CBD Grade A offices' net demand turns positive, but vacancies rise again

THE full-year net demand for Grade A office space in Singapore's central business district (CBD) for 2021 is likely to be up to six times that of 2020, Cushman & Wakefield forecast.

This comes as net demand in the first half of this year turned positive, at 68,000 square feet (sq ft), going by data from the real estate consultancy.

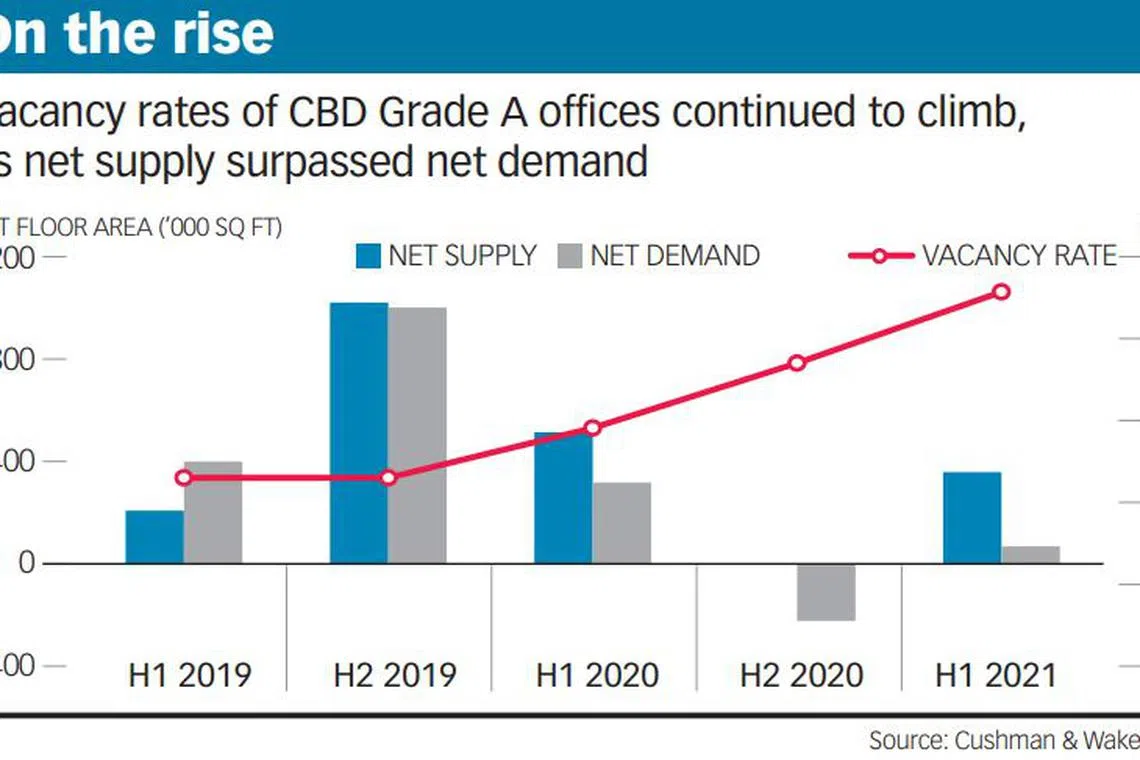

However, vacancy rates of CBD Grade A offices continued to increase as net supply again outpaced net demand, which remained "relatively weak", said Wong Xian Yang, Cushman & Wakefield head of research, Singapore.

Net supply amounted to nearly 359,000 sq ft in H1 2021, from zero in H2 2020. The greater net supply was attributed to Afro-Asia Building and the addition of Lazada One, formerly known as 5One Central, to the CBD Grade A basket, Mr Wong noted.

Vacancies climbed for the fifth consecutive quarter, reaching 4.6 per cent in Q2 2021, up from 4.2 per cent in Q1 2021. The latest figure is the highest vacancy rate for the CBD Grade A office market since Q1 2018, when it was 4.9 per cent, Cushman & Wakefield said on Monday.

The bulk of new leases signed in H1 2021 for CBD Grade A offices were with technology and finance tenants. Demand from the latter mostly came from existing financial institutions and investment funds that are relocating or expanding, the consultancy told The Business Times (BT).

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Tech and finance occupiers, looking to lock in the lower rents during the Covid-19 pandemic to expand and position for the economic recovery, have taken up or pre-committed to many of the spaces vacated by banks, which continue to right-size their offices, Cushman & Wakefield said.

Even with these lower rents, the typical lease period has not changed significantly and still depends on the type and size of space, it added. "For most cases, it is still 3+3 (three-year lease with a three-year option to extend). But for larger new leases of 10,000 sq ft and above for bare units, they are looking at 5+5 to amortise the fit-out costs," Cushman & Wakefield told BT.

Meanwhile, overall rents of CBD Grade A office space posted their first uptick in Q2 2021, after five straight quarters of declines, as market sentiment and occupier confidence improved, JLL said last month.

In Cushman & Wakefield's basket of CBD Grade A office properties, monthly rents rose 0.5 per cent quarter on quarter to S$9.60 per square foot in Q2 2021.

This rental growth was driven by prime office buildings as tenants embarked on a flight to quality. Prime Grade A rents jumped by 1 per cent quarter on quarter in Q2 2021 while non-prime Grade A rents inched up by 0.1 per cent, based on Cushman & Wakefield's basket.

"Market recovery will be two-tier, with prime office buildings recovering the fastest, while older buildings lag behind," said Mark Lampard, the real estate services firm's head of commercial leasing for Singapore.

"Nonetheless, as prime office buildings fill up, demand will spill over to the other buildings in the CBD," he added.

Cushman & Wakefield expects rents to increase by 1-3 per cent in the second half of this year, fuelled by a strong economic rebound, the city-state's ambitious vaccination roll-out, and steady demand from fast-growing tech companies as well as financial and investment firms.

In addition, the limited new Grade A supply in the CBD may support rental rates. "CapitaSpring, which will contribute the bulk of new supply in H2 2021, has seen strong pre-commitments. Only Guoco Midtown in Bugis will be completed in 2022, and is undertaking pre-lease marketing with active negotiations underway," the consulting group noted.

Mr Lampard pointed out that historically, the rebound in CBD Grade A office rents tended to be V-shaped, with available spaces quickly snapped up as economic activity expanded.

"However, the current K-shaped recovery will result in a gradual rebound in rents," he said. For one thing, hybrid work arrangements have caused a structural decline in demand for office space, and some tenants are taking a watch-and-wait approach given the uncertainty around the pandemic situation.

Tenants also have more options now, given the increase in quality workplaces such as offices and business parks in decentralised locations, including one-north, Alexandra or Harbourfront, Mr Lampard said.

READ MORE:

- Have Singapore office rents bottomed?

- BT Explains: Why office landlords aren't fretting over banks cutting space

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.