Singapore private home prices down 1.1% q-o-q in Q2 2020: URA flash estimate

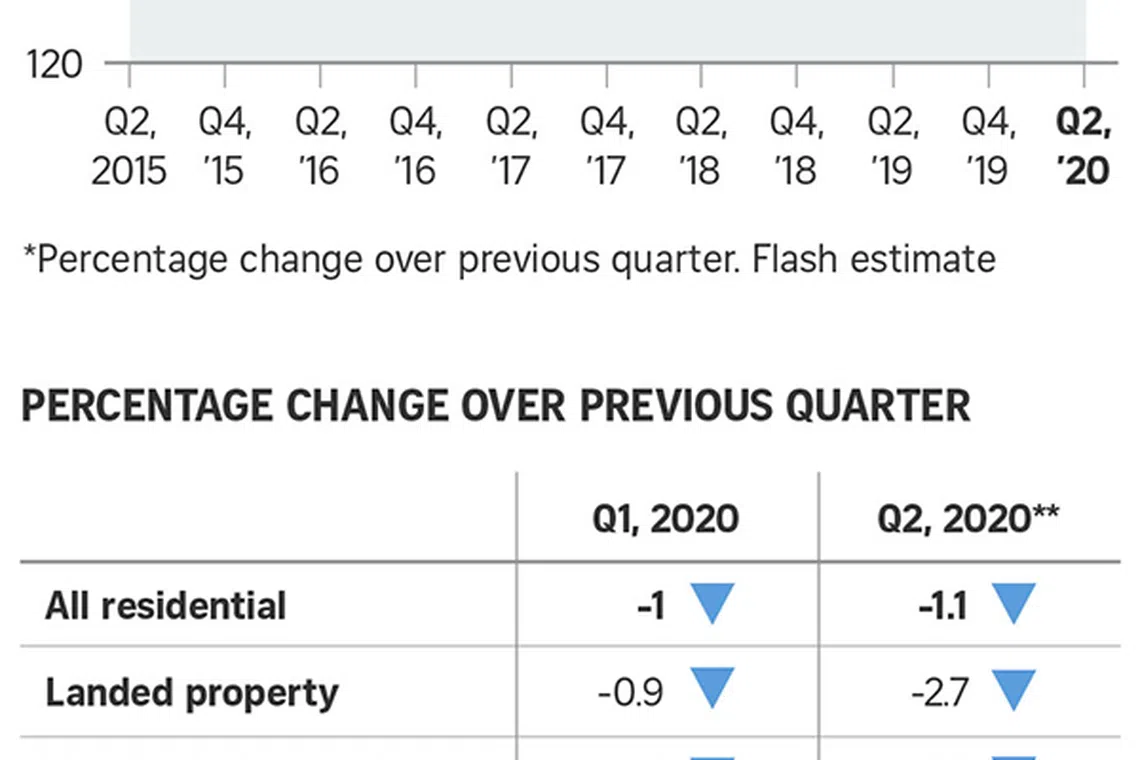

THE Urban Redevelopment Authority's (URA) flash estimate for the second quarter of 2020 shows that the overall price index for private homes shrank 1.1 per cent over the preceding quarter.

This follows a 1 per cent drop in Q1 this year.

Year on year, the index is down 0.3 per cent, according to the URA flash estimate released on Wednesday morning.

Prices of non-landed properties eased 0.6 per cent quarter on quarter in Q2 after slipping 1 per cent in the previous quarter.

Giving a breakdown by region, the URA said that prices of non-landed homes in the prime areas or core central region (CCR) dipped 0.1 per cent in Q2, a much smaller decline compared with the 2.2 per cent drop in the previous quarter.

However, in the city fringe or rest of central region (RCR) , prices fell 1.9 per cent quarter on quarter in Q2, a bigger drop compared with the 0.5 per cent decline in the previous quarter.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

In the suburbs or outside central region (OCR), prices remained unchanged in Q2, compared with a 0.4 per cent decline in the previous quarter.

The URA also said that prices of landed properties fell 2.7 per cent quarter on quarter in Q2, following a 0.9 per cent drop in the previous quarter.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment, and data on units sold by developers up to mid-June. The statistics will be updated on July 24, when the URA releases its full set of real estate statistics for the second quarter.

"Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. The public is advised to interpret the flash estimates with caution," the URA said in its press release.

Property consultants attribute the drop in private home prices in Q2 this year largely to the "circuit breaker" partial lockdown to curb the spread of Covid-19. From April 7 to June 18, showflats were closed and property viewings disallowed. These restrictions resulted in lower transaction volumes, which in turn led to the 1.1 per cent quarter-on-quarter drop in URA's benchmark overall private home price index.

Observing that the OCR was the only market segment with no price change in Q2 over the previous quarter, ERA Realty head of research and consultancy Nicholas Mak said: "This could be due to the resilient demand for properties in the OCR primarily from HDB upgraders."

The stable HDB resale prices and the high number of HDB flats that could be sold on the resale market in 2019 and 2020 could lead to stable demand for private properties from HDB upgraders. An estimated 27,000 HDB flats reached the end of their five-year Minimum Occupation Period (MOP) in 2019. Another 26,000 HDB flats will reach the end of the MOP in 2020. By comparison, the annual average number of HDB flats that have reached the end of their MOP in the 10-year period to 2018 was 9,000 flats per year.

"These relatively new flats could be sold on the resale market and the owners could upgrade to private housing," Mr Mak added. Moreover, suburban condos come with lower price tags and are more affordable, compared with real estate in the central region, he noted.

Mr Mak predicts a 3 to 6 per cent drop in URA's overall private home price index for the whole of 2020.

OrangeTee & Tie head of research and consultancy Christine Sun expects the index to post a full-year decline of 3 to 5 per cent.

Huttons Asia research director Lee Sze Teck said: "We think the property market will stabilise from Q3 2020 and we think prices will ease around 3 per cent in 2020."

Knight Frank Singapore's research head Leonard Tay said that while developers will continue to offer discounts in order to reignite home buying interest that began in May, overall price declines are likely to be moderate.

"Therefore, in the second half of 2020, with the phased relaxation of restrictions and some measure of human interaction, transaction volumes should increase. Nevertheless, URA's overall private home price index is likely to drop by about 5 per cent this year, due to recessionary pressures affecting all sectors of the economy," he added.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

DBS puts 46 retail units, HDB shops on market for S$210 million

US mortgage rates jump above 7% for the first time this year

Far East Shopping Centre back on market at unchanged S$928 million asking price

London mansions sold at 30% discount spell gloom for luxury market

Delfi Orchard up for collective sale at S$438 million guide price

US existing home sales drop in March; median price increases