expected to be completed in 2027.

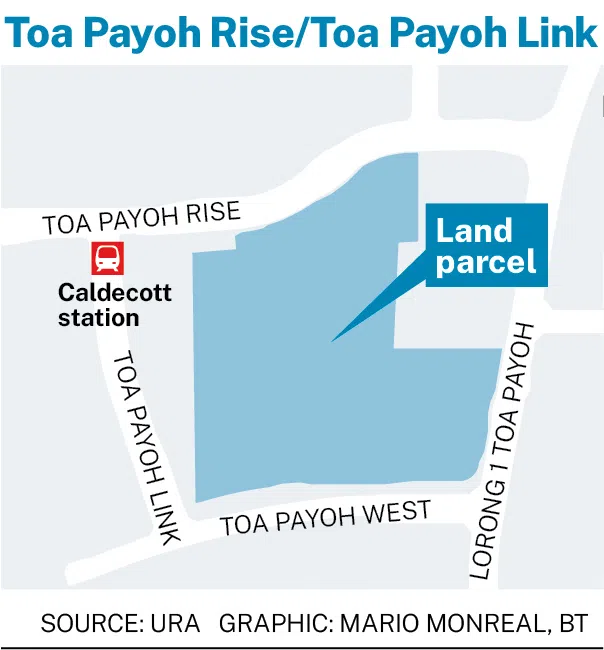

In the city fringe area, Toa Payoh and Bishan may soon see new residential projects. Both locales are popular with homebuyers for their proximity to elite schools and central location. The most recent new condo launch in the area, The Orie at Toa Payoh Lorong 1, sold 86 per cent of its 777 units at S$2,704 psf on average over its launch weekend.

Plots bounded by Toa Payoh Link and Toa Payoh Rise may be rezoned to residential with commercial use on the first storey. A high gross plot ratio of 4.7 has been proposed for the area, which is next to Caldecott MRT station and could yield a total of 4,000 to 5,000 dwelling units, according to Lee.

SEE ALSO

Lee said that the sites could turn out a mix of public and private homes. “Toa Payoh is a very popular area among buyers, and almost all the four-room and five-room flats that fulfilled their minimum occupancy period in 2024/2025 achieved a selling price of S$1 million and above.”

Mogul.sg chief research officer Nicholas Mak pointed out that the Toa Payoh Link/Toa Payoh Rise site is the largest plot earmarked for redevelopment in the May 7 update.

“Given the site’s substantial size, if the government chooses to develop public housing on it, it could be transformed into an integrated development as a new town centre,” said Mak, expecting the site to yield 3,000 to 3,500 public flats.

Another parcel along Lorong 4 Toa Payoh with a proposed gross plot ratio of 3.4 could yield some 300 to 350 condo units or 200 to 250 HDB Plus flats, estimated OrangeTee’s chief researcher and strategist Christine Sun.

Mak estimates the site to yield about 210 to 260 HDB flats, which could serve as replacement units for homeowners affected by the Selective En-bloc Redevelopment Scheme and Voluntary Early Redevelopment Scheme.

In the Sin Ming area, a plot at Lorong Puntong spanning slightly more than 4,000 sq m is expected to be used for condo development and could see about 130 to 150 units, said Mak.

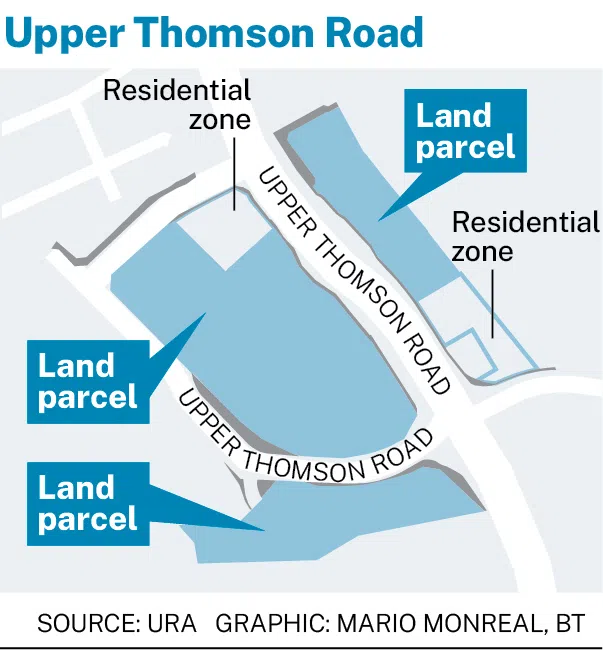

Land plots along Upper Thomson Road are also expected to be turned into residential use, and could yield around 2,200 to 2,300 condo units, or 1,500 to 1,600 HDB flats, said Sun.

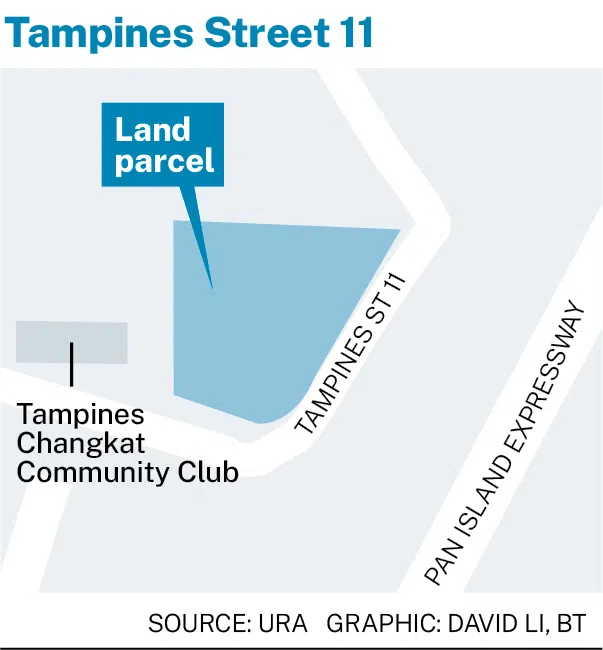

In the east, a residential site with a health and medical zone is being proposed for Tampines Street 11. With a land area of about 14,433 square metres (sq m) and gross plot ratio of 2, Sun expects the site to yield 200 to 250 HDB flats.

The site is near a GLS site on Tampines Avenue 11, which was awarded in 2023 to UOL, Singapore Land and CapitaLand Development at S$1.21 billion, or S$885 per square foot per plot ratio.

The project, Parktown Residence, was launched in February 2025 and posted strong sales. About 87 per cent of the 1,193 units in the large mixed-use development were sold within the first two days, at an average of S$2,360 per square foot (psf).

However, Mak said that the site, if offered for sale through a GLS tender, may not generate the “most optimal economic value”. He expects lower demand for private homes on this site as buyers “would not like to live next to a hospital, hospice or nursing home”.

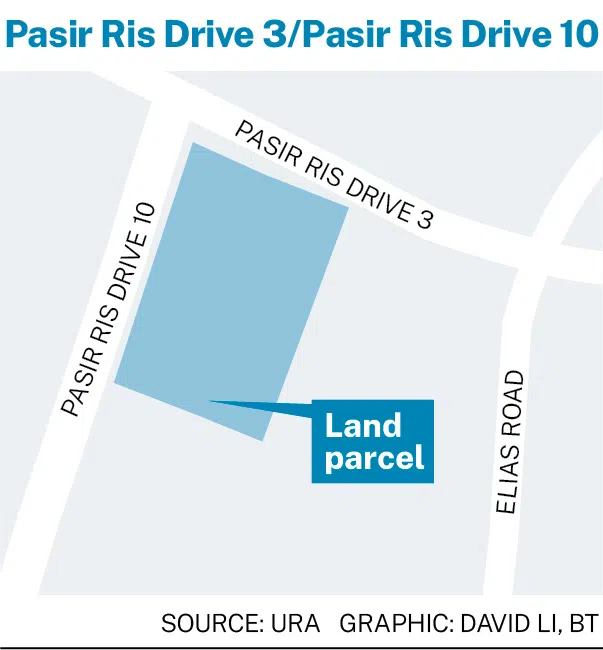

In the neighbouring planning area of Pasir Ris, a parcel bound by Pasir Ris Drive 3 and Pasir Ris Drive 10 has been proposed to be rezoned as residential with a gross plot ratio of 3.2.

The site is likely to be sold under the GLS programme, said Mogul.sg’s Mak, and could potentially yield 1,100 to 1,180 condominium units.

Pasir Ris has not seen a GLS site for private condo development since 2012, and demand in the east is strong, said Mak, pointing to the robust take-up rate of Parktown Residence. The last GLS site sold in Pasir Ris was developed into Vue 8 Residence.

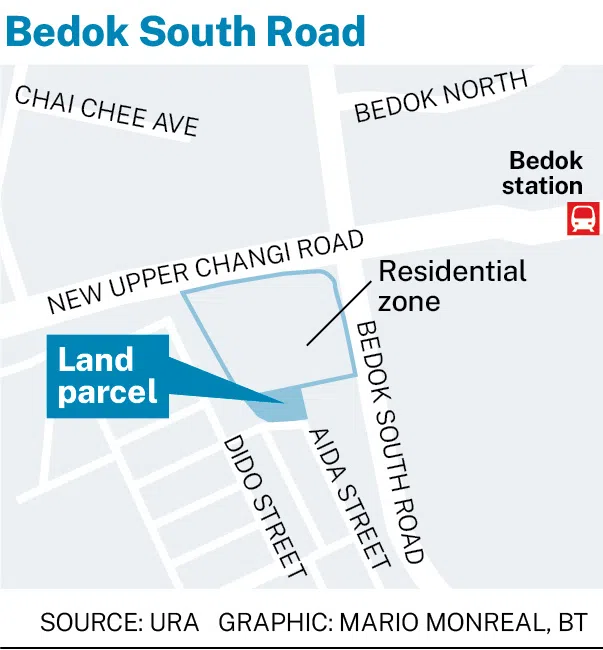

Also in the east, Bedok South Road will see more new homes being built. Land that housed schools is expected to be rezoned to residential use, while an adjacent parcel will have its plot ratio raised. OrangeTee’s Sun said the earmarked area can yield about 1,000 to 1,100 condo units or 700 to 800 HDB Standard flats.

Up in the north at Yishun, a site located near Chencharu Park is being set aside for residential use. An estimated 1,000 or more BTO Standard flats may be built on the site, said Huttons’ Lee.

The government had earlier announced plans to grow a new estate in Chencharu, where it sees potential for 10,000 homes. The first GLS site to be put up for sale in Chencharu is coming up for tender on May 22, with a 3-hectare parcel on offer for 875 condo units and 13,000 sq m of commercial space.

Land parcels at Sunbird Avenue, Simei Road and Upper Changi Road may also be redeveloped into residential projects. The proposed amendments will inject more homes and amenities into the Upper Changi Road area and facilitate infrastructural works to serve future developments, noted URA.

Lee said: “If there are flats with shorter waiting time at Chencharu, Bedok South Road, Tampines Street 11, Sunbird Avenue/Simei Road and Pasir Ris Drive 3, they may potentially pull demand away from the resale market and help to stabilise prices.”

HDB resale prices were up 1.6 per cent in the first quarter of 2025, lower than the 2.6 per cent price increase seen in the previous quarter.

In the west, plans are in the pipeline to redevelop several parcels within Brickland District in Tengah Town into housing sites, parks, places of worship, health and medical care facilities, educational institution and civic and community institutions.

The three parcels could yield around 1,400 flats, added OrangeTee’s Sun.

Apart from housing, the URA on May 9 earmarked land parcels along Eunos Avenue 5 and Dover Road to be redeveloped into health and medical care zones.

A new nursing home is likely to be built in Dover to meet the anticipated demand for such services in the area, said the authority.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.