Developers' sales in Feb signal pick-up in momentum, say analysts

977 new private homes and 329 EC units sold in February

Singapore

DEVELOPERS' sales momentum had picked up this year, even before the recent easing of the property cooling measures; sales figures for February bear this out and March figures are projected to be even more sterling.

A total 977 new private homes and 329 executive condominiums (ECs) were sold by developers last month - respectively 2.6 times and 1.8 times more than the numbers sold in January.

Compared to a year ago, the number of private homes sold in February was nearly 3.2 times greater; that of ECs was 2.5 times higher.

The sales data were collated by the Urban Redevelopment Authority (URA) through a survey of developers.

Many property observers said that the fact that some 79 per cent of the new private homes sold in February came from previously launched projects reflects a broad-based recovery in demand.

JLL national director of research and consultancy Ong Teck Hui said: "The recent easing of the seller's stamp duty (SSD) and the total debt servicing ratio (TDSR) would be a favourable enhancement on a market that is already on a buying uptrend."

Edmund Tie & Company head of South-east Asia research Lee Nai Jia was just as sanguine. He expects the easing of the SSD from March 11 to encourage more buyers on the sidelines to enter the market.

"We anticipate sales momentum to continue, with highly anticipated projects such as Seaside Residences to headline sales in the coming months."

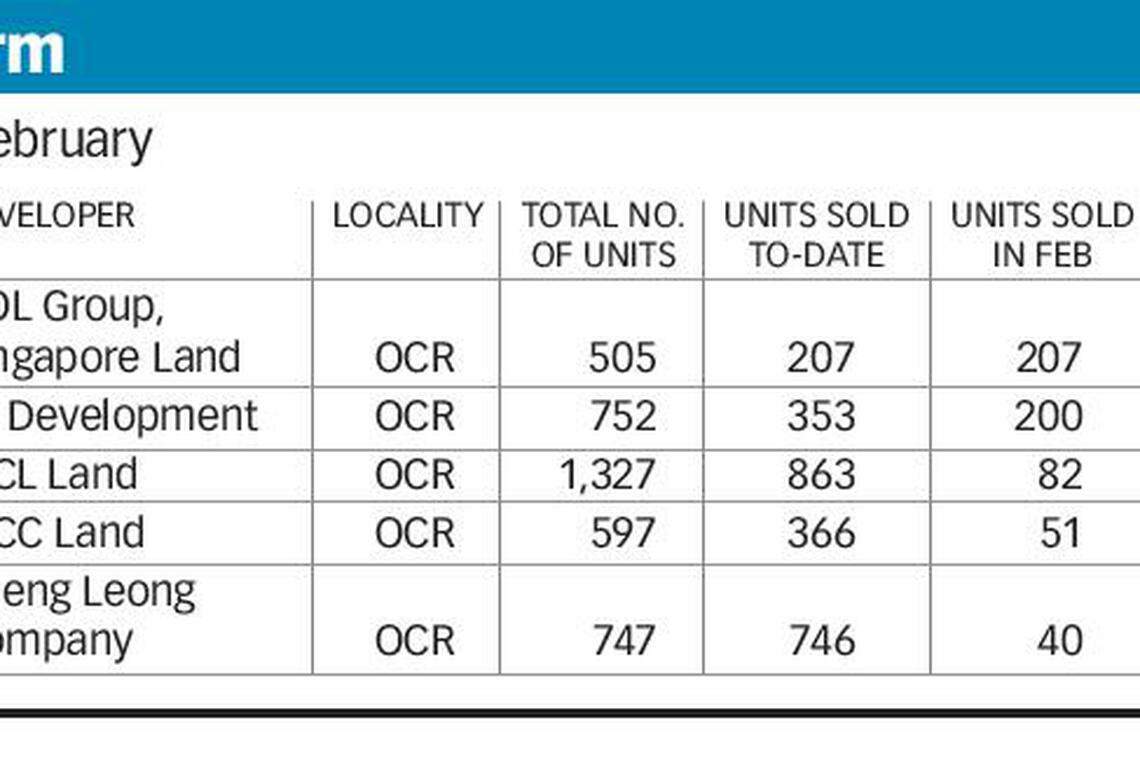

The top selling project in February was The Clement Canopy by UOL Group and Singapore Land.

The 505-unit development in Clementi, the first project to be launched this year, moved 207 units at a median pricing of S$1,343 per square foot (psf).

ERA Realty key executive officer Eugene Lim noted that its launch in February cast buyers' attention on the Clementi/West Coast area, and this benefited EL Development's Parc Riviera, which was priced lower on a per square foot basis.

Parc Riviera, located in West Coast Road, emerged runner-up in February, selling 200 units at a median S$1,281 psf.

Agents said that commissions to agencies for this project now hover at 4 to 5 per cent, up from 2.5 to 3 per cent at the start.

There was also strong pick-up in sales in the Sol Acres EC project by MCL Land, which sold 82 units in February at a median S$782 psf, and at The Santorini by MCC Land, which moved 51 units at a median pricing of S$1,041 psf in February.

Three in every four private residential units sold were in the suburban region or Outside Central Region last month, in tandem with the higher proportion of new launches in the region, URA data shows.

CBRE research head for Singapore and South-east Asia Desmond Sim noted that "quantum play" continues to drive sales; he does not expect this to change, even with the recent tweaks in the property measures.

"The changes in the SSD were targeted predominantly at taxes on disposal. Taxes surrounding acquisition have not changed and will continue to remain a barrier, filtering out owner-occupiers from speculators or investors," he said.

The government has reduced the holding period for SSD to three years from four, and cut the tax rate under each tier by four percentage points for residential properties bought from March 11.

In addition, the TDSR no longer applies to mortgage equity withdrawal loans with loan-to-value ratios of 50 per cent and below.

The sales figures reported by developers for new launches this month are already setting the stage for a stronger month.

CEL Development said it sold another 23 units at 720-unit Grandeur Park Residences in Tanah Merah last weekend, following the news on the cooling measures. This takes its total sales this month to 462. About 60 per cent of units in the project are one- and two-bedders.

Qingjian Realty also moved nearly 170 of the total 497 units in EC project iNz Residence on booking day this month.

Dr Lee noted that buyers of these projects were banking on cheap financing. Both DBS Bank and UOB offered a zero per cent spread under their fixed-deposit home-loan rate packages with no lock-in period, and a one-time free conversion for a limited period; this was soon followed by OCBC's new "step-down mortgage board rate" package, which pegs the interest rate to the bank's variable internal rate or board rate - also for a limited period.

ERA's Mr Lim projects new private home sales for this month to range from 1,100 to 1,300 units; OrangeTee expects the month's sales figures to exceed 1,300 units. PropNex Realty chief executive Ismail Gafoor's estimate for March is even more upbeat, at more than 1,500 units.

Since the start of this year, developers have continued to move units in delicensed projects. These are completed projects that have received Certificate of Statutory Completion and individual strata titles issued to buyers, and are hence not included in the monthly compilation of licensed developers' new home sales. PropNex data indicates that, in the first 71 days of this year, about 50 units at The Peak @ Cairnhill II and 30 units at OUE Twin Peaks were sold.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

DBS puts 46 retail units, HDB shops on market for S$210 million

US mortgage rates jump above 7% for the first time this year

Far East Shopping Centre back on market at unchanged S$928 million asking price

London mansions sold at 30% discount spell gloom for luxury market

Delfi Orchard up for collective sale at S$438 million guide price

US existing home sales drop in March; median price increases