Coworking spaces in Singapore tripled since 2015 to 3.7m sq ft: Colliers

COWORKING spaces now take up 3.7 million square feet (sq ft) in net lettable area (NLA) of Singapore's commercial space, tripling from 1.2 million sq ft in 2015 to become one of the top six occupier sectors, said Colliers International.

The top occupier sector in the Singapore CBD (central business district) Grade A office space are financial services, followed by professional services, technology, media and telecommunications, resources, energy and commodities, consumer, then flexible workspace.

Colliers' research projects the NLA for flexible workspaces to grow by 24 per cent in 2019, driven by demand from multinational corporations on top of new start-ups. The sector has also seen a 36 per cent growth in compound annual growth rate by NLA.

That being said, pace of growth might slow to 15 per cent due to a higher base and tighter vacancies, the real estate firm said in a report out on Tuesday.

Flexible workspaces now account for 5 per cent of Central Business District (CBD) Premium and Grade A offices, said the report.

In terms of distribution, 83 per cent of flexible workspace resides in the CBD, 12 per cent in the city fringe and 5 per cent in the suburban area.

Within the CBD, 52 per cent of coworking spaces are located in Raffles Place or New Downtown, followed by 22 per cent at Shenton Way or Tanjong Pagar. City Hall takes up 16 per cent of the distribution, while Orchard Road takes up 7 per cent and Beach Road and Bugis takes up 3 per cent.

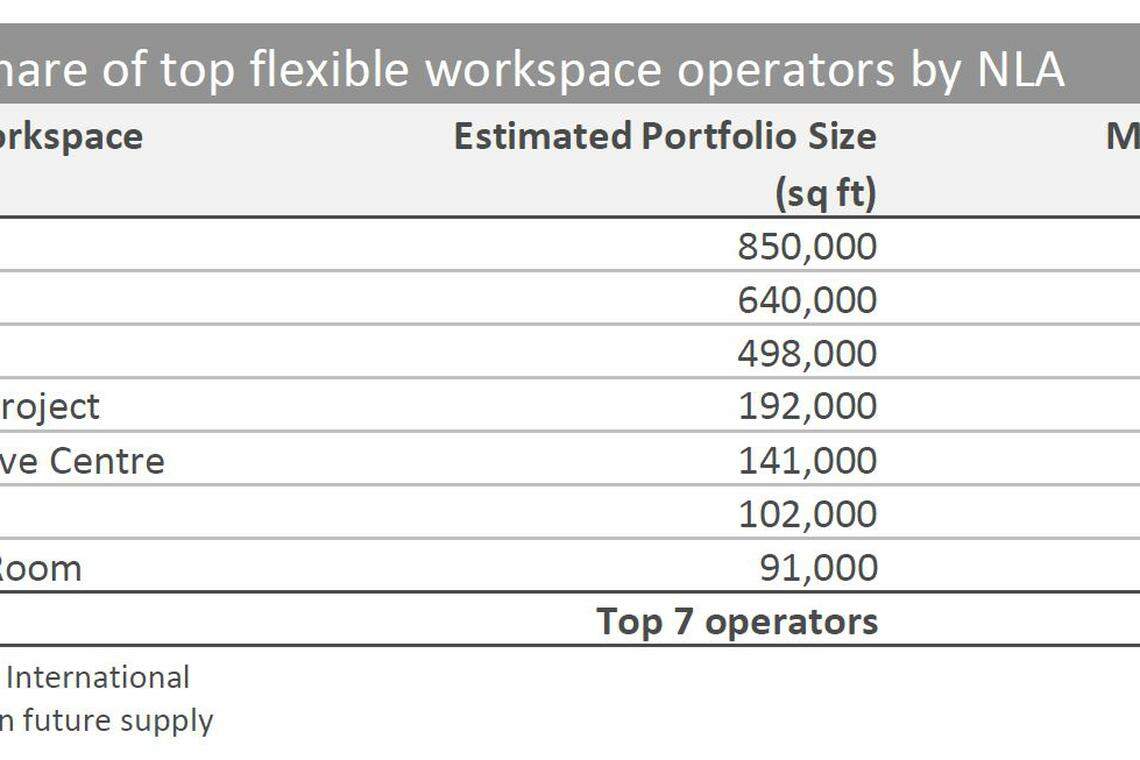

When it comes to market share, the leading coworking operator in Singapore is WeWork which holds a 22 per cent share of the pie or 850,000 sq ft in portfolio size.

Next is IWG at 16.6 per cent with 640,000 sq ft, followed by JustGroup at 12.8 per cent and 498,000 sq ft.

After consolidation in the sector, the top seven operators now hold 65 per cent of the market share, with the top three - WeWork, IWG, and JustGroup - sitting on 51 per cent of the space.

Colliers said bigger operators have been scaling up their portfolios aggressively, while some of the smaller operators with no economies of scale were either acquired or squeezed out. Based on its research, most of the closures came from small-sized, single-space operators, with an average floor space of 7,500 sq ft.

Colliers' head of research Tricia Song said Singapore is considered "one of the most mature" markets in Asia for flexible workspace. She added: "We believe it will continue to advance and expand, given the still-low penetration rate of 5 per cent."

Due to the competitive landscape, average desk cost fell 12 per cent to US$573 per month, from a year ago. Colliers added that desk rates could also decline further, with lower space allocation per desk to maintain margins. This is due to a trend seen in London which is regarded as the most mature flexible market in the world.

To expand, operators may also expand into fringe areas of the retail or hotel space due to tight vacancy in the CBD.

Continued consolidation is expected in the industry through continued collaboration between landlords and flexible workspace operations; as well as mergers and acquisitions among smaller operators, or international operators looking to enter new markets.

The outlook on the sector would also "change significantly" should conventional landlords launch their own coworking products and enter the market as opposed to offering long-term leases to established operators.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Homebuyers shun new real estate in Vancouver, hurting builders

US pending home sales jump in March to hit highest in the year

Blackstone strikes US$1.6 billion student housing deal with KKR

European real estate deals slump to lowest level in 13 years

Singapore Q1 industrial rents rise further as occupancy dips and prices fall: JTC

Condo resale volumes rebound in March; prices inch up 0.4%: SRX, 99.co