CDL's hotel business showing green shoots of recovery from Q2

PROPERTY and hotels group City Developments Limited (CDL), which posted a S$32.1 million group net loss in the first-half of this year, is starting to see light at the end of the tunnel for its hospitality business after being hit by the Covid-19 pandemic that erupted last year.

The group's hotel business has begun to show green shoots of recovery from the second quarter of this year against Q2 2020, and all regions posted positive gross operating profit for June 2021.

The group's overall revenue per available room more than doubled to S$63.2 for Q2 2021 from S$29 in Q2 2020, with all regions posting growth as border restrictions began easing.

CDL's executive chairman Kwek Leng Beng, 80, said: "We are optimistic of a stronger rebound by the end of 2021/early 2022 and expect strong latent demand for travel domestically and regionally, with further upside once international travel is allowed."

"Vaccination rates and quarantine-free travel have been the catalysts for the hospitality sector's recovery which is already gaining traction."

The hotel industry veteran added: "A lot of people say that the hotel (industry) will recover in four years' time. But I believe, having specialised in this (field), that it'll recover sometime this year, or early next year. Let's not write it off... We can already see many of our hotels beginning to recover, even in the US, UK, France, and so on. So I'd like you to bear in mind that we have seen recovery. I can feel it..."

Losses before interest, tax, depreciation and amortisation from the group's hotel operations narrowed to S$47 million for the first-half ended June 30, 2021 from S$126 million for the same period last year.

Over the same period, loss before tax from hotel operations also narrowed to S$143 million from S$208 million previously - due to absence of impairment losses in H1 2021, coupled with improved performance from the Asia and New Zealand hotels.

CDL group chief financial officer, Yiong Yim Ming, said at the group's first-half results briefing: "CDL expects Ebitda (earnings before interest, tax, depreciation and amortisation) for its hotel operations to turn positive in Q3/Q4 this year though profit before tax will be more challenging, given our depreciation on our hotel assets."

CDL C09 sank into the red for the first half of 2021 from a year ago, due to higher tax expenses and the prolonged impact of the ongoing Covid-19 pandemic, the company said on Thursday.

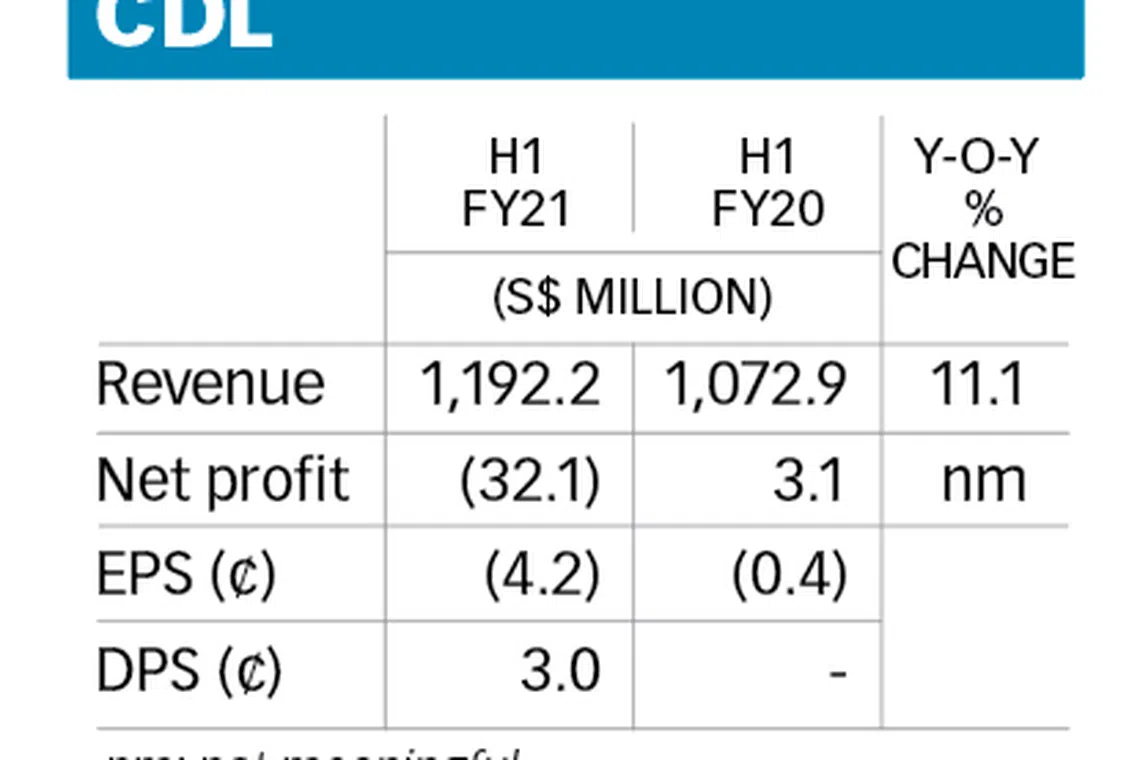

Net loss for the six months ended June 30, 2021 stood at S$32.1 million, reversing from a net profit of S$3.1 million posted the same period a year ago.

READ MORE: CDL expects H1 net loss of up to S$35m due to Covid-19 restrictions

The results translate to loss per share (LPS) of 4.2 Singapore cents, against LPS of 0.4 cent for the year-ago period.

The group said its losses are chiefly attributable to a substantial deferred tax credit of S$17.6 million from the New Zealand government recognised in H1 2020 that was not similarly applied this year. The tax credit, it said, was part of the New Zealand government's Covid-19 Business Continuity Package.

Revenue was up 11.1 per cent to S$1.19 billion compared with S$1.07 billion last year, however, boosted by its buoyant property development business segment. This saw a revenue growth of 35.5 per cent.

CDL said there was also some revenue contribution from the group's overseas projects, including the Shenzhen Longgang Tusincere Tech Park, which it acquired in February 2021.

But its hotel segment registered a 10.8 per cent decline in revenue, with weak occupancies and depressed room rates with revenue per available room declining 10.1 per cent year on year in H1 2021. This, it said, was in view of travel restrictions still in place for most countries.

The group said its investment properties segment also generated lower rental income, impacted by decreased footfalls and sustained rental rebates given to its retail tenants.

The board has proposed an interim dividend of three Singapore cents per share.

READ MORE:

- CDL's New Zealand unit acquires development land in Havelock North

- CDL reports operational improvements but is wary of Covid-19 impact

- CDL rolls out support for tenants amid heightened alert

- CDL confirms applications have been made for S-Reit IPO

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.